Stablecoin Bill Passes, Why Is FRAX the Biggest Winner?

TechFlow Selected TechFlow Selected

Stablecoin Bill Passes, Why Is FRAX the Biggest Winner?

Founder participates in GENIUS bill drafting, FXS token price doubles within the month.

Author: Alex Liu, Foresight News

Stablecoin Bill and FXS

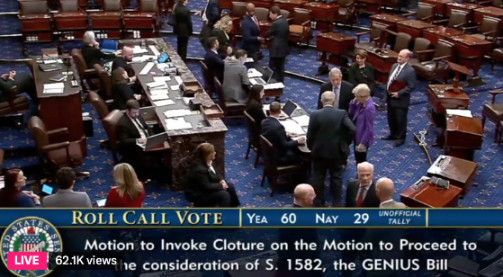

On May 20, the U.S. stablecoin legislation known as the GENIUS Act passed in the Senate vote, now only awaiting a House of Representatives vote and presidential signature to become law. The market previously viewed the Senate vote as the biggest hurdle for the bill’s passage, and barring any surprises, its full enactment appears to be merely a matter of time.

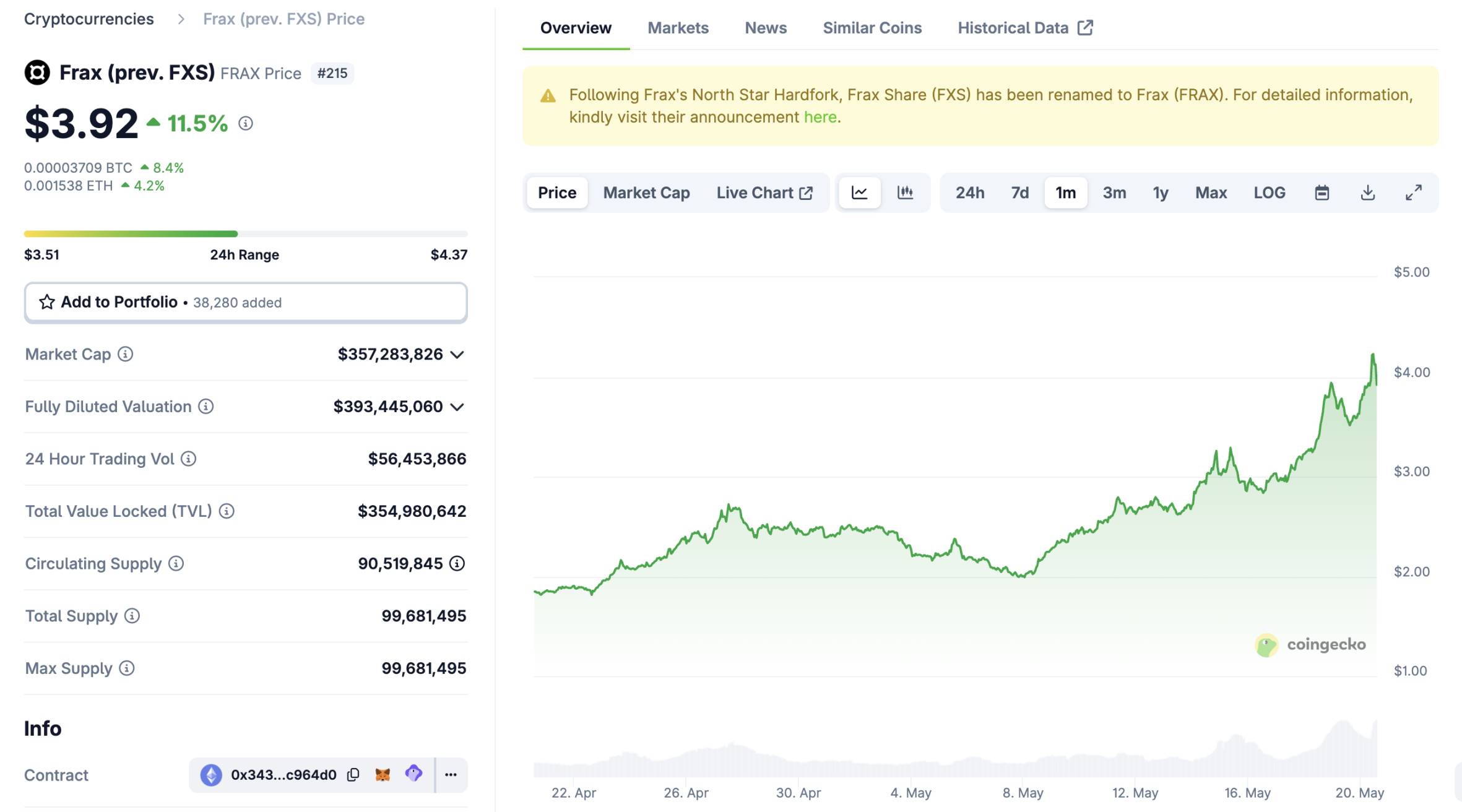

Which crypto project stands to gain the most from this legislative victory? Judging by token price performance, it may be Frax Finance.

Following the Senate's approval, Frax Finance’s token FXS (now renamed FRAX, though not yet updated on centralized exchanges) surged past 4.4 USDT, leading gains across major exchanges. Even with some pullback, FXS has still gained over 100% within the month when viewed on a longer timeframe.

Why does this bill benefit Frax Finance, and why do some regard Frax as the biggest winner of the GENIUS Act?

Frax Finance

Frax Finance offers more than just a stablecoin, including liquid staking, lending, and L2 solutions. However, these are deeply rooted in stablecoins. Frax was once the issuer of the hybrid algorithmic stablecoin FRAX but abandoned the "algo-stable" track after the Luna UST collapse, transitioning into a fully collateralized stablecoin.

Since then, FRAX has further evolved into frxUSD, backed by fiat currency, with the stated goal of becoming “the first licensed fiat-backed stablecoin.”

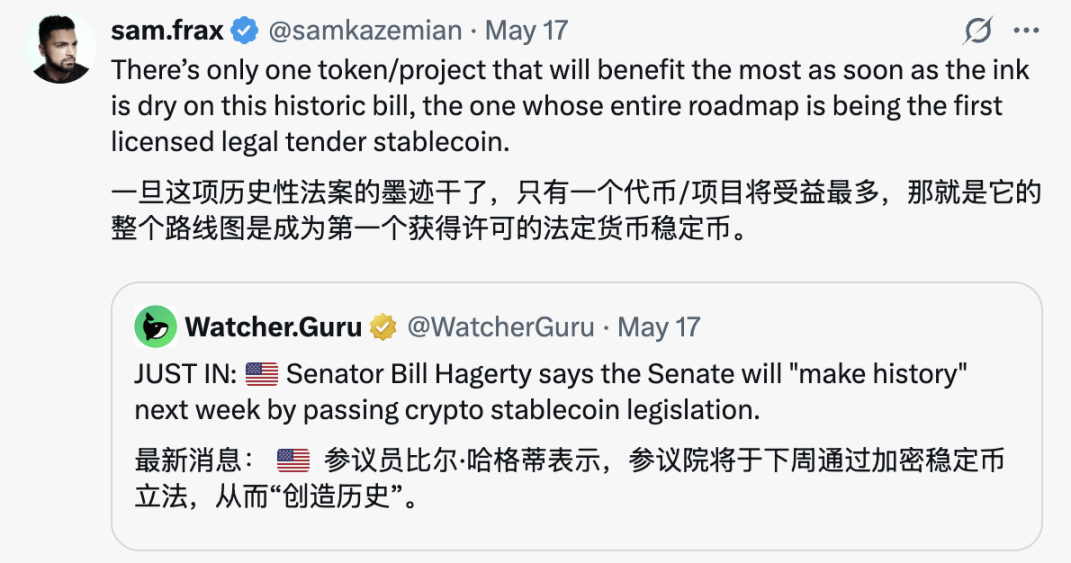

Frax founder Sam hints that Frax benefits the most from the bill

But how could frxUSD become the "first" licensed fiat-backed stablecoin ahead of products like USDC and USDY? On the regulatory front, it may indeed have a “first-mover advantage” due to proximity.

Sam Kazemian, founder of Frax Finance, has frequently shared photos since early this year of himself in Washington, D.C., meeting with key figures in crypto legislation. He is rumored to have been deeply involved in discussions and drafting of the GENIUS Act. The market appears to be pricing in a regulatory edge for Frax Finance as a result.

Sam with pro-crypto Senator Lummis

If true, as a drafter and participant in the bill, Sam naturally has deeper insight into the GENIUS Act, making it easier for his project to meet requirements. Additionally, his close relationships with lawmakers might open regulatory fast-tracks for FRAX in the future.

FRAX’s Future Roadmap

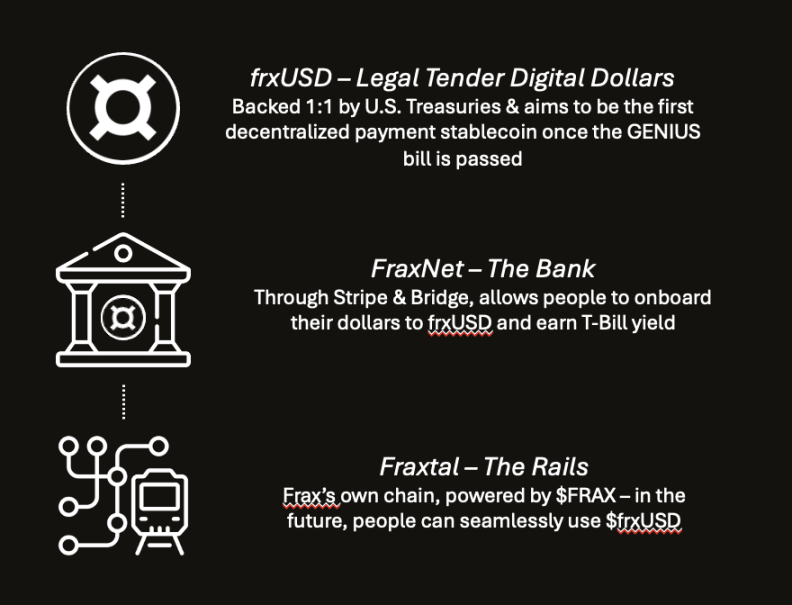

Beyond potential regulatory advantages, FRAX is building a vertically integrated stablecoin ecosystem—comprising frxUSD (stablecoin), FraxNet (banking interface), and Fraxtal (L2 execution layer)—to align with future regulatory demands:

-

frxUSD: FRAX’s stablecoin, pegged 1:1 to the U.S. dollar.

-

FraxNet: A banking interface designed to connect traditional finance with DeFi.

-

Fraxtal: An L2 execution layer (potentially evolving toward L1) offering efficient transactions and scalability.

Token restructuring is also part of FRAX’s future plan. FXS has been rebranded as FRAX and endowed with functions including gas, governance, burning, and staking. This adjustment aims to enhance FRAX’s functionality and market competitiveness, enabling greater flexibility under compliance frameworks.

Staking FRAX to obtain veFRAX can yield potential rewards such as FXTL (Frax’s own points), Karak, Ethena, and Symbiotic points.

With the founder actively engaging in stablecoin-related legislation and strategically aligning product development with emerging narratives, FXS (FRAX) performance warrants continued attention as the GENIUS Act progresses toward implementation.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News