GMX lost more than just money—its status was stolen too

TechFlow Selected TechFlow Selected

GMX lost more than just money—its status was stolen too

Power has no eternity.

By TechFlow

On July 9, veteran on-chain perpetual exchange GMX suffered a major blow.

A hacker exploited a reentrancy vulnerability in GMX's V1 smart contract, stealing approximately $42 million worth of crypto assets—including USDC, FRAX, WBTC, and WETH—from its GLP liquidity pool.

On-chain data shows about $9.6 million has already been bridged across chains. The GMX team has issued an ultimatum to the attacker: return 90% of the funds within 48 hours and receive a 10% "white hat bounty" with no further legal action taken.

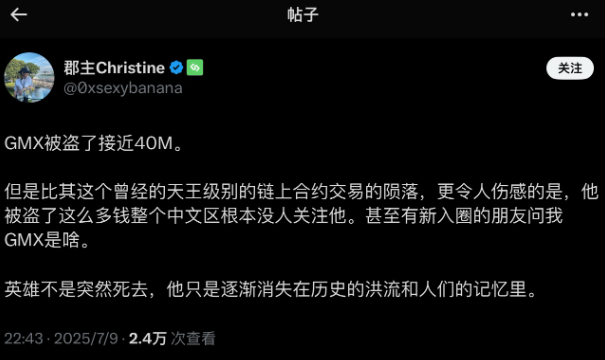

Yet, despite the significant sum involved, the incident hasn’t sparked widespread discussion.

One particularly blunt comment summed it up:

"Who even keeps money in GMX anymore?"

While everyone is buzzing about Bitcoin hitting new highs, Pumpfun’s upcoming token launch, or ETH regaining strength… the market may have already moved on from GMX.

The former “perpetual DEX king” has been sidelined.

In the short-memory, attention-starved world of crypto, being ignored is the harshest punishment. This hack didn’t just steal $42 million—it also took with it GMX’s once-glorious reputation.

Remembering the Glory Days

P newcomers entering this cycle might not even recognize the name GMX.

But looking back at its peak, this decentralized perpetual futures exchange (Perp DEX) was once a shining star in on-chain trading—so much so that calling it “the Hyperliquid of the last cycle” wouldn’t be far off.

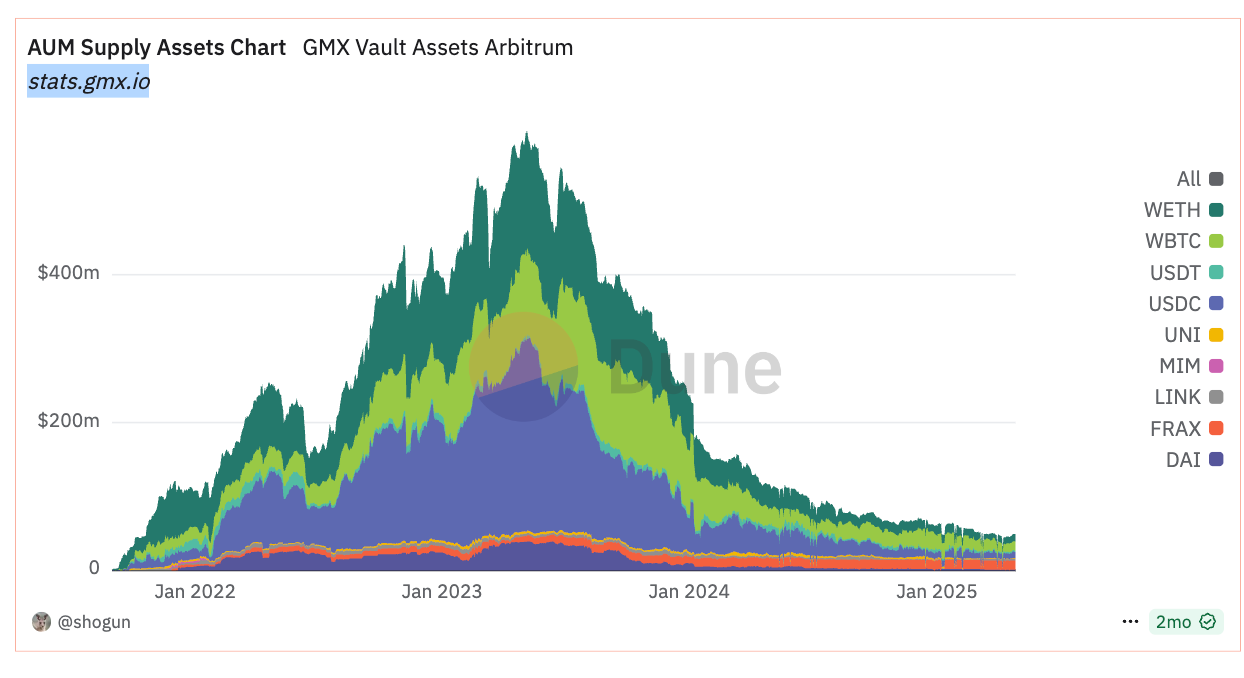

In September 2021, GMX launched on Arbitrum and quickly rose to prominence thanks to its innovative multi-asset GLP liquidity pool. The GLP pool aggregated various assets like USDC, DAI, WBTC, and WETH, supporting up to 100x leverage, attracting massive user interest and capital inflows.

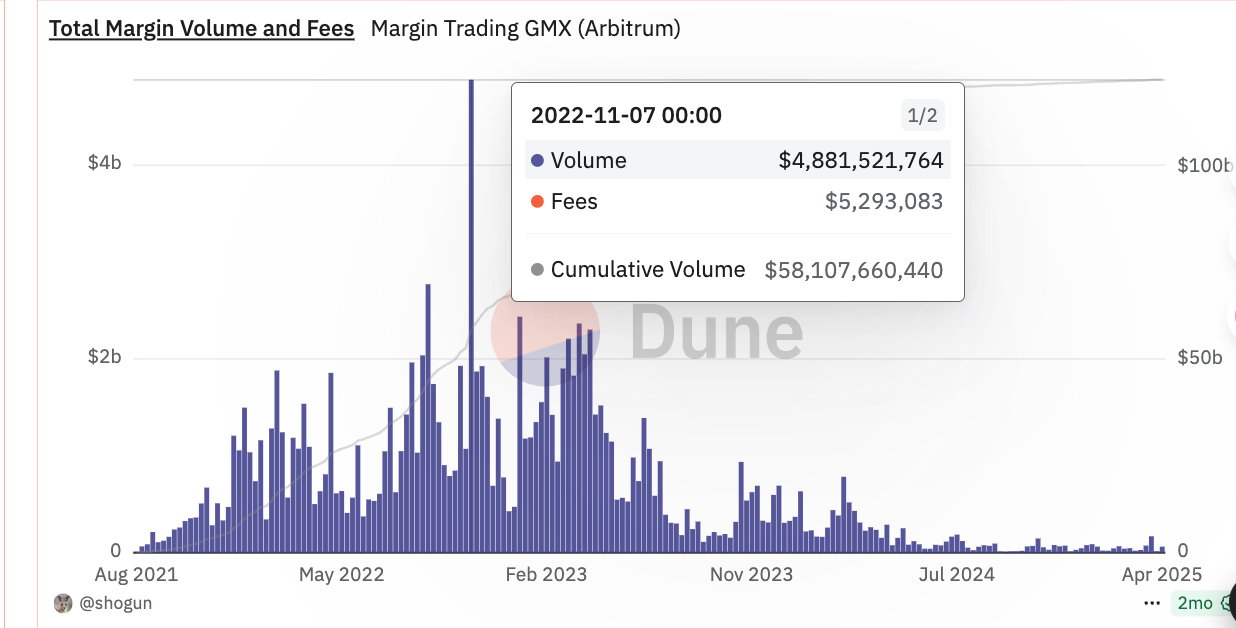

From 2022 to 2023, GMX accumulated trading volume surged to $277 billion, with daily average volume reaching $923 million. According to DefiLlama data, its TVL peaked at nearly $700 million in May 2023, accounting for roughly 15% of Arbitrum’s total value locked—solidifying its position as the leading on-chain Perp DEX.

At the time, GMX excelled both technically and economically.

Its vAMM mechanism eliminated the complexity of traditional order books, while cross-chain expansion to Avalanche (early 2022) and Solana (March 2025) broadened its reach, amassing over 700,000 users.

Token stakers earned 30% of protocol fees (paid in ETH or AVAX), plus rewards in esGMX and Multiplier Points (MP), with APRs peaking at 100%. In 2022, more than 30% of circulating GMX tokens were staked, effectively mitigating sell pressure.

Back then, on-chain derivatives lacked the broad participation and acceptance seen today with meme coins, mainly appealing to seasoned DeFi users and those distrustful of CEXs. Under these conditions, GMX’s success was no small feat.

So much so that many later DEXs referenced GMX in their whitepapers and marketing materials, positioning themselves as improved alternatives—highlighting better UX or higher yields—much like how tech companies compare themselves to Apple or Tesla during product launches.

New King Hyperliquid, Power Shift

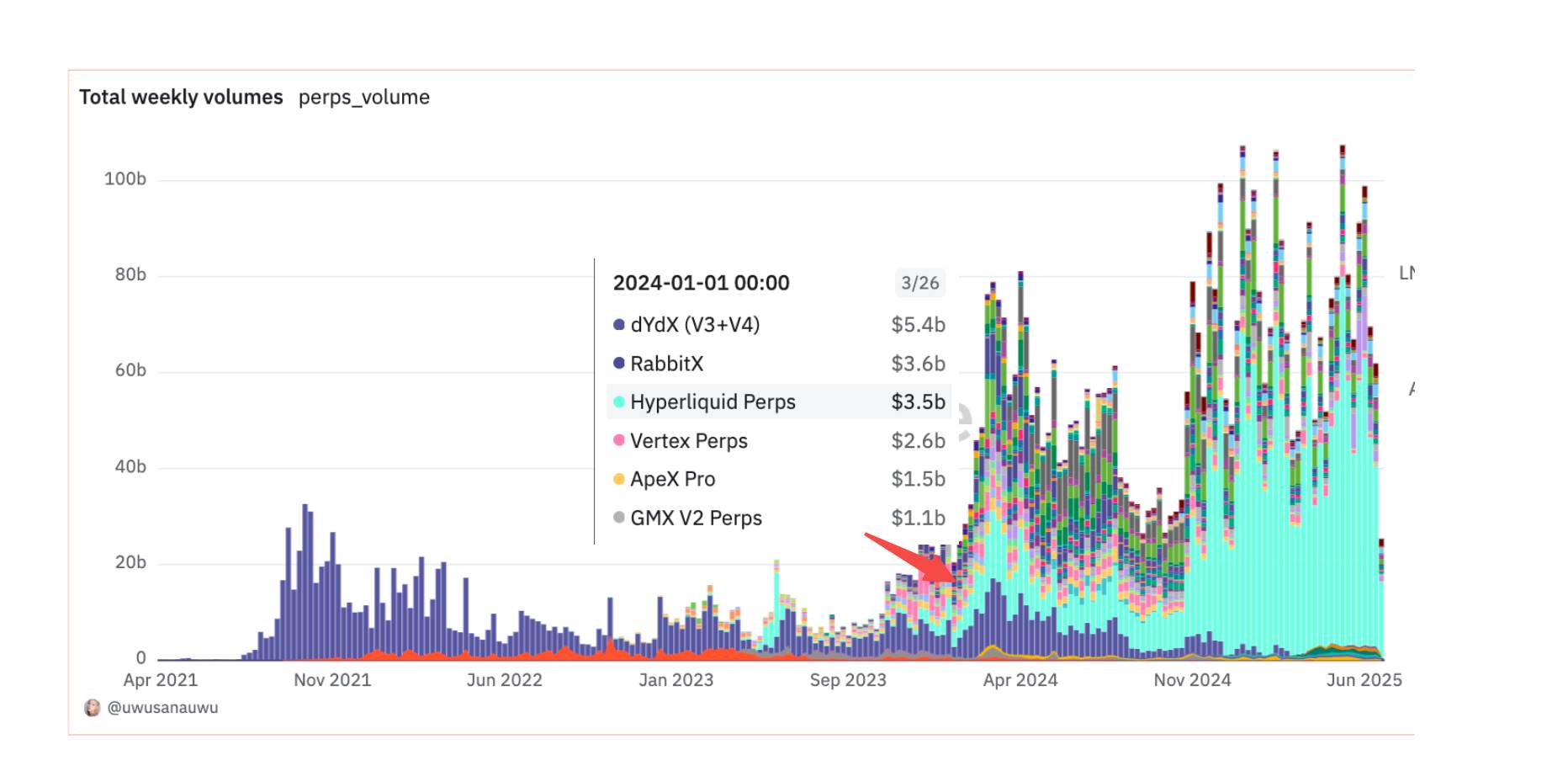

The chart below clearly shows GMX’s AUM on Arbitrum began a sharp decline starting late 2023. By April, it had dropped to around $30–40 million—far from its peak.

This downturn coincides almost exactly with the rise of Hyperliquid.

Hyperliquid represents the new generation. Using an order book model instead of traditional vAMM, it significantly reduces slippage and price manipulation risks. Degens on-chain are extremely sensitive to UX and yield—small improvements lead to gradual but decisive shifts in user behavior.

For example, during the final week of 2023, Hyperliquid quietly achieved $3.5 billion in trading volume across all on-chain DEXs, compared to GMX’s $1.1 billion.

In fact, it’s not just GMX—every similar DEX has felt Hyperliquid’s impact. Data charts confirm this: since late 2024, Hyperliquid has dominated the on-chain Perp DEX market with overwhelming share.

Broadly speaking, the DeFi boom of 2021–2022 fueled GMX’s rapid growth. But during the same period, numerous VCs began investing heavily in on-chain infrastructure, leading to a surge of lower-cost, higher-performance products and fierce competition among on-chain DEXs.

As dozens of chains emerged, each developed its own native DEX—like Jupiter on Solana. While GMX could operate cross-chain, it also meant competing against local champions on multiple fronts, inevitably losing market share.

The crown passes hands. The fall of GMX may have been inevitable—the recent hack merely brought it back into the spotlight.

No Throne Is Eternal

GMX’s decline isn’t unique—it’s another chapter in the fast-paced turnover defining the crypto space.

Where are the once-popular GameFi projects from the last cycle, like StepN? If that example involves some degree of team misconduct, consider the many projects that never even launched a token or made serious mistakes—yet were still left behind by the times.

Take wallet providers from two years ago pushing MPC and omnichain features for better UX. Once OKX Wallet and Binance Alpha tightly integrated with their ecosystem gateways, those competitors vanished overnight.

Uniswap was once the gold standard for DEXs, yet its dominance wavered with the rise of SushiSwap and Curve. Aave and Compound continue iterating, but face growing pressure from newer lending protocols.

In crypto, product experience alone isn’t a durable moat. Speculation drives liquidity—and can tear down any moat in an instant.

When a narrative ignites a sector, projects spring up like feudal lords vying for supremacy. Yet rise and fall come in cycles. Looking back, the only constant is BTC.

No throne lasts forever in crypto. Attention is power—and GMX’s silence may be the best proof of that.

Data sources used in this article:

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News