Delving into the Essence of Advanced LSD Strategies: From Frax/Yearn's LSD to Leveraged Staking and Re-staking

TechFlow Selected TechFlow Selected

Delving into the Essence of Advanced LSD Strategies: From Frax/Yearn's LSD to Leveraged Staking and Re-staking

If you don't know where the revenue comes from, then you are the source of the revenue.

By CapitalismLab

ETH staking rewards are relatively equal—so where do those high-yield LSD projects come from?

There’s a famous saying: If you don’t know where the yield comes from, you *are* the yield.

From Frax/Yearn's LSDs to leveraged staking and re-staking, this article will break down the essence of these advanced LSD strategies.

Protocol Asset Incentives

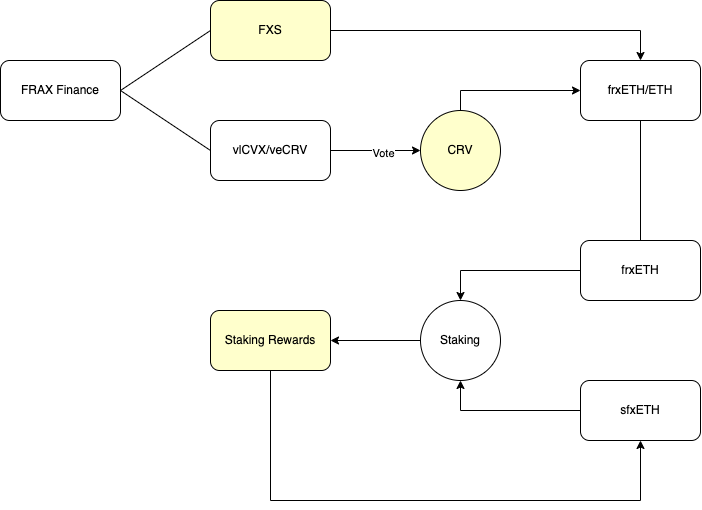

First, let’s analyze the reward distribution system of Frax/frxETH using a diagram, with sources of yield highlighted in yellow:

FXS token incentives: Frax Finance directly allocates its governance tokens to the frxETH pool.

Frax-controlled vlCVX/veCRV voting power indirectly directs CRV/CVX emissions to the frxETH pool.

ETH staking rewards.

Whether direct or indirect, these incentives all originate from Frax Finance—the only difference lies in form and packaging. Simplifying the model makes it clear: the source and distribution of yield are:

Frax Finance uses protocol assets/income to incentivize frxETH.

All staking rewards from both frxETH and sfrxETH go entirely to sfrxETH.

sfrxETH earns “two layers” of staking yield, hence its higher APR.

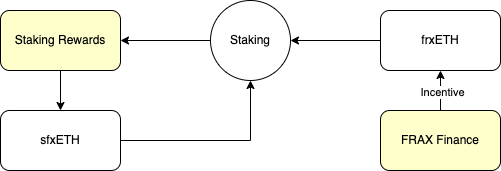

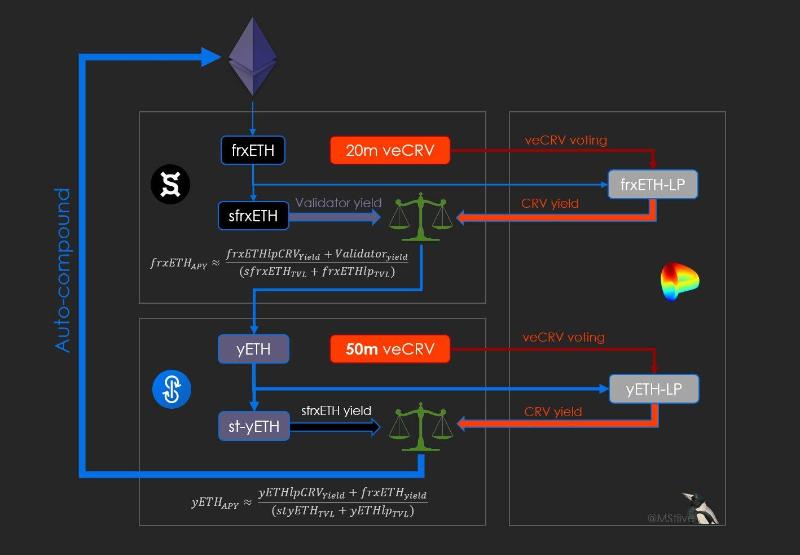

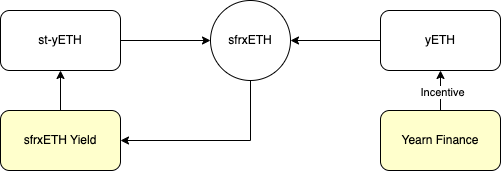

Similarly, let’s apply the same analysis to Yearn’s upcoming yETH:

After simplification, we can clearly see that the yield sources and distribution are:

Yearn Finance incentivizes liquidity (and thus indirectly yETH) through protocol assets.

All sfrxETH rewards from yETH/st-yETH go entirely to st-yETH.

Note: The “protocol assets” here aren’t limited to Yearn’s treasury—they may also include voting rights diverted from products like yCRV.

Indeed, the excess yields of frxETH and st-yETH stem from direct or indirect subsidies by protocol assets!

Wait—doesn’t this lead to infinite recursion? Not quite:

Protocol assets have opportunity costs—for example, vlCVX/veCRV could otherwise earn bribes.

If a protocol isn't just vaporware, it must generate utility—such as revenue sharing. Once scale is reached, subsidies and earnings balance out, eliminating excess returns.

So what’s the point? Because there’s an expectation that LSDs will explode post-Shanghai upgrade. As referenced in the tweet below, LSDs that grow large enough can build moats. By expanding now and securing market share, they position themselves for substantial future returns.

Further Reading: Lido's Story: Value, Growth, and Moat – The Upcoming Battle for Liquid Staking Post-Shanghai Upgrade

Is this excess yield sustainable?

Increasing staked assets or protocol assets will dilute excess yield. If protocol assets appreciate relative to ETH (due to price or other factors), this process slows; otherwise, it accelerates. This model exhibits clear reflexivity. While fundamentally based on subsidies, sophisticated packaging is essential—compelling narratives can boost protocol asset value and fuel a positive feedback loop.

Put simply, yield comes from two sides: protocol assets and underlying assets. Could these be diversified further? The project bestLSD (name aside) claims to open up both ends—sourcing protocol assets from GMX/GLP to CRV/CVX/Velo, and underlying assets from AMM LPs to leveraged staking. In short, it combines both sides to maximize yield.

Further Reading: A Thread About bestLSD

While this seems a bit wild, it reminds us that beyond protocols holding CRV/CVX, any protocol with income-generating assets could theoretically compete. The barrier to entry is actually low, so competition may intensify. So it's another use case for GLP and gDAI—gud!

Yield Spread Arbitrage

As for boosting returns via leveraged staking through lending protocols (see thread below), the mechanism is essentially yield spread arbitrage. While depositors may seem disadvantaged, borrowers take on additional LSD protocol risk and liquidity risk. Lending protocols act as conduits, transmitting staking yields back to native assets.

Further Reading: Lending Protocols Will Be the Biggest Hidden Winners After ETH's Shanghai Upgrade

Taking on a Second Job

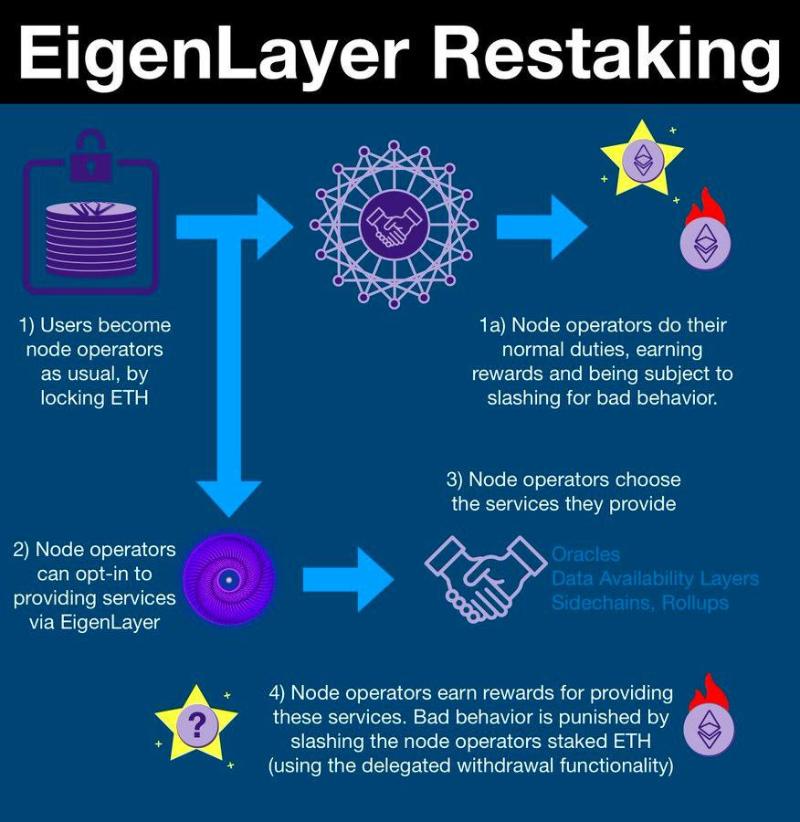

Re-staking—third parties leveraging Ethereum’s base-layer security—can be described non-technically but simply as follows:

Networks and applications require nodes or similar entities to ensure security.

To prevent malicious behavior by these entities, there must be consequences.

Therefore, require collateral—slashing it upon misbehavior.

Collateral should also be capital-efficient—ETH staking is a primary way to generate yield, so use staked assets as collateral.

Managing deposits, withdrawals, and slashing of staked assets requires execution—this is re-staking.

You run nodes for third-party networks—taking on a second job—so naturally, they pay you.

In summary, protocol asset incentives, yield spread arbitrage, and “taking on a second job” (re-staking) represent three sources of excess yield. It must be emphasized that complex strategies bring greater risks. One must assess whether excess yield adequately compensates for increased risk—after all, no matter the source, yields may ultimately end up in the hands of opportunistic actors (“scientists”).

LSDs inherently involve interaction with real-world validators, making them relatively “heavy” operations. However, these advanced strategies abstract LSD assets into more modular, “lightweight” financial instruments. The barriers here are clearly lower than traditional LSDs, leading to more innovation and experimentation. This space warrants ongoing attention—so follow @NintendoDoomed, thanks喵, for continuous LSD insights喵.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News