Comparison of On-Chain Perpetual DEXs: dYdX, GMX, Gains, Kwenta, and Level

TechFlow Selected TechFlow Selected

Comparison of On-Chain Perpetual DEXs: dYdX, GMX, Gains, Kwenta, and Level

This article will conduct a comparative analysis of the trading volume, fees, and native token valuations of several representative decentralized perpetual contract exchanges, and explore the challenges they may face as well as their future development directions.

Author: ThorHartvigsen

Translation: TechFlow

Since the collapse of FTX, an increasing number of traders have shifted to on-chain perpetual DEXs, and the market size has continued to expand.

While centralized exchanges like Binance remain the primary venues for derivatives trading, as decentralized technologies mature, more capital is expected to flow into the decentralized perpetual contracts market.

This article compares and analyzes representative decentralized perpetual exchanges in terms of trading volume, fees, and native token valuations, while also discussing their potential challenges and future development directions.

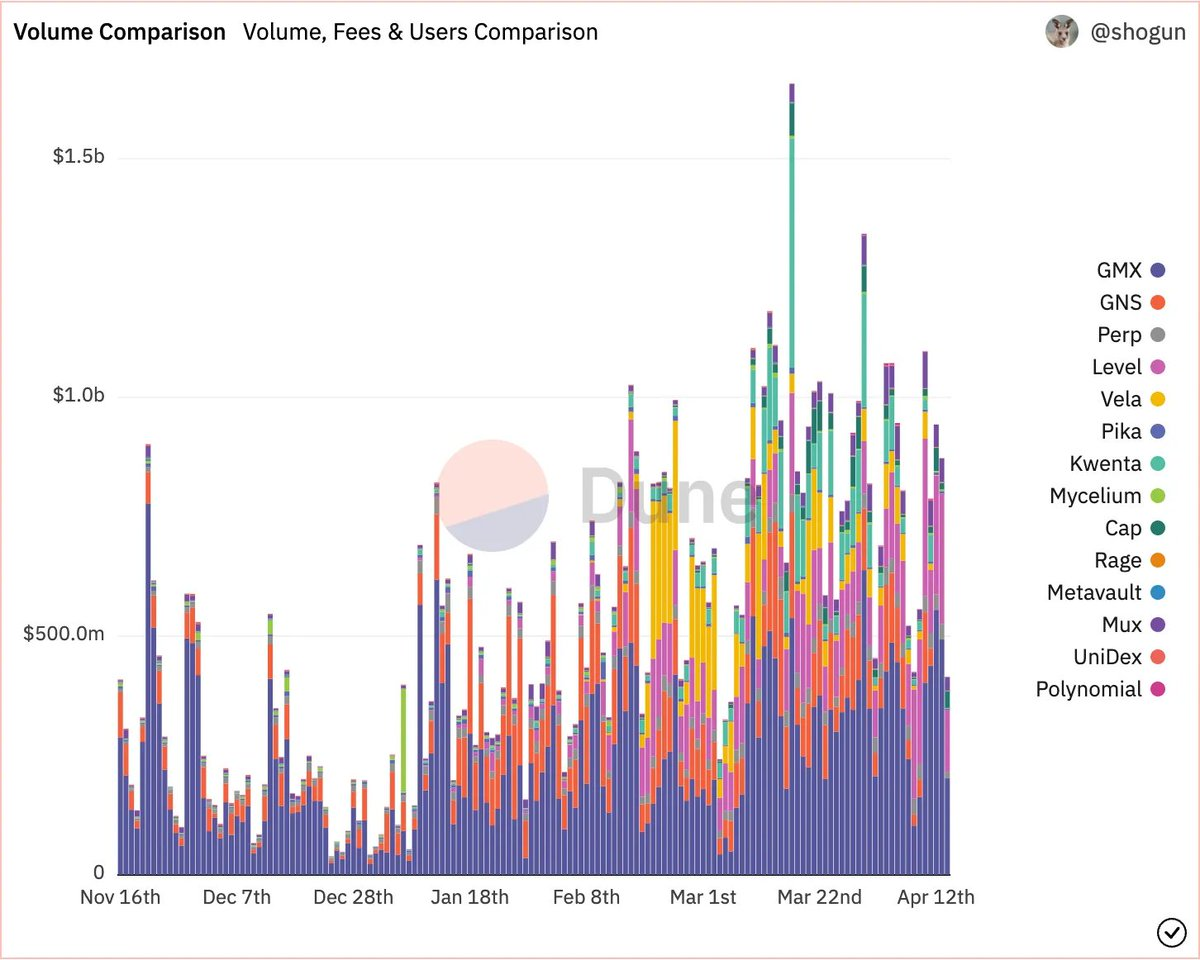

Overview of the Decentralized Perpetual Market

In Q1 2023, the total trading volume across on-chain perpetual contract exchanges reached $164.2 billion.

Although this represents significant growth compared to earlier periods, Binance alone generated $4.5 trillion in derivatives trading volume during just the first quarter.

Since the collapse of FTX, more traders have moved on-chain, leading to the emergence of several new protocols. As the market matures, I have no doubt that cumulative on-chain perpetual trading volume will grow to multiple trillions of dollars each quarter.

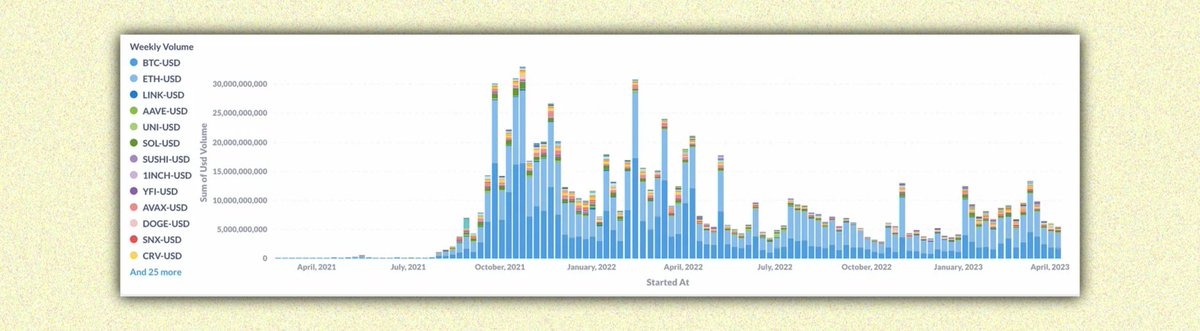

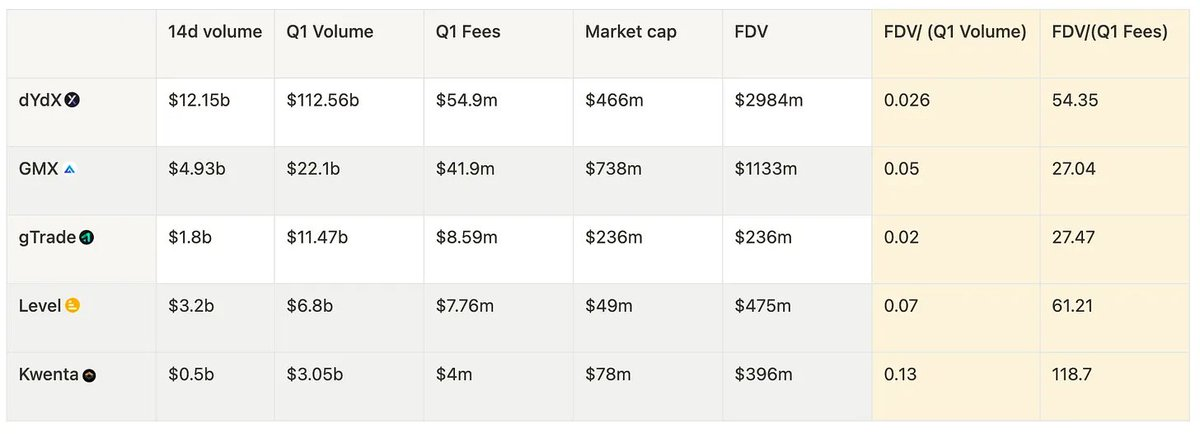

The table below shows the total trading volume and fees generated by leading on-chain perpetual exchanges. Two points stand out:

• dYdX continues to attract substantial trading volume;

• Despite significantly lower trading volume, GMX's fees are nearly equivalent to those of dYdX.

dYdX

-

Total trading volume: $913 billion;

-

14-day trading volume: $12.15 billion;

-

14-day fees: $3.24 million.

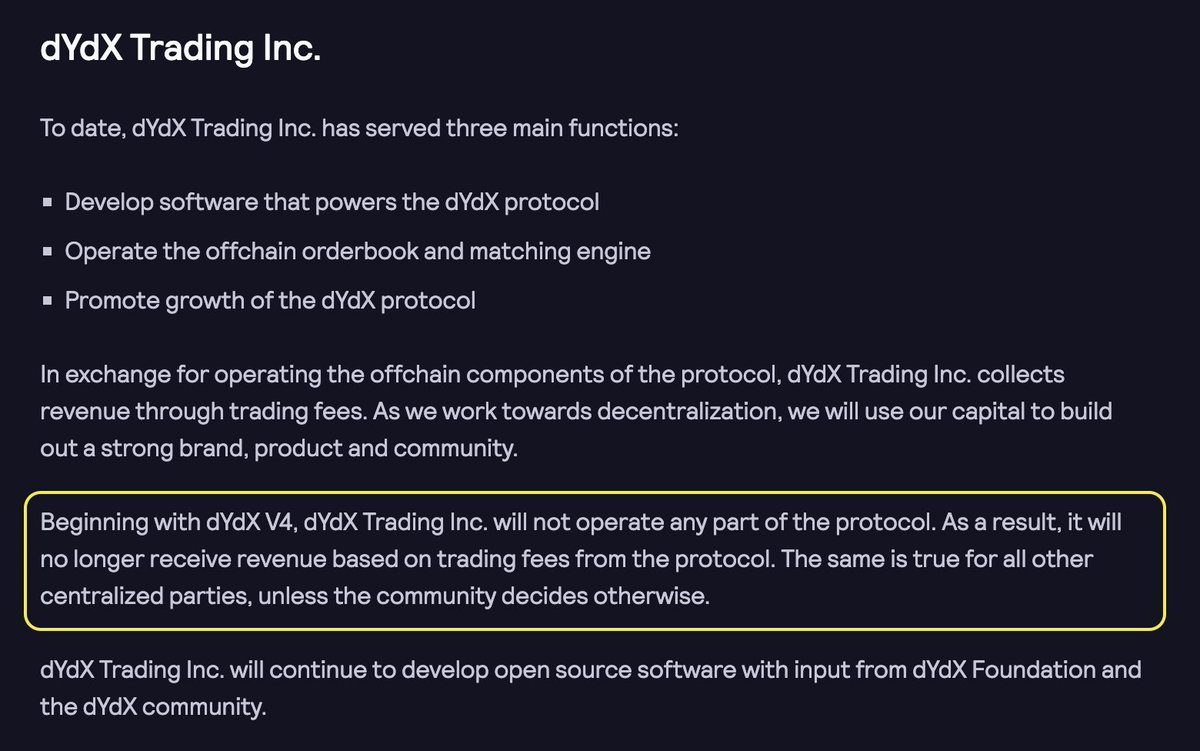

dYdX currently operates on a custom zk-rollup built by Starkware but will transition later this year (with dYdX V4) to an appchain within the Cosmos ecosystem.

In V4, dYdX validators will run a decentralized order book and matching engine on-chain. Current tests have already achieved throughput exceeding 500+ TPS. Upon launch, all fee revenue will no longer be allocated to centralized entities.

GMX

-

Total trading volume: $100.5 billion;

-

14-day trading volume: $4.93 billion;

-

Total fees: $148.2 million;

-

14-day fees: $7.43 million.

Last year, GMX sparked the narrative around on-chain perpetual contracts. Despite numerous new entrants over recent months, GMX continues to see growing daily trading volume, user count, and fee generation.

GMX V2 will introduce synthetic asset trading capabilities (beyond just cryptocurrencies).

• Utilizing Chainlink low-latency oracles for improved real-time market data;

• Each trading pair will have separate liquidity pools to isolate risk;

• Phasing out the GLP token after V2 rollout.

Expected release in Q2 or Q3.

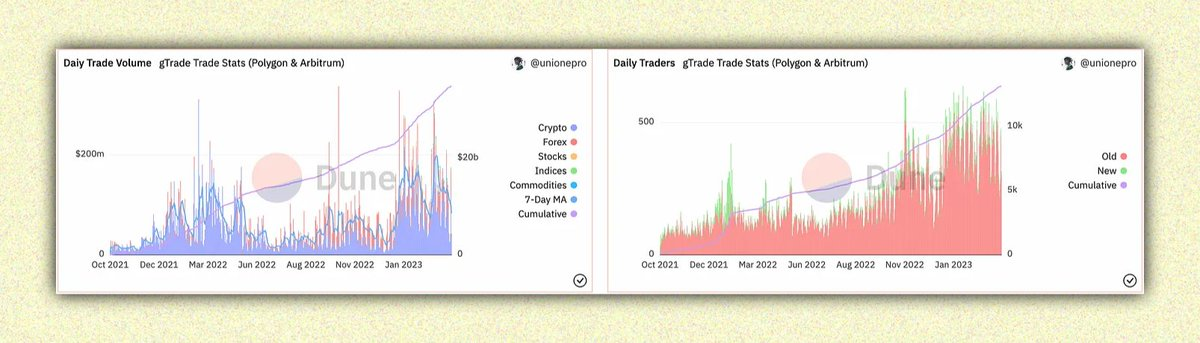

GainsNetwork

-

Total trading volume: $35 billion;

-

14-day trading volume: $1.8 billion;

-

Total fees: $254 million;

-

14-day fees: $1.6 million.

Daily trading volume surged after gTrade deployed on Arbitrum in January.

Now approximately 80% of total volume occurs on Arbitrum. Since the introduction of the gDAI vault, significant liquidity has flowed in. The vault tokenizes users’ share of liquidity and allows them to deposit these tokens into AMMs, lending protocols, etc.

Kwenta

-

Total trading volume: $6.4 billion;

-

14-day trading volume: $500 million;

-

Total fees: $12.6 million;

-

14-day fees: $800,000.

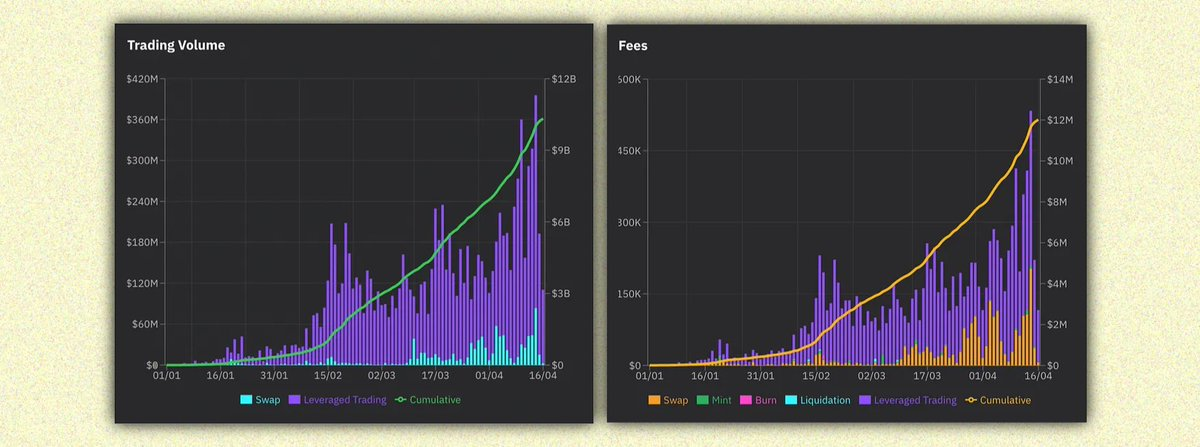

Kwenta launched its V2 version in February, adding many new tradable assets, resulting in a sharp increase in trading volume since then.

Kwenta leverages Synthetix as the liquidity layer for perpetual derivative trading. As Synthetix V3 introduces additional collateral assets backing sUSD, we may see deeper liquidity on Kwenta.

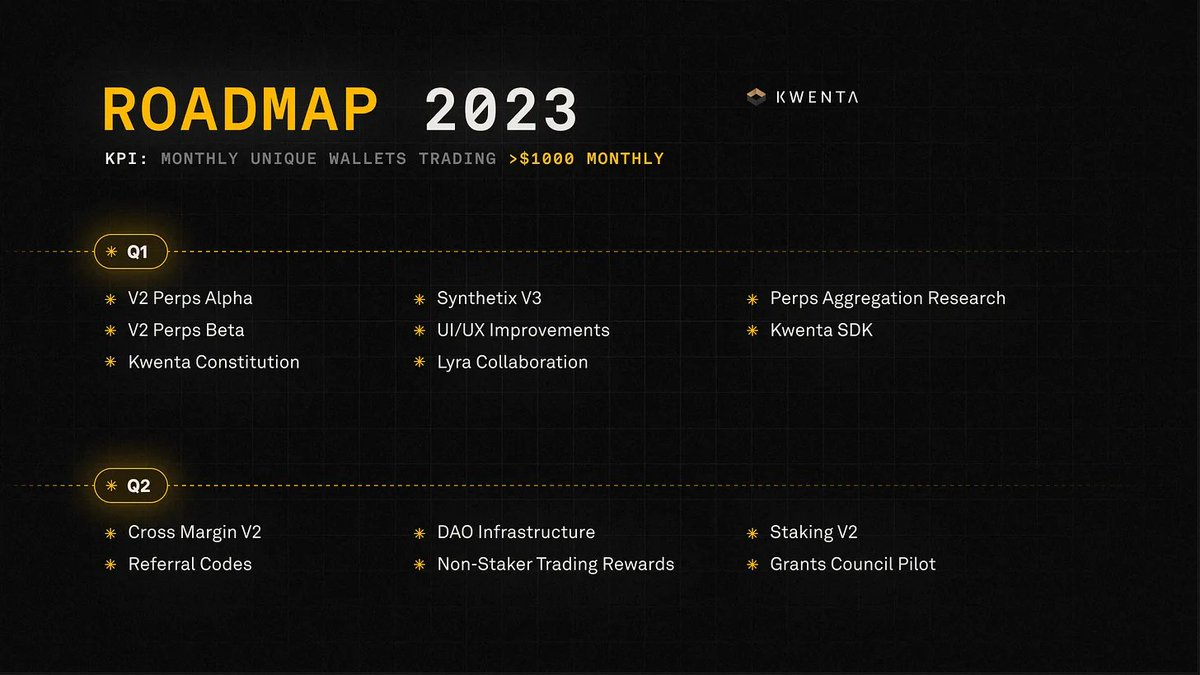

Current Kwenta Roadmap:

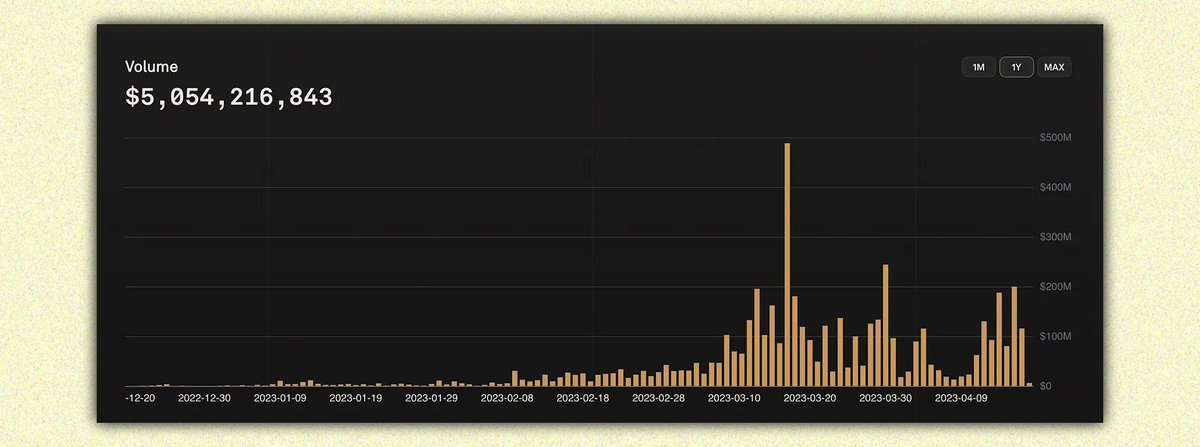

Level

-

Total trading volume: $10.3 billion;

-

14-day trading volume: $3.2 billion;

-

Total fees: $12 million;

-

14-day fees: $3.9 million.

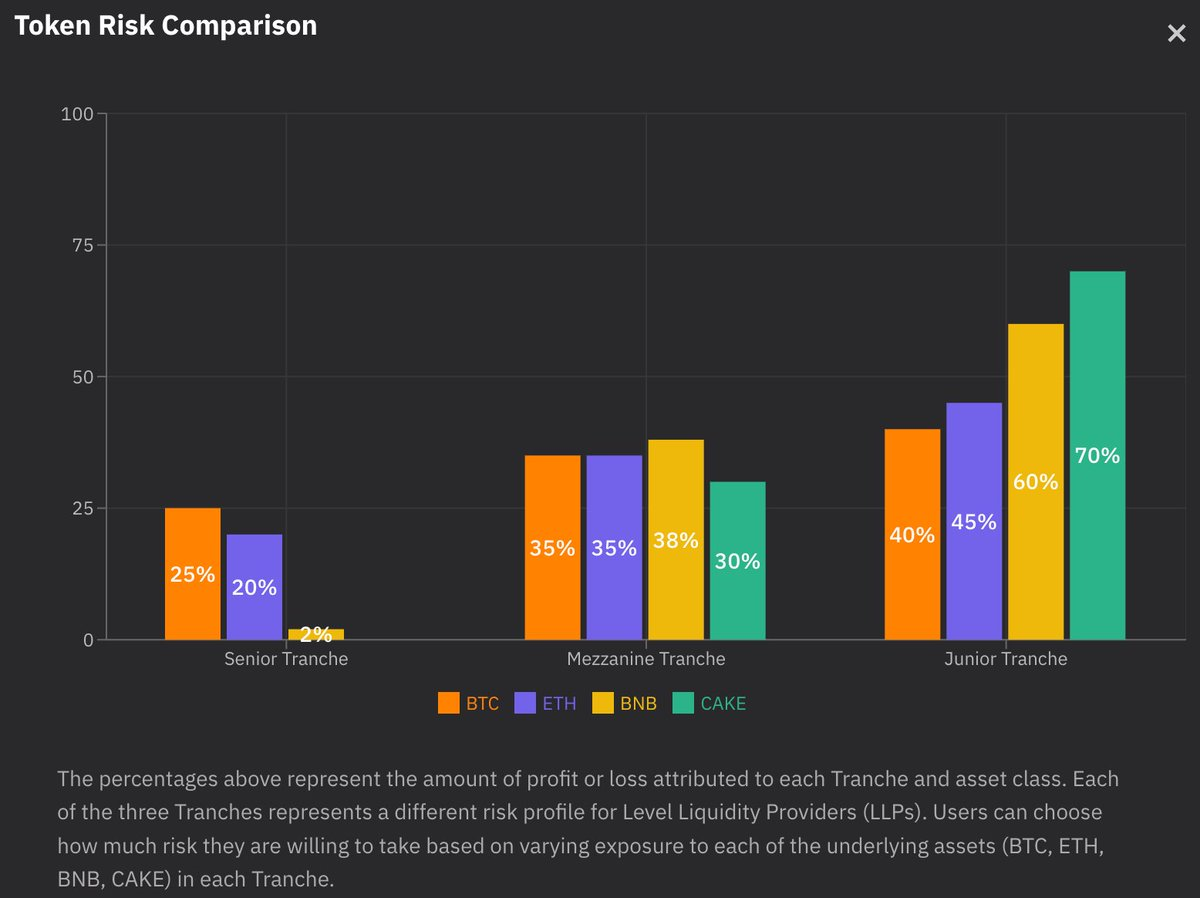

Level is the largest perpetual contract exchange on the BNB Chain, offering four trading pairs: ETH, BTC, BNB, and CAKE.

Tranches provide liquidity for traders with higher risk tolerance—higher-risk tranches receive a larger share of trading fees. Level also plans to expand to new chains in 2023 and upgrade its current liquidity structure.

Comparative Analysis

The table below shows recent trading volumes, fees, and native token valuations.

Lower FDV/Volume and FDV/Fees ratios indicate better valuations. Note that there can be significant differences when calculating these metrics using market cap versus FDV.

Based on these figures, GNS and GMX appear best valued (also because their FDVs are closer to market caps). Based on market cap calculations, DYDX appears most attractively valued. However, it's important to consider upcoming token unlocks.

It’s also worth noting that both Kwenta and Level incentivize traders through native token emissions. Will they sustain growth if token emissions decrease?

Personally, I am closely watching $DYDX and $GMX, as both are expected to experience catalyst events later this year (e.g., protocol upgrades, new product launches).

In conclusion, I firmly believe significant liquidity will flow into this market. If trading volumes grow 10–20x in the future, many of these tokens could see substantial price appreciation from current levels due to this additional growth.

(The above does not constitute investment advice!)

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News