Opinion: Why FRAX is the Best Investment Target in the Stablecoin Narrative?

TechFlow Selected TechFlow Selected

Opinion: Why FRAX is the Best Investment Target in the Stablecoin Narrative?

Frax has evolved into a full-stack monetary system built around regulatory clarity, institutional collaboration, and vertical integration.

Author: Kyle, Crypto KOL

Translation: Felix, PANews

Note: Crypto KOL Kyle currently holds FRAX; this article represents only Kyle's personal views.

Key Points:

-

Market cap $276M / Fully diluted market cap $304M; Frax offers an excellent asymmetric opportunity to bet on stablecoins, and with the upcoming GENIUS Act, Frax aims to become one of the first U.S.-compliant payment stablecoins

-

Founder Sam Kazemian is actively involved in drafting U.S. stablecoin legislation, giving FRAX regulatory alignment

-

Asymmetric positioning: favorable regulatory tailwinds + product-market-regulation fit + undervalued token (widely criticized)

-

FRAX has now become a vertically integrated stablecoin stack: frxUSD (stablecoin), FraxNet (banking interface), Fraxtal (L2 execution layer)

-

frxUSD is fully backed by U.S. Treasuries and cash

-

Token rebranding: FXS renamed to FRAX, now serving as Gas, governance, burn, and staking token; legacy frax dollar is deprecated and replaced by frxUSD

-

Undervalued: compared to peers like Ethena ($6.1B), with ~$304M fully diluted market cap, it offers the best liquid token exposure within the stablecoin narrative—USDC/USDT have no tokens (private companies), Maker/Curve are not direct enough

-

Real-world integration live: custodial services via BlackRock/Superstate, partners include Stripe and Bridge

Let’s address the elephant in the room. When people hear FRAX, their first reaction is hesitation—usually because it seems too complex, trying to do “too many things,” or due to past bad trading experiences with FRAX.

Before reading further, please completely set aside any prior biases you may have about FRAX and approach it with an open mind. Pretend this is your first time learning about it—Frax as a whole has fundamentally transformed into a completely different application, with a shift so significant that it reverses its previous trajectory.

1. FRAX Is Poised to Ride the Coming Stablecoin Wave

The stablecoin narrative is one every crypto native knows and agrees has massive total addressable market (TAM) potential. Yet, few talk about the GENIUS & STABLE Acts—two landmark bills proposed in the U.S. Congress that define stablecoin regulation. Why? Because politics is an extremely difficult process full of obstacles. Expectations for outcomes are low, seen as inconsequential noise. Most believe these bills matter but lack basic understanding of their significance. At best, they think stablecoin legislation passing would be nice; at worst, they expect endless delays leading to nothing.

Yet, these bills are crucial in reshaping the future of stablecoins. Here’s a comparative summary:

These two bills contain two critical elements:

First, they legally define payment stablecoins. The GENIUS Act will formally allow Payment Stablecoin (PS) issuers to issue legally compliant digital dollars as settlement instruments for interbank payments within the U.S. and global financial systems.

Payment stablecoins represent the biggest structural change, leveling the playing field for innovation and opening the entire multi-trillion-dollar U.S. banking sector to stablecoin startups. Today’s $200B stablecoin market cap represents just 1% of M1 money supply. The U.S. stablecoin bills mark the first time payment stablecoins are recognized as legitimate M1 digital dollars. In other words, the great stablecoin era is about to begin.

Second, the bill is significant in creating a federal regulatory framework for stablecoins—and more importantly, it will become the global standard for stablecoin issuance. Currently, stablecoins exist in a legal gray area—with no real regulatory framework in the U.S. This prevents traditional players from truly integrating stablecoins and limits existing participants from realizing their full potential. This bill changes all that, thus ringing the bell for the dawn of the great stablecoin era.

Today, multiple crypto figures in Washington D.C. are helping draft this landmark legislation—one of them being Frax’s Sam Kazemian.

This is no longer just a DeFi protocol, but a monetary institution built with compliance in mind even before regulations pass. Frax is now ready for legal, institutional, and global expansion.

FRAX: Bringing Global M1 Money Into Stablecoins

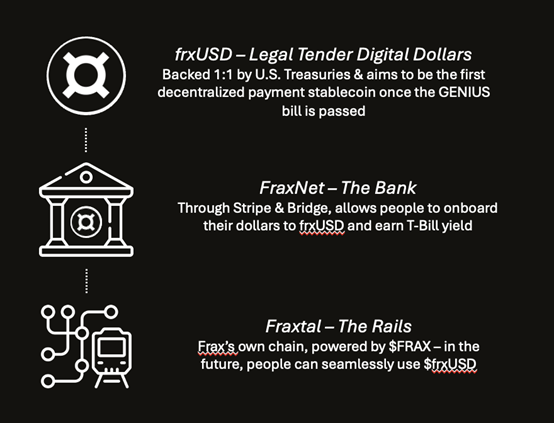

Now let’s discuss what Frax is building today. Frax isn’t just creating a stablecoin—it’s constructing a complete monetary system that integrates TradFi and DeFi into a unified structure, aiming to capture global M1 money supply. Frax achieves this through a vertically integrated architecture covering issuance, yield, and settlement—the three pillars of modern banking—consisting of three components:

-

frxUSD – Digital fiat currency

-

FraxNet – Banking layer

-

Fraxtal – Channel

1. frxUSD: Digital Dollar Backed by Legal Tender

frxUSD is Frax’s flagship stablecoin—a digital dollar fully backed 1:1 by short-term U.S. Treasuries and cash equivalents. Importantly, this is entirely different from Frax’s previous stablecoin—frxUSD is designed to comply with the GENIUS Act and become a payment stablecoin (which is why Sam spends so much time in Washington).

frxUSD is fully backed by cash and short-term Treasuries and custodied via BlackRock and Superstate (BUIDL and UStb). frxUSD aims to become the first payment stablecoin in the U.S. with legal tender characteristics, compliant reserve structure, and institutional integration.

2. FraxNet: The Bank

If frxUSD is the dollar, then FraxNet is the bank interface. FraxNet is essentially a stablecoin banking app—fully KYC-compliant, meeting custody requirements, yet natively on-chain. Imagine logging into your account, viewing your Goldman Sachs money market fund holdings, minting frxUSD from it, and streaming the yield directly back to your Fraxtal address in real time.

The goal is simple: convert every dollar in traditional money market funds (MMFs) into interoperable on-chain dollars. Frax has partnered with Stripe and Bridge to achieve this—unsurprising given Stripe’s recent announcement of stablecoin integration.

This is exactly where Frax becomes exciting—a stablecoin tied to real-world assets, targeting a multi-trillion-dollar TAM.

3. Fraxtal: Execution Layer for Stablecoin Commerce

Finally, Frax’s native chain, Fraxtal. frxUSD will be natively issued, transferred, and settled on Fraxtal. Fraxtal is a hard fork of Optimism Bedrock, featuring native bridging capabilities like Circle’s CCTP, and optimized for frxUSD as the accounting unit.

Fraxtal also uses FRAX (formerly FXS) as its Gas token—meaning every application built on Fraxtal, from FraxLend to FraxSwap to Frax Name Service, requires FRAX to operate. Moreover, fees generated by these apps will directly fund FRAX buybacks and burns.

FRAX has likely moved beyond its old identity as a decentralized stablecoin. Instead, FRAX is building a complete stack monetary system comprising:

-

frxUSD as a legally compliant stablecoin

-

FraxNet as the institutional bridge and user onboarding layer

-

Fraxtal as the global execution layer

This is a convergence of cash flow, utility, and growth. And most exciting is Sam’s effort to ensure regulatory compliance. Right now, no other decentralized stablecoin issuer is taking this path of compliance, transparency, and legality.

While everyone focuses on stablecoins, the next wave of mass adoption—the real, trillion-dollar-scale wave—will come from institutions and consumers who must follow the law. They need redemption rights. They need clear rules. They need to walk into a boardroom and say: "Yes, this complies with U.S. law."

This is product-market-regulation fit in action.

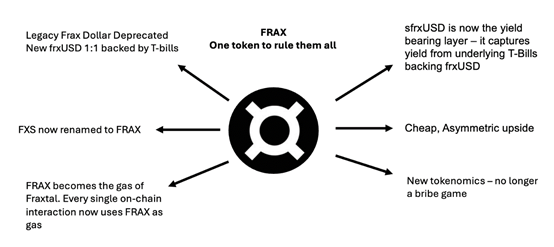

2. FRAX Rebranding

Now let’s discuss some subtle but powerful changes FRAX has recently undergone, adding momentum to the protocol. This section covers updates from FIP-428.

In short:

-

Legacy Frax stablecoin is deprecated, now called Legacy Frax Dollar. The new stablecoin is named frxUSD.

-

FXS renamed to FRAX—using a single core asset to represent the entire protocol.

-

veFXS renamed to veFRAX, wFXS to wFRAX, etc.

-

However, exchanges are still working to support this transition, so it will take time.

-

FRAX will serve as Gas on Fraxtal, replacing frxETH. All on-chain interactions now use FRAX as Gas. There are plans to eventually support validator staking with FRAX, significantly boosting token utility.

-

New tokenomics: Tail emission schedule—8% issued annually, decreasing by 1% each year until reaching a 3% floor. Emissions are now distributed via FXTL points, a points system rewarding protocol-aligned behaviors.

-

You can boost conversion rates using Flox Capacitors, which require staking FRAX. The goal is clear: reward long-term users who lock, stake, and actively participate in the ecosystem.

-

This also means no more FXS gauges—no more mercenary LP mining; no more massive token emissions just to maintain TVL—everything is earned.

-

Frax is no longer a bribery game—it’s now more like an L1 token with monetary premium, burn mechanics, yield, and utility, rather than a bribe + mining token—making FRAX eligible for repricing.

-

sfrxUSD is now the yield-generating layer—it captures yield from the underlying Treasuries backing frxUSD.

There are other nuances too. FIP-428 is a brilliant proposal that ties the entire ecosystem to a single token: FRAX. Every part of the Frax system now flows back to the token; Fraxtal fees? Burn FRAX. FXTL emissions? Only users holding and staking FRAX can earn. Future validator staking? Requires FRAX. Governance? veFRAX. Most importantly, FRAX is now an L1 token as it serves as native Gas on the chain.

Frax has essentially created a monetary loop with internal demand, utility, and consumption mechanisms. Personally, the key point is understanding this is not just a rebrand. Frax is becoming the most regulated, yield-generating, vertically integrated dollar stack in crypto.

3. Among All Liquid Tokens, FRAX Is the Best Pick

Finally, let’s discuss its advantages. It’s well known that stablecoins are the most popular product in crypto, serving the largest possible market—essentially the world. The stablecoin narrative is crystal clear, yet there are very few investable tokens available to capitalize on this opportunity.

I believe Frax is the best liquid token to bet on the stablecoin narrative, with massive upside potential. Beyond the “North Star” upgrade and building an entire banking system, Frax occupies the optimal position in the stablecoin value chain.

The reason is simple: among all participants—whether DEXs, lending markets, or payment apps—the issuer captures the largest economic share. Controlling issuance is a massive value driver, capturing the juiciest profits—as they say, whoever controls distribution wins.

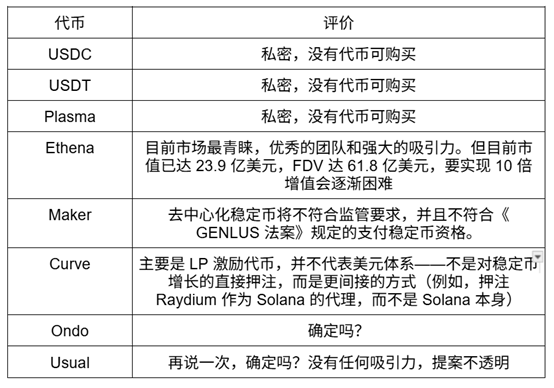

This is why, from an investment standpoint, USDC/USDT are the most popular products today—unfortunately, they have no tokens. Below is a comparison table showing why Frax is the best liquid token in today’s market representing the stablecoin thesis:

On the other hand, FRAX is almost fully diluted, with a market cap of $276M and FDV of $304M as of May 10. This is a token under $500M in market cap partnering with Bridge and Stripe.

Second, FRAX is indeed undervalued. As mentioned at the start, when introducing this project to others, they often show some level of disdain. But they’re all wrong—seeing such a chart doesn’t surprise me at all; this is precisely the reason to buy—at this price point, it’s an asymmetric investment with huge upside potential; if Sam can execute (so far he has, building partnerships with all these giants), growth is evident.

4. Trading Risks

Now that we’ve covered the upside, let’s discuss risks. Actually, the risks here are quite straightforward:

1. The stablecoin bill gets delayed, fails to pass, or undergoes changes affecting FRAX

In fact, this is already happening—just days ago, the bill failed to pass the U.S. Senate. However, quoting Sam, who has been working closely with these lawmakers over the past months: “It’s not as dire as people make it out to be. We never expected it to pass before Congress goes on recess in August, especially by late July. This is part of the political process. It couldn’t possibly pass three months earlier than expected. I’m an optimist, but not that optimistic. Everything is still on track, expecting passage in July—that’s always been my expectation.”

July will be the critical month; if it hasn’t passed by then, start worrying. Until then, stay calm.

2. Why so much focus on the GENIUS Act and little mention of the STABLE Act? What if the STABLE Act passes instead?

Again, according to Sam, that’s not how it works—both bills could pass their respective chambers, followed by a reconciliation period where a compromise final draft will be submitted to the President for signing. The final version will likely resemble the GENIUS Act more than the STABLE Act—and that’s what matters.

3. What’s the worst-case scenario?

Neither bill passes—this would likely only happen under major disaster scenarios, such as global financial collapse, halting all efforts completely.

But the situation isn’t entirely dependent on the bills—Frax has already demonstrated tremendous progress in upgrading the protocol, which I believe is sufficient reason to bet on them.

4. Failure to deliver on promises

Given that Sam is fully committed in Washington D.C. acting as founder, this scenario is highly unlikely.

Conclusion

FRAX is no longer the “half-baked” (half-supported, half-not) algorithmic stablecoin remembered from 2022. It has evolved into a full-stack monetary system built around regulatory clarity, institutional alignment, and vertical integration. The founder is in Washington assisting policymakers. The stablecoin is backed by U.S. Treasuries and institutionally custodied. The token is gaining real utility—as Gas, governance, burn mechanism, and more.

The purest stablecoin bet in crypto today—and such opportunities don’t come often. A token trading below $16, directly tied to crypto’s largest potential market—the U.S. dollar itself. Looking forward to FRAX’s future.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News