Value Accumulation Case Study: How Yuga Labs Built a Vast Business Empire?

TechFlow Selected TechFlow Selected

Value Accumulation Case Study: How Yuga Labs Built a Vast Business Empire?

How is the value generated within the Yuga ecosystem distributed among different stakeholders?

Author: Vader Research

Translation: TechFlow

Value accrual is a crucial yet often overlooked topic in Web3. In this article, we will explore how value generated within the Yuga ecosystem is distributed among various stakeholders (Yuga Labs, $APE, BAYC, MAYC, etc.).

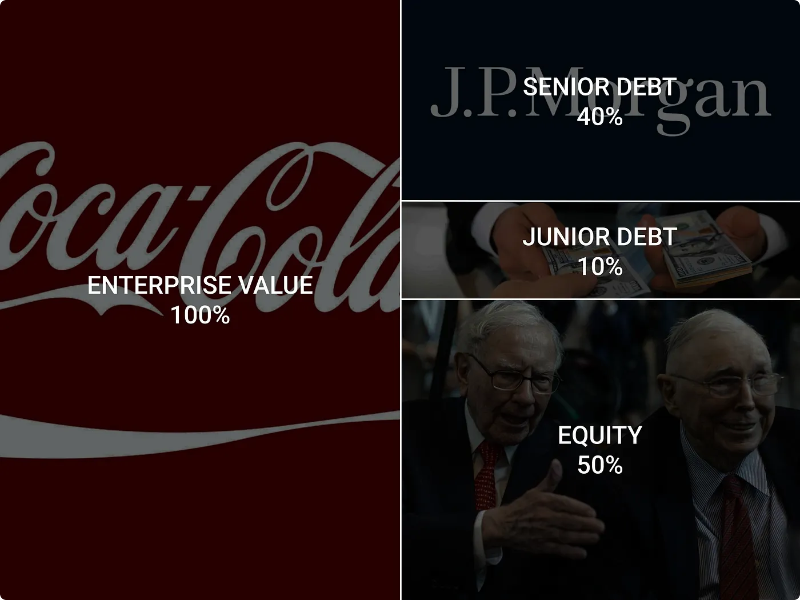

1. Capital Structure and Enterprise Value

In Web2 companies, capital structure typically consists of equity and multiple layers of debt. Senior creditors usually have higher collateral security but receive lower interest rates, while subordinated creditors hold less secure collateral but charge higher interest rates.

Enterprise value is like a price tag for a company. It tells us the total worth of the company, including both money it owes to others (such as banks) and money belonging to owners (such as shareholders).

Enterprise Value = Equity Value + Debt Value

Creditors and minority shareholders have legal rights to a company's earnings and assets. In contrast, NFT and token holders do not enjoy such protections. Nevertheless, by treating tokens and NFTs issued by Web3 companies as part of the overall capital structure, we can enhance the design and architecture of value creation.

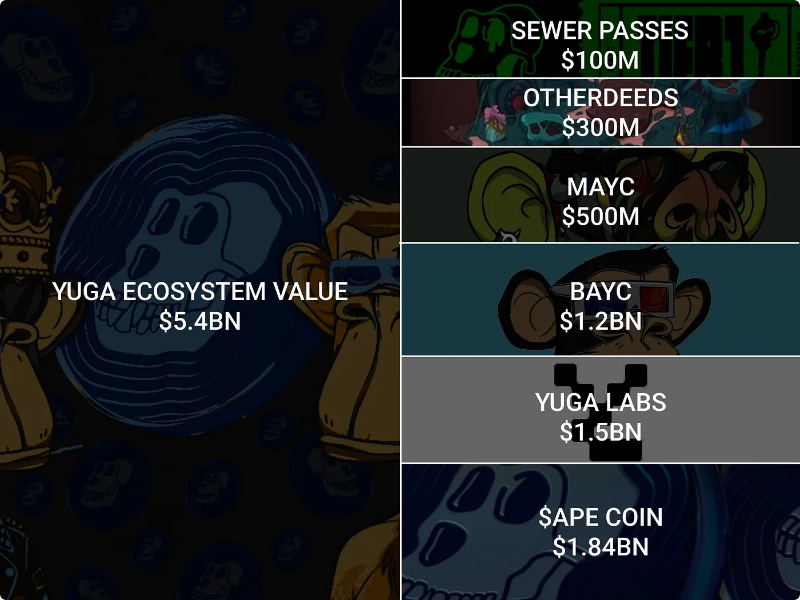

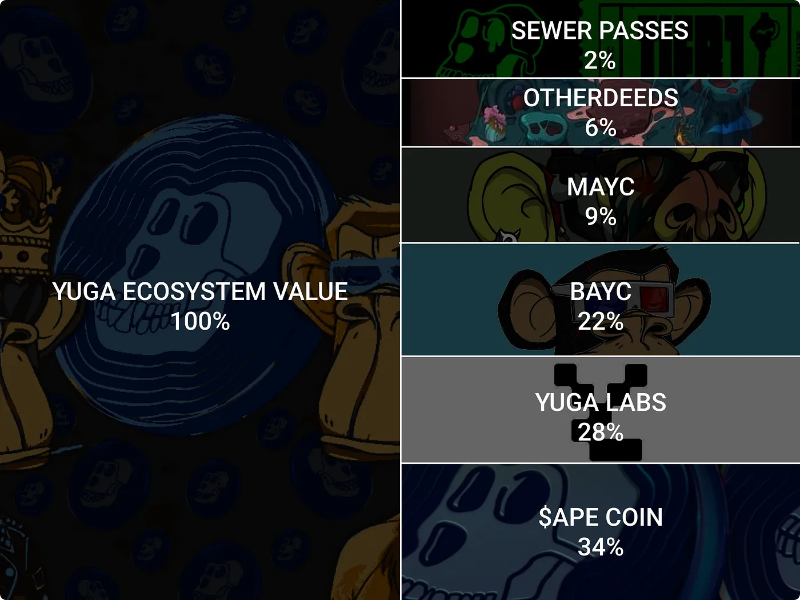

Applying the same logic, the value of the Yuga ecosystem equals the total value of the entire Yuga world. It is the sum of all funds owned by the Yuga Labs equity entity and the value of all existing NFT collections (BAYC, MAYC, etc.) and tokens ($APE).

Yuga Ecosystem Value = Yuga Labs Equity Value + Yuga NFT and Token Value

2. Intrinsic Value

Intrinsic value refers to an asset’s future worth, which we can estimate based on its potential profitability. However, since future money is worth less than present money, we discount future earnings accordingly.

Therefore, the fundamental value of a company, token, or NFT equals the discounted value of its future earnings. By the same logic, the value of the Yuga ecosystem also equals the discounted value of its future earnings.

Yuga Ecosystem Value = Discounted Future Earnings

3. What Is YUGA’s Business Model?

How does the Yuga ecosystem generate revenue? Let's examine the primary sources of income in the Yuga ecosystem.

Yuga has two main revenue streams:

-

NFT and Token Sales → Creating and selling new tokens and NFT collections;

-

NFT Royalties → Charging fees on every secondary NFT transaction.

4. The Dark Side of Launching New NFTs: Dilution

The Yuga ecosystem gains significant revenue by creating and selling new NFT sets such as BAYC, MAYC, and Otherdeeds. Yuga Labs earned $100 million from the initial sale of MAYC and $330 million from the initial sale of Otherdeeds, while holding over $2 billion in Ape Coin and $40 million in Otherdeeds on its balance sheet.

However, launching new NFT collections also has drawbacks: it dilutes ownership for existing Yuga ecosystem stakeholders (Yuga Labs, $APE, BAYC). For current Yuga ecosystem stakeholders to benefit from issuance, the value created through launching and selling new NFT collections must outweigh the cost of dilution.

This concept resembles mergers and acquisitions (M&As), where an acquiring company purchases a target company via share exchange. Thus, shareholders of the acquiring company experience dilution. The success of an acquisition depends on whether the target company generates enough value to offset the dilution cost. If the value created exceeds the cost, the acquisition is considered successful; otherwise, it is deemed a failure.

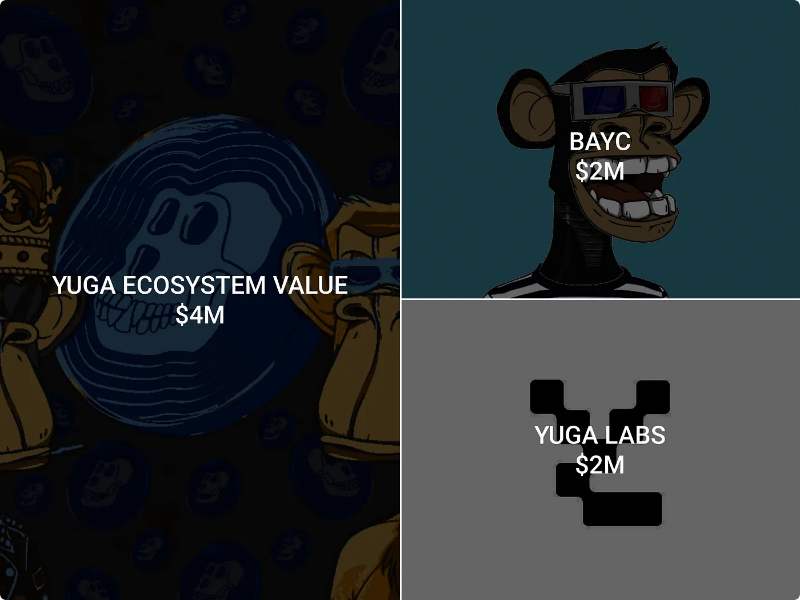

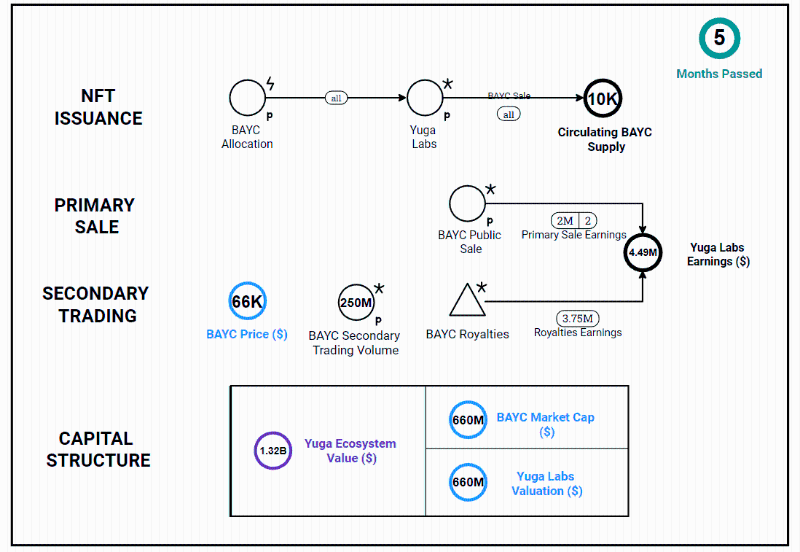

5. BAYC Sale | May 2021

When Yuga Labs issued and sold 10,000 BAYCs at $200 each, they created a new stakeholder group—BAYC holders—and raised $2 million from the primary sale.

Note that NFTs sold by PFP projects and Web3 gaming studios are not just virtual goods—people buy them expecting their value to increase over time.

That's why BAYC owners are treated as a distinct stakeholder group within the Yuga ecosystem, because the issuing company bears responsibility toward these NFT holders.

In the months following the sale, BAYC prices surged significantly, reaching $66,000 by the end of August.

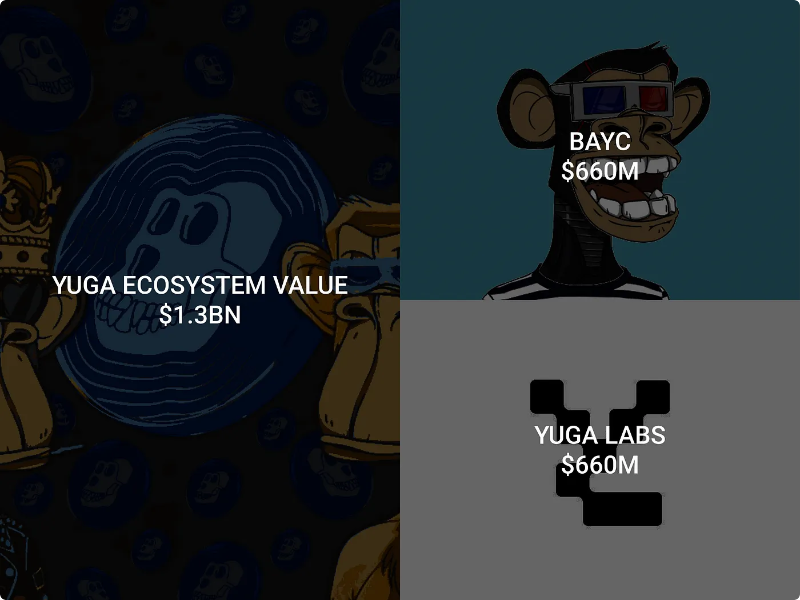

This implies a market cap of up to $660 million for BAYC. Assuming a 1:1 conversion rate between BAYC market cap and Yuga Labs’ equity valuation, Yuga Labs would be valued at approximately $660 million.

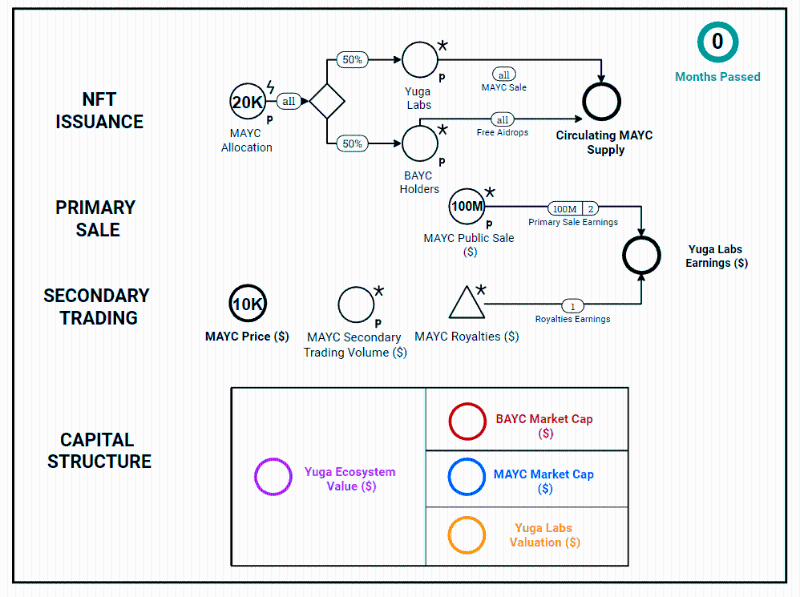

Analysis of the Machinations diagram above:

-

Yuga Labs sold 10,000 BAYCs and raised $2 million.

-

Within four months, BAYC prices rose from $200 to $66,000.

-

By month four, Yuga Labs had already earned $2.5 million in BAYC royalty revenue.

6. MAYC Sale | August 2021

Next, let's analyze the launch and sale of MAYC. Prior to the MAYC launch, BAYC had a market cap of about $660 million, and the entire ecosystem consisted solely of BAYC holders and Yuga Labs, owned by four founders.

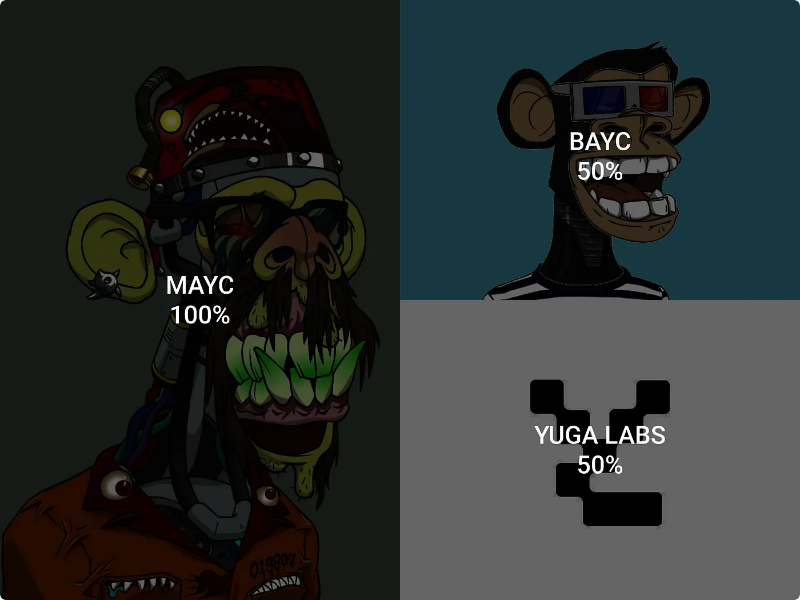

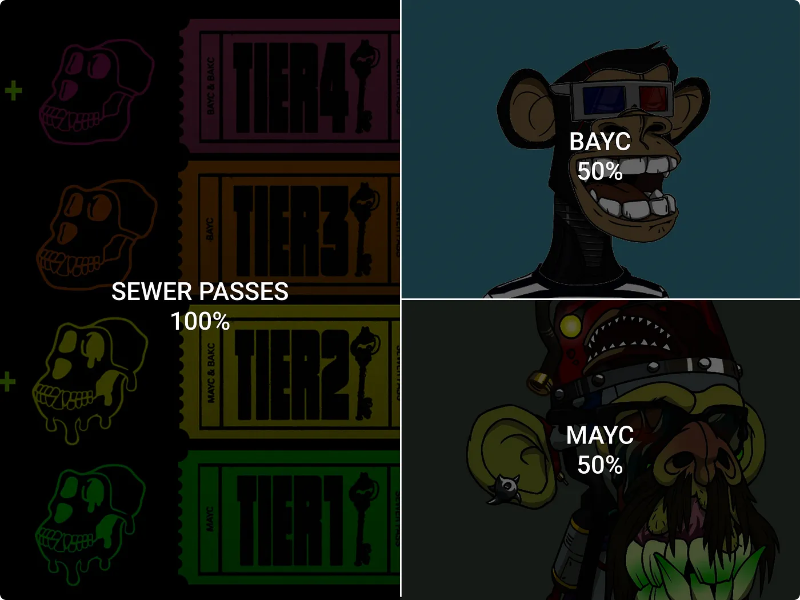

Additionally, 20,000 MAYC NFTs were created: 10,000 sold publicly and 10,000 distributed to BAYC holders. This means Yuga Labs and BAYC holders each received 50% of the proceeds from the MAYC issuance.

Unlike other PFP NFT series, BAYC holders can claim future Yuga NFTs for free. This sends a clear message to BAYC holders that they hold a critical position within the Yuga ecosystem.

Yuga Labs successfully sold 10,000 MAYC NFTs at $10,000 each, earning $100 million. The 10,000 MAYC NFTs gifted to BAYC holders were theoretically worth $100 million at the end of the sale.

At the time of the MAYC launch, several concerns emerged. First, uncertainty existed about whether Yuga Labs could sell all 10,000 MAYC NFTs. Second, there was concern that launching a new collection (MAYC) might siphon value from BAYC, causing BAYC NFT prices to drop due to increased competition.

Despite these concerns, the MAYC sale proved a massive success for Yuga Labs, generating $100 million in revenue and paving the way for future NFT products.

Let’s analyze the Machinations diagram above:

-

Yuga Labs sold 10,000 MAYCs for $100 million.

-

MAYC prices rose from $10,000 to $58,000 over seven months.

-

By month seven, Yuga Labs had generated $25 million in MAYC royalties.

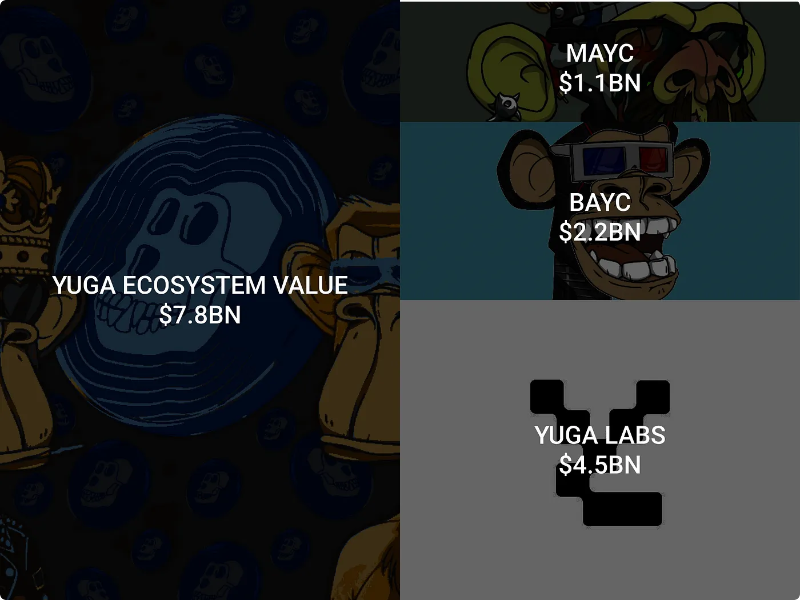

Shortly before the ApeCoin launch, BAYC traded at $2.2 billion and MAYC at $1.1 billion. Yuga’s launch of new NFT collections created substantial new value, attracting well-funded late-stage crypto venture investors.

Yuga secured a remarkable $450 million seed round at a $4.5 billion valuation led by a16z, announced shortly after the ApeCoin launch. If we use the seed round valuation instead of the 1:1 NFT-to-equity rule, the value accumulation structure would look like this:

7. $APE Launch | March 2022

The launch of ApeCoin in March 2022 was a pivotal event in the Yuga ecosystem and highly anticipated by the NFT community. Having achieved multiple successful launches in the blockchain space, many eagerly awaited ApeCoin’s debut, hoping it would meet Yuga Labs’ high standards.

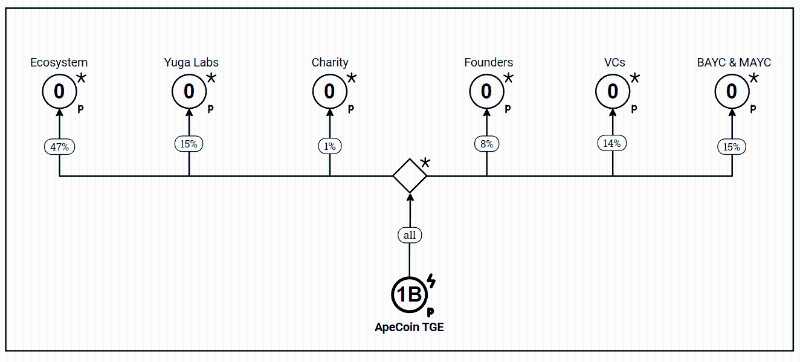

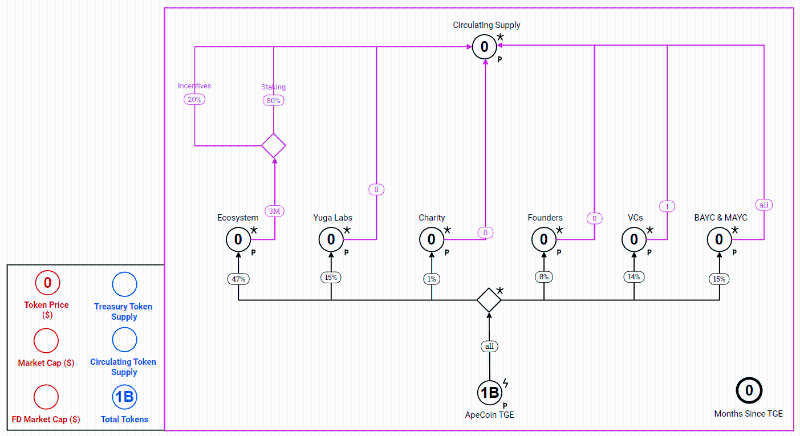

The initial token distribution allocated 47% to the ecosystem, 15% to Yuga Labs, 1% to charity, 8% to founders, 14% to VCs, and 15% to BAYC and MAYC holders.

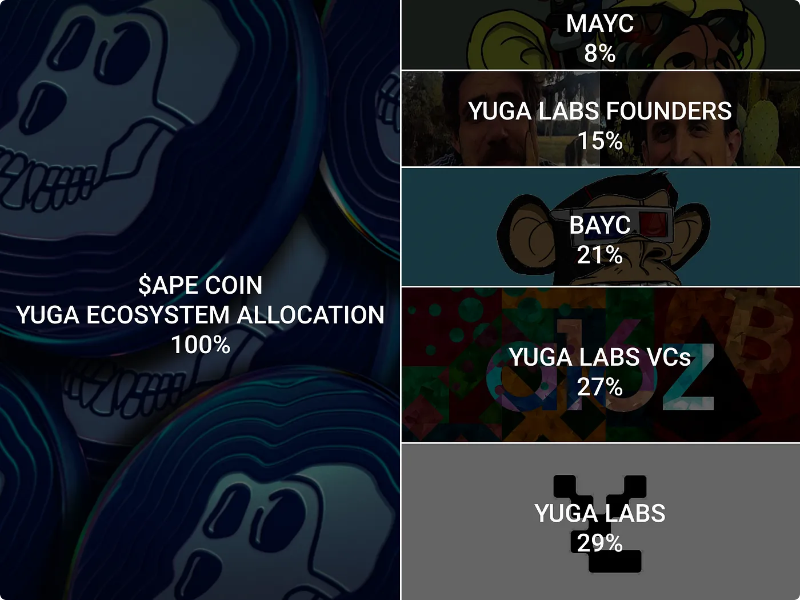

Our definition of Yuga ecosystem stakeholders (Yuga Labs, BAYC, MAYC, VCs) received a combined 52% of the tokens. Let's break down this 52% allocation:

While the figures mentioned earlier provide some insight, they don’t fully reflect reality. Note that Yuga Labs’ venture investors and founders also have direct stakes in Yuga Labs, meaning they indirectly receive more tokens than previously stated. Therefore, further analysis is needed for a more accurate picture of token distribution.

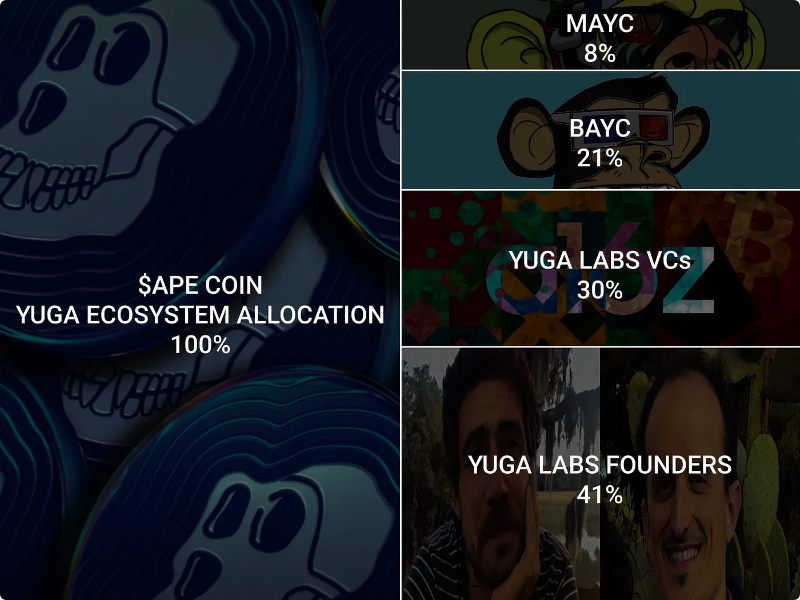

Assuming no employees or advisors hold ownership in Yuga Labs, and excluding potential equity dilution from the Larva Labs (CryptoPunks IP) acquisition, based on the $450 million seed round, it appears Yuga Labs founders own 89% of the company, with VCs owning the remaining 11%. Adding these together, this translates to a 41% token allocation for Yuga Labs founders and 30% for Yuga Labs VCs.

Since $APE Coin distribution differs greatly from MAYC, $APE favors Yuga Labs shareholders over BAYC and MAYC holders.

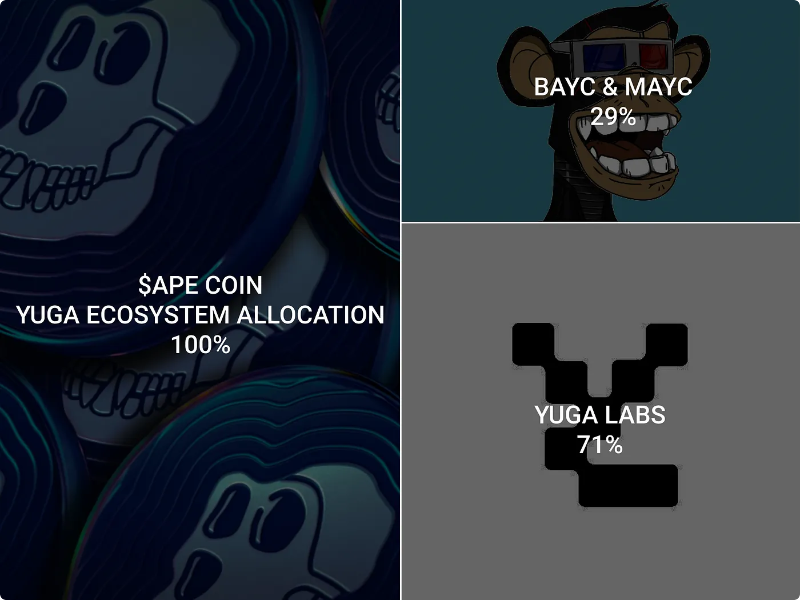

Our calculations show Yuga Labs and its shareholders received 71% of the allocation, while BAYC/MAYC holders received only 29%, a 2.4:1 ratio—higher than the 1:1 ratio seen in MAYC distribution. Therefore, a16z and Yuga Labs’ founders gained greater $APE allocations at the expense of BAYC and MAYC holders.

Notably, tokens allocated to BAYC and MAYC holders are immediately usable, while those allocated to Yuga Labs, VCs, and founders are subject to a four-year vesting period.

8. OTHERDEEDS Sale | May 2022

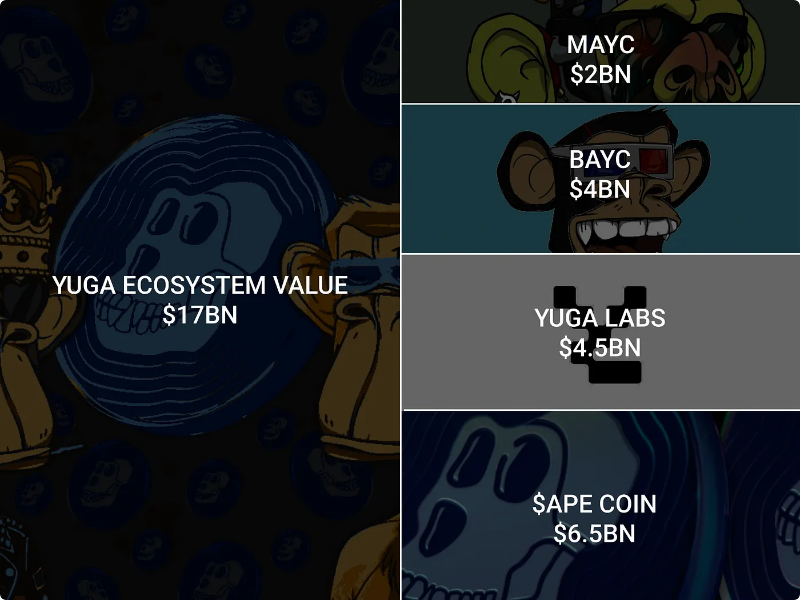

In the days preceding the Otherdeeds sale, Bored Ape Yacht Club (BAYC), Mutant Ape Yacht Club (MAYC), and the $APE token all reached record highs.

BAYC achieved an astonishing market cap of around $4 billion, MAYC reached approximately $2 billion, and the $APE token hit $6.5 billion. In less than two years, Yuga Labs transformed ten thousand JPEG monkeys with no utility into a multi-billion-dollar empire!

It's important to note that NFT collection market caps are calculated as floor price multiplied by circulating supply, so the actual valuation could be much lower if someone attempted to buy all circulating Yuga ecosystem assets at once.

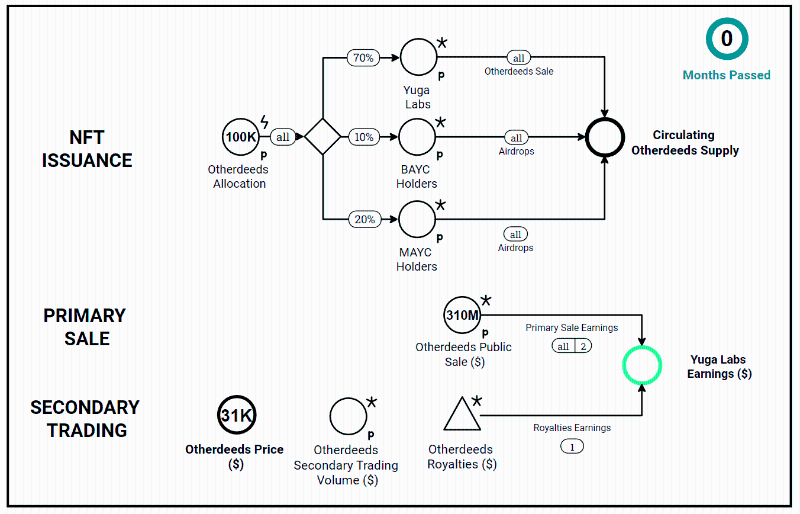

Out of 100,000 Otherdeeds issued, 55,000 were publicly sold, 10,000 gifted to BAYC holders, 20,000 to MAYC holders, and 15,000 retained by Yuga Labs.

Overall, 70% of Otherdeeds were allocated to Yuga Labs. We see another instance where Yuga Labs acquired assets from NFT and $APE holders at premium prices. Moreover, MAYC holders received disproportionate allocation at the expense of BAYC holders, while $APE holders received no Otherdeeds allocation at all.

Let’s analyze:

-

Yuga Labs sold 55,000 Otherdeeds NFTs for $310 million. While this purchasing power came from $APE, Yuga Labs committed not to touch the $APE proceeds from Otherdeeds sales for one year. As a result, the current value of $APE proceeds from Otherdeeds sales held by Yuga is approximately $80 million.

-

Otherdeeds prices dropped from $31,000 to $2,000 within seven months.

-

By month seven, Yuga Labs had already generated $56 million in Otherdeeds royalties.

Although we said earlier that $APE holders received no Otherdeeds allocation, it's important to note that the primary sale was conducted using $APE. However, using $APE as a medium to purchase Otherdeeds assets in auctions doesn't necessarily confer lasting value to $APE or make it a sustainable value sink.

Only $16 million worth of $APE deposited by Otherdeeds buyers into the $APE DAO treasury would permanently accrue value to $APE. In that case, the surplus $APE in the treasury would be collectively voted on by the APE governance team to determine its usage—as it would remain on the APE DAO’s balance sheet.

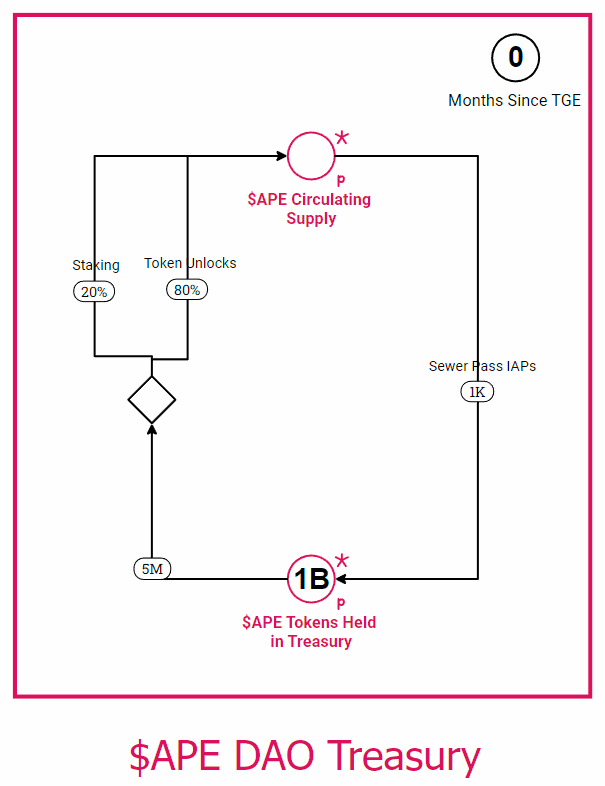

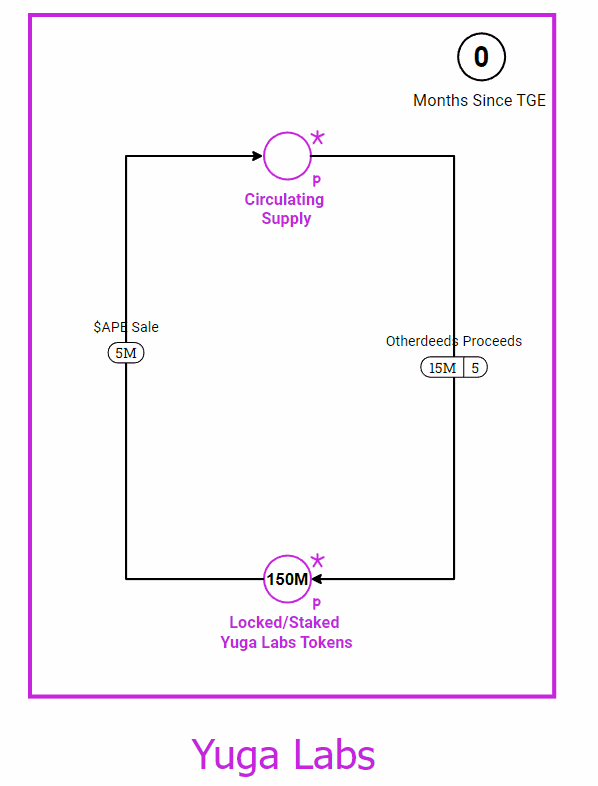

In this hypothetical chart, we observe several events. Each month, 5 million APE tokens enter circulation through scheduled unlocks and staking rewards. Additionally, we see 1,000 APE tokens per month flowing back into the $APE reserve via Sewer Pass IAP sales in Yuga’s mobile game (which we’ll discuss shortly).

As more tokens accumulate in the reserve, the theoretical value of $APE increases. However, if tokens are not accumulating in the treasury but are instead being staked, this merely delays the inevitable—Yuga Labs selling their own token allocations.

Regarding the Otherdeeds sale, it's crucial to understand that the $APE paid by buyers went directly into Yuga Labs’ wallet—not into the APE DAO treasury. This means Yuga Labs fully controls these tokens and can sell them at any time, distributing proceeds to its shareholders. However, Yuga Labs pledged not to sell $APE tokens obtained from Otherdeeds sales for one year.

Effectively, Yuga Labs temporarily locked up $APE for one year, but they likely will sell a portion when the lockup ends. This made $APE a scarce resource during that year, but in reality, the tokens remained under Yuga Labs’ control.

In this hypothetical chart, we illustrate a scenario where, even with Yuga Labs regularly selling 5 million $APE tokens, the proceeds from the Otherdeeds sale only temporarily ease downward pressure on $APE.

9. SEWER PASS Launch | January 2023

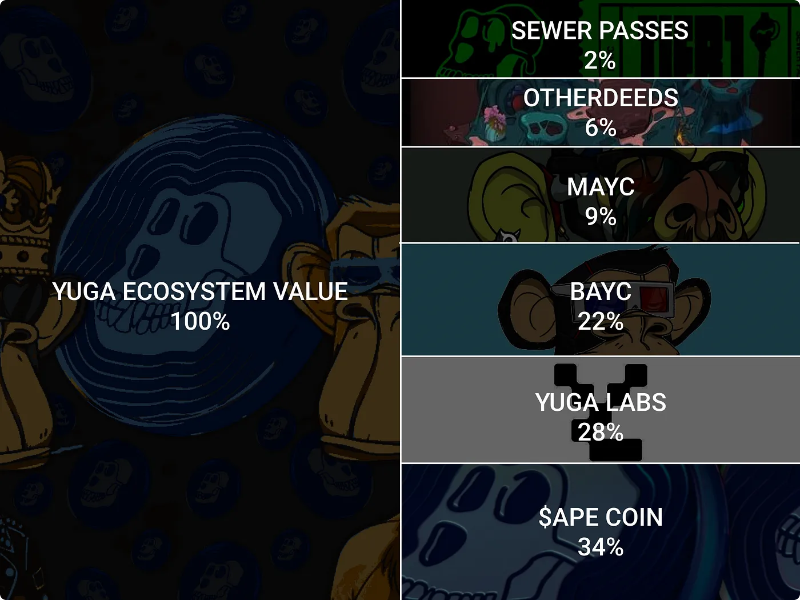

Before the Sewer Pass launch, as the broader crypto market declined, the value of Yuga’s assets also fell. Specifically, the Yuga ecosystem value dropped from $17 billion in May 2022 to $3.8 billion in January 2023.

Now let's analyze the structure of the Sewer Pass issuance.

Below is the capital structure of the Yuga ecosystem as of March 2023:

-

Yuga Labs: Owns NFTs, games, and other assets

-

Bored Ape Yacht Club (BAYC): Holds Sewer Pass NFTs

-

Mutant Ape Yacht Club (MAYC): Holds Sewer Pass NFTs

-

APE DAO: Owns APE tokens and Otherdeeds NFTs, governed by APE token holders

Here, the Sewer Pass NFT serves as a bridge connecting the BAYC and MAYC communities to Yuga Labs. However, since Yuga Labs itself does not hold Sewer Pass NFTs, the value of this collection is not included in Yuga Labs’ total assets. Meanwhile, although in-game microtransactions can be purchased using APE tokens, their revenue scale is negligible compared to Sewer Pass NFTs.

10. Revenue Streams in the YUGA Ecosystem

The table shows revenue earned by Yuga Labs, BAYC, and MAYC from issuing and selling Yuga NFTs and tokens. Although BAYC and MAYC holders appear to have earned higher revenues—$1.3 billion and $572 million respectively—Yuga Labs earned $412 million, excluding tokens and NFTs held in reserves. Notably, Yuga Labs holds $2 billion worth of $APE Coin in its reserves.

Royalties have become a key revenue source for NFT projects, though their sustainability faces challenges amid ongoing competition across NFT markets.

Yuga Labs charges 2.5% royalties on BAYC and MAYC, and 5% on Otherdeeds and Sewer Passes. Notably, all royalty income flows exclusively to Yuga Labs, with no distribution to other stakeholders in the Yuga ecosystem. As such, Yuga Labs has accumulated $182 million in royalty revenue to date.

Compared to primary sales, royalty revenues are relatively small. As previously noted, primary sales represent a superior mechanism for monetizing intellectual property. However, royalties serve as a supplementary income stream, providing additional revenue.

11. Stakeholder Issues

One of the biggest challenges when managing multiple holders is misaligned incentives. With no legal or predefined smart contract specifying who is entitled to what, each holder may strive to maximize their short-term gains. At some point, internal conflicts may arise among multiple stakeholders, each trying to capture value into their own assets.

To prevent this, Yuga Labs must take responsibility for managing multiple stakeholders, ensuring fair treatment when launching new offerings and creating new revenue channels. A well-designed structure should aim to maximize collaboration among all stakeholders and minimize incentive misalignment.

Thoughts:

-

If Yuga launched a new series tomorrow, how would the company allocate it among its stakeholders?

-

If Sewer Pass holders receive no airdrops, what value or utility does the Sewer Pass have? Why would anyone continue holding their Sewer Pass? Why wouldn't they just sell it? The same question applies to Otherdeeds.

-

What percentage of game/metaverse revenue will be shared with Yuga’s stakeholders? Will BAYC/MAYC holders receive no share of game revenue?

-

If game revenue is only distributed to $APE and Otherdeeds holders, what would the split be? 50/50? 80/20? Would the allocation be based on recent market prices or primary sale prices?

Let’s consider this from a retail investor’s perspective. If someone wants to invest in the Yuga ecosystem, which asset should they buy?

This is an important question because each asset offers different revenue channels, allowing investors to capture value within the Yuga ecosystem. If Yuga performs well in the future, but the investor’s chosen asset underperforms relative to other Yuga assets, it could lead to great disappointment.

Buying BAYC and MAYC presents a compelling value proposition. By owning these assets, investors gain a certain percentage reward from each new Yuga NFT or token issuance. Even if Yuga sometimes allocates fewer rewards to BAYC and MAYC holders, they still receive some portion from issuances.

If you believe Yuga’s future NFT and token collections will hold value, then BAYC or MAYC are the assets to buy. However, you won’t receive Yuga’s royalty revenues. The minimum capital required to purchase these assets is relatively high, as BAYC and MAYC floor prices are above $110,000 and $20,000 respectively.

$APE offers a different value proposition. Currently, $APE provides vague and superficial “utility,” with no clear explanation of how value from the Yuga ecosystem accrues to $APE. While using $APE to buy Otherdeeds creates temporary value, it merely postpones the inevitable. Once $APE holders realize that value created by the Yuga ecosystem does not flow back to $APE, they have no reason to hold it.

Using $APE for in-game microtransactions represents clearer utility (assuming proceeds go to the $APE DAO treasury). We may see more $APE utility emerge in Yuga’s games/metaverse. However, Yuga has not yet announced utility for existing assets. Delaying such announcements is strategically wise, as it fuels speculation and anticipation among asset holders.

But this also means unmet expectations could lead to dissatisfaction. Even if Yuga develops outstanding IP, games, or a metaverse, if BAYC holders or Yuga Labs capture disproportionately more value compared to $APE or Otherdeeds holders, discontent will follow.

12. Conclusion

Value accrual structure is a challenging topic in the Web3 world. Every set of NFTs or tokens issued by a project becomes a liability on its Web3 capital structure. To ensure all stakeholders remain aligned and collaborate effectively, projects need a carefully designed value accrual framework.

If you’re an investor, conducting thorough due diligence to fully understand the income and value channels you’re exposed to is essential. Making the wrong asset choice—even while backing the right project and team—can lead to deep disappointment.

In short, a well-structured value accrual model is critical to the success of Web3 projects, and investors should take the time to fully understand the assets they’re investing in to avoid future regret.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News