DeFi Derivatives: Comparing Mainstream Approaches – Real Asset-Backed vs Synthetic Asset Trading

TechFlow Selected TechFlow Selected

DeFi Derivatives: Comparing Mainstream Approaches – Real Asset-Backed vs Synthetic Asset Trading

This article will discuss the hard liquidity support model and the synthetic model.

Author: Chaos Labs

Translation: TechFlow

Written by research analyst @0xGeeGee

In both traditional finance and cryptocurrency, derivatives markets are significantly larger than spot markets. For example, as of now, Bitcoin's daily spot trading volume is approximately $4 billion, while its derivatives volume reaches as high as $53.89 billion (source: Cryptoquant.com).

Bitcoin: Volume ratio (spot vs derivatives) — Source: CryptoQuant

This trend has been accelerating since early 2021, as noted in this report, and continues today. In traditional finance, derivatives markets have long surpassed spot markets; centralized crypto exchanges (CEX) have followed suit. However, within decentralized finance (DeFi), derivatives have not yet overtaken spot markets on decentralized exchanges (DEX). For instance, over the past 24 hours, @Uniswap v3 facilitated $1.3 billion in spot trading, while @HyperliquidX processed around $1 billion in derivatives volume (source: Coingecko Data).

Nonetheless, the gap is narrowing, and it’s clear that as the ecosystem matures, on-chain derivatives may eventually surpass spot markets—just like in other mature financial systems. While demand is shifting toward derivatives, this growth requires secure and efficient trading platforms and models to support it.

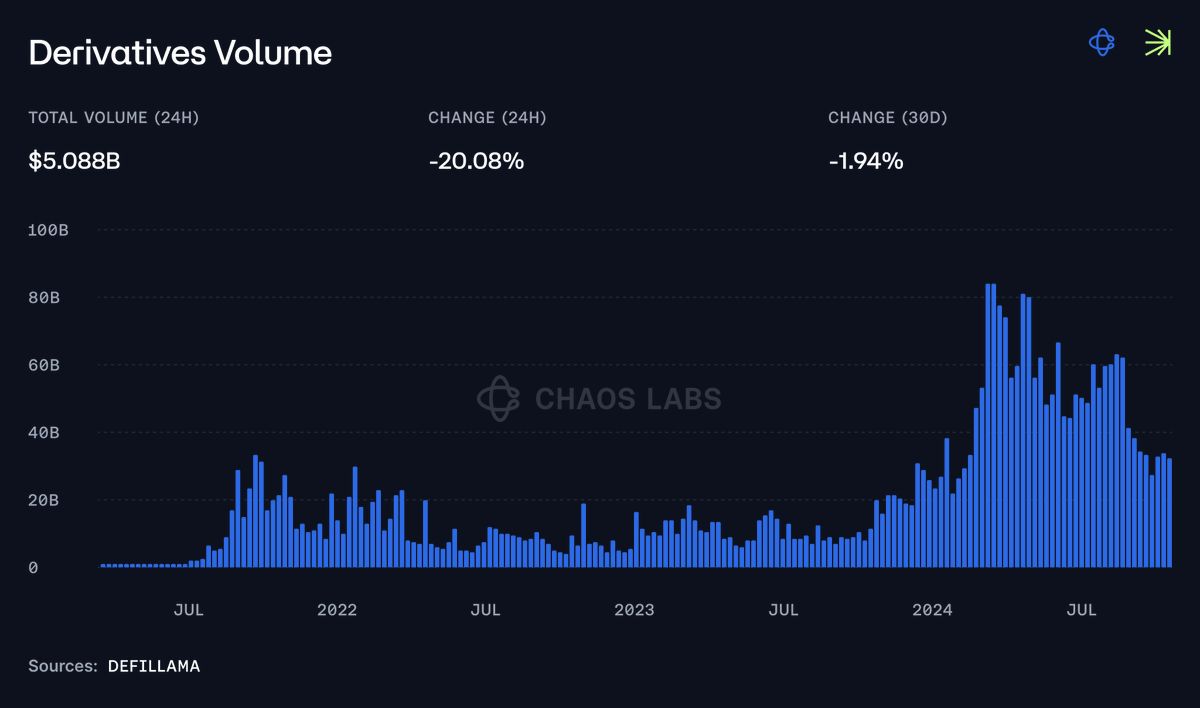

Derivatives volume — Source: DefiLlama

Understanding the different models underpinning derivatives markets is crucial for building infrastructure that supports this shift. In this article, I will discuss two main models: the hard liquidity-backed model and the synthetic model.

Hard Liquidity-Backed Model

In the hard liquidity-backed model, traders interact with real assets, tokens, or stablecoins deposited into liquidity pools. These assets are effectively lent to traders to open margin positions. Examples of protocols using this approach include @GMX_IO, @JupiterExchange, @GearboxProtocol's PURE, and @Contango_xyz.

Liquidity providers (LPs) earn trading fees by depositing real assets and may also receive rewards by acting as counterparty to traders. Thus, LP returns depend on asset performance within the pool, utilization rates, and trader profitability—especially in models lacking mechanisms to balance long and short trading volumes.

Advantages:

Lower bankruptcy risk: Since trades are backed by real assets, the system faces lower risk of insolvency.

Composability in DeFi: Hard-backed models like GMX and Jupiter allow re-pledging of liquidity pool tokens: $GLP and $JLP tokens can be used as collateral or staked across other DeFi applications, enhancing capital efficiency.

Reduced need for trading/market-making incentives: Because LPs act as counterparties or market makers, direct incentives are less critical. Although token incentives often reward LPs during early stages, long-term returns primarily come from trading fees, simplifying the design of balanced incentive programs.

Deeper market liquidity: The hard-backed model promotes deeper liquidity by requiring baskets of real, asset-backed liquidity. Over recent years, this has made protocols like GMX among the most efficient venues for swapping spot assets, as liquidity concentrates in pools serving both derivatives and spot markets.

Screenshot from DefiLlama showing number of protocols and pools including GLP and JLP yields

Within this category, different sub-models have emerged based on how liquidity is sourced and shared:

GMX v1 and Jupiter: These protocols use globally shared liquidity pools where all assets are pooled together. This ensures deep liquidity and enhances composability by allowing LPs to use a single token across various DeFi protocols.

GMX v2 and Gearbox's PURE: Feature isolated liquidity pools with modular architecture, where each asset or market has its own dedicated liquidity pool. This reduces systemic risk, enabling support for longer-tail and higher-risk assets. Each asset’s risks and returns are independent, preventing one asset from affecting the entire protocol’s liquidity and creating distinct risk/reward profiles.

Contango also operates within this “hard liquidity-backed” framework. Though not a standalone model, Contango runs atop existing lending protocols like Aave, offering a leveraged DEX experience. It uses real assets borrowed from lending pools along with flash loans to create leveraged positions.

Synthetic Model

While the hard liquidity-backed model ensures security and composability through real asset collateral, the synthetic model takes a different approach.

In the synthetic model, trades typically do not rely on real asset backing. Instead, these systems use order books, liquidity vaults, and price oracles to create and manage positions.

Synthetic models vary widely—some rely on peer-to-peer order book matching supported by active market makers, who may be professional entities or algorithmically managed vaults, with liquidity either globally shared or market-isolated; others adopt a purely synthetic approach where the protocol itself acts as counterparty.

What is a liquidity vault?

In synthetic derivatives models, a liquidity vault is a centralized liquidity mechanism that provides the funding source for trades—either directly backing synthetic positions or functioning as a market maker. Despite structural variations across protocols, the primary purpose of liquidity vaults is to supply trading liquidity.

These vaults are typically managed by professional market makers (e.g., Bluefin’s stablecoin pool) or algorithms (e.g., Hyperliquid, dYdX unlimited, Elixir Pool). In certain models, they serve as pure passive counterparty pools (e.g., Gains Trade). Often, these vaults are open to the public, allowing users to provide liquidity and earn rewards through platform participation.

Liquidity vaults can be shared across listed markets—as in Hyperliquid—or partially isolated, as seen in @dYdX unlimited, @SynFuturesDeFi, and @bluefinapp. These approaches carry similar trade-offs regarding risk and return as previously discussed.

Some protocols, such as Bluefin, employ a hybrid model, combining a globally shared liquidity vault managed by market makers with isolated algorithmic pools.

In synthetic models, liquidity is generally provided collectively by active users (via peer-to-peer matching), liquidity vaults (as backup), and market makers placing bids and asks on order books. As mentioned earlier, in purely synthetic models like @GainsNetwork_io, the liquidity vault itself serves as counterparty to all trades, eliminating the need for direct order matching.

Advantages:

The trade-offs in synthetic models differ from those in hard-backed models but bring their own set of benefits:

Capital efficiency: Synthetic models are highly capital-efficient because they don’t require direct 1:1 physical asset backing. As long as sufficient liquidity exists to cover potential outcomes of active trades, the system can operate with fewer underlying assets.

Asset flexibility: These systems offer greater flexibility in tradable assets since positions are synthetically created. There's no need to provide direct liquidity for every asset, enabling more diverse trading pairs and faster—even semi-permissioned—listing of new assets.

This is particularly evident in Hyperliquid’s pre-launch markets, where assets being traded don't even exist yet.

Better price execution: Because trades are purely synthetic, there's potential for superior price execution, especially when market makers actively quote prices on the order book.

However, these models also come with significant drawbacks:

Oracle dependency: Synthetic models heavily rely on price oracles, making them more vulnerable to oracle-related issues such as manipulation or latency.

Lack of liquidity contribution: Unlike hard-backed models, synthetic trading does not contribute to global spot market liquidity for assets, as liquidity exists only within derivative order books.

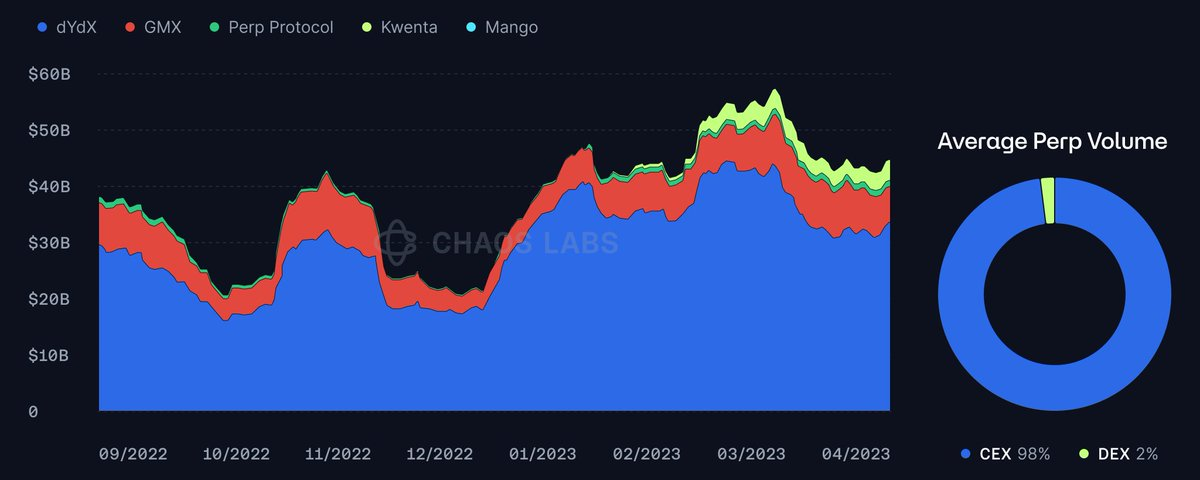

Although decentralized exchanges still represent a small portion of total perpetual contract volume (around 2% of the market), diverse models are laying the foundation for future real growth. The combination of these models, along with continuous improvements in capital efficiency and risk management, will be key to expanding DEXs’ share of the derivatives market.

Perpetual contract volume distribution — Source: GSR Annual Report

Chaos Labs’ Contribution

Chaos Labs plays a vital role in risk management for both hard-backed and synthetic models, meeting the specific needs of our partner platforms such as @GMX_IO, @dYdX, @SynFuturesDefi, @JupiterExchange, @OstiumLabs, and @Bluefinapp.

As a long-term risk analytics provider, Chaos Labs helps protocols manage leverage limits, liquidation thresholds, collateral requirements, and overall platform health through real-time risk assessment and simulation.

Chaos Labs’ latest product, Edge Network, introduces a decentralized oracle system that mitigates oracle-related risks, ensuring both synthetic and hard-backed models can benefit from real-time, accurate price data. Edge is already used as the primary oracle by prominent platforms like Jupiter.

Chaos Labs also collaborates with partners to design optimized liquidity incentive programs, ensuring smooth trading experiences and attracting more liquidity.

Finally, Chaos Labs offers public dashboards to monitor risk parameters across platforms such as GMX, Jupiter, Bluefin, and dYdX.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News