GMX Ecosystem Overview: The GLP Lego is Being Built – Which Protocols Are Worth Watching?

TechFlow Selected TechFlow Selected

GMX Ecosystem Overview: The GLP Lego is Being Built – Which Protocols Are Worth Watching?

Thanks to DeFi's composability, this Lego-like building approach enables GLP to play roles across various protocols, including yield leverage, auto-compounding, and lending.

Authored by: Henry Ang, Mustafa Yilham, Allen Zhao & Jermaine Wong, Bixin Ventures

Real yield is considered the purest form of yield available on-chain—it does not rely heavily on token emissions but instead stems from actual fees and revenues generated by protocol activity. If a protocol chooses to share profits with users, this sustainable yield becomes highly attractive to DeFi farmers.

GMX stands out as a representative project generating real yield. As a popular perpetual trading platform, GMX uses GLP as liquidity for trades, distributing 70% of platform fees and traders’ losses in ETH or AVAX to LPs and GMX token holders. In other words, as one of the largest fee generators in DeFi, GMX channels most of its revenue back to stakeholders.

Figure 1: Fees generated by DeFi protocols on February 11

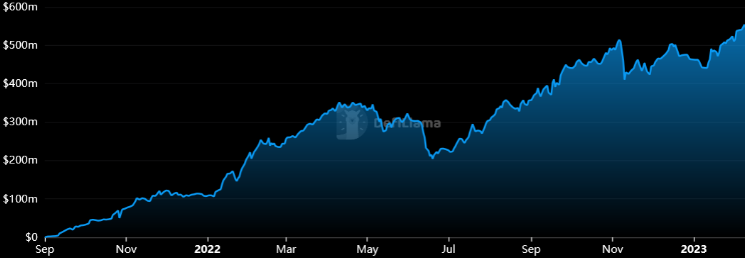

Since GMX’s launch, demand for GLP has surged. Currently, GMX has over $500 million in total value locked (TVL), consistently growing. The real yield narrative sparked by GMX has gained increasing traction, prompting developers to build projects atop it and attract GLP份额, leading to what is now known as the GLP War.

Figure 2: GMX TVL

Origins of the GLP War

Before diving into the GLP War, let's briefly review GMX and GLP.

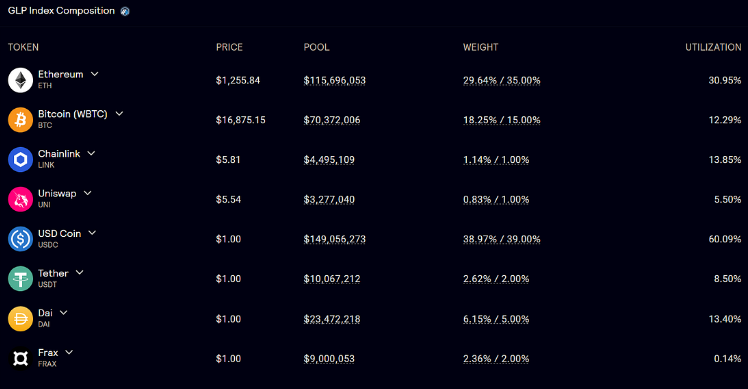

GLP is a liquidity pool similar to Uniswap LP tokens, composed of a basket of assets as shown below—48% stablecoins and 52% other cryptocurrencies such as BTC and ETH. Due to price volatility of these assets, the overall value fluctuates. Users are incentivized to stake GLP to profit from traders' losses and receive esGMX along with 70% of platform trading fees.

Figure 3: Composition of GMX’s GLP

Due to market risks, GLP stakers may experience losses despite earning yields. The chart below compares GLP returns versus earnings. Since inception, GLP has delivered a return of -13%.

Additionally, GLP rewards are paid in ETH or AVAX and must be manually claimed and reinvested by users. Although gas fees on Arbitrum and Avalanche are low, repeated manual compounding inevitably incurs transaction costs.

The Beginning

Various protocols have identified pain points with GLP and proposed solutions: What if GLP’s risk exposure could be hedged? What if yields were leveraged? What if rewards could auto-compound? What if GLP could be used as collateral? Developers began exploring breakthroughs—thus, the GLP War began.

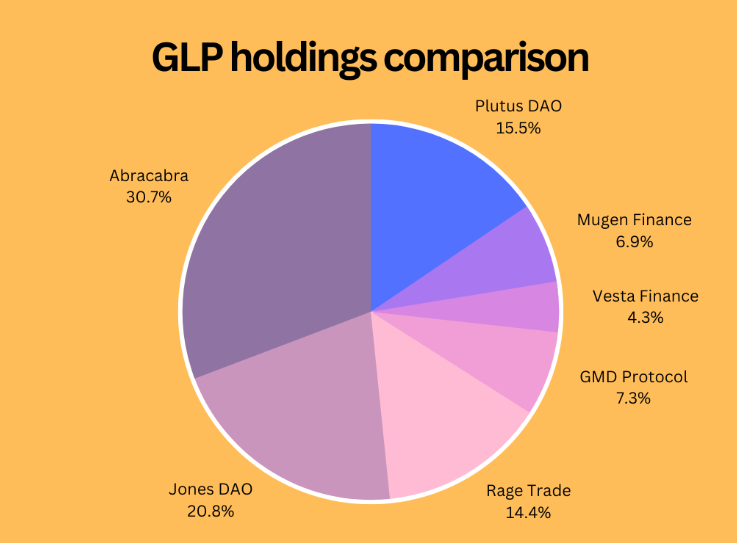

Figure 5: Distribution of GLP holdings across various protocols

GMX Ecosystem

PlutusDAO

PlutusDAO is a yield aggregator governed by its native PLS token. It offers liquid staking for veAssets such as veJones, veDPX, or veSPA. After integrating GLP, users can deposit GLP to unlock plvGLP, which unlocks enhanced functionality.

With plvGLP, ETH rewards are automatically calculated every 8 hours. Thanks to auto-compounding, plvGLP appreciates in value, delivering higher APY to holders. PLS tokens are also distributed as liquidity mining rewards to plvGLP stakers. Plutus charges a 10% fee on GLP-generated yields.

plvGLP also enables composability with other protocols. Standard GLP can only be staked on GMX and lacks integration elsewhere. plvGLP solves this by partnering with lending and asset management protocols. Through Lodestar Finance and Vendor Finance, users can borrow against or collateralize plvGLP, enabling advanced strategies—such as leveraged long or short positions—or manually executing delta-neutral strategies by borrowing BTC and ETH. @0xBobdbldr details these strategies here.

Recently, Plutus partnered with FactorDAO for asset management. Factor strategists can leverage Plutus products to create new use cases, such as the Plutus Index Vault—a vault aggregating all plsAssets to diversify yield sources. They are also exploring further integrations with RodeoDolomite and others.

Mugen Finance

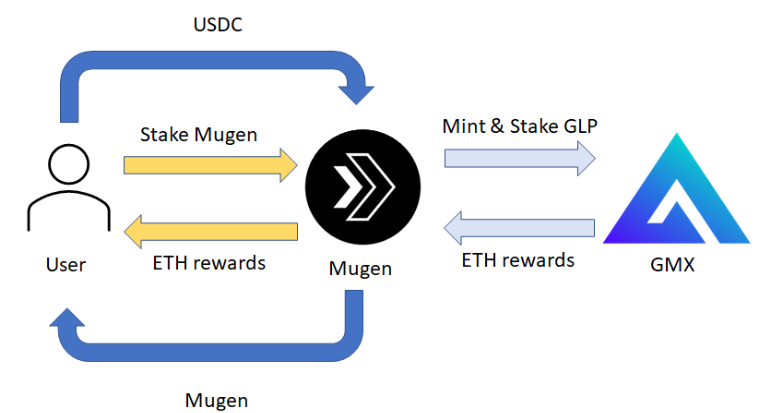

Mugen Finance was among the earliest projects built on GMX. Mugen is a cross-chain yield aggregator built on LayerZero, functioning like a Yearn Finance on LayerZero, allowing users to earn yield from multiple protocols across chains. Currently, their platform supports only one strategy: the GLP strategy.

The GLP strategy is executed by Mugen’s treasury based on whitelisted capital amounts. The treasury earns yield by minting and staking GLP. Users depositing funds into Mugen mint the native MGN token. MGN staked as xMugen receives ETH yield from the treasury. Users can opt for auto-compounding, where ETH rewards are used to buy more MGN and restake, boosting APY due to higher compounding frequency than manual reinvestment.

Though basic, Mugen’s strategy provides farmers with diversified options and automated compounding. In the future, Mugen plans to integrate additional protocols, enabling users to earn yield from multiple sources and chains simply by staking MGN.

Figure 6: Simplified workflow of Mugen Finance

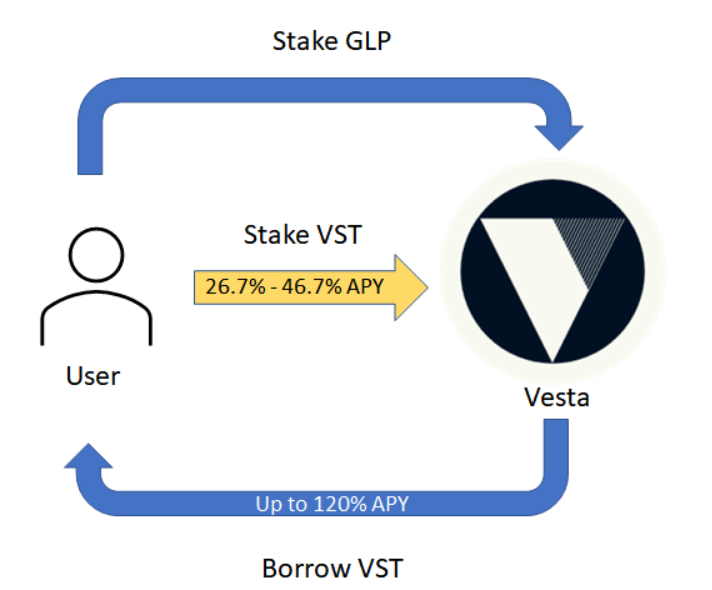

Vesta Finance

Vesta Finance is a collateralized debt platform allowing users to lock collateral and mint VST, its native stablecoin. GLP is accepted as collateral on Vesta, creating new utility for GLP holders. Users can deposit GLP and borrow VST to maximize capital efficiency.

VST can be staked in Vesta’s pools, earning stablecoin yields ranging from 10% to 40%, depending on lock-up duration. At a 150% collateralization ratio, VST yield ranges from 6.7% to 26.7%. Overall, GLP yield can reach approximately 46.7% without direct exposure.

Vesta also allows leveraging GLP yield. Similar to Degenbox, users deposit GLP to obtain VST loans, then use them to purchase more GLP. Repeating this process creates higher leverage. At a 120% collateralization ratio, up to 6x leverage is possible, pushing APY close to 120%.

Figure 7: Illustration of leveraged GLP yield

However, this strategy is vulnerable to price fluctuations in assets like BTC and ETH, introducing liquidation risk. Risk DAO published an excellent article analyzing Vesta Finance’s risks and current configuration safety.

Unstoppable Finance

Unstoppable Finance offers a completely free auto-compounder for GLP holders. Unlike other protocols charging a percentage of yield or deposits, Unstoppable charges no fees, helping users save on gas. Its vaults are built using the ERC-4626 tokenized vault standard, enabling anyone to build atop them.

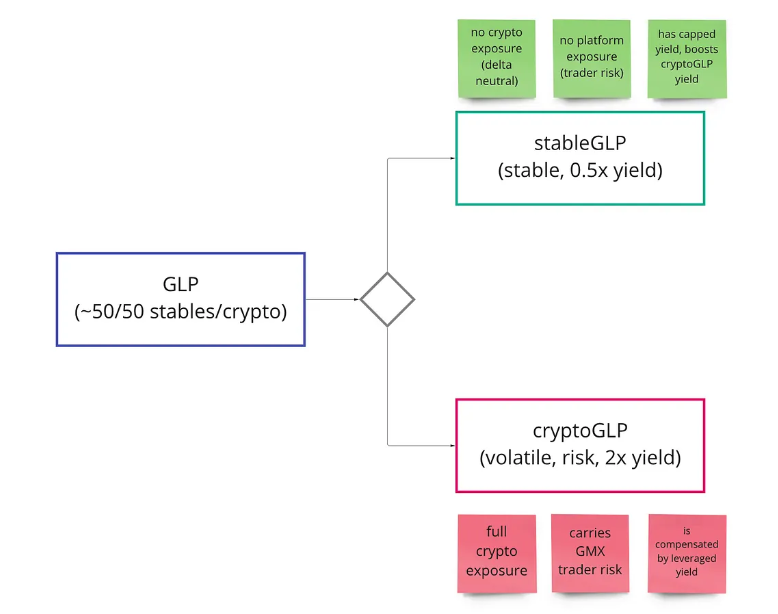

They are also developing a new mechanism called TriGLP. This mechanism tokenizes GLP into stableGLP and cryptoGLP, each earning different yields based on assumed risk. Their goal is to create a delta-neutral-like stable position yielding around 10% annually, immune to volatility, and a crypto-like position yielding about 30% annually while maintaining full ETH/BTC exposure.

Figure 8: TriGLP Mechanism Diagram

GMD Protocol

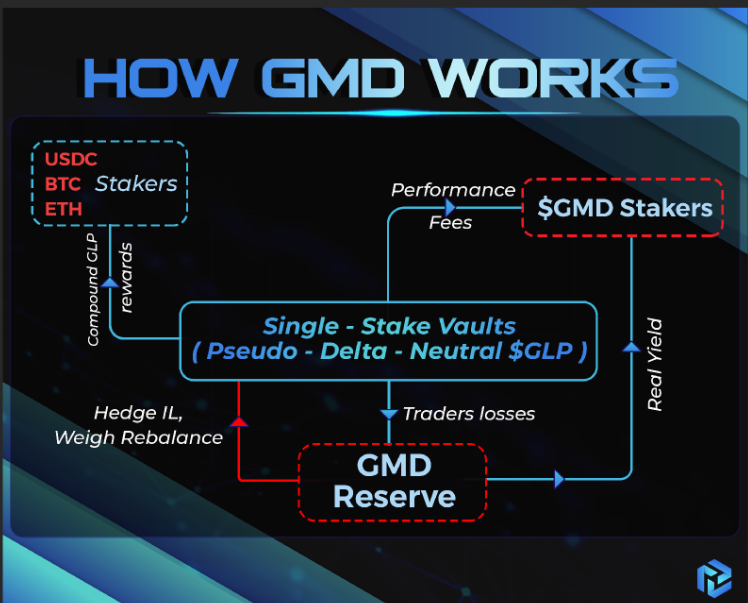

GMD Protocol is another yield aggregator offering enhanced features, mitigating GLP’s direct exposure through a pseudo-delta-neutral strategy.

GMD offers single-asset vaults for BTC, ETH, and USDC, with deposit caps based on GLP’s relative ratios of USDC, ETH, and BTC. Assets deposited are used to mint GLP and earn yield, allowing users to maintain pseudo delta neutrality on their deposited assets. For example, users seeking yield on USDC without exposure to BTC, ETH, or other tokens within GLP can deposit into GMD’s USDC vault to earn partial GLP yield. This pseudo-delta-neutral strategy relies on the composition ratio of USDC, ETH, and BTC within GLP.

Over time, allocations across GMD’s three vaults need to be manually rebalanced weekly to align with updated GLP ratios. GMD does not rebalance user funds directly, but sets aside 5–15% of total value into Delta-Neutral Vaults for rebalancing. This helps mitigate low-reserve issues, as the protocol maintains liquidity for withdrawals.

To further reduce volatility risk from smaller assets in GLP like those on Uniswap, GMD maintains a protocol reserve worth 5–15% of total TVL in GLP. Funded by the treasury, this reserve compensates users if their asset value drops below GLP value. GMD expects this reserve to grow over time, benefiting from losses incurred by GMX traders.

Figure 9: GMD Working Mechanism

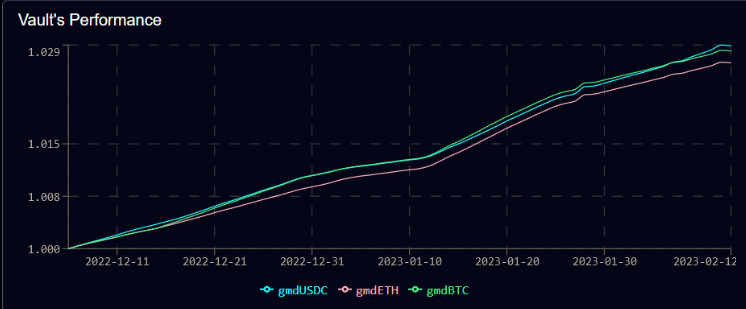

In practice, the three vaults yielded between 2.6% and 2.9% from December 11, 2022, to February 12, 2023. Extrapolated, this translates to an APY of approximately 16.6%–18.7%, slightly below the advertised 20%–26% APY.

Figure 10: GMD Vault Performance

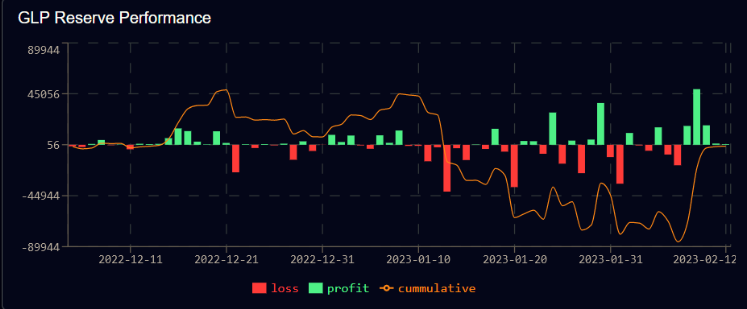

Although GMD aims for delta neutrality, it lacks short exposure to achieve true delta neutrality. The protocol requires reserves to cover impermanent loss, limiting scalability. Without sufficient reserves (i.e., 5–15% of TVL), vaults cannot scale significantly. Expansion depends on reserve performance. To date, GLP reserves have broken even, constraining GMD’s ability to grow vault sizes.

Figure 11: GMD Reserve Performance

Yield Yak

Yield Yak is an auto-compounder on Avalanche. Each time a user clicks reinvest, they earn compounded AVAX rewards—an effective incentive.

Thanks to Avalanche’s $180 million incentive program, Avalanche Rush, Yield Yak can offer additional rewards. Depositors in the GLP strategy can receive up to 300,000 AVAX from Avalanche Rush. Additionally, users can permanently stake esGMX on Yield Yak to maximize GLP rewards. To optimize GLP, Yield Yak upgraded Yak Swap, which automatically selects the optimal path to swap assets into GLP, helping rebalance GLP to target index weights. This reduces slippage for users while aiding GMX in maintaining proper asset ratios.

Rage Trade

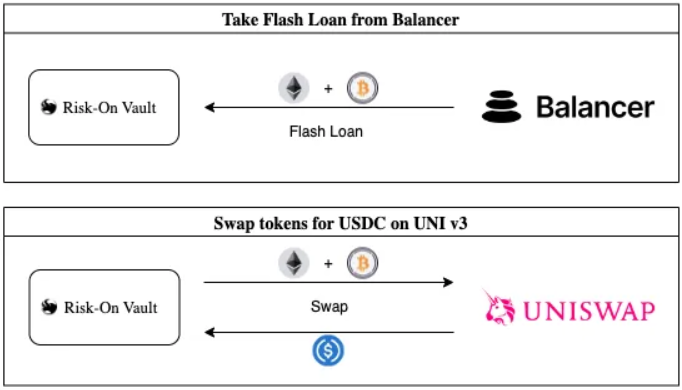

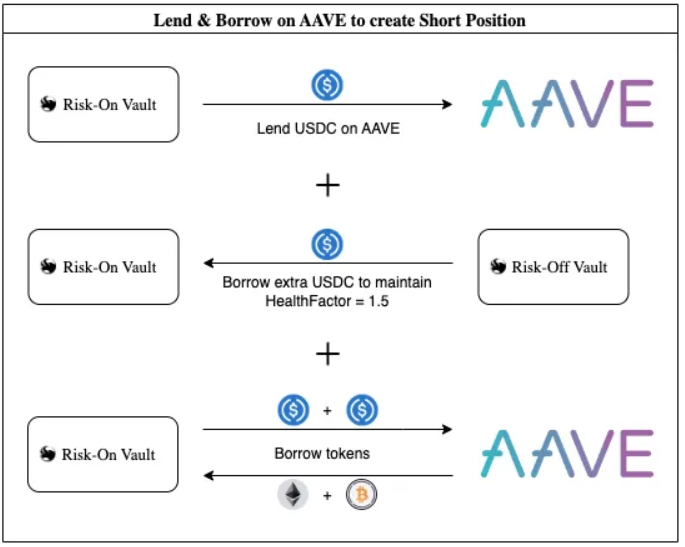

Rage Trade is a perpetual trading platform on Arbitrum leveraging LayerZero’s infrastructure. It was the first to introduce a dual-vault system to minimize direct market risk, featuring Risk-Off Vault and Risk-On Vault, operating on Aave and Uniswap to hedge BTC and ETH exposure.

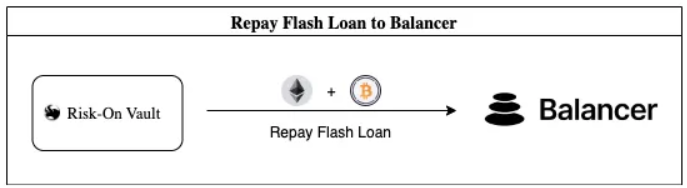

Users deposit sGLP or USDC into the Risk-On Vault, which uses flash loans on Balancer to borrow BTC and ETH, sells them on Uniswap for USDC, then deposits that USDC along with USDC from the Risk-Off Vault into Aave to borrow BTC and ETH again, repaying the flash loan. This creates a short position on Aave, as the Risk-On Vault is now borrowing BTC and ETH.

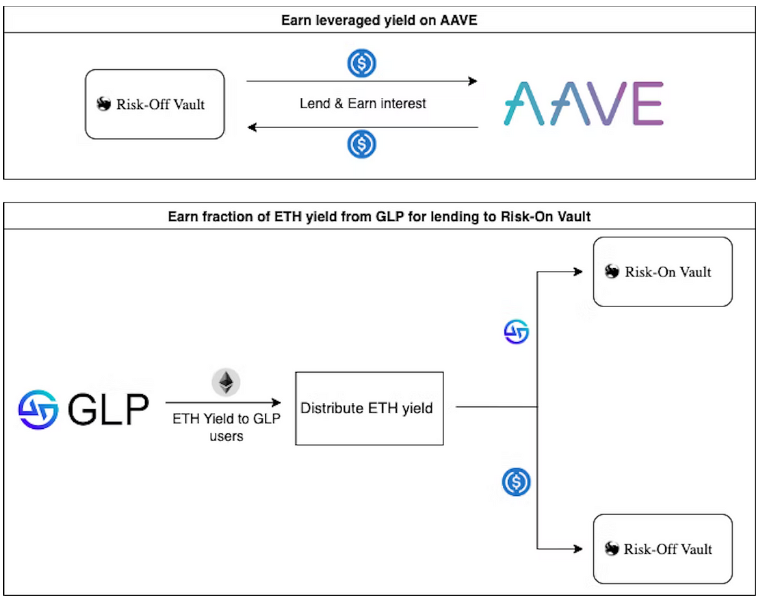

A key feature of the Risk-Off Vault is providing collateral to support the Risk-On Vault, maintaining a healthy borrowing ratio of 1.5 on Aave. Every 12 hours, the position is reopened to collect fees, rebalancing PnL between Aave and GLP collateral shorts, and adjusting hedges according to GLP deposit composition.

Figure 12: Risk-On Vault Mechanism

Figure 13: Risk-Off Vault Mechanism

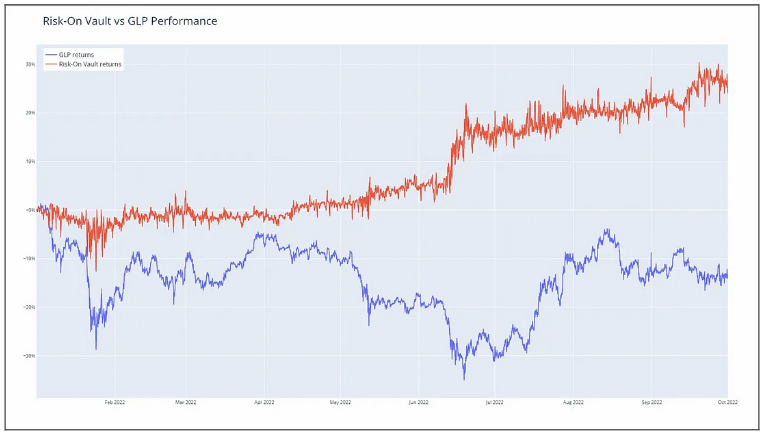

Compared to GLP returns, the Risk-On Vault theoretically delivers ~25% profit versus GLP’s -13%.

Figure 13: Vault Performance Comparison

Currently, however, the Risk-On Vault shows a return of -1.2%. The GLP value loss is primarily due to high hedging costs and profitable traders. Once Rage Trade completes its second audit and raises deposit limits, it expects to significantly reduce hedging costs. To hedge trader PnL, Rage Trade will offer optional partial or full hedging, potentially as separate vaults for users to deposit into.

Jones DAO

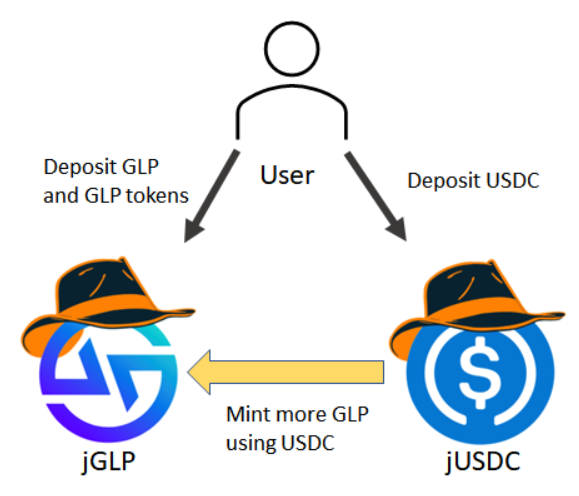

Jones DAO is a yield, strategy, and liquidity protocol designed to enhance capital efficiency. Using a dual-vault mechanism to deliver leveraged yield, Jones DAO’s jGLP vault accepts GLP and any underlying asset in GLP, while the jUSDC vault accepts USDC deposits.

USDC from the jUSDC vault is used to mint additional GLP, creating a leveraged GLP position. GLP rewards are then distributed between jGLP and jUSDC depositors, earning 33% and 11.3% APY respectively. The jGLP vault automatically adjusts leverage to prevent liquidation, and users can opt for auto-compounding.

Figure 14: Jones DAO Protocol Mechanism

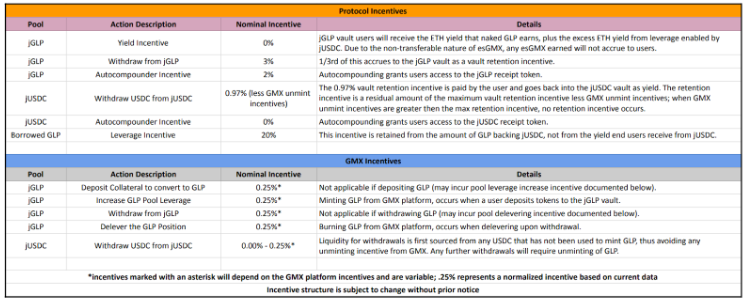

Jones DAO employs a unique fee structure designed for long-term growth: users who continue staking collect fees from those who unstake, incentivizing continued participation.

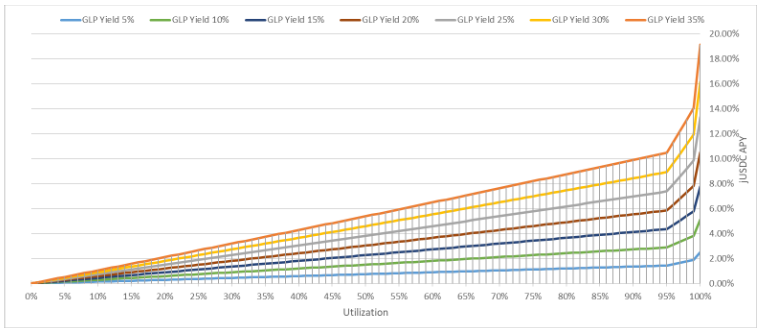

The more USDC deposited into the jUSDC vault, the more GLP can be purchased, increasing leverage. The chart below shows the relationship between jUSDC APY and vault utilization, indicating that with a 35% GLP yield, jUSDC yield can rise to nearly 20% due to increased leverage.

Figure 16: Relationship Between jUSDC APY and Vault Utilization

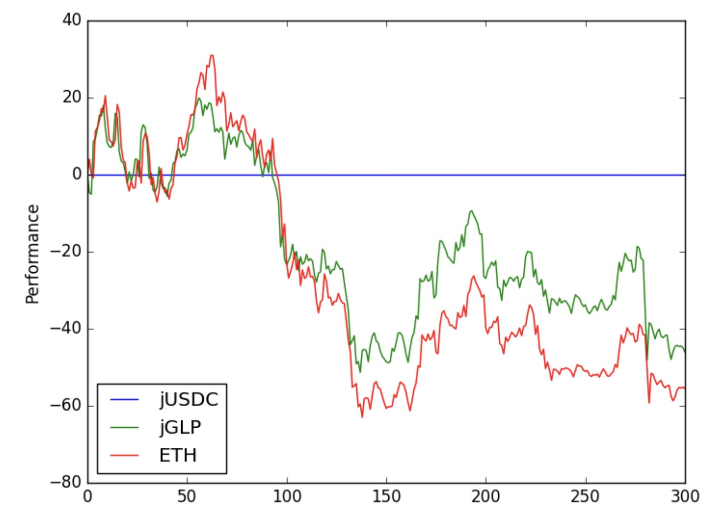

In terms of performance, jGLP does not hedge market risk—in fact, it amplifies it. Thus, jGLP vault performance depends heavily on market conditions. Backtesting under 0% GLP yield and 80% utilization shows jGLP outperforming ETH. Including GLP yield would likely improve results.

Figure 17: jUSDC and jGLP vs. ETH Performance

Abracadabra

Abracadabra is a lending platform with its own stablecoin, MIM, borrowable against interest-bearing collateral. It introduced magicGLP, an auto-compounder for GLP tokens. ETH rewards from GLP are used to purchase more GLP, which is then converted into magicGLP. Using MIM on the platform, users can choose to leverage their position by 4%, achieving up to 84% APY on their GLP.

Steadefi

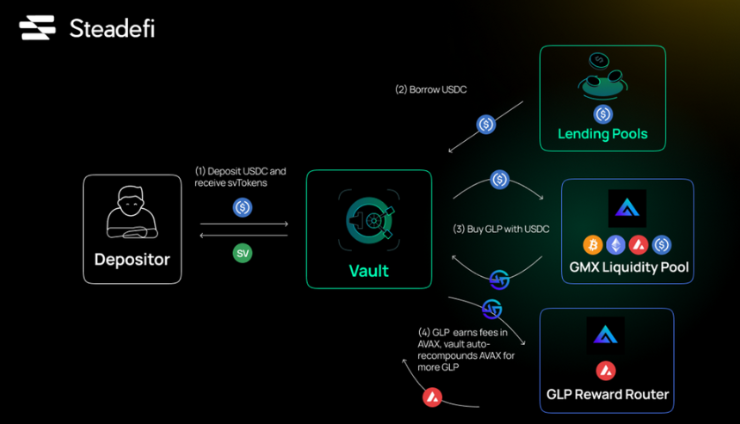

Steadefi is a platform offering automated yield-leveraging strategies. It currently operates one vault offering a 3x leveraged GLP position.

For every $1 deposited into the vault, $2 is borrowed from a lending pool to mint GLP. This effectively creates a 3x leveraged position, which auto-compounds and rebalances as needed over time.

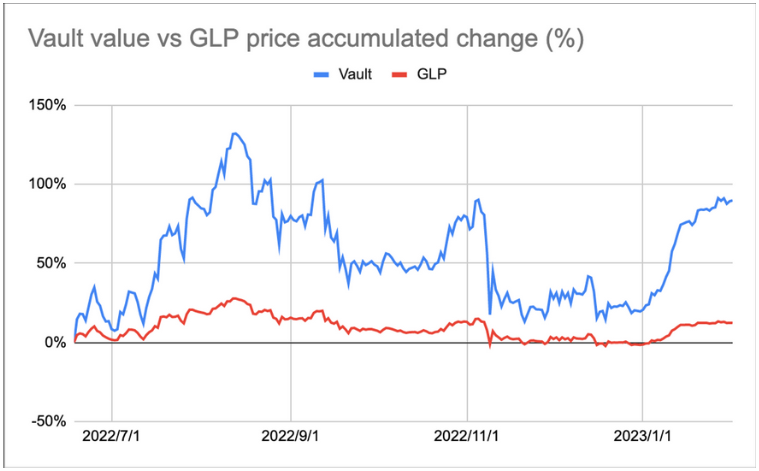

In performance, GLP achieved a PnL of 12.3%, while Steadefi’s vault reached 89.8%, outperforming GLP with a 7x higher yield.

Figure 19: Steadefi vs. GLP Performance Comparison

Comparison of Key Protocol Metrics

Note: GLP FDV data as of February 16

Potential New Entrants

Umami Finance

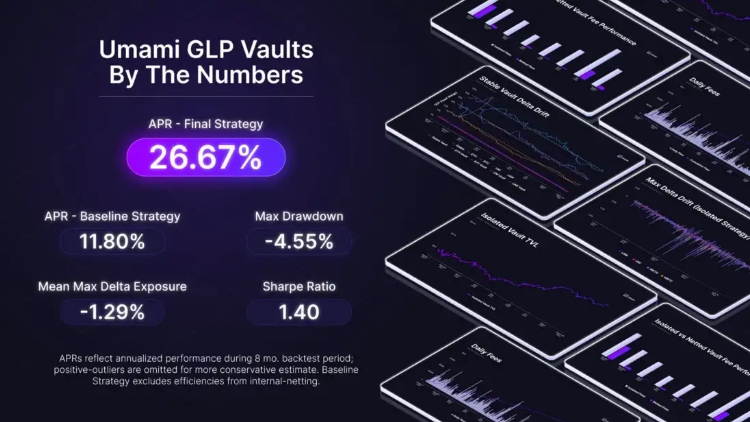

Umami Finance plans to launch v2 of its GLP vaults, featuring an algorithmic hedging strategy. Umami is still conducting backend testing and optimizing its vaults. Recent test results show an annualized yield of 26.7%.

Figure 18: Umami Test Results

Yama Finance

Yama Finance is building a fully cross-chain stablecoin optimized for maximum capital efficiency, speed, and security. It has not yet launched its GLP yield-leveraging product on Arbitrum.

Yama can offer up to 101x leverage, unlocking superior yield opportunities. For GLP, it caps leverage at 17x, targeting an APY of 333% (assuming a 19.6% GLP yield). Yama has not yet detailed the mechanism behind its leveraged GLP yield strategy, which may involve borrowers using GLP as collateral to borrow YAMA and establish leveraged positions for higher returns.

The Future of the GLP War

Clearly, numerous developers have built protocols on top of GMX, many amassing millions in TVL, demonstrating clear market demand for GLP-based products.

DeFi’s composability enables this Lego-like construction, allowing GLP to serve diverse functions—yield leveraging, auto-compounding, and lending. As the GMX ecosystem grows, more protocols are expected to integrate GLP. However, GLP faces risks of being fully drained if traders profit and withdraw assets. Thus, many future protocols may attempt to hedge trader PnL to reduce risk.

Disclaimer: The above information does not constitute investment advice. Additionally, Rage Trade, mentioned in this article, is part of our portfolio. You can read more about our research here.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News