The crypto industry is undergoing its toughest shakeout, and the only opportunity might lie in vertical niche strategies.

TechFlow Selected TechFlow Selected

The crypto industry is undergoing its toughest shakeout, and the only opportunity might lie in vertical niche strategies.

The essence of blockchain is a financial conduit; as long as a product can leverage these conduits to facilitate economic transactions within disordered niche markets, value will be generated.

Author: Joel John

Translation: AididiaoJP, Foresight News

The crypto industry is gradually shifting away from grand narratives and focusing instead on the sustainability of economic models. The reason is simple: as institutional capital begins to enter the space, economic fundamentals will become paramount, and crypto entrepreneurs must reposition themselves accordingly.

Crypto has moved past infancy and is entering a new phase where revenue foundations determine project success.

Humans are shaped by emotions, built upon them—nostalgia in particular. This longing for the familiar makes us resistant to technological change. Call it "cognitive inertia": an inability to escape old ways of thinking. When the underlying logic of an industry shifts, early adopters often cling to outdated methods. When electric lights emerged, some lamented that oil lamps were better; in 1976, Bill Gates had to publish an open letter defending paid software against disgruntled hackers.

Today, the crypto space is experiencing its own moment of cognitive inertia.

In my spare time, I've constantly reflected on how the industry will evolve. The vision once dreamed of during "DeFi Summer" is now materializing—Robinhood has issued stocks on blockchain.

As the industry crosses the chasm, how should founders and capital allocators respond? How will core crypto narratives shift when internet edge users begin adopting these tools? This article attempts to explain how extracting monetary premiums through transforming economic activity into compelling narratives can drive value.

Let’s dive in.

Traditional Crypto Playbooks Are No Longer Working

Risk investment traces back to the 19th-century whaling era. Capitalists funded ships, crews, and equipment, with successful voyages often returning tenfold profits. But most expeditions failed—due to storms, shipwrecks, or mutinies. Still, one win could cover all losses.

Modern venture capital operates similarly. A single breakout success in a portfolio can justify numerous failures.

The common thread linking whaling and the late-2000s app boom is market scale. If the market is large enough, whaling works; if user density enables network effects, app development thrives. In both cases, the concentration of potential users creates a market size sufficient to support high returns.

Contrast this with today’s L2 ecosystems—they’re fragmenting an already small and increasingly stagnant market. Without volatility or new wealth effects (like meme assets on Solana), users lack incentives to switch chains. It's like sailing from North America to hunt whales in Australia. Lackluster economic output is directly reflected in token prices.

This phenomenon can be understood through “protocol socialism”: protocols subsidize open-source applications via grants, even when they have no users or economic output. These grants are often based on social proximity or technical alignment, evolving into popularity contests funded by token hype rather than efficient markets.

During 2021’s liquidity surge, it didn’t matter whether tokens generated fees, whether users were bots, or even if apps existed at all. Investors bet on the probabilistic assumption that the protocol would attract massive adoption—akin to buying shares before Android or Linux took off.

The problem is that in the history of open-source innovation, binding capital incentives to forkable code rarely succeeds. Companies like Amazon, IBM, Lenovo, Google, and Microsoft directly incentivize developer contributions to open-source projects—not through token speculation, but because they build profitable products atop them.

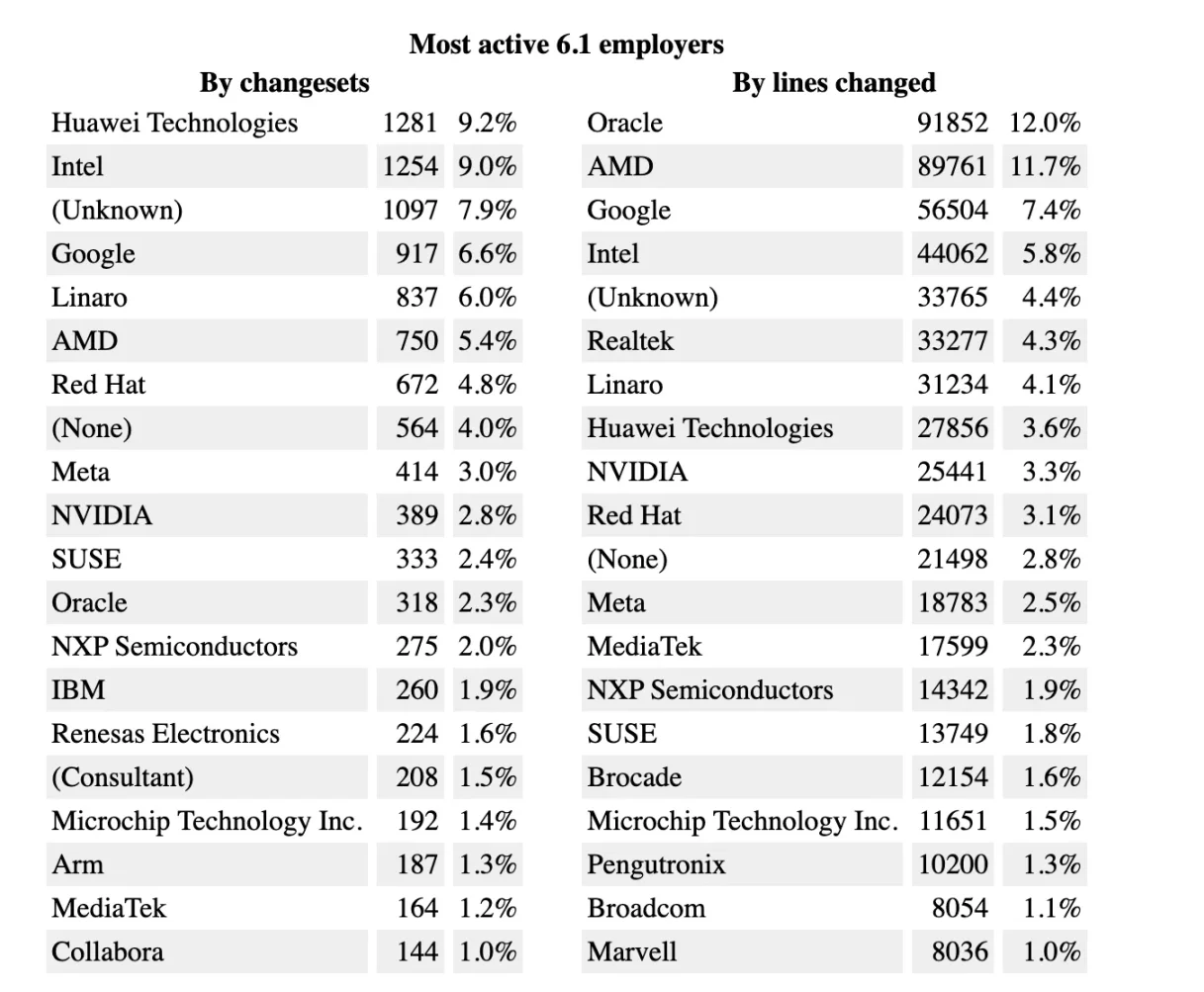

In 2023, Oracle was actually the top contributor to Linux kernel changes. Why do for-profit firms invest in these operating systems? The answer is clear:

They use these foundational layers to create revenue-generating products. AWS generates billions relying partly on Linux server architecture; Google’s strategy of open-sourcing Android attracted Samsung, Huawei, and others to help build a mobile ecosystem under its leadership.

These operating systems benefit from network effects, justifying continuous investment. Over three decades, the scale of economic activity supported by their user bases has created formidable moats.

Compare this to today’s L1/L2 landscape: According to DeFillama, among over 300 existing L1s and L2s, only seven generate more than $200,000 in daily fees, and only ten ecosystems have TVL exceeding $1 billion. For developers, building on most L2s is like opening a store in the desert—scarce liquidity, unstable foundation. Unless you pay people to come, there's no reason for users to show up. Ironically, pressured by grants, incentives, and airdrops, most apps are doing exactly that. Developers aren’t competing for protocol fee shares—the very signal of protocol activity—but for attention.

In such an environment, economic output becomes secondary. Hype and performance attract more eyes. Projects don’t need real profitability—just the appearance of building. As long as people buy the token, the model holds. Being in Dubai, I often wonder why we see drone shows or taxi ads promoting tokens. Do CMOs really expect users to emerge from this desert outpost? Why are so many founders obsessed with “KOL rounds”?

The answer lies in Web3’s bridge between attention and capital inflow. Capture enough eyeballs, generate enough FOMO (fear of missing out), and you stand a chance at high valuations.

All economic behavior stems from attention. Without sustained attention, you cannot convince others to talk, date, collaborate, or trade. But when attention becomes the sole objective, the cost is evident. In today’s AI-driven content flood, repeating old scripts—top VC endorsements, major exchange listings, random airdrops, fake TVL games—no longer works. If everyone plays the same game, no one wins. This is the harsh reality the crypto industry is slowly awakening to.

In 2017, building on Ethereum was viable despite low usage because the base asset ETH could surge 200x in a year. In 2023, Solana recreated a similar wealth effect—its native asset rebounded ~20x from lows, fueling a wave of meme asset mania.

When investor and founder enthusiasm runs high, new wealth effects sustain open-source innovation in crypto. But over recent quarters, this logic has reversed: angel investments from individuals have declined, founders’ personal funds struggle to survive funding winters, and large financing rounds have sharply decreased.

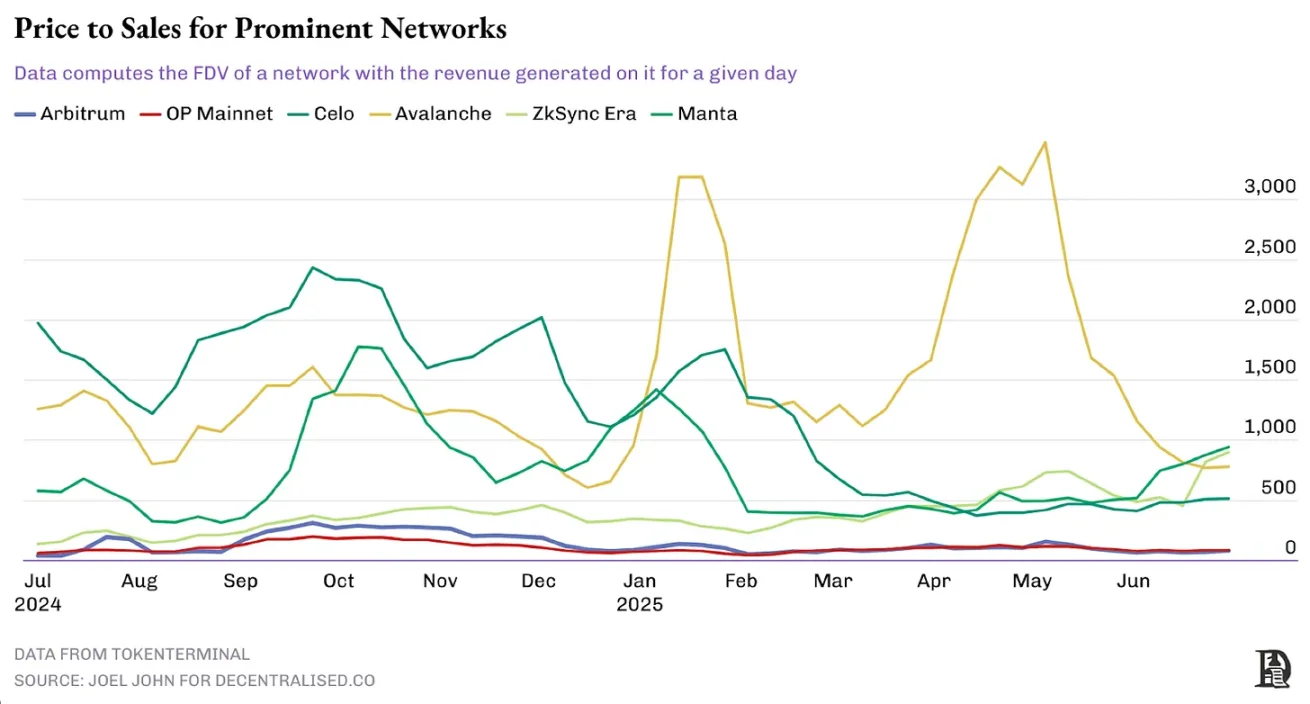

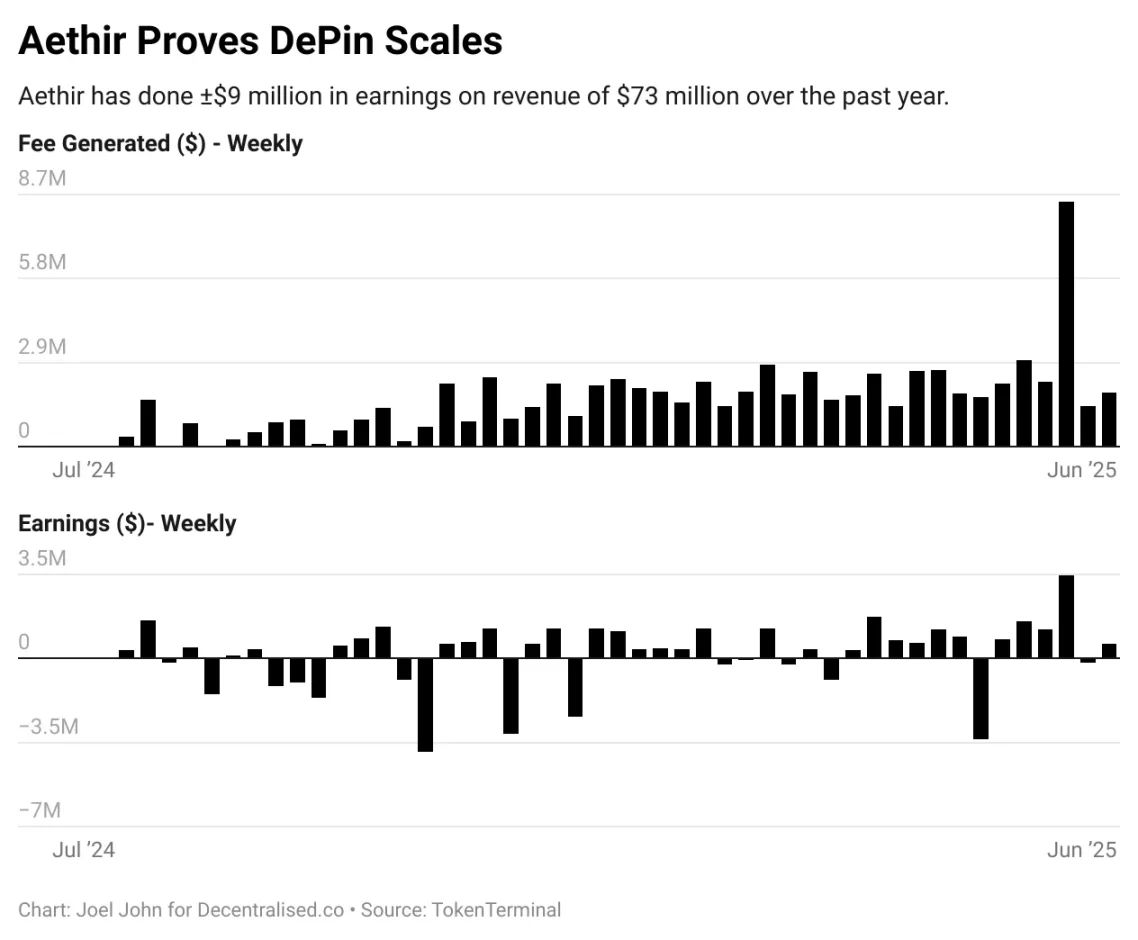

The consequence of application stagnation is clearly visible in the price-to-sales (P/S) ratios of mainstream networks. Lower P/S ratios generally indicate healthier valuations. As shown later with Aethir, P/S declines as revenue grows. But for most networks, the opposite occurs—new token emissions maintain valuations while revenues stagnate or decline.

The table below samples recently launched networks, reflecting economic realities. Optimism and Arbitrum maintain relatively sustainable P/S ratios of 40–60x, while some networks exceed 1,000x.

So where do we go from here?

Revenue Over Narrative

I’ve been fortunate to participate early in several crypto data products. Two stand out:

-

Nansen: the first platform using AI to label wallets and visualize fund flows

-

Kaito: the first AI-powered tool tracking product sentiment and creator influence within crypto Twitter

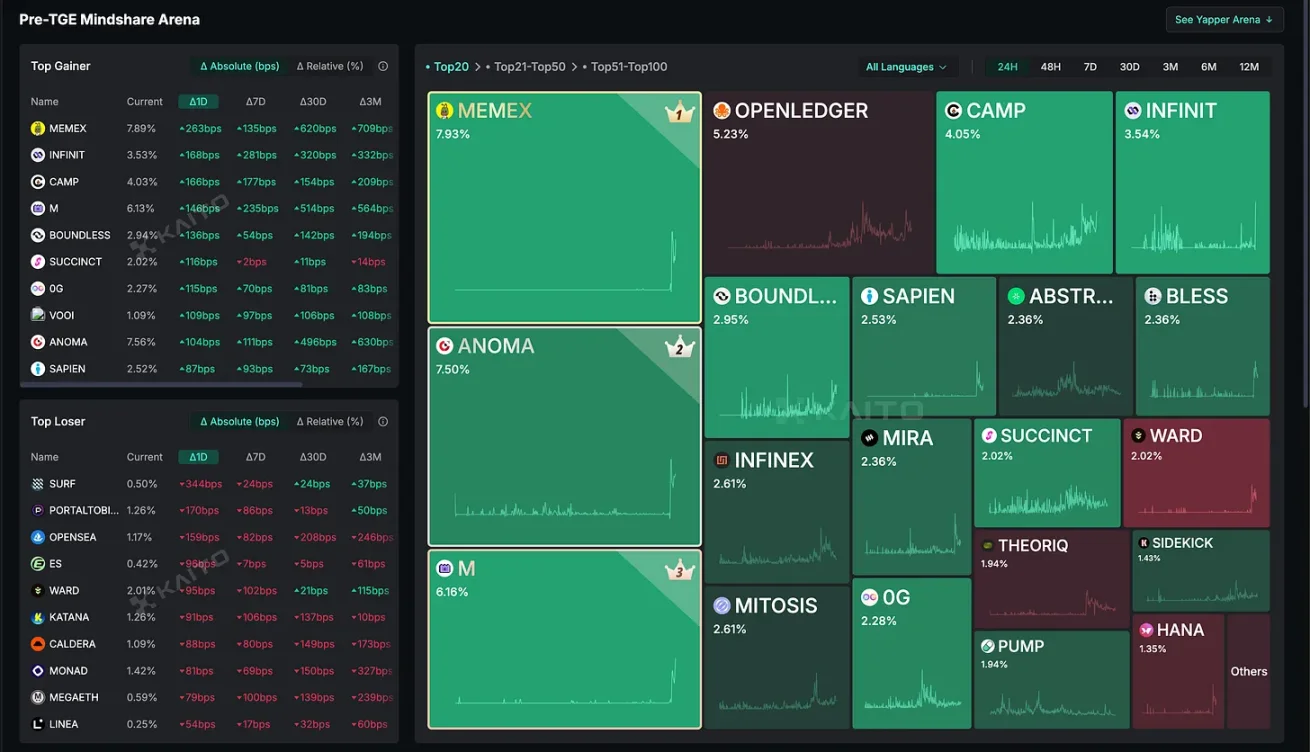

Their launch timing is telling. Nansen emerged mid-way through the NFT and DeFi boom, when tracking whale movements was critical. To this day, I use its stablecoin index to gauge risk appetite in Web3. Kaito launched in Q2 2024, after the Bitcoin ETF frenzy—when fund flows mattered less than narrative control. During periods of declining on-chain activity, it quantified attention allocation.

Kaito became the benchmark for measuring attention flow, fundamentally changing crypto marketing. The era of faking value through bot-inflated metrics is over.

Looking back, awareness drove value discovery—but not sustainable growth. Most “hot” projects in 2024 have since crashed 90%. In contrast, steady builders over years fall into two categories: vertical-specific applications with native tokens, and centralized applications without them. Both follow the traditional path toward product-market fit (PMF).

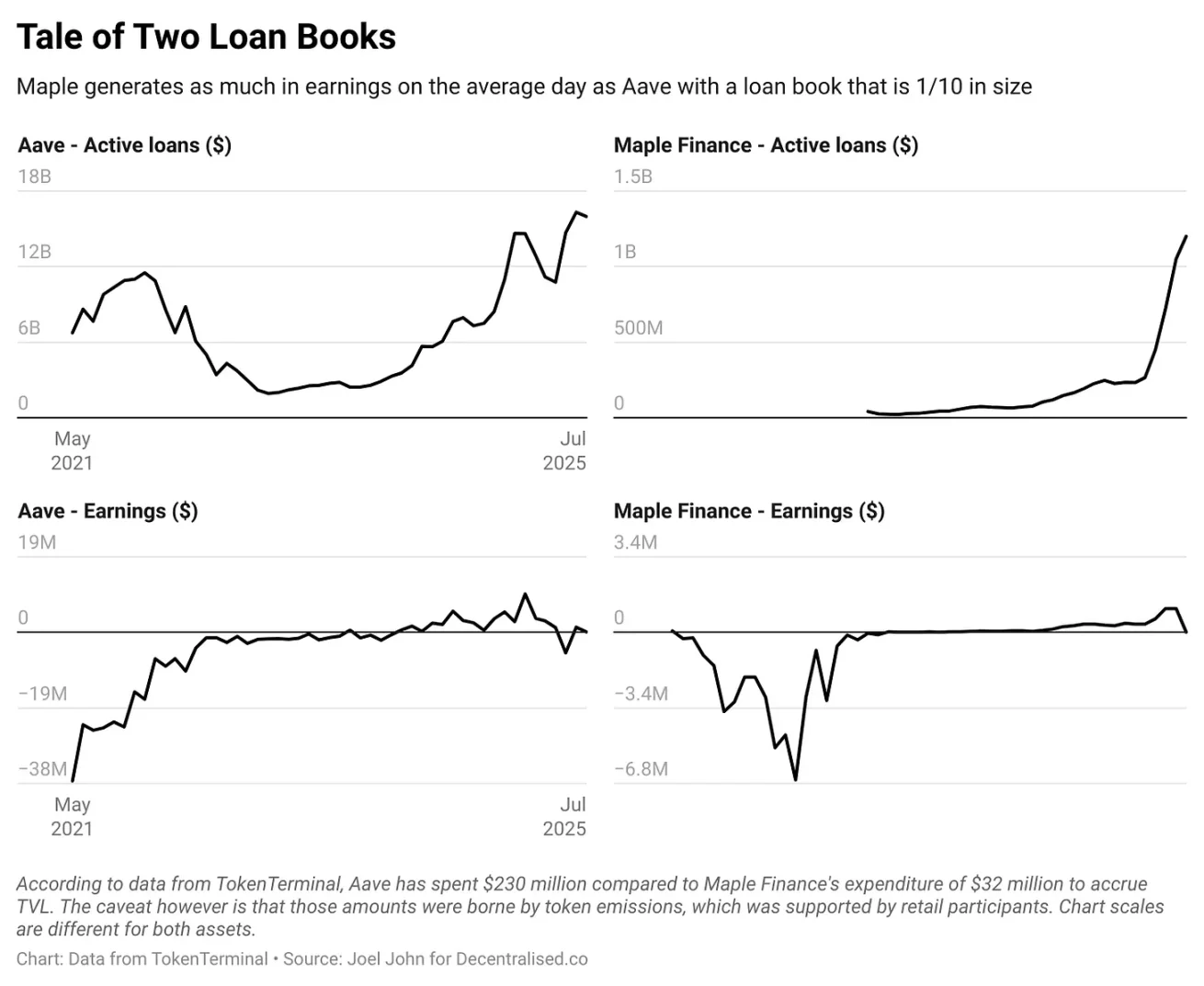

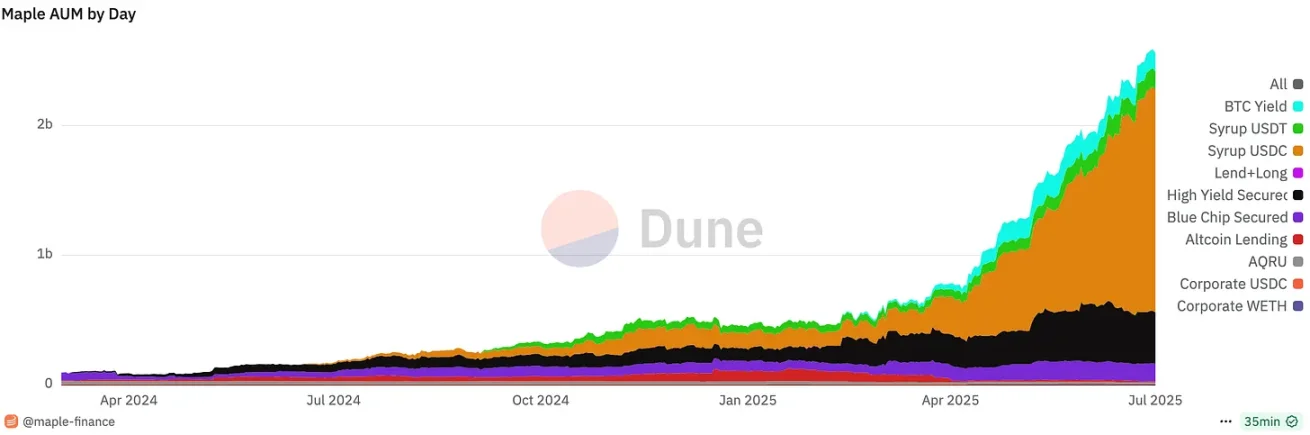

Take Aave and Maple Finance as examples of TVL evolution. Data from TokenTerminal shows Aave spent $230 million to build a current lending scale of $16 billion; Maple achieved $1.2 billion in loans with just $30 million. While both now yield similar returns (P/S around 40x), their volatility differs significantly. Aave invested heavily early to build a capital moat; Maple focused on the niche of institutional lending. This isn't about superiority—it highlights crypto’s great divergence: one path builds capital barriers early; the other dominates specialized verticals.

Maple's Dune dashboard

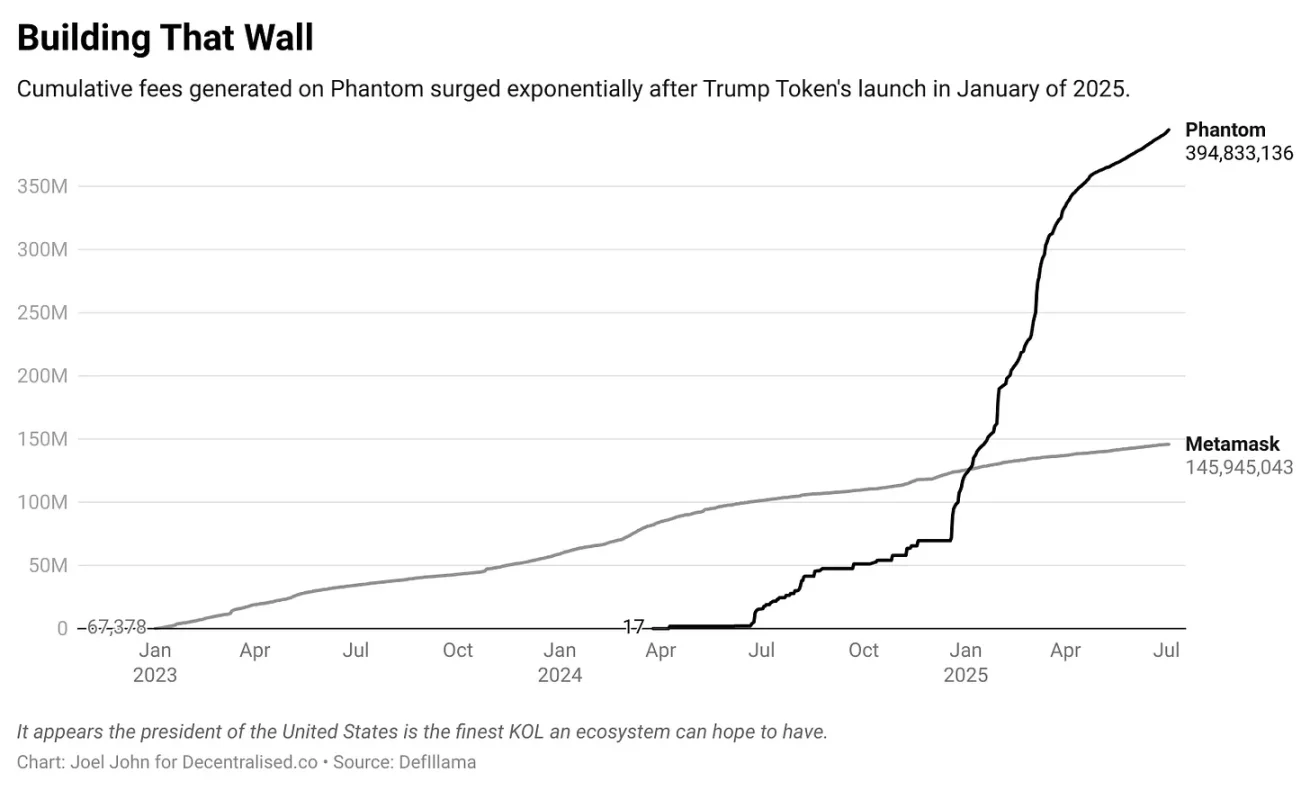

A similar split exists between Phantom and Metamask wallets. DeFiLLama data shows Metamask has generated $135 million in fees since April 2023, while Phantom earned $422 million since April 2024. Despite Solana’s larger meme coin ecosystem, this reflects a broader Web3 trend. Metamask, launched in 2018, enjoys unmatched brand recognition; Phantom, a newer entrant, succeeded by precisely targeting the Solana ecosystem with superior product design.

Axiom takes this further. Since February this year, it has generated $140 million in fees—$1.8 million yesterday alone. Last year, most application-layer income came from trading interfaces. They don’t perform “decentralization theater,” but directly address core user needs. Sustainability remains to be seen—but when a product earns nearly $200 million in six months, the question shifts from “can it last?” to “does it need to?”

Believing crypto will remain limited to gambling, or that tokens will eventually be unnecessary, is like claiming U.S. GDP will center solely on Las Vegas or that the internet exists only for pornography. Blockchains are financial rails. As long as products can leverage these rails to facilitate economic transactions in fragmented, disordered markets, value will emerge. The Aethir protocol exemplifies this perfectly.

During last year’s AI boom, premium GPU rentals were in short supply. Aethir built a marketplace for GPU compute power, serving clients including the gaming industry. For data center operators, Aethir provides stable income. To date, Aethir has generated approximately $78 million in revenue since late last year, with over $9 million in profit. Is it “trending” on crypto Twitter? Not particularly. But its economic model is sustainable—even as its token price falls. This disconnect between price and economic fundamentals defines what we might call “vibecession” in crypto: one side sees protocols with little usage; the other, a few products with surging revenues unreflected in token prices.

The Imitation Game

The film *The Imitation Game* tells the story of Alan Turing breaking the Enigma code. One scene stands out: after cracking the cipher, the Allies must restrain themselves from acting immediately—premature action would reveal their breakthrough. Markets work similarly.

Startups are ultimately games of perception. You're always selling the probability that future value exceeds current fundamentals. When confidence in improving fundamentals rises, equity value follows. That’s why signs of war boost Palantir’s stock, or why Tesla shares surged when Trump won.

But perception games can backfire. Failure to effectively communicate progress shows up in price. This “communication gap” is creating new investment opportunities.

Welcome to crypto’s age of great divergence: assets with revenue and PMF will crush those without foundations; founders can build applications atop mature protocols without issuing tokens; hedge funds will scrutinize protocol economics closely, as exchange listings no longer justify high valuations.

Market maturation paves the way for the next wave of capital influx, with traditional equity markets beginning to favor crypto-native assets. Current assets form a barbell structure—one end holding meme coins like fartcoin, the other solid projects like Morpho and Maple. Ironically, both attract institutional interest.

Protocols like Aave that built moats will endure. But where does this leave new founders? The writing is on the wall:

-

Launching a token may no longer be ideal. More and more VC-free trading interface projects are already generating millions in revenue

-

Existing tokens will face rigorous scrutiny from traditional capital, reducing the pool of investable assets and creating crowded trades

-

M&A by public companies will increase, introducing new sources of capital beyond token holders and VCs

These trends aren’t entirely new. Arthur from DeFiance and Noah from Theia Capital have long shifted toward revenue-based investing. What’s different now is that more traditional capital is entering crypto. For founders, this means focusing on niche markets and extracting value from small user bases could yield massive profits—because pools of capital are waiting to acquire them. This expansion of capital sources may be the most optimistic development in the industry in years.

The unresolved question remains: can we overcome cognitive inertia and adapt consciously to this shift? Like many pivotal questions in life, only time will tell.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News