GMX LEGO Overview: A Roundup of 28 Projects Built on GMX

TechFlow Selected TechFlow Selected

GMX LEGO Overview: A Roundup of 28 Projects Built on GMX

A Guide to the 28 Projects on GMX, Including Vaults, Lending, Social Trading, Options, and More

Author: TokenInsight

Translation: Odaily

Composability is a core feature of DeFi, enabling developers to rapidly create new projects by integrating existing protocols. One such protocol is GMX, which had an outstanding 2022. Its liquidity provider token, GLP, consistently delivered over 20% returns denominated in $ETH, fueling the popular “real yield” narrative.

As a result, developers began building atop GMX, and today there are 28 such projects. This article introduces all of them and analyzes key players. They fall into five categories: vaults, lending, social trading, options, and others.

Vaults

Vaults form the largest category with 13 projects, ranging from basic auto-compounding pools to sophisticated structured finance products designed to enhance GLP returns.

-

Auto-Compounding

Einstein reportedly called compound interest the eighth wonder of the world. If, like me, you often forget to reinvest your GLP earnings back into the GLP pool, then you’ve missed out on some free money.

Without compounding, $100 invested at the beginning of the year would grow to just $120 by year-end, assuming a 20% return. But if you reinvested earnings twice daily, that same $100 would grow to $122.14. And when factoring in multiplier points—a unique GLP feature that rewards long-term holders—returns can be even higher.

Numerous products now offer automatic compounding for GLP holders, ensuring they don’t miss out on potential gains.

Abracadabra

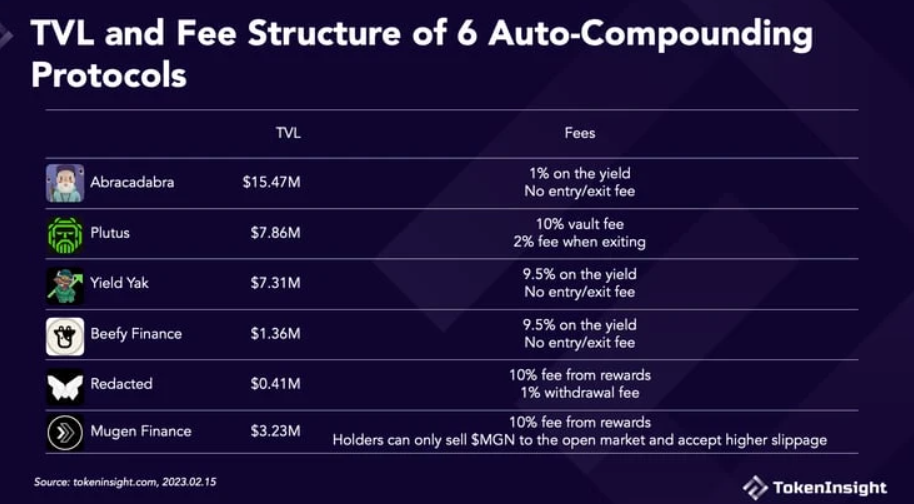

Abracadabra hosts the largest GLP auto-compounding pool, with $15.47 million in TVL. Users deposit GLP to receive magicGLP, which automatically reinvests earned yields into the GLP pool twice daily to maximize returns. Like other vault tokens, the value of magicGLP increases over time, leading to a rising redemption rate of magicGLP for GLP.

Abracadabra charges a 1% fee on generated yield and imposes no entry or exit fees—the lowest cost among auto-compounding vaults.

Plutus

Plutus is the second-largest auto-compounding pool with $7.86 million in TVL. Users deposit GLP to receive plvGLP, which compounds automatically every 8 hours. The platform charges a 2% withdrawal fee and a 10% vault fee.

In exchange, plvGLP holders earn 15% in $PLS liquidity mining rewards—amounting to 2.25 million $PLS distributed to plvGLP holders over two years. Rewards are weighted more heavily in early months. $PLS can be locked to earn a share of protocol revenues and gain control over veTokens within Plutus. Beyond plvGLP, Plutus also offers governance aggregation and liquidity-related products.

Yield Yak

Yield Yak is a GLP farm on Avalanche with $7.31 million in TVL. Similar to Abracadabra and Plutus, Yield Yak automatically reinvests $AVAX rewards into GLP and acquires esGMX to boost returns. It charges a 9.5% management fee on yield and has no entry or exit fees.

Beefy Finance

Beefy Finance has $1.36 million in TVL. Its vault compounds at least once per day and triggers additional compounding upon any deposit, resulting in 10–20 compounding events daily. It also charges a 9.5% management fee on yield, with no entry or exit fees—identical to Yield Yak.

Redacted

Redacted adds diversity to vault offerings. Its Pirex product provides liquidity for staked GMX and GLP on top of auto-compounding. It offers two modes: Simple Mode and Standard Mode.

Simple Mode functions similarly to other auto-compounding vaults. Notably, it also offers a GMX vault. Users deposit GMX or GLP to receive apxGMX or apxGLP. Simple Mode charges a 1% withdrawal fee paid to vault token holders, plus a 10% platform fee and a 0.3% welfare reward fee on yield.

Standard Mode provides liquidity for staked GMX and GLP. Users deposit GMX or GLP to receive pxGMX or pxGLP. These deposits remain staked on GMX as usual.

The difference is that pxGMX and pxGLP are transferable. For example, pxGMX has liquidity pools on Camelot on Arbitrum and Trader Joe on Avalanche.

When staking directly through GMX, earned esGMX is non-transferable. But via Pirex, esGMX is tokenized as pxGMX and becomes tradable. Additionally, accrued multiplier points are never lost—even when users sell pxGMX on the open market—because the underlying GMX remains staked. Thus, users avoid penalties related to losing multiplier points or selling staked GMX.

Standard Mode charges a 1% swap fee and 10% of yield as fees.

Pirex’s GMX Vault is an interesting innovation, while its GLP Vault is similar to others but with higher fees. As a result, the GMX Vault has $404,555 in TVL, compared to only $38,557 in the GLP Vault.

Mugen Finance

Mugen Finance’s GLP vault has $3.23 million in TVL. It claims to be a multi-chain aggregator using sustainable protocol revenue to generate yield. However, Mugen currently supports only one chain and one protocol: GMX.

Mugen’s mechanism differs from typical GLP vaults. $MGN is the protocol token. Users deposit $USDC into the Mugen vault to mint $MGN, which the protocol uses to purchase GLP. Users stake $MGN to earn yields generated by GLP.

What’s the difference between buying $MGN versus buying GLP directly? Buying $MGN is worse by a factor of three.

When you buy via $MGN, the Mugen team deducts 10% from your GLP returns.

While you can burn GLP to redeem assets from the GLP pool, you cannot withdraw assets from the Mugen vault. You can only sell $MGN on the open market. Currently, $MGN trades at $81, while its underlying vault value is $126—meaning early investors face a 35% loss if they exit.

Mugen also includes a special design to “prevent users from depositing and withdrawing around reward distributions.” This delays GLP reward payouts over 30 days. For instance, if Mugen earns 100 $ETH from GLP yields today, each staker receives 1/30th of their share daily over the next 30 days. If you exit early, you forfeit remaining rewards.

So why would anyone buy $MGN? Later entrants benefit from early investors’ losses. Since early users must sell $MGN on the open market, the price stays below intrinsic value. Buying $MGN today lets you acquire $126 worth of GLP exposure for just $81.

Additionally, only 84% of MGN is staked. This means stakers earn higher yields because 16% of MGN holders effectively forfeit their GLP income (though note that GLP itself is auto-staked).

Using any auto-compounding vault carries additional smart contract risk. When users expected automated yield distribution, Mugen previously paused payouts without explanation.

Finally, the project relies on a community-developed frontend for user interaction. While it has an official website, functionality is extremely limited.

The table below summarizes the key details of the six auto-compounding vaults discussed above.

-

Advanced Strategies

Beyond basic auto-compounding, several projects have developed more complex GLP strategies.

The most common is Delta Neutral strategy. Since GLP consists of 50% stablecoins and 50% $BTC+$ETH, GLP holders effectively hold a 0.5x leveraged long position in crypto, exposing them to price volatility in BTC and ETH (plus minor exposure to smaller assets in the GLP basket like $UNI and $LINK). This works well in bull markets—but poses risks in bear markets. Hence, Delta Neutral vaults have emerged to hedge these exposures.

Rage Trade

Rage Trade’s Delta Neutral vault is the most popular, known as the Risk On Vault. Rage Trade invests users’ deposited $USDC into the GLP pool while simultaneously opening short positions in $ETH and $BTC via flash loans. Our previous article explains Rage Trade’s mechanism in greater detail. The end result is that your long exposure from holding GLP is automatically hedged.

Rage Trade also features a Risk Off Vault to complement the Risk On Vault. The Risk Off Vault lends USDC to the Risk On Vault to fund short positions. In return, Risk Off Vault earns Aave lending rates and a portion of the GLP rewards generated by the Risk On Vault.

Risk On Vault has $7,330,180 in TVL; Risk Off Vault has $3,799,645. Combined, they total $11.13 million in TVL.

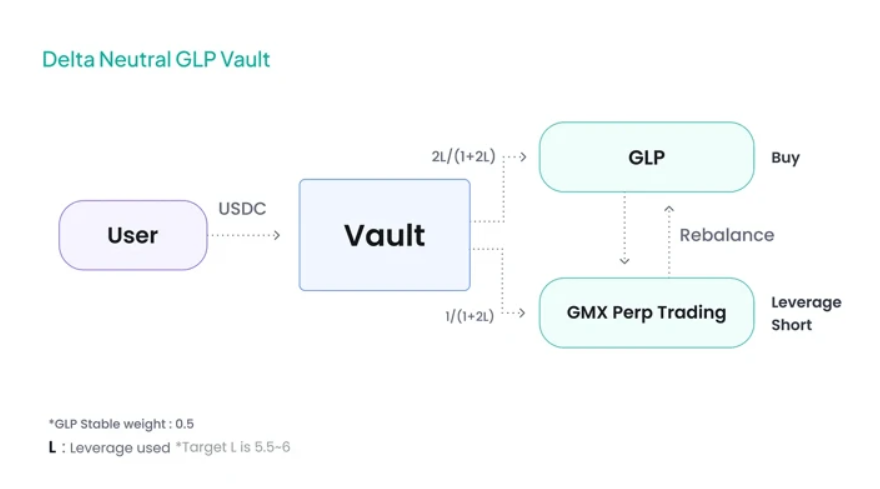

Neutra Finance

Neutra Finance achieves Delta Neutrality through another method—opening leveraged short positions on GMX to offset GLP’s long exposure. It maintains Delta Neutrality via a unique rebalancing mechanism. Its current TVL is $1.16 million.

Source: Neutra Finance

Umami

Similar to Neutra, Umami’s Delta neutral strategy involves hedging trades on GMX. It also implements an internal netting strategy that reallocates Delta across Umami vaults to minimize hedging costs. Hedging amounts are algorithmically rebalanced periodically.

Umami was scheduled to launch Beta in March. However, its CEO recently exited, dumping all his tokens. Although the remaining team decided to continue development as a DAO, this unfortunate incident may delay the product.

Source: Umami

Vovo Finance

Vovo Finance presents another intriguing Delta Neutral solution. Instead of automatic hedging, Vovo allows users to manually hedge.

Each week, the vault collects yield from staked GLP and uses it to open 10x leveraged positions on GMX. Users choose their preferred asset and direction—ETH up, ETH down, BTC up, or BTC down. After one week, the vault automatically closes the leveraged position and reinvests profits to buy and stake more GLP.

Vovo’s four vaults combined have $66,013 in TVL.

GMD

GMD offers a variant of the Delta Neutral strategy. Rather than directly hedging price movements of GLP’s underlying assets, GMD creates three separate vaults allowing users to be exposed to only one asset instead of all assets in the GLP basket. For example, while holding GLP means exposure to both BTC and ETH, GMD allows users’ GLP-like exposure to include only BTC, ETH, or USDC. It also uses protocol revenue to protect users from traders’ PnL. However, as discussed in my earlier article, GMX traders generally lose money in most scenarios.

GMD’s GLP TVL stands at $4.27 million.

Olive

Olive brings more financial alchemy to the competition. It offers principal-protected vaults that combine composability and structured products to boost yields without risking users’ principal. Olive uses various complex strategies to trade the weekly yield earned from deposited GLP. It operates on a weekly cycle, charging a 2% management fee and a 10% performance fee if the period generates positive returns.

Its current TVL is $299,000.

Jones DAO

The final major player in the GMX vault race is Jones DAO, with $10.75 million in TVL.

It is a leveraged auto-compounding pool consisting of two vaults: a GLP vault and a USDC vault. Our prior article discusses its mechanism in depth. In short, the Jones DAO GLP vault purchases GLP and mints jGLP, then borrows $USDC from the USDC vault to buy more GLP. Leverage is dynamically adjusted based on market trends.

Depositors in the USDC vault earn interest and a share of GLP rewards as lenders.

jGLP can be used to provide liquidity on the Jones DAO platform and across the Arbitrum ecosystem. For example, users can supply liquidity in the jGLP-USDC pool on Camelot.

-

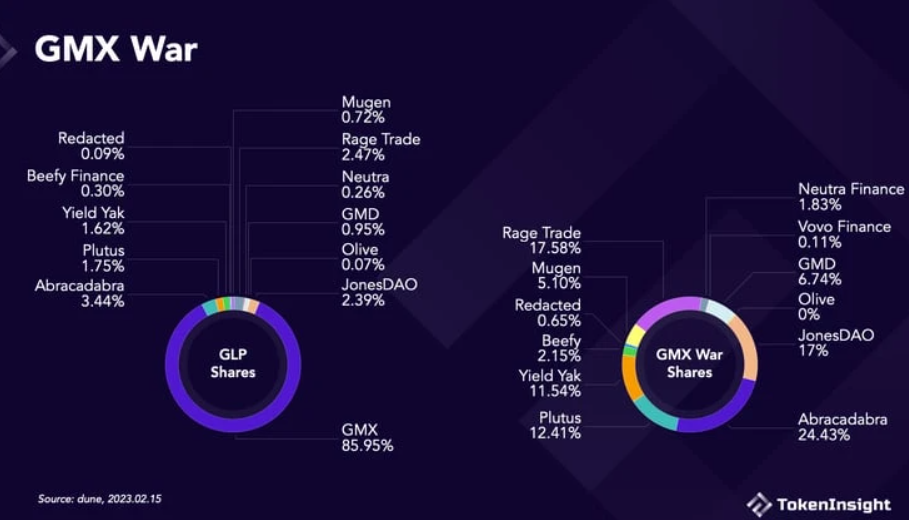

GMX War

The GMX War has begun, with vault builders competing fiercely for a larger share of GLP. While basic auto-compounding is already attractive, further innovation could push GLP yields even higher.

I am highly optimistic about vault products. GLP AUM currently stands at $443 million, yet all vaults combined represent only a small fraction (15%) of total GLP. Most GLP remains idle in holders’ wallets, waiting to be captured by vault providers.

Moreover, GLP as a yield-generating product holds immense potential. Anchor, the Ponzi scheme on Terra promising 20% returns, successfully amassed over $17 billion in AUM. GLP has consistently outperformed that benchmark, with returns derived from real trading fees. There’s a vast gap between $443 million and $17 billion, and better vault products will attract more users to mint GLP.

One caveat: we are at or near the bottom of a crypto cycle. While Delta Neutral strategies were beneficial over the past year as prices corrected from all-time highs, they become counterproductive during bull runs—hedging away all upside gains from rising prices.

Lending

Outside vaults, lending is the second-largest ecosystem on GMX, enabling users to borrow against their GLP holdings to leverage yield farming. The Jones DAO vault is also a yield product with built-in lending.

Key players in this space include Vesta, Sentiment, Rodeo, and Tender.fi, along with Delta Prime, Yeti, and Moremoney on Avalanche.

All allow users to borrow using GLP as collateral. Sentiment also accepts GMX as collateral, while Rodeo operates its own GLP auto-compounding vault.

Options

GMX’s perpetual trading integrates well with options exchanges.

Lyra

Lyra is a DEX for options trading. The protocol aims to keep liquidity providers close to Delta Neutral by opening long or short positions on GMX or Synthetix.

Dopex

Dopex is another options DEX that integrates with GMX in two ways.

Their Atlantic Perp Protection shields GMX traders from liquidation risk. Upon purchasing an option, if a trade approaches liquidation, the stablecoin collateral from the Dopex option is automatically transferred from the Dopex contract to the trader’s GMX margin account.

Dopex also helps users hedge against GLP price fluctuations. If GLP price falls below the option strike price, users receive settlement payouts. If GLP price rises, users retain their GLP holdings and benefit from appreciation.

Social Trading

With the launches of STFX and Perpy, social trading has recently gained momentum. It enables users to copy trades from high-performing traders.

STFX

STFX stands for Single Trade Finance Exchange. It offers short-term, non-custodial, actively managed vaults dedicated to single trades. STFX traders use GMX to execute their trades. The platform charges a fixed 20% performance fee.

Perpy Finance

Perpy Finance is conceptually similar to STFX but differs in structure. According to Perpy, key differences include continuous vaults, variable fees, no fundraising periods, and enhanced privacy.

Source: Perpy Finance

Puppet Finance (GMX Blueberry Club)

Puppet Finance is the upcoming copy-trading feature from GMX Blueberry Club. Users deposit funds into different pools based on intent—e.g., ETH into an ETH long pool or USDC into an ETH short pool. Puppet tracks each registered trader’s performance, allowing users to mirror their trades. The product is still under development, with more details expected upon launch of GMX synthetics.

Others

DappsOS

DappOS is an operating protocol designed to lower barriers to interacting with crypto infrastructure. On GMX, DappOS allows users to access GMX directly via BSC wallets. It’s a cool feature that could bring more users to GMX.

Demex

Demex bridges GLP to Cosmos via smart contracts and offers auto-compounding services, enabling Cosmos users to access GMX and earn GLP yields.

MUX

MUX, rebranded from MCDEX, is an independent perp DEX and trading aggregator. Its perp DEX mirrors GMX. If fees are lower, MUX traders can open positions directly on GMX.

Final Thoughts

The synergies within the GMX ecosystem benefit all its projects. For example, vault products can integrate with lending protocols, enabling degens to leverage their GLP farms. Social trading platforms can drive GMX trading volume, increasing fees and boosting GLP returns.

Additionally, an Arbitrum airdrop could happen at any moment. I expect most recipients to reinvest their airdrop gains into Arbitrum-based projects. The GMX ecosystem is currently one of the most vibrant on Arbitrum. One or more of the projects listed above will likely benefit significantly from the Arbitrum airdrop.

Furthermore, despite regulatory risks, I believe the “real yield” narrative will sweep through DeFi. Established leaders like Uniswap may be displaced by revenue-sharing protocols. As Bezos famously said, “Your margin is my opportunity.” Uniswap would struggle to compete with a peer protocol that shares revenue with users, especially if user experience is comparable. As a leader in the “real yield” movement, GMX will attract even more attention—and its ecosystem projects will thrive alongside it.

Therefore, all projects mentioned in this article warrant continued attention—they may include the next 100x plays during the upcoming bull run.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News