Deribit acquired by Coinbase, is the derivatives race heating up?

TechFlow Selected TechFlow Selected

Deribit acquired by Coinbase, is the derivatives race heating up?

In the U.S. market, Coinbase primarily focuses on spot trading, while Deribit, an exchange known for derivatives, controls the majority of crypto options trading volume.

Author: Pzai, Foresight News

In recent years, compliant exchanges such as Coinbase and Kraken have been rushing into derivatives trading. On May 8, Coinbase announced a record-breaking $2.9 billion acquisition of Deribit, surpassing Kraken's $1.5 billion purchase of the derivatives platform NinjaTrader on March 20, becoming the largest single acquisition deal in the cryptocurrency sector.

Recent financial reports from Coinbase show that its first-quarter 2025 revenue increased by 24% year-on-year but declined 10% quarter-on-quarter, missing market expectations ($2.105 billion). Net profit plummeted 94% year-on-year to $66 million. First-quarter trading revenue dropped 19% to $1.2 billion, with trading volume down 10%. Following the announcement, Coinbase's stock price rose as much as 6%. According to Benchmark analysis, the acquisition will strengthen the Coinbase Prime platform and institutional appeal, gradually securing pricing power in crypto options. Will this acquisition trigger explosive growth in Coinbase’s derivatives business and thereby improve long-term stock outlook?

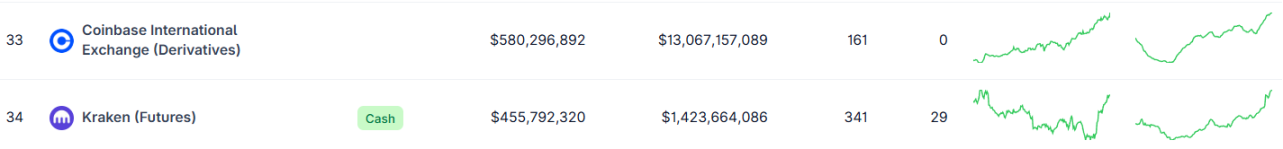

In the U.S. market, Coinbase primarily focuses on spot trading, while Deribit, known for its expertise in derivatives, controls the majority of crypto options trading volume. According to CoinGecko data, Coinbase and Kraken (this site) rank only 33rd and 34th respectively in derivatives trading, offering insufficient depth and liquidity to attract traders.

As a specialized derivatives trading platform, Deribit differs from large-scale cryptocurrency exchanges like Binance and Coinbase in that its core users are professional traders and institutions, among whom it enjoys high recognition. Data shows that its trading volume approached $1.2 trillion in 2024, with daily derivatives trading reaching $2.8 billion.

From a market structure perspective, derivatives trading has already become a pillar of the crypto industry. According to a Coinglass report, global crypto derivatives averaged over $100 billion in daily trading volume in 2024, far exceeding spot market volumes. Market distribution among major exchanges also shows clear differences. For example, Binance’s daily trading volume reaches around $110 billion, far surpassing the total futures volume on Coinbase International. Therefore, Coinbase needs a platform capable of capturing future demand for crypto derivatives trading.

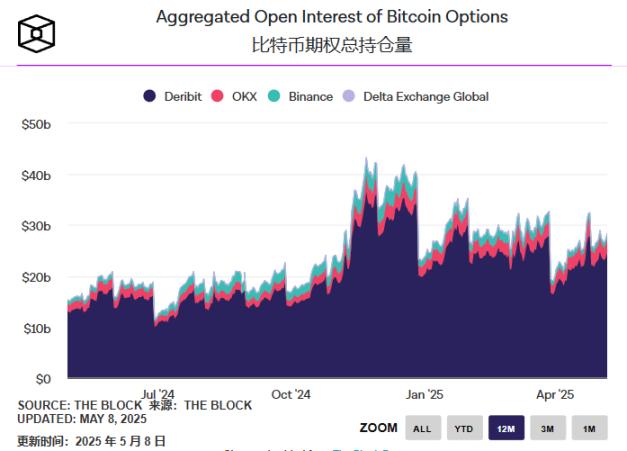

In terms of total open interest, Deribit consistently maintains option positions at the tens-of-billions level, accounting for more than 90% of the overall market. What attracts Coinbase is precisely the financial benefits (hundreds of billions in options trading volume) and growth potential brought by this large options position. Coinbase stated that Deribit has a "consistent profitability track record," with adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization) showing sustained positive growth, and expects further improvement in profitability post-merger.

The acquisition includes $700 million in cash and 11 million shares of Coinbase common stock. Based on Deribit’s 2024 trading volume, its annual fee income is estimated at approximately $420 million (at a 0.035% fee rate), giving it a price-to-sales ratio significantly lower than peers (such as Robinhood’s 15x). Analysts expect that integrating Deribit will increase Coinbase’s average daily derivatives trading volume by 40%, diversify trading revenue, and raise derivatives revenue share to over 30% by 2026. From a long-term perspective, this deal offers solid cost-effectiveness.

Prior strategic acquisitions by Coinbase include Xapo (wallet service provider, now Coinbase Custody), Tagomi (brokerage firm, now Coinbase Prime), FairX (compliant derivatives platform, transformed into Coinbase Derivatives), and One River Digital (now Coinbase Asset Management). This latest acquisition reflects how, amid shrinking spot markets, the vast futures market can provide new growth opportunities for Coinbase.

Additionally, Deribit’s long-standing reliance on options has allowed competitors to lure users with higher leverage, lower fees, and diversified derivatives (such as structured products and leveraged tokens). Through Coinbase’s acquisition and integration, its global user base—especially institutional clients via Coinbase Prime—can complement Deribit’s professional derivatives capabilities.

Under the lure of such significant business expansion, Coinbase has recently gone all-out in user incentives. Over the past two weeks, rumors have spread widely in the airdrop community about Coinbase offering 200 USDC to new derivatives customers, drawing massive user inflows to the exchange. Due to regional restrictions on participation, even proof-of-address documents have become highly sought after.

According to Bernstein analysts, as the industry evolves toward “one-stop” multi-asset platforms, crypto exchanges and brokers are making “major moves in mergers and acquisitions.” Coinbase is continuously expanding the business boundaries of compliant exchanges. With compliant players like Kraken and Coinbase entering the derivatives space—from merely holding spot positions to engaging in long-short battles—we can expect gradual maturation of crypto offerings in European and U.S. markets, as the competitive landscape begins to take shape.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News