Understanding the Hidden Pitfalls of DeFi Derivatives Trading from the $XPL Incident

TechFlow Selected TechFlow Selected

Understanding the Hidden Pitfalls of DeFi Derivatives Trading from the $XPL Incident

🎣To you, the fishing platform represents an opportunity; to the whale, it's prey.

Author: K2 Kai

This massive XPL liquidation on HyperLiquid was not an accident. It mirrors the earlier JELLYJELLY incident and is far from a simple market fluctuation—it was a brazen "liquidity hunt," precisely exploiting weaknesses in mechanisms, human psychology, and market structure.

According to on-chain data monitoring, the core sequence of events unfolded as follows:

-

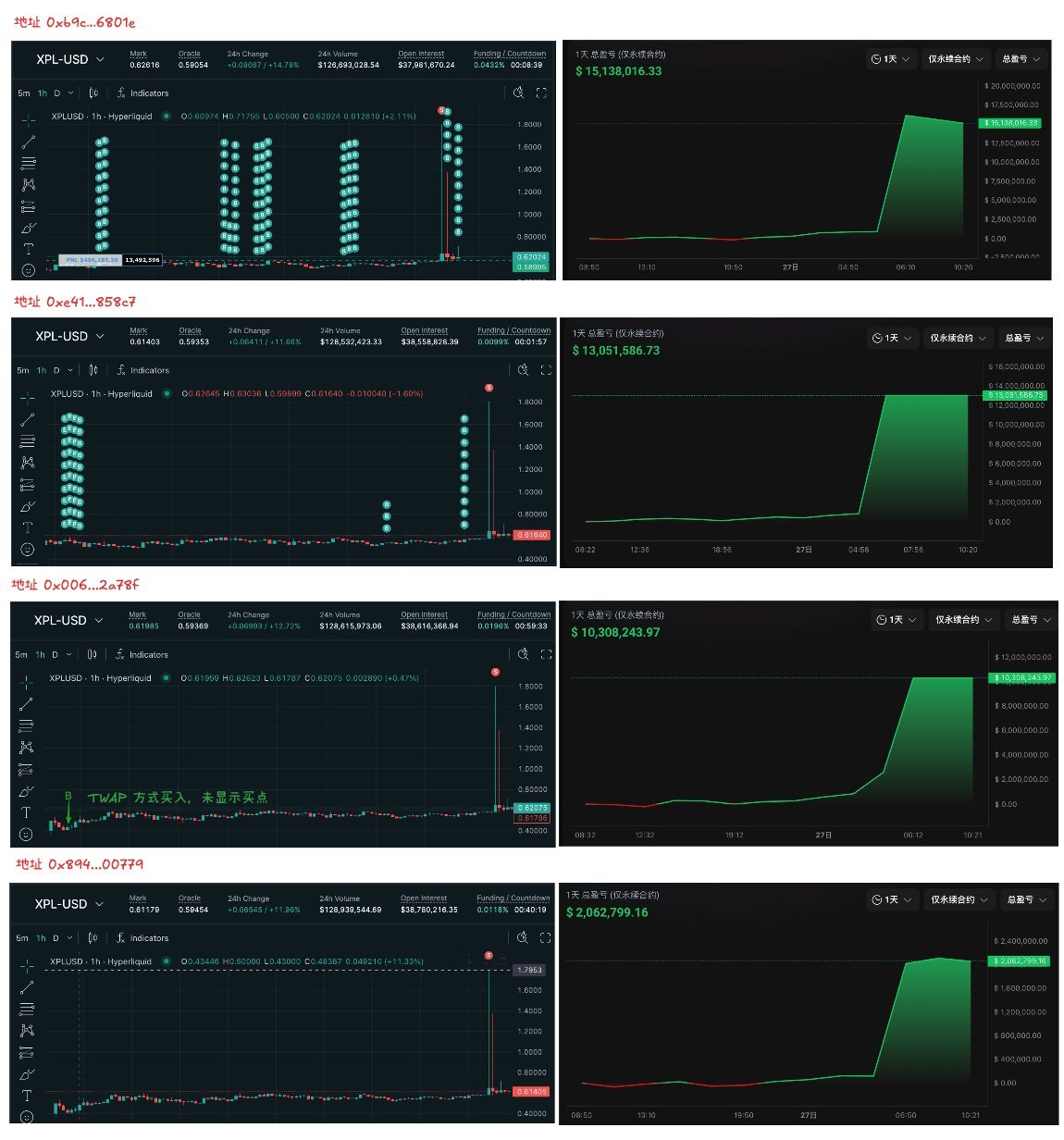

05:35 AM: A whale address 0xb9c…6801e suddenly deposited a large amount of USDC into HyperLiquid and opened a 3x leveraged long position on the XPL token. Its aggressive buying immediately swept through the entire order book, triggering a vertical surge in XPL's price.

-

05:36 – 05:37: Driven by this whale, XPL’s price skyrocketed from nearly $0.60 to a peak of around $1.80 within approximately two minutes—an increase exceeding 200%. This sharp rise triggered massive short liquidations, including losses of about $4.59 million from address 0xC2Cb and $2 million from address 0x64a4.

-

Rapid Profit-Taking: At the peak, the whale quickly closed its position, locking in approximately $16 million in profit within just one minute. Meanwhile, two other coordinated whale addresses also took profits at the top. In total, these three addresses collectively gained nearly $38 million.

Post-Event Holdings

Notably, after securing most of their profits, the whale still maintained a long position of up to 15.2 million XPL tokens—worth over $10.2 million—indicating a possible intent to continue influencing the market's direction.

Four main addresses participated in the $XPL hedge raid, collectively profiting $46.1 million (source: @ai_9684xtp)

How Was This Targeted Raid Executed?

Exploiting liquidity weakness: The operation was clearly divided and skillfully executed. On-chain data shows that at least four whale addresses were involved in this raid, extracting $46.1 million:

-

Exploiting Liquidity Weakness: Why XPL? Because it was a pre-market contract with almost no participants—its liquidity pool was as shallow as a puddle. In such an environment, price control lies almost entirely in the hands of those with capital. By using 3x leverage to sweep all existing orders, the whales exploited this structural asymmetry, moving the entire market with relatively small capital.

-

Triggering a Chain Reaction of Liquidations: The price surge from $0.60 to $1.80 wasn’t driven by real demand. The whales only provided initial capital—the real fuel came from all the traders holding short positions.

Let me explain this "death spiral": Whales push the price up with large buy orders → your short position gets liquidated → the system forces you to buy to close your position → your forced buying pushes the price even higher → the next short position hits its liquidation point...

When the snowball reaches maximum size, the whales calmly offload their holdings onto these forced buyers, completing the harvest.

-

Highly Coordinated Operation: On-chain fund flows clearly show this wasn't a solo effort. At least four addresses exhibited identical patterns in funding sources, entry timing, pump execution, and exit rhythm—as if trained in the same institution.

-

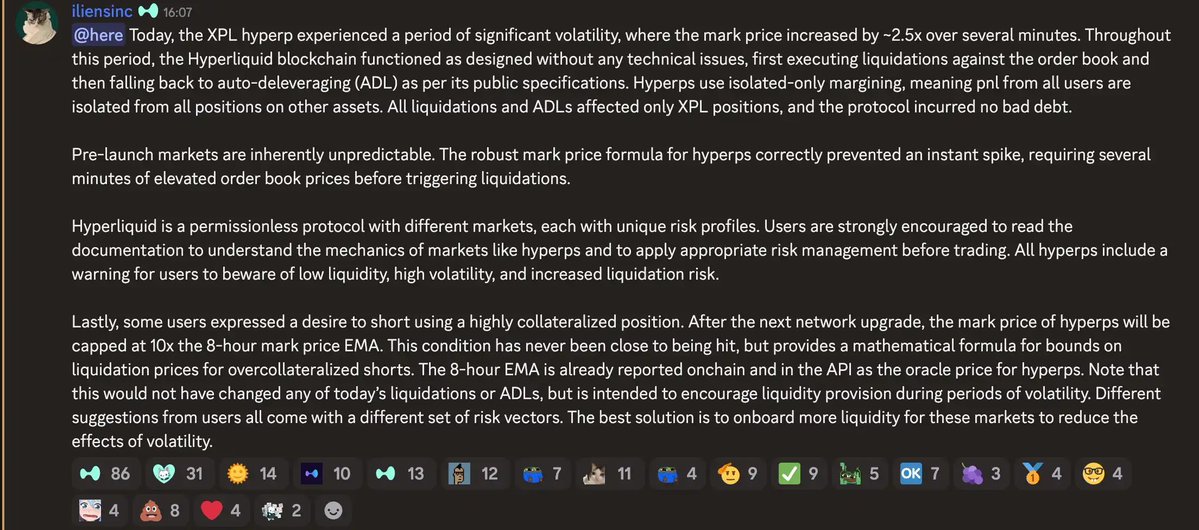

Amplified Platform Design Flaws: HyperLiquid’s internal pricing mechanism does not integrate external oracles, meaning prices are determined solely by activity within the platform. The whales exploited exactly this—doing whatever they wanted in this shallow pond. More ironically, the JELLYJELLY incident months earlier followed the exact same recipe, same outcome.

JELLYJELLY Incident Recap

The XPL event is not isolated. On March 26 this year, HyperLiquid experienced a similar price manipulation involving the JELLYJELLY token. A whale first dumped JELLYJELLY, causing a sharp price drop and forcing the platform’s liquidity pool (HLP) into passive short positions. The whale then rapidly bought back and pumped the price, resulting in nearly $12 million in losses for the HLP treasury. Afterwards, HyperLiquid had to delist the trading pair and compensate affected users.

Although HyperLiquid updated its leverage and liquidation mechanisms after the JELLYJELLY incident, the recurrence with XPL reveals that the system remains significantly vulnerable when whales exploit capital advantages and structural loopholes.

To Avoid Being the Next "Meal," Follow These Guidelines

The XPL incident reaffirms a harsh reality: in illiquid markets, retail traders are natural "counterparties" and "fuel" for whales. To avoid becoming the next victim, the following points are crucial:

-

Don’t Play With Sharks in a Small Pond

Avoid leveraged trading in pre-market contracts, new tokens, or low-cap coins. Shallow water, few fish, easy targets. If you must participate, treat it as high-risk speculation using only funds you can afford to lose completely. Never dream of catching a big move.

-

Leverage Is the Rope That Hangs You

In such conditions, there's no difference between 2x and 20x leverage—it all disappears in an instant. Always keep your position size within what you can accept losing, e.g., 5% of your total capital. Staying alive matters more than anything.

-

Beware of Abnormal Order Books and Fund Flows

When you see a token spiking vertically without reason, and sell orders being wiped out like paper—don’t FOMO, run! That’s not an opportunity; it’s the start of a massacre. Skilled traders should monitor on-chain data (via platforms like Onchain Lens, Lookonchain), as large inflows into specific platforms often signal impending attacks.

Before placing bets in a casino with opaque rules, spend five minutes checking whether the platform uses oracles and has sufficient trading depth.

A good platform tries to protect you, rather than letting its rules become weapons others use against you.

After the incident, HyperLiquid issued an official statement consisting of just one sentence: “It’s not our fault. Reflect on yourself.”

-

Don’t Bet Your Life Savings on a Fantasy

Whales profit from information gaps and rule exploits. Many people lose money chasing fantasies of sudden wealth. Stop chasing opportunities that aren’t meant for you. Focus on risk management—it’s far more important.

Finally, remember this: In this jungle, the greatest danger isn’t price swings—it’s the ones hiding behind the rules, treating you as prey. Don’t be the prey.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News