Which crypto projects will lead the trend amid the multi-chain DeFi 3.0 wave?

TechFlow Selected TechFlow Selected

Which crypto projects will lead the trend amid the multi-chain DeFi 3.0 wave?

What will DeFi 3.0 look like? Which cryptocurrency projects will lead the trend?

Written by Jack Niewold, Founder of Crypto Pragmatist

Compiled by TechFlow

What will DeFi 3.0 look like? Which crypto projects will lead the way?

-

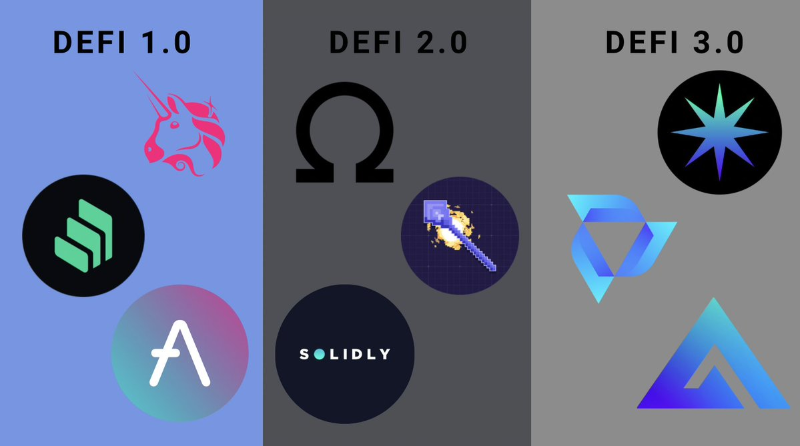

DeFi 1.0 laid the foundation for DeFi: AAVE, COMP, UNI.

-

DeFi 2.0, however, was plagued by scams, frauds, and yield pyramids.

The author presents several theories on what DeFi 3.0 will entail and why—covering aspects such as multichain interoperability, capital efficiency, incentive redesign, and product liquidity flywheels.

This article also highlights pioneering DeFi 3.0 projects, including multichain lending markets, rapidly iterating perpetual contract DEXs, passive liquidity initiatives, and reliable forked protocols. Let’s examine the characteristics of these projects one by one.

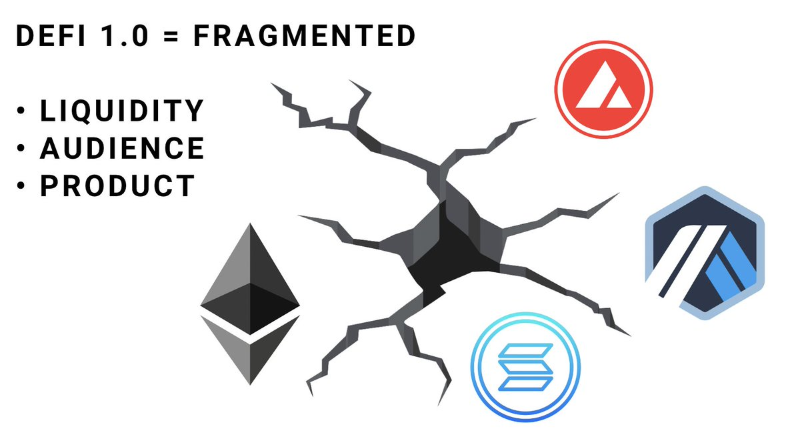

Multichain

Representative of DeFi 3.0: Radiant ($RDNT)

Protocols face challenges in achieving unified liquidity and vision:

• Teams overextend across multiple chains

• Fragmented product usage

• Dispersed liquidity.

How to solve this problem?

In Radiant's upcoming V2, you can:

• Deposit native collateral (e.g., USDC on Arbitrum)

• Borrow ETH against USDC on a new chain

• Sell it for another asset.

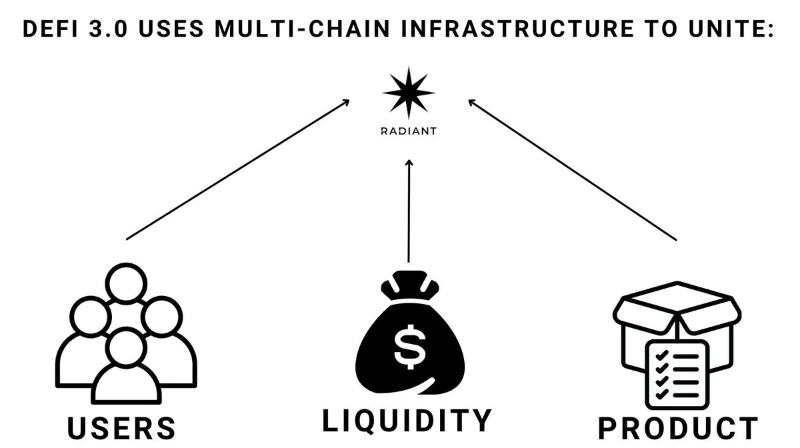

At the product level, Radiant becomes a home—not tied to any specific chain itself.

What fundamental problem does Radiant's Omnichain model solve?

Liquidity Unification:

-

Protocols that attract liquidity become winners.

-

Protocols adopting an Omnichain model find it easier to attract liquidity.

-

Omnichain-based protocols are more likely to succeed.

Capital Efficiency

Radiant is also innovating in this area:

If I want $1 million exposure to ETH, I could deposit my ETH into a lending protocol to earn yield. Or I could collateralize my ETH to borrow USDC and then participate in liquidity mining.

Incentive Redesign

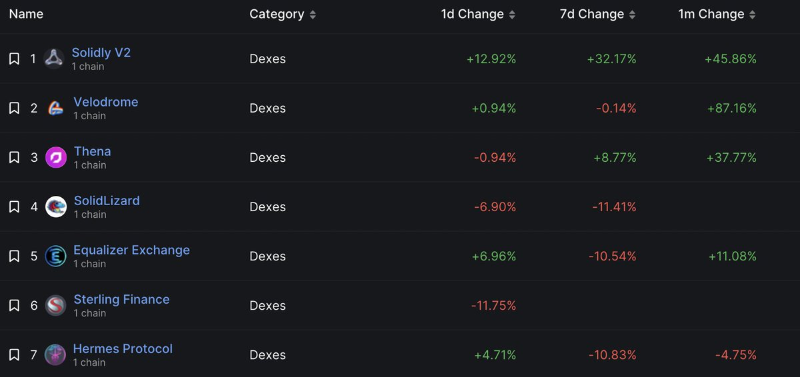

Representative: Solidly forks

Although the DeFi 2.0 protocol Solidly had a problematic inflationary token model, it did pioneer a new type of incentive design. Now, its forks have redesigned the system and found ways to align incentives across different stakers.

Consider these forked projects:

• SatinExchange (MATIC)

• VelodromeFi (OP)

• Thena (BNB)

• SolidLizard (Arbitrum)

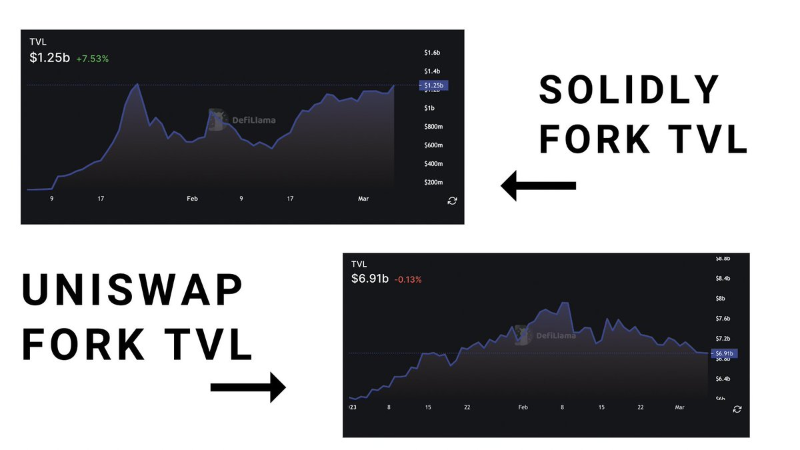

These protocols steadily drove up the total value locked (TVL) of Solidly forks throughout 2023.

Why?

These Solidly forks have successfully aligned incentives among various stakeholders:

• Users;

• Ecosystem;

• Other protocols;

• Liquidity providers;

• Team members;

• Fee revenue;

Meanwhile, Uniswap forks have struggled.

Product-Liquidity-Flywheel

Pioneered by GMX, the final piece of the DeFi 3.0 puzzle relates to the liquidity flywheel:

-

DeFi 1.0 + 2.0: Issue tokens and gradually increase supply to incentivize liquidity.

-

DeFi 3.0: Find a model that doesn't require token rewards at all!

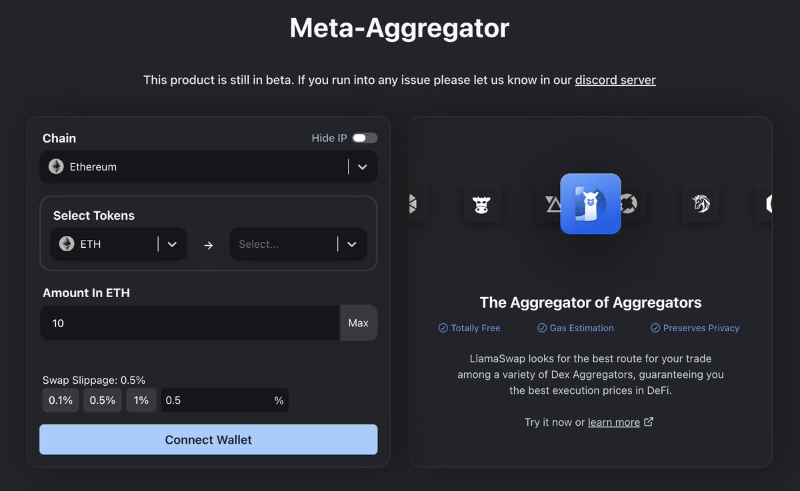

GMX and similar forked projects like Vela demonstrate that liquidity can be driven without token incentives. In this model, tokens act as equity rather than inflationary rewards. Projects like Sentiment and DefiLlama show that you don’t need tokens to achieve adoption.

In many of the protocols mentioned above, we see users—not the protocol—paying for liquidity. This model allows token holders to easily collect fees, enabling a more sustainable structure.

What do you think DeFi 3.0 will look like?

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News