Focusing on Frax Protocol's RWA Business: Future Product Planning and Impact Analysis

TechFlow Selected TechFlow Selected

Focusing on Frax Protocol's RWA Business: Future Product Planning and Impact Analysis

This article aims to outline Frax's future product roadmap (FRAX V3, frxETH V2, and Fraxchain) and analyze their potential impacts.

Author: Yuuki, LD Capital

FXS received favorable market feedback during the CRV turmoil due to FraxLend’s dynamic interest rate design that protects borrowers. Meanwhile, Sam, founder of Frax Protocol, initiated a governance proposal on August 4 to advance RWA (real-world assets) operations, attracting further market attention.

This article aims to outline Frax's future product roadmap (FRAX V3, frxETH V2, and Fraxchain) and analyze their potential impacts.

1. FRAX V3 — Focus on RWA Expansion (Launch within August)

Frax founder Sam has proposed on the governance forum to expand RWA operations through FinresPBC, expected to go live within August. Key points include:

1. FinresPBC is a non-profit entity established early this year. All earnings generated from assets held on behalf of Frax Protocol, after deducting operating costs, will be returned to the protocol;

2. FinresPBC will not participate in the development, operation, or governance of Frax Protocol, nor in any profit-generating activities (such as collateralization, lending, staking, or other commercial ventures), ensuring operational simplicity and stability;

3. FinresPBC’s current banking partner is Lead Bank, which provides compliant financial services for crypto protocols. FinresPBC is actively expanding partnerships with additional crypto-friendly financial institutions;

4. Future operations of FinresPBC will include minting/redeeming USDP and USDC; earning yield on USD deposits via IntraFi savings accounts insured by the U.S. Federal Deposit Insurance Corporation (FDIC); purchasing U.S. Treasuries in segregated accounts to earn interest;

5. FinresPBC will publish monthly asset statements, reserve reports, and operating cost details. It will provide Frax Protocol with 24/7 access to custodied assets and use reserves on-demand to buy back and burn FRAX, or mint USDP/USDC sent to Frax Protocol’s AMO (Autonomous Money On-chain).

More architectural details about FRAX V3 have not yet been officially released, but based on information shared by the team across Telegram, forums, and interviews, we summarize the following:

1. Sam noted that FinresPBC’s operating expenses will be significantly lower than those of Maker or other RWA protocols. If FinresPBC holds $500 million in assets for Frax Protocol, annual fees are expected to stay below $200,000.

2. In an interview with Ouroboros Capital on July 28, Sam mentioned FRAX V3 would launch within 30 days. Given that FinresPBC and initial banking relationships are already established, it is likely the RWA business will go live in August, pending DAO voting on the proposal and final parameter confirmation.

3. FRAX V3 will introduce FraxBonds: Frax Protocol will continuously issue four bond series open for public purchase. Upon maturity, bonds will automatically convert into FRAX stablecoins. Enabled by FinresPBC, there will be no cap on the scale of FraxBonds issuance. These bonds will be standard ERC-20 tokens, with Frax Protocol deploying liquidity on Curve to enable secondary market trading.

4. The Borrow-AMM design for FRAX liquidity in FRAX V3 will operate without oracle price feeds, eliminating oracle risk.

Potential Impact:

1. The FRAX stablecoin has seen declining market share under pressure from Maker’s aggressive RWA expansion—especially given Maker’s DSR now offers an 8% deposit yield, luring users to hold Dai for yield. Currently, DSR yields far exceed U.S. Treasury yields because of a gap between Maker’s Treasury purchases and Dai deposits in the system—a spread that appears unsustainable. While specific details of Frax’s RWA operations remain undisclosed, due to structural similarities with ETH staking and available information, we estimate that in the early stages—before scaling up—Frax RWA could achieve high yields by combining Treasury returns with Curve incentives, enabling strong product traction. In the medium to long term, if—as Sam claims—FinresPBC’s operating costs are substantially lower than competitors, Frax’s RWA operations may gain sustainable competitive advantage, helping expand FRAX’s market share.

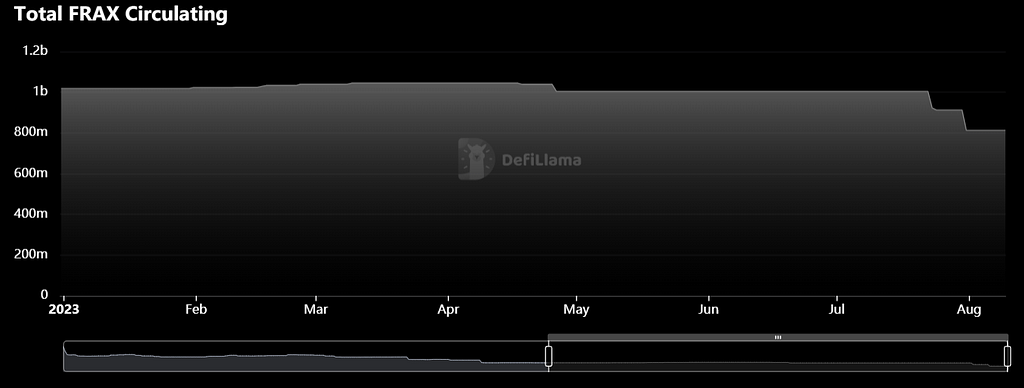

Frax’s market cap recently declined from $1 billion to $813 million

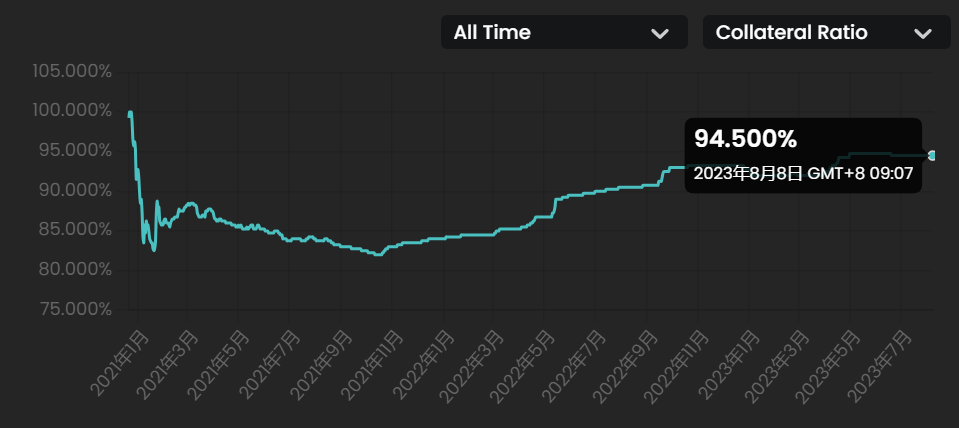

2. Maker’s strategy of generating profits from U.S. Treasury RWAs and repurchasing MKR on-chain has been a key driver behind recent MKR price increases. Frax currently operates a partially collateralized model, where protocol revenues are used to increase FRAX’s collateral ratio (CR). If RWA operations generate additional income to accelerate collateral replenishment, and if these revenues are redirected to veFXS holders or used to buy back FXS, this would support FXS pricing. Currently, FRAX’s collateral ratio stands at 94.5%. Frax Protocol holds $280 million in idle USDC; assuming a 5% yield, this generates $14 million annually—accounting for 75% of Frax’s current annual revenue.

Current FRAX collateral ratio is 94.5%

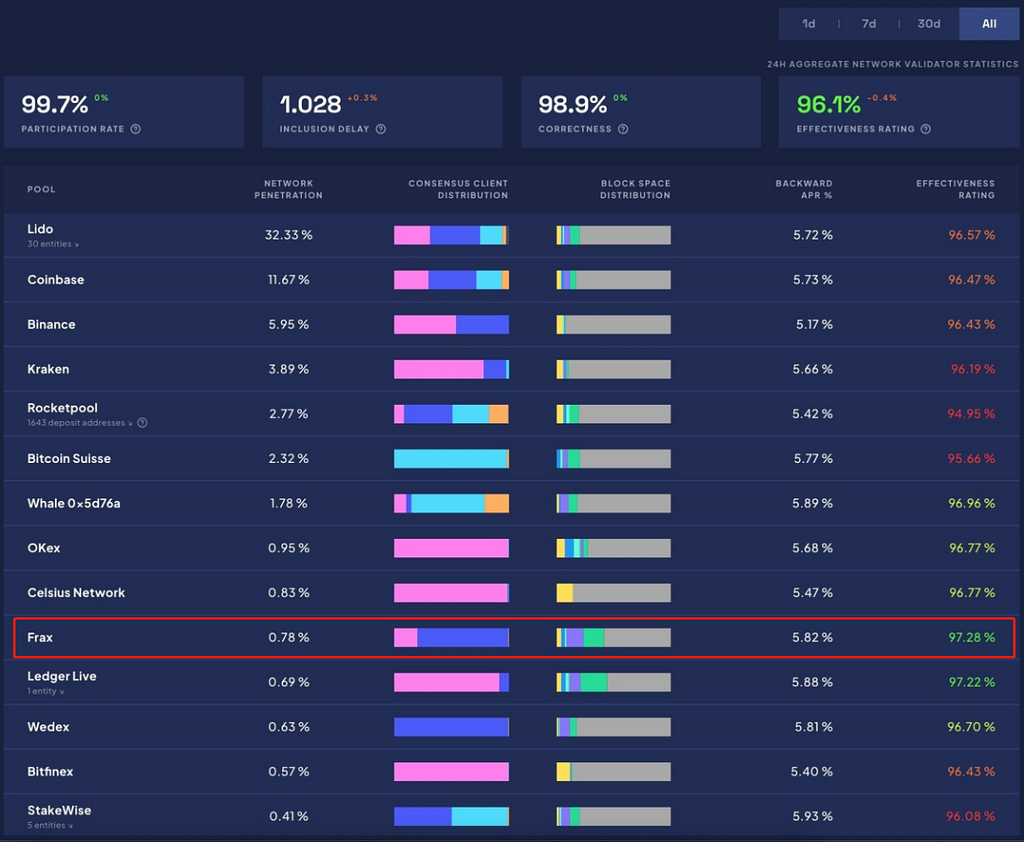

2. frxETH V2 — Focus on Decentralization and Staking Attractiveness (Launch in ~50 Days)

Sam mentioned in a Twitter Space that frxETH V2 is expected to launch approximately 50 days from now. In the current frxETH V1, user ETH is staked via nodes operated directly by the team, with the protocol taking a 10% fee. frxETH V1 benefits from Frax’s strong governance position within the Curve ecosystem, effectively driving liquidity for frxETH. Additionally, the dual-token model (frxETH and sfrxETH) enables the Frax Ether system to offer the highest yield in the market. This has helped Frax Ether emerge as a latecomer to become one of the top three LSD protocols.

frxETH V1 staking flowchart

In the upcoming frxETH V2, Frax aims to maintain high APY while addressing centralization concerns. The overall design resembles Rocket Pool but includes unique Frax-specific enhancements. Key differences include:

1. In Rocket Pool, user-deposited ETH accumulates in a deposit pool and does not earn yield until validator activation, which drags down rETH’s overall returns. This pool currently has a cap of 18,000 ETH. In contrast, frxETH V2 will first allocate user deposits to the Curve AMO. Only when node operators require ETH for pairing will funds be transferred from the Curve AMO to the Lending Pool. This allows idle ETH to earn transaction fees and mining rewards within the Curve AMO, resulting in higher overall yields compared to Rocket Pool.

2. After the Atlas upgrade, Rocket Pool enforces a near-fixed 14% commission for node operators. In contrast, frxETH V2 plans to determine node commissions through market mechanisms. In frxETH V1, Frax has proven to be one of the most efficient and stable node operators in the market, and they will join frxETH V2 to compete fairly for node commissions. Introducing competition and including highly efficient teams is expected to further benefit end-users by increasing net yields.

Frax Ether currently offers the most efficient staking

frxETH V2 product flowchart

Beyond frxETH V2, another critical feature to watch is the introduction of redemption functionality. While sfrxETH currently offers the highest yield in the market, its growth rate over the past month (+4.56%) lags behind Lido (+5.17%) and Rocket Pool (+7.47%). A primary reason is that frxETH cannot currently be redeemed directly and must instead be swapped for ETH on secondary markets like Curve. This limitation amplifies concerns among whales and some users, prompting them to shift toward Lido or Rocket Pool.

3. Fraxchain — Focus on Ecosystem Growth and frxETH Consumption (Launch Early 2024)

Fraxchain is an Ethereum Layer 2 network planned to use a hybrid rollup approach combining OP Rollup and zkRollup. This architecture aims to provide developers with OP’s developer-friendly coding environment while delivering zk’s finality, security, and decentralization benefits to users. As one of the top three LSD protocols, Fraxchain will create synergies with frxETH: using frxETH as gas on Fraxchain will encourage holding of frxETH, reducing conversions to sfrxETH, thereby allowing Frax Protocol to offer higher staking yields to compete for market share. The plan includes migrating Frax’s full DeFi product suite to Fraxchain to reduce gas costs and bring initial traffic and capital. Notably, Fraxchain is not intended to be an app-specific chain. While supporting Frax’s existing stablecoin ecosystem, it also aims to expand its broader ecosystem and drive adoption to better benefit the native Frax economy.

Overall, Frax boasts a lean and highly capable team known for efficient execution and rapid product deployment. With FRAX V3 and frxETH V2即将 launching, the project warrants close attention.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News