GLP Derivative Protocol Strategy Breakdown: Delta Neutral Strategy, Collateralized Lending, Liquidity Receipts, and Competitors

TechFlow Selected TechFlow Selected

GLP Derivative Protocol Strategy Breakdown: Delta Neutral Strategy, Collateralized Lending, Liquidity Receipts, and Competitors

What has driven the surprising wave of DeFi innovation on Arbitrum in recent times?

Written by: Morty

Over the past period, there has been remarkable DeFi innovation on Arbitrum. One of the key drivers behind this trend is the deployment of GMX—a decentralized derivatives exchange—on Arbitrum. Thanks to DeFi’s Lego-like composability, other protocols have begun building products based on GMX, with the most common design being frameworks built around GLP.

Next, let's break down these types of products in detail.

First, what is GLP?

In the GMX ecosystem, two tokens exist: GMX, the governance and reward-distribution token, and GLP, the liquidity provider token.

GMX does not operate on an order-book model. In GMX markets, one side consists of liquidity providers and the other of traders. Investors can purchase GLP to provide liquidity for traders on GMX and in return receive 70% of GMX trading fee revenues. Liquidity providers and traders are counter-parties—meaning when traders profit, GLP holders incur losses; when traders lose, GLP holders gain.

GLP is composed of a basket of major assets—50% stablecoins, 28% ETH, 20% WBTC, and some other mainstream assets. Liquidity providers enter or exit the market by minting or redeeming GLP.

Most GLP derivative product designs aim to reduce investor risk, increase returns for GLP holders, and thus enhance capital efficiency.

Now, let’s examine the strategies employed by these protocols:

1. Delta-Neutral Strategy

Offering delta-neutral strategies to attract investors is the dominant approach among most GLP derivative protocols.

According to Wikipedia, in finance, a portfolio composed of related financial instruments that remains unaffected by small price movements in the underlying asset is considered delta-neutral. In traditional finance, investment strategies designed to profit in sideways markets are referred to as delta-neutral strategies.

In other words, delta-neutral trading aims to establish positions that do not react to minor fluctuations in the price of the underlying asset. Therefore, the goal of a GLP delta-neutral strategy is to generate returns for GLP holders while reducing their sensitivity to price changes.

Let’s take Rage Trade as an example.

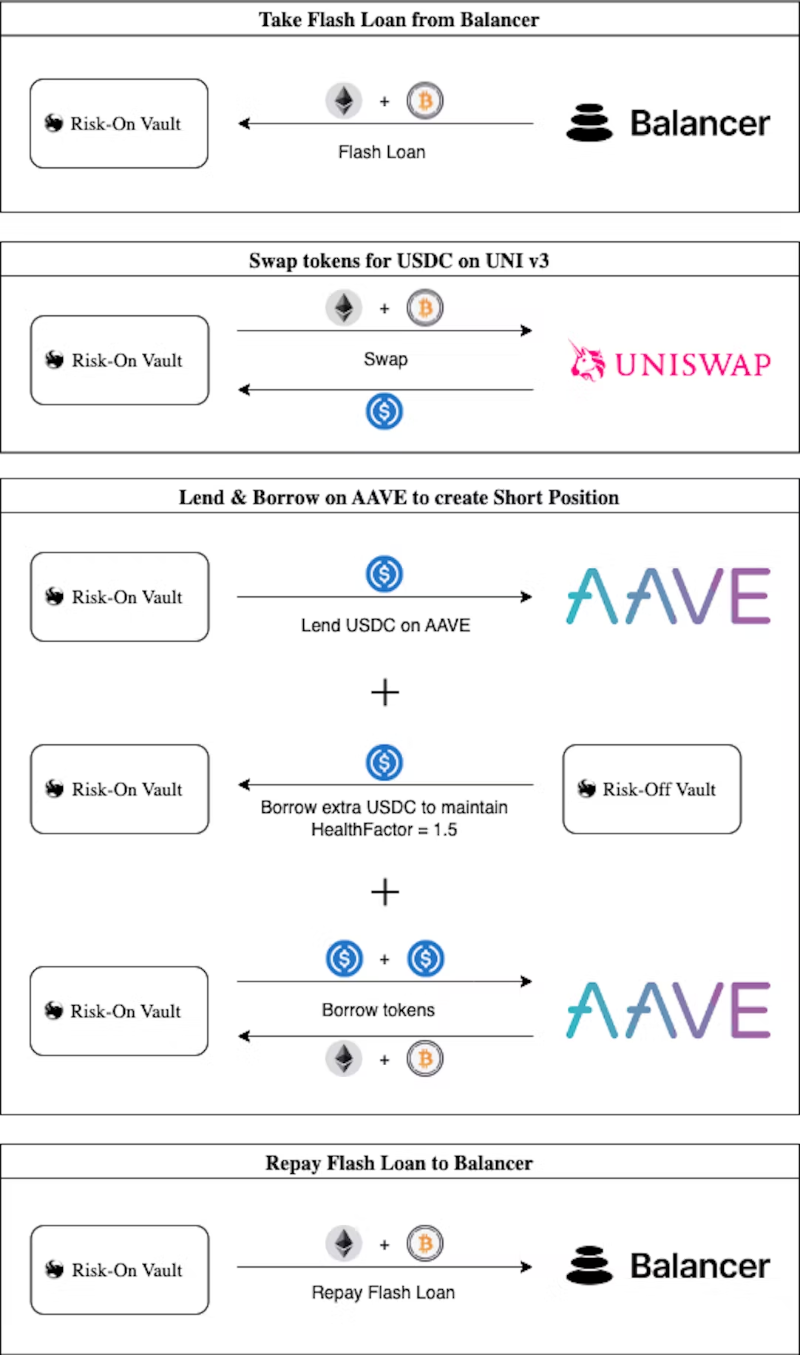

Rage Trade offers users a product called the "Delta Neutral Vault," split into two vaults: Risk-On Vault (9% APY) and Risk-Off Vault (5% APY). Users deposit USDC to earn yield, and currently both vaults are at capacity.

How do the vaults work?

The core mechanism involves providing liquidity to GMX in a delta-neutral manner to earn ETH rewards. To minimize user risk exposure, Rage Trade launched two distinct products catering to different risk appetites. By combining funds from the Risk-On and Risk-Off Vaults, Rage Trade achieves yield generation across varying risk profiles.

Phase One: Rage Trade converts part of the user’s USDC into GLP and deposits it into GMX to earn a share of trading fees.

Phase Two: Based on the ETH and BTC positions within GLP, Rage Trade uses flash loans on Balancer to borrow ETH and BTC, sells them on UniSwap to obtain USDC, then deposits the USDC into Aave to borrow ETH and BTC to repay the Balancer loans. To maximize capital efficiency, Rage Trade maintains a health factor of 1.5x on its short positions in Aave.

Specifically, the Risk-On Vault not only stakes GLP to earn GMX fee rewards but also borrows USDC from the Risk-Off Vault to open short positions, thereby hedging against price volatility in ETH and BTC.

Meanwhile, the Risk-Off Vault earns interest by lending USDC on Aave and also receives a small portion of ETH rewards from GLP proportional to the amount of USDC lent to the Risk-On Vault.

Every 12 hours, the Risk-On Vault rebalances its hedge position according to updated weights and prices, automatically compounding its earned ETH rewards back into GLP.

Phase Three: ETH rewards generated from GMX since the last rebalance are distributed between the Risk-On and Risk-Off Vaults based on the utilization rate of the Risk-Off Vault.

The ETH reward share allocated to the Risk-Off Vault is automatically converted into USDC and restaked on Aave to earn additional interest.

Rage Trade’s product design follows a delta-neutral investment strategy and offers differentiated yield options tailored to users with varying risk preferences through its Risk-On and Risk-Off structure.

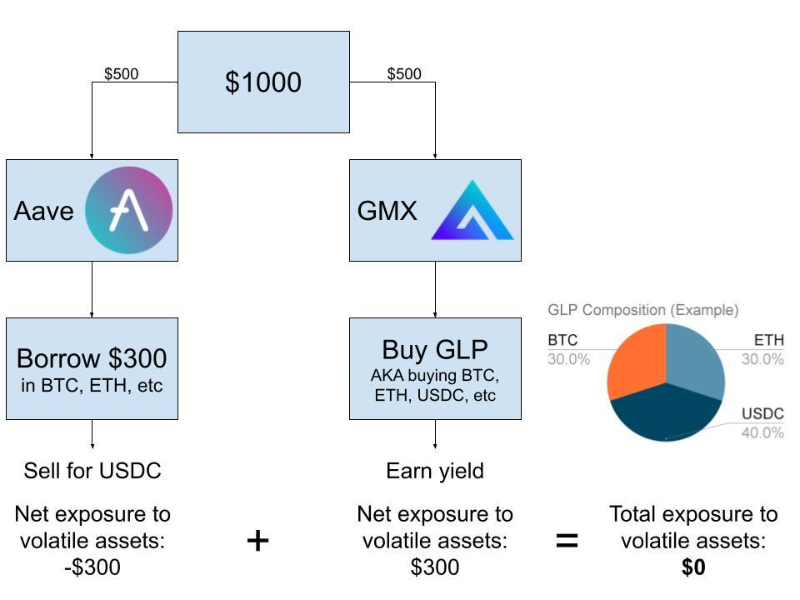

Compared to other delta-neutral vaults, Rage Trade’s design and volatility management are more sophisticated. It refines earlier approaches—for instance, DeCommas simply splits USDC in half, using one half to buy GLP and the other to earn interest in Aave, thereby reducing exposure. This enhanced complexity is precisely Rage Trade’s main advantage.

DeCommas Delta Vault operation model

2. GLP Collateralized Lending and Stablecoin Minting

Since GLP consists of a diversified basket of major assets, with 50% being USDC, it exhibits low volatility and is highly suitable as collateral for lending.

Take Vesta Finance as an example.

Users can deposit GLP into Vesta Finance, which directly stakes the GLP on GMX. As a result, users earn both lending interest and GLP dividend rewards (Vesta takes a 20% cut). Depositors can mint the stablecoin VST, which can then be used for liquidation staking or liquidity mining. This significantly enhances capital efficiency for GLP holders. Additionally, the protocol aims to accumulate esGMX to further boost yields for stakers.

Currently, Vesta Finance has a TVL (total value locked) of $22 million and has minted $8.75 million in VST.

3. GLP Liquidity Tokens

Another way to improve capital efficiency is by issuing liquidity tokens, similar to how Lido provides stETH tokens to ETH stakers.

GMD Protocol is a prime example.

It employs a pseudo delta-neutral strategy and offers investors a product called "Delta-Neutral Vaults."

Investors can deposit single assets such as USDC, ETH, or BTC into individual vaults within GMD Protocol. The protocol then compounds these deposits through strategic investments. In return, users receive gmdUSDC, gmdETH, or gmdBTC as receipt tokens. GMD encourages users to utilize these tokens to earn additional yields. When exiting, users can redeem their gmdTokens for the underlying assets (USDC, ETH, BTC) plus accrued earnings.

Does GMX Have Competitors?

Yes, it does.

Vela Finance is a perpetual leverage exchange that introduced its own liquidity provision product, VLP. Unlike GMX, VLP contains only USDC as its underlying asset. Users simply collateralize USDC to obtain VLP. Because there are no volatile assets involved, VLP holders only incur losses when traders profit. Conversely, VLP holders earn from trader losses and 60% of trading fees.

Due to its inherent delta-neutral nature, VLP holders do not require third-party protocols to implement delta-neutral strategies. Hence, sections "2" and "3" above may represent potential areas for innovation based on VLP.

How Does Vela Finance Compete With GMX?

It offers higher incentives for liquidity providers, rewarding VLP stakers with its native token. The campaign starts on March 14. Currently, a $2.5 million VLP vault has already been filled.

However, compared to GMX—which has already established strong first-mover advantages and moats—Vela Finance, being newly launched, still has significant ground to cover. In the short term, especially given that GLP-based derivative protocols are already maturing, VLP poses no immediate threat to GLP. The real contender capable of challenging GMX’s market share is Gains Network, which utilizes a DAI-based vault system.

Thanks to the synthetic asset nature of its DAI vault, Gains Network offers users more trading pairs (including cryptocurrencies, forex, and stocks), higher leverage, and complex risk management mechanisms under high capital efficiency. As a result, Gains Network is positioned to compete with GMX’s fully collateralized model—and it has already deployed on Arbitrum.

While the DAI vault operates on principles similar to GLP, it lacks GLP’s high scalability. However, on December 8 last year, Gains Network announced a new vault strategy: users who deposit assets into the vault receive gTokens. For example, depositing DAI yields a gDAI receipt token. The redemption price of gToken is influenced by accumulated fees and PnL data from open positions. The mechanism resembles VLP but is more complex. Going forward, Gains Network will also introduce liquidity staking incentives.

Given that the gToken model is more complex and inherently delta-neutral, developing derivative products on top becomes significantly harder, making it unlikely to spark widespread developer adoption.

In Conclusion

GMX and GLP derivative protocols represent a win-win collaboration: GMX provides a low-volatility LP token, while GLP derivative protocols offer capital-efficient strategies with enhanced hedged returns for GLP holders. GMX’s GLP not only sustains derivative protocols built upon it, but those same protocols in turn help expand GLP’s footprint, reinforcing GMX’s robust liquidity moat. Challengers in the spot/futures leverage trading space can only attempt to lure liquidity providers through higher incentives, like Vela Finance. Perhaps only a true innovator in this space will eventually stand a chance to challenge GMX’s leading position.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News