The "Singularity Moment" for Perp DEXs: Why Can Hyperliquid Kick Open the Door to On-Chain Derivatives?

TechFlow Selected TechFlow Selected

The "Singularity Moment" for Perp DEXs: Why Can Hyperliquid Kick Open the Door to On-Chain Derivatives?

Hyperliquid might just be the beginning.

Author: imToken

"Derivatives are the holy grail of DeFi." The idea that on-chain perp protocols represent the next phase of DeFi has been widely accepted since 2020.

But in reality, over the past five years, perp DEXs have struggled to balance "performance" and "decentralization," constrained by either scalability or cost. Although AMM-based models like GMX achieved permissionless trading, they still fall short of CEXs in terms of trade speed, slippage, and depth.

It wasn't until Hyperliquid emerged—leveraging its unique on-chain order book architecture to deliver a CEX-level smooth experience on a fully self-custodial blockchain—that things began to change. The recent approval of HIP-3 proposal further tore down the walls between Crypto and TradFi, opening up infinite possibilities for trading more asset classes on-chain.

This article will dive deep into Hyperliquid's operational mechanics and revenue sources, objectively analyze its potential risks, and explore the revolutionary variables it brings to the DeFi derivatives space.

The Cycle of the Perp DEX Landscape

Leverage is a core primitive of finance. In mature financial markets, derivatives trading far surpasses spot trading in liquidity, capital size, and trading volume. After all, margin and leverage allow limited funds to control larger market exposures, meeting diverse needs such as hedging, speculation, and yield management.

The crypto world has also validated this pattern in the CEX space. As early as 2020, derivative trading via futures contracts on CEXs started replacing spot trading and gradually became the dominant force.

Data from Coinglass shows that in the past 24 hours, daily trading volumes of major CEX futures contracts have reached hundreds of billions of dollars, with Binance exceeding $130 billion.

Source: Coinglass

In contrast, on-chain perp DEXs have had a long five-year journey. dYdX experimented with an on-chain order book aiming for a more centralized-like experience but faced challenges balancing performance and decentralization. AMM-based models like GMX enabled permissionless trading, yet still lag significantly behind CEXs in execution speed, slippage, and depth.

In fact, the sudden collapse of FTX in early November 2022 briefly boosted trading volume and new user numbers for on-chain derivatives protocols like GMX and dYdX. However, due to constraints including market conditions, on-chain performance, trading depth, and available instruments, the entire sector quickly fell silent again.

To be honest, once users realize they face the same liquidation risks on-chain without getting CEX-grade liquidity and experience, their willingness to migrate naturally drops to zero.

The key issue isn't whether there's demand for on-chain derivatives—it's the persistent lack of a product form that offers both irreplaceable value beyond CEXs and solves performance bottlenecks.

The market gap is clear: DeFi needs a perp DEX protocol capable of delivering true CEX-level experience.

It was precisely against this backdrop that Hyperliquid emerged, introducing a new variable to the entire sector. Little known is that although Hyperliquid only gained mainstream attention this year, it actually launched back in 2023 and has been iterating and accumulating for the past two years.

Is Hyperliquid the Ultimate Form of an 'On-Chain CEX'?

Facing the long-standing dilemma of "performance vs. decentralization" in the perp DEX space, Hyperliquid has a straightforward goal—to replicate the seamless CEX experience directly on-chain.

To achieve this, it took an aggressive path: instead of relying on existing L1 performance limits, it built a dedicated L1 appchain using Arbitrum Orbit technology stack, deploying a fully on-chain order book and matching engine on top.

This means every step—from order placement, matching, to settlement—occurs transparently on-chain while achieving millisecond-level processing speeds. Architecturally, Hyperliquid resembles a "fully on-chain version" of dYdX, no longer dependent on any off-chain matching, aiming straight for the ultimate form of an "on-chain CEX."

The impact of this aggressive approach was immediate.

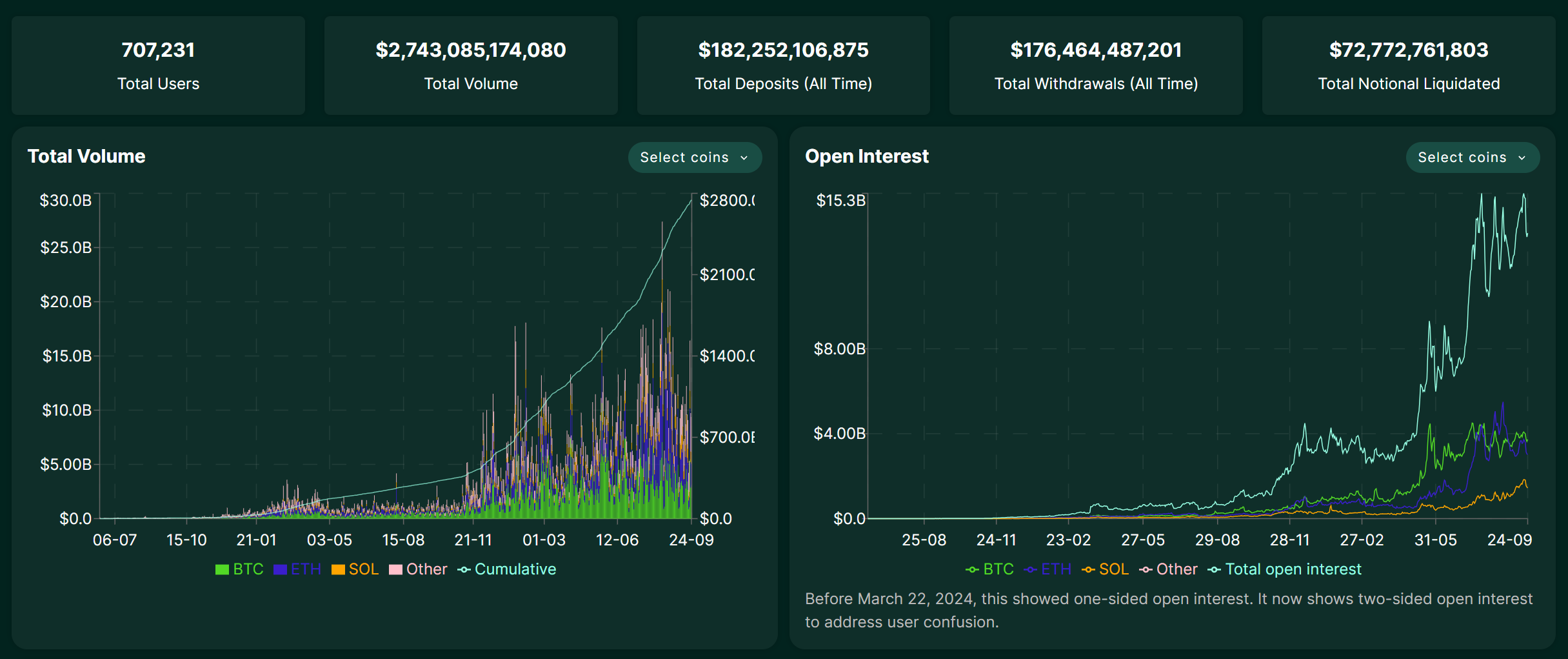

Since the beginning of this year, Hyperliquid's daily trading volume has surged, peaking at $20 billion. As of September 25, 2025, its cumulative trading volume exceeded $2.7 trillion—its revenue scale even surpassing most tier-two CEXs. This clearly demonstrates that on-chain derivatives don't lack demand; rather, they lack a product form truly adapted to DeFi's characteristics.

Source: Hyperliquid

Naturally, such strong growth quickly attracted ecosystem momentum. The recent bidding war over USDH issuance rights on HyperLiquid drew high-profile players like Circle, Paxos, and Frax Finance into public competition (see further reading: Starting from USDH on HyperLiquid Becoming Highly Sought-After: Where Lies the Fulcrum of DeFi Stablecoins?), serving as the best evidence.

Yet, merely replicating the CEX experience isn't Hyperliquid's endgame. The recently passed HIP-3 proposal introduces permissionless, developer-deployed perpetual markets at the core infrastructure level. Previously, only the core team could list trading pairs, but now any user staking 1 million HYPE can directly deploy their own market on-chain.

In short, HIP-3 allows permissionless creation and listing of derivative markets for any asset on Hyperliquid. This completely breaks the previous limitation of Perp DEXs being restricted to major cryptocurrencies. Under the HIP-3 framework, we may soon see on Hyperliquid:

-

Stock markets: Trading top global financial assets like Tesla (TSLA) and Apple (AAPL);

-

Commodities and forex: Trading traditional financial products like gold (XAU), silver (XAG), or EUR/USD;

-

Prediction markets: Betting on various events such as "Will the Fed cut rates next time?" or "What will be the floor price of a blue-chip NFT?"

This would greatly expand Hyperliquid’s asset classes and potential user base, blurring the lines between DeFi and TradFi. In other words, it enables any global user to access core traditional assets and financial instruments in a decentralized, permissionless manner.

What About the Other Side of the Coin

Despite Hyperliquid's high performance and innovative model being exciting, there are non-negligible risks involved—especially given it hasn't yet undergone a major crisis "stress test."

The cross-chain bridge issue stands out as the most discussed concern within the community. Hyperliquid connects to the mainnet via a cross-chain bridge controlled by a 3/4 multi-sig, creating a centralized trust point. If these signers encounter issues—accidental (e.g., lost private keys) or malicious (e.g., collusion)—it would directly threaten the asset security of all users on the bridge.

Next is treasury strategy risk, as HLP treasury returns are not principal-guaranteed. If market-making strategies incur losses under certain market conditions, the principal deposited into the treasury will also decrease. Users enjoying high expected returns must simultaneously bear the risk of strategy failure.

As an on-chain protocol, Hyperliquid also faces standard DeFi risks such as smart contract vulnerabilities, oracle price feed errors, and user liquidations during leveraged trading. In fact, over recent months, the platform has experienced multiple large-scale extreme liquidation events due to malicious manipulation of prices for some low-market-cap tokens, exposing gaps in its risk control and market oversight.

Objectively speaking, another often overlooked issue is that as a rapidly growing platform, Hyperliquid has not yet faced major regulatory scrutiny or serious security incidents. During a platform's rapid expansion phase, risks are often masked by the halo of fast growth.

All in all, the story of perp DEXs is far from over.

Hyperliquid is just the beginning. Its rapid rise proves both the real demand for on-chain derivatives and the feasibility of overcoming performance bottlenecks through architectural innovation. HIP-3 further expands imagination into stocks, gold, forex, and even prediction markets, making the boundary between DeFi and TradFi blur for the first time.

While high returns always come hand-in-hand with high risks, from a macro perspective, the appeal of the DeFi derivatives space won't fade due to risks associated with a single project. It's possible that future projects will emerge to succeed Hyperliquid/Aster as the next leaders in on-chain derivatives. Therefore, as long as we believe in the charm and potential of the DeFi ecosystem and the derivatives赛道, we should pay sufficient attention to such promising early-stage projects.

Perhaps years from now, looking back, this moment may mark a brand-new historical opportunity.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News