What Makes Gains Network Outperform GMX in Daily Revenue?

TechFlow Selected TechFlow Selected

What Makes Gains Network Outperform GMX in Daily Revenue?

How Gains Network Achieved a Market Cap Doubling in a Month and Outperformed GMX in Daily Revenue?

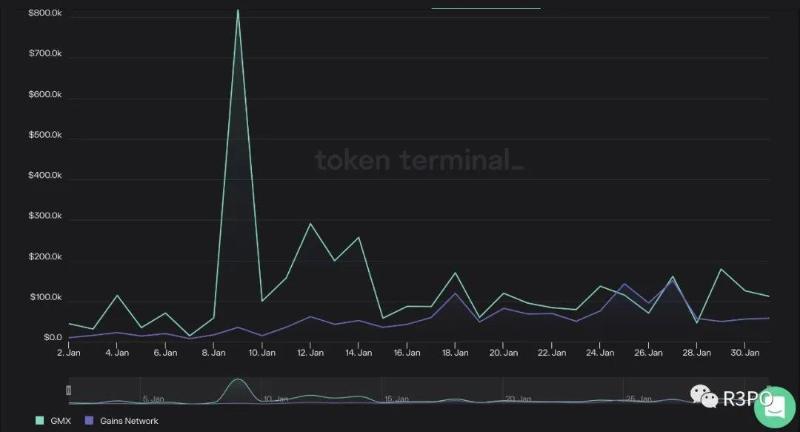

gTrade, launched by Gains.Network, is a Polygon-based decentralized perpetual contracts exchange. After launching on Arbitrum, gTrade achieved over $1.7 billion in monthly trading volume and generated more than $1.2 million in monthly revenue. On January 25, its daily revenue surpassed that of GMX, and it also exceeded GMX in weekly trading volume last week.

Currently, the market cap of $GNS is around $180 million, up over 100% in one month. Recently, the platform’s trading volume, user count, and transaction fees have been steadily increasing, generating consistent income. R3PO believes that GNS is expected to enter a new phase of deflation, and overall, the protocol demonstrates strong growth potential due to its robust product capabilities.

Investment Highlights & Outlook:

1. The product offers an exceptionally smooth user experience, enabling “one-click” trading after a single authorization without requiring repeated approvals.

2. Offers a wide range of trading pairs—nearly 100—including cryptocurrencies (40+), forex (20+), and tokenized stocks (30+). Commodities are also being added recently.

3. Due to diversified trading activity, liquidity providers (LPs) benefit from risk diversification and consistent profitability.

4. Positive outlook for Gains Network capturing market share from GMX within the Arbitrum ecosystem.

Project Overview:

Gains adopts a model somewhat similar to GMX, but instead of providing liquidity into a basket of assets, users deposit into a vault holding only DAI.

Like GLP, this vault acts as the counterparty to traders on the DEX. Users can deposit DAI as collateral to open long or short positions. They can also act as LPs in the vault, earning trading fees while internalizing traders’ profits and losses. Its flagship product is gTrade—a highly efficient and user-friendly decentralized leveraged trading platform allowing leverage of up to 1,000x on stocks, cryptocurrencies, and forex. Beyond the exchange, Gains Network also features NFT collection and staking programs.

Gains has several unique features, including support for stocks and forex in addition to cryptocurrencies. The exchange serves as a "degens' paradise" (where "degens" refers to individuals engaging in high-risk trading), offering leverage ranging from 100x to 1,000x depending on the asset class, the highest among all DEXs.

The entire gTrade platform operates using DAI and Gains Network's native token, GNS. Leverage is synthetically generated, with the product module composed of the DAI Vault, GNS/DAI liquidity, and the GNS token. DAI is drawn from the vault to pay traders’ positive PnL, or received from traders when their PnL is negative. Through a single liquidity pool for all orders and the DAI vault, gTrade supports multiple trading pairs and leveraged products. There are currently 70 trading pairs on the exchange, including cryptocurrencies, forex, and tokenized stocks.

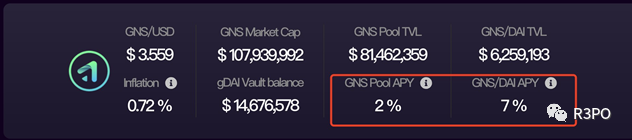

GNS has over 8,000 independent users. On December 26, 2022, it had approximately 300 daily active users and a TVL of $21.94M, with daily new user acquisition now stabilizing between 10–30 users. The market cap of $GNS stands at $103M, having facilitated $22 billion in trading volume and collected $14 million in fees (0.08% of position value), of which 32.5% was redistributed to $GNS stakers/LPs.

Additional Product Features:

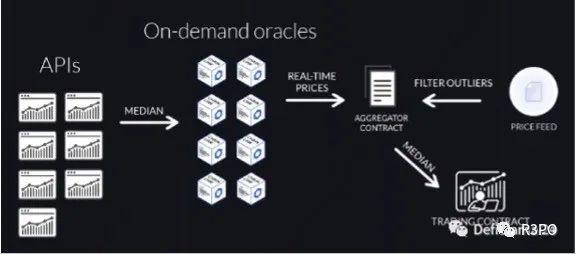

1) Oracle

Chainlink's DON (Decentralized Oracle Network) powers gTrade’s data feeds. gTrade operates a custom real-time Chainlink node operator network to obtain mid-spot prices for each trade order.

2) Trading Fees

gTrade charges 0.08% of leveraged value for opening and closing crypto positions, and 0.008% for forex trades. Price impact (%) = (open interest {long/short} + new position size / 2) / 1% depth {up/down}. Price impact is zero for forex, but applies to crypto and stocks.

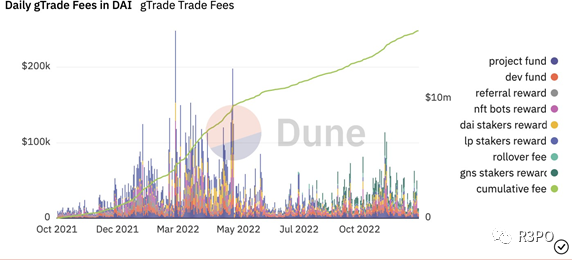

gTrade also charges funding fees based on net exposure and volatility of the trading pair, as well as rollover fees on collateral, to manage risk in the DAI vault. Fees are distributed among the team, project treasury, liquidity providers, GNS stakers, affiliates, the DAI vault, GNS/DAI LPs, and NFT holders who execute limit orders and liquidations in a decentralized manner.

3) Leverage Limits Across Markets

● gTrade currently offers leverage between 4x and 150x for cryptocurrency pairs.

● For stocks, leverage ranges from 3x to 100x.

Revenue Model

gTrade operates two pools: the DAI Pool acts as the "first line of defense," directly serving as the counterparty to traders—essentially functioning as a vault insurance pool. The GNS/DAI pool on Quickswap serves as the "second line of defense." When traders realize large profits, causing the DAI in the insurance pool to fall below the deposited TVL, gTrade gradually sells GNS in the second pool to acquire DAI and replenish the first pool.

Conversely, if traders incur significant losses and the DAI pool exceeds 110% of TVL, indicating that gTrade (as counterparty) has profited, the excess DAI above 110% is used to buy back and burn GNS tokens via the GNS/DAI pool.

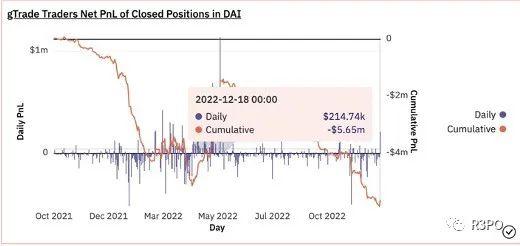

gTrade’s profit model is based on a key assumption: over time, retail traders collectively lose money. With high leverage and the inherent volatility of crypto, this effect is amplified. Based on this theory, gTrade has operated for 14 months through December, achieving a cumulative PnL of -5.65m.

Accompanying this is continuously growing protocol revenue, with total fees generated reaching $15.68m.

Additional Project Details

1) Security

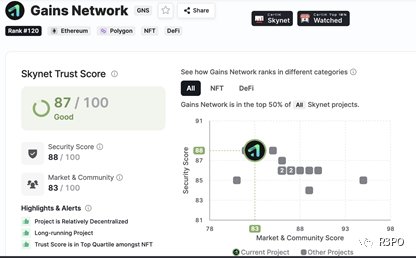

Gains Network has been audited by renowned security firm CERTIK. CERTIK identified seven issues in Gains Network v9, three of which have been resolved and three confirmed.

The most critical issue relates to project centralization. The kynet Trust Score gives an overall trust rating of 87/100, which is a solid result.

2) GNS Token

The Gains Network economy is powered by its native token, GNS. It has a hard cap of 100,000,000 GNS, intended as a fail-safe mechanism that should never be triggered. Initially, 38,500,000 GNS tokens were issued. 25% of the initial supply was burned within a year, leaving a current circulating supply of over 30.2 million, with 75.2% of these staked.

3) GNS Staking

Users can stake $GNS to earn DAI from trading activity on gTrade. 40% of market order fees and 15% of limit order fees are allocated to GNS stakers. Gains Network reports that 70% of its trades are market orders, so on average, 32.5% of all order fees go to $GNS stakers. The current APY for the GNS staking pool is 2%, while the DAI pool offers 7% APY.

4) DAI Vault

The DAI Vault generates returns from traders’ DAI transaction fees and is also used to pay out trader profits. Users can stake DAI based on platform trading volume and earn fees. If the vault becomes undercollateralized, stakers may face losses. However, since its launch in December 2021 and through various market conditions, no DAI staker has exited at a loss.

5) GNS/DAI Liquidity Pool

As decentralized protocols require liquid capital pools, users are incentivized to provide liquidity in the GNS/DAI pool on Quickswap, earning both GNS and dQUICK rewards, while still collecting swap fees from Quickswap.

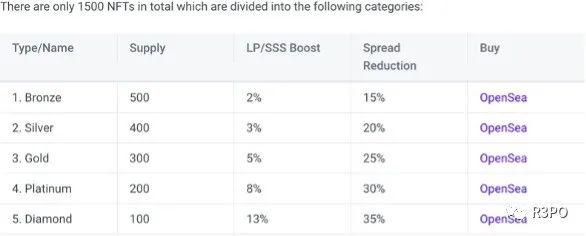

6) GNS NFTs

To gain special benefits, users can purchase the project’s native NFTs. There are five different types of NFTs that unlock exclusive perks, offering enhanced boosts to LP rewards and single-sided staking.

Competitive Landscape

The main difference between $GMX and $GNS lies in their product models: $GMX relies on perpetual and spot trading, while $GNS focuses on synthetic asset trading. Perpetual and spot trading require liquidity pools, hence the existence of $GLP (which also exposes LPs to impermanent loss). However, this limits the number of tradable assets due to capital requirements.

In contrast, $GNS uses synthetic assets that do not require liquidity pools. This allows them to list as many tokens as desired, significantly improving capital efficiency. Synthetic assets, along with forex and stock trading, offer traders new opportunities without needing tokenization, liquidity pools, or third-party interactions. The limitation of synthetics is reliance on external data providers, as prices are not determined by on-platform supply and demand.

GNS has over 8,000 unique users, with approximately 300 daily active users, and daily new user growth has stabilized at 10–30 users. The market cap of $GNS is $107M. Besides GMX, $GNS faces competition from other players, with GMX being the most direct competitor—though GMX is constrained by its development team’s limited innovation drive.

Risk Factors

Only one core developer on the team.

Uses a custom DON oracle with limited proven foundation.

Betting against traders—the profitability heavily depends on traders’ skill levels.

Only supports DAI as the sole trading token—while this mitigates regulatory risks, it also introduces limitations.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News