Why is predicting crypto bull and bear markets considered "futile"?

TechFlow Selected TechFlow Selected

Why is predicting crypto bull and bear markets considered "futile"?

Fearless of bull or bear markets, developers' advancements in technological innovation and other areas are the driving force propelling the industry forward.

We often come across terms like "bull market" and "bear market" on social media when describing the development of the crypto market. What do these animal metaphors actually mean?

Simply put, the term "bull market" originates from the upward thrusting motion of a bull's horns during an attack. In a crypto bull market, prices surge, optimism soars, and price charts point sharply upward. The term "bear market" comes from the way a bear swipes downward with its paws when attacking. Another theory traces it to the old proverb "don't sell the bear's skin before you've caught the bear," where "selling bear skins" became a metaphor for speculative stocks (short selling). In short, a bull market indicates favorable market conditions, while a bear market is just the opposite.

The previous shift from bull to bear in the crypto market began with the DeFi summer of 2020. The DeFi sector broke through the conceptual idealism of decentralized applications, becoming the first practical use case in the crypto space. Capital flooded into crypto, particularly into DeFi, leading to global expansion of crypto assets. Unfortunately, however, numerous damaging scams also flourished under the cover of the bull market boom.

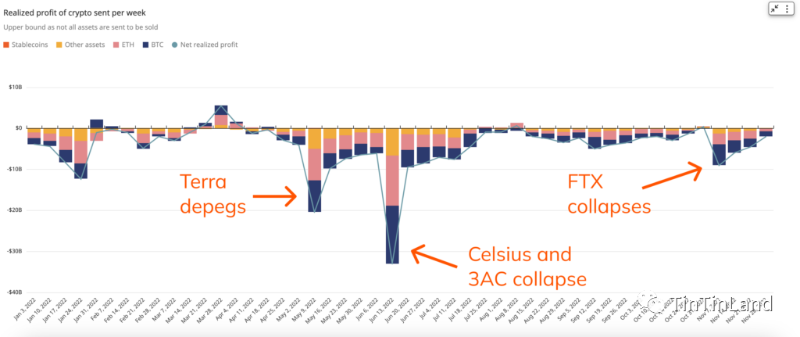

Source: chainalysist

In 2022, as these fraudulent activities were exposed and global monetary policy tightened, the crypto market plunged into a bear market comparable to that of 2018. Now in 2023, the overall direction of the crypto market remains a major concern for countless Web3 enthusiasts.

Articles predicting bull and bear trends in crypto continue to emerge. Can the crypto market turn from bear to bull this year? The following analysis will explore market shifts based on industry development cycles, explain why predicting bull or bear trends is ultimately "futile," and attempt to summarize the major trends shaping the crypto space this year.

Will 2023 See a Shift from Bear to Bull in Crypto?

Shifts between crypto bull and bear cycles are not entirely unpredictable. First, let’s understand the typical signs of each phase.

During a crypto bear market cycle, you may observe one or more of the following:

-

Prolonged decline in digital asset prices

-

Increased hyperbolic media coverage about "crypto collapse" or "crypto apocalypse"

-

Low investor confidence

-

Newcomers fleeing the market

During a crypto bull market cycle, you may observe one or more of the following:

-

Steady growth in demand for digital assets

-

Increased media coverage highlighting market gains

-

High investor confidence

-

Large influx of new developers and investors entering the market

Next, we'll analyze whether a shift from bear to bull is likely this year by examining industry performance during different market phases, focusing on two key aspects: crypto investment and developer activity.

Crypto Investment

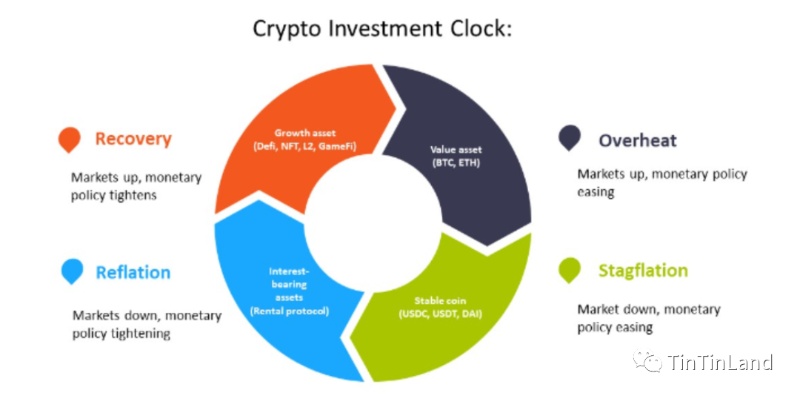

From an economic perspective, the transition between crypto bull and bear markets resembles the "Merrill Lynch Investment Clock" cycle theory: underinvestment creates conditions for a bull market, excessive speculation during the bull market creates bubbles, bubble bursts trigger crashes, and prolonged bear markets lead back to underinvestment. In other words, if there is little investment in one period, the next cycle is more likely to generate a wealth effect and thus a bull market.

According to data compiled by Messari, in 2022 there were 1,769 publicly announced Web3 VC investment projects—30% higher than in 2021—with total funding reaching $37.7 billion, up 19% year-on-year. Clearly, due to overly optimistic market expectations, crypto VC investments remained high even during the 2022 bear market, resulting in relatively lower returns. As such, the wealth effect typically associated with bull markets is unlikely to materialize.

Web3 Developers

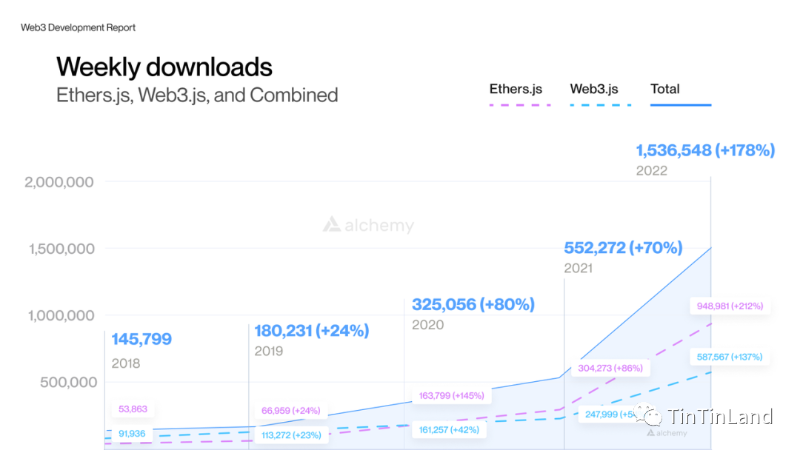

Despite the downturn in the crypto market in 2022, Web3 developers did not stop building. According to Alchemy’s “Web3 Developer Report,” developer activity in the crypto space remained strong throughout 2022. For example, installations of Ethereum-standard JavaScript libraries Ethers.js and Web3.js grew tenfold, the number of new developers hit a record high, and monthly active developers increased by 5% year-on-year—clear signs of a thriving influx of new talent building Web3. (For detailed report analysis, see “Interpreting the Latest Web3 Developer Report | Predicting the Best Time for Developers to Enter the Web3 ‘Bull Market’”)

Taken together, these analyses suggest that crypto asset prices are unlikely to surpass the highs of the previous bull run this year, and investment returns in crypto will likely continue to decline. Even though developers remain committed and cautious optimism is emerging, a minor bull rally might occur due to various factors. However, the prolonged bear market in crypto will persist, with continued incidents of project failures impacting industry development.

What Does a Prolonged Bear Market Mean for Industry Development?

Based on the above analysis and outlook on the state of the Web3 industry, the bear market winter will continue to affect developer and investor confidence this year. Is Web3 just a passing fad, or the future of the next-generation internet? This year’s major Web3 development trends may offer some clues.

The negative impact of the FTX collapse will continue into this year

As FTX’s bankruptcy and legal proceedings unfold, liquidity issues and insolvencies may continue to surface in both CeFi and DeFi projects. The trust violations involved in the FTX incident have severely impacted financial market regulation, significantly reduced yields on DeFi products, and undermined investor activity and user confidence.

Moreover, similar malicious fraud cases are expected to increase this year, accelerating the bursting of the crypto bubble. However, the International Monetary Fund has noted that due to declining global populations and rising labor and operational costs, DeFi offers lower capital costs, lower entry barriers, greater accessibility, and open information flows—making its long-term prospects still promising.

Despite severe setbacks in the crypto industry, the outlook for 2023 remains optimistic

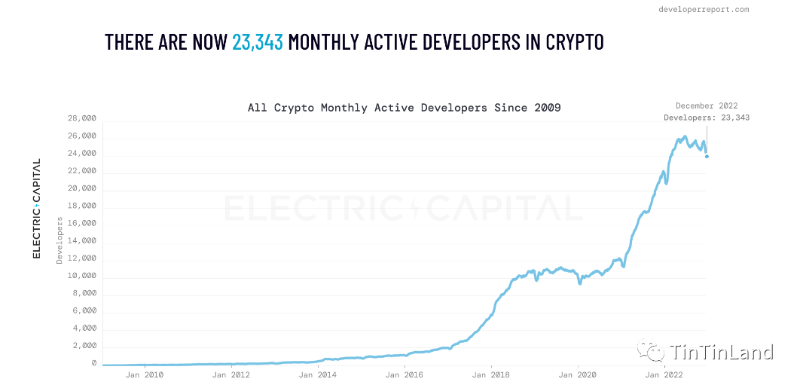

Web3 is an industry built by builders, and currently, a large number of developers are entering and building within Web3. According to Electric Capital’s latest “2022 Web3 Developer Report,” as of December 2022, 23,343 developers were actively contributing to the crypto space each month, with over 61,000 first-time code contributors—a record high—and monthly active developers growing 5% year-on-year.

Notably, 72% of active developers are working on crypto projects outside the Bitcoin and Ethereum ecosystems. Emerging ecosystems like Solana, NEAR, and Polygon saw their active developer bases grow by 40% year-on-year, while rising projects such as Sui, Aptos, Starknet, Mina, Osmosis, Hedera, Optimism, and Arbitrum showed even stronger growth, exceeding 50% year-on-year. This indicates that although Bitcoin and Ethereum remain dominant, contributions to emerging projects are significant, and the crypto ecosystem is still rapidly expanding.

While most industry speculators have already left, these visionary builders continue their long-term efforts. Developers are constructing better infrastructure and more valuable applications, which will attract more people to participate in Web3. Therefore, 2023 will be a year of grounded development for Web3 projects—a year when the crypto space transitions from speculative investment to actual project building.

Crypto development will deepen integration with traditional industries

Traditional brands such as Nike, Gucci, and Dior are increasingly embracing Web3, leveraging the metaverse and other tools for marketing to enhance brand value and visibility. At the same time, Web3 projects are adopting core strengths from traditional industries—for example, DeFi protocols integrating with traditional financial systems, NFTs linked to sports events, and Web3 games adopting the gameplay mechanics of traditional games through Play-to-Own (PTO) models.

One emerging narrative today is that "the line between decentralized solutions and the real world is becoming increasingly blurred," a trend some refer to as "Web2.5." Overall, as Web3 continues to innovate through deeper integration with traditional sectors, more Web3 projects will enter mainstream public awareness.

The cyclical shifts between bull and bear markets in the crypto industry represent both a shakeout and a new opportunity. These narratives are not new to Web3 users, and the turbulence of the bear market will likely continue to influence industry developments in 2023. But the influx of new user groups signals that after decades of evolution, the crypto industry is beginning to transform our lives. Behind these fundamental changes lies another wave of technological advancement.

Why Is Predicting Crypto Bull and Bear Markets Futile?

Based on our assessment of industry development, it's clear that the crypto market is indeed going through a volatile bear market phase this year. While understanding broader market trends can guide development and investment decisions—helping projects plan ahead and mitigate risks—the question remains: why is it futile to predict exactly when a bull or bear market begins or ends?

In the crypto space, speculators seek only short-term profits and show no interest in participating in or building the Web3 community. Such speculators flood in during bull markets. During bear markets, speculative opportunities quickly diminish, and after the market washes out the weak, those who remain may truly be the ones building the future of crypto. Regardless of market cycles, those genuinely committed to making an impact in Web3 will not retreat—long-term accumulation and gradual progress are the keys to sustainable success.

Therefore, predicting bull and bear markets is futile for developers. Progress in technological innovation and project development by developers is the backbone driving the market and the industry forward. Although the early stages of the crypto industry are marked by frequent bull and bear swings, developers who remain idle during the bear market winter—blaming poor market conditions—will miss crucial opportunities.

"The road ahead is long and arduous; I will search high and low." And diligently exploring the development trends of Web3 is precisely the mission behind TinTinLand’s “2023 Crypto Industry Trends Forecast” series. Our next article will focus on the future of zero-knowledge proofs in Web3—stay tuned! We also welcome community members to leave comments and share your thoughts or insights on any crypto topics you’d like us to cover.

Data Sources

https://blog.chainalysis.com/reports/ftx-investor-impact-less-than-previous-crises/

https://bitpay.com/blog/bull-and-bear-markets/#origins-of-names

https://www.developerreport.com/developer-report

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News