From Tenant to Broker: The Cryptocurrency Business Inside Trump Tower

TechFlow Selected TechFlow Selected

From Tenant to Broker: The Cryptocurrency Business Inside Trump Tower

Live downstairs from power, so the wealth elevator goes straight to your office.

By David, TechFlow

In January 2025, Donald Trump returned to the White House. Among his executive orders was one particularly eye-catching directive: allowing 401(k) retirement funds to invest in cryptocurrency.

One month after the policy announcement, a company named American Bitcoin went public on Nasdaq. This firm, which claims it will become the "world's largest bitcoin mining enterprise," counts Trump’s two sons, Eric Trump and Donald Trump Jr., among its major shareholders.

Connecting these events is a little-known company: Dominari Holdings.

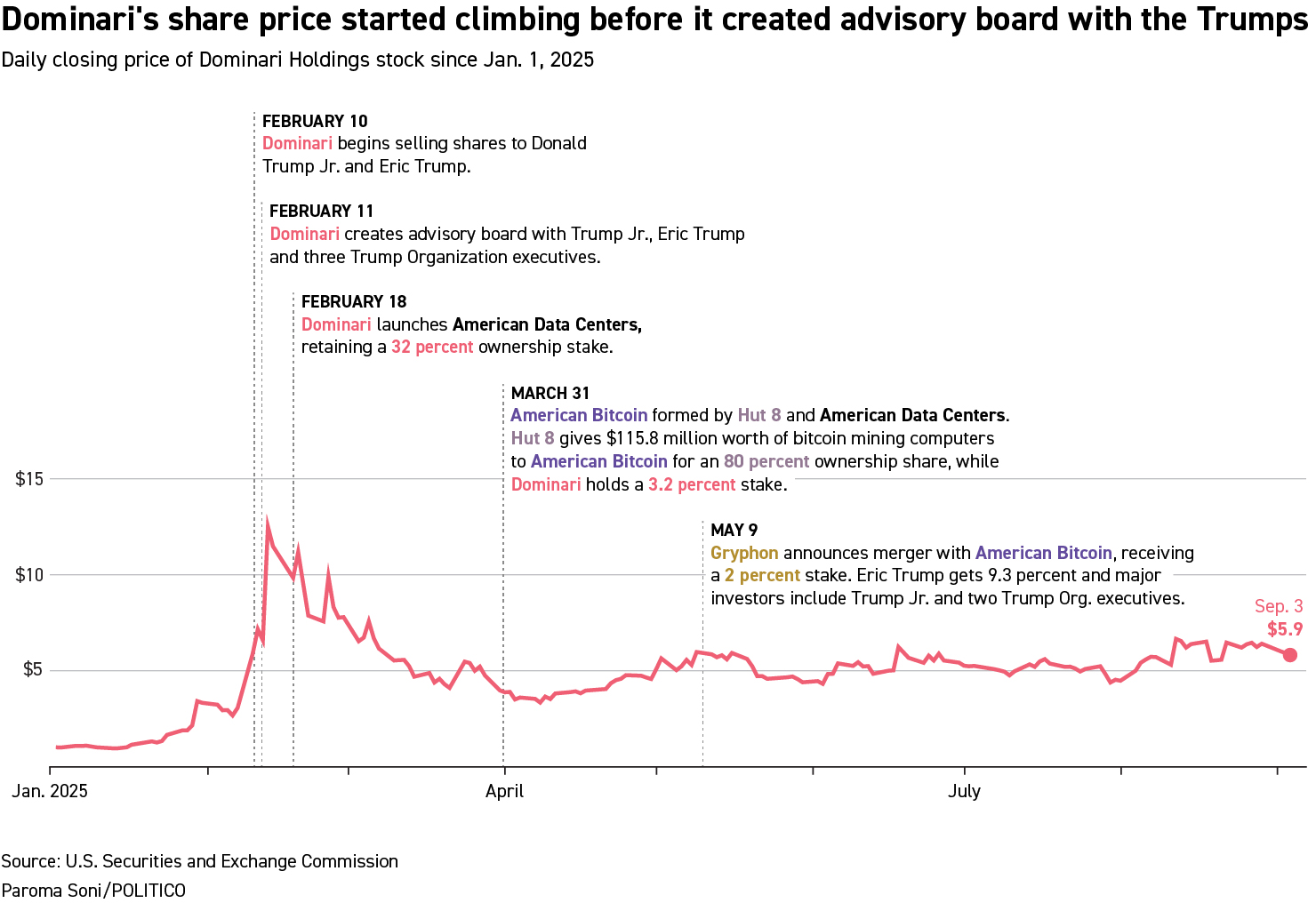

After becoming associated with the Trump family and the crypto narrative, its stock price surged from $1.09 at the beginning of the year to $6.09—an increase of over 450%.

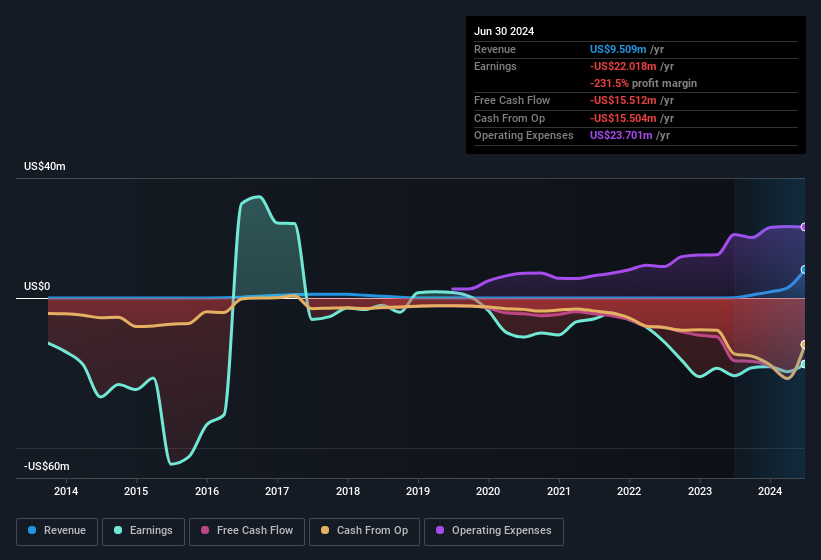

The transformation has been so dramatic that many have forgotten that just four years ago, it was a pharmaceutical company suffering consecutive annual losses.

This is a story about how $750,000 in annual rent leveraged tens of millions in business. The protagonists aren't crypto titans or Wall Street giants, but two shrewd middle-aged men: Anthony Hayes, a lawyer by training, and Kyle Wool, a Wall Street veteran.

Their secret to wealth is simple: Move into Trump Tower and become neighbors with the Trump sons.

An Expensive Decision

In 2021, Anthony Hayes faced a mess.

When he took over, the company wasn’t yet called Dominari Holdings—it was AIkido Pharma, a biopharmaceutical firm. Like many similar companies, it had burned through years of funding on drug development without bringing any product to market. According to SEC filings, by the end of 2023, the company had accumulated liabilities exceeding $223 million. Its stock price had long hovered around $1.

Image source: NasdaqCM:DOMH Earnings and Revenue History August 12th 2024

Hayes isn’t a pharmaceutical expert—he’s a lawyer, formerly a partner at a top 100 U.S. law firm, who later founded a company specializing in intellectual property transactions. After taking control of AIkido, he made two decisions:

First, abandon the pharmaceutical business; second, move the company into Trump Tower.

To execute this, he brought in Kyle Wool. Wool spent over two decades on Wall Street with an impressive resume: former Executive Director at Morgan Stanley, Managing Director at Oppenheimer, overseeing wealth management operations in Asia. He frequently appeared on Fox Business and was a regular guest on Maria Bartiromo’s morning show.

What does moving into Trump Tower mean?

According to the company’s annual report, rental expenses jumped from $140,000 in 2022 to $773,000 in 2023. At the time, the company had only about 20 employees. By Manhattan standards, that amount could rent an entire floor of Class A office space.

More critically, the company was still losing money—$14.8 million in the first half of 2025 alone. Spending such a large sum on rent seemed utterly irrational.

But Hayes and Wool weren’t after office space. Trump’s two sons, Eric and Donald Jr., worked upstairs. Elevator rides offered chances for “chance” encounters; dinner parties with mutual friends meant shared tables.

Inside Trump Tower, they might gain entry into Trump’s commercial ecosystem.

Business Upstairs and Downstairs

Cultivating relationships takes time and skill.

According to The Wall Street Journal, after moving into Trump Tower, Hayes and Wool began a long-term “social investment.” Golf tournaments, charity galas, private gatherings—any occasion where they could “naturally” meet the Trump sons—they never missed.

This investment bore fruit in February 2025. Dominari announced that Donald Trump Jr. and Eric Trump had joined the company’s advisory board, along with three executives from the Trump Organization.

The brothers’ involvement was not symbolic. Each invested $1 million privately to purchase approximately 216,000 shares, and also received 750,000 shares as compensation for their advisory roles. Upon the news, Dominari’s stock soared from $1.09 to $13—a peak increase of over 1200%.

Even after some pullback, the brothers’ investments multiplied several times over. According to Bloomberg data, Eric Trump currently holds about 6.3% of the shares, worth over $5 million.

But this was only the beginning. On March 31, Dominari announced a partnership with Canadian-listed Hut 8 to form American Bitcoin. The positioning of this new company was interesting—not just mining bitcoin, but flying the flag of “Made in America,” aligning with Trump’s “America First” policy.

In this deal, Hut 8 contributed mining equipment valued at $115 million and took 80% ownership. Dominari received only 3%. Though small in proportion, that 3% stake was already worth $32 million by late June—one of Dominari’s most valuable assets.

More importantly, through this platform, the Trump family formally entered the bitcoin mining industry. Eric Trump personally holds an additional 9% stake in American Bitcoin.

On August 27, Dominari established a cryptocurrency advisory committee, hiring two heavyweight figures:

Sonny Singh, former executive at BitPay, who helped secure BitPay’s New York crypto license and launched the first crypto debit cards; and Tristan Chaudhry, a DeFi developer and early investor in Litecoin and Dogecoin.

"Digital assets are no longer on the fringes of finance—they’re moving to the center," said CEO Hayes when announcing the committee.

This may have inadvertently revealed the truth: in the Trump era, cryptocurrencies are indeed shifting from the margins to the mainstream, and those who positioned themselves early are reaping massive rewards.

Dancers in the Gray Zone

On Wall Street, networks often speak louder than financial statements. Dominari’s shareholder list and web of connections paint a picture of a company operating in the gray zone.

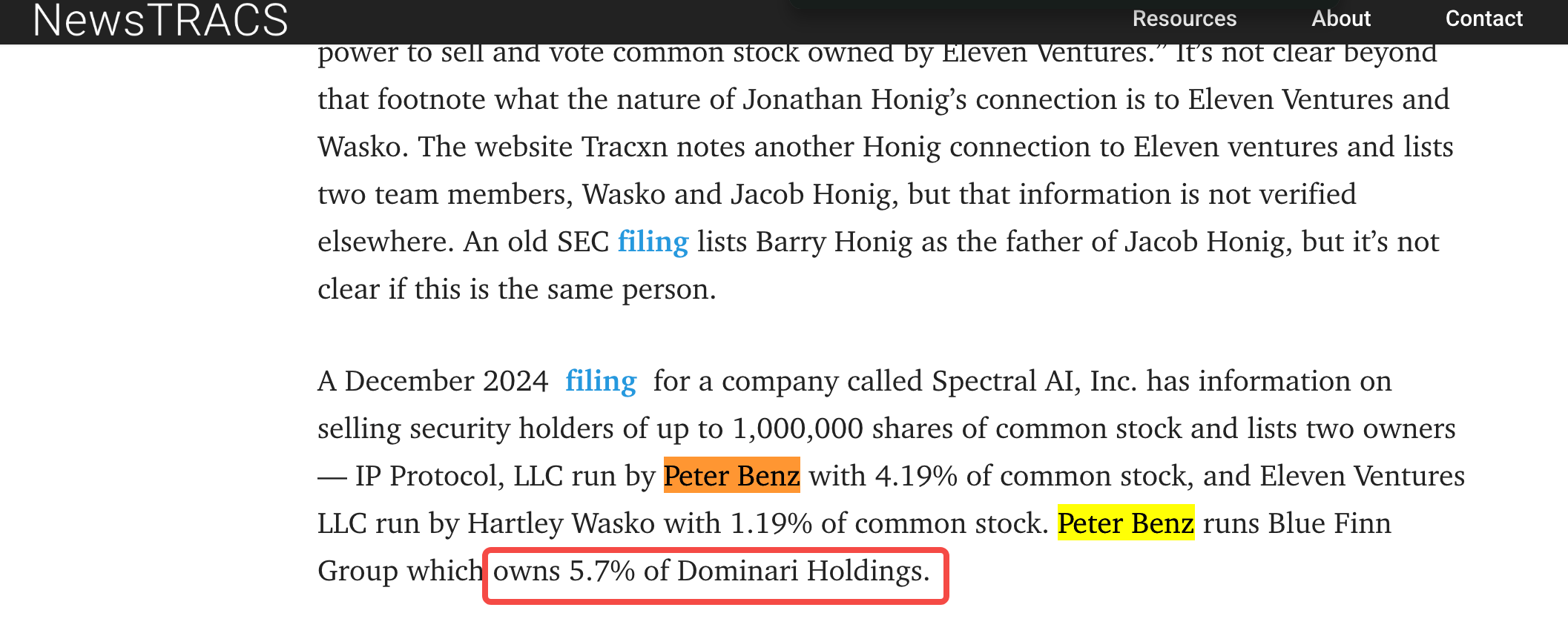

In March 2025, an investor named Peter Benz became a 5.7% major shareholder in Dominari through Blue Finn Group. Interestingly, Benz had served as director at several companies, including IDI, Inc., whose executives Michael Brauser and Philip Frost were later accused by the SEC of involvement in a $27 million stock fraud scheme.

While Benz himself has never been accused of wrongdoing, these tenuous associations reveal the ecosystem Dominari inhabits—one full of opportunity, yet skirting regulatory boundaries.

Even more subtle is Kyle Wool’s background.

During his time at Morgan Stanley, his team handled business related to Devon Archer, who was Hunter Biden’s former business partner. From serving Democratic circles to now managing deals for the Trump family, Wool has witnessed and participated in both poles of America’s power game.

But the real issue isn’t these connections—it’s the company’s financial logic.

According to Bloomberg, in Q2 2025, Dominari reported revenue of $34 million, a 452% year-on-year increase. Yet, during the same period, administrative expenses totaled $53.5 million, including $26.1 million in stock options granted to CEO Hayes and President Wool.

In other words, every dollar earned wasn’t enough to cover operating costs, let alone generate profit. Its most valuable asset—the 3% stake in American Bitcoin—is tied to a newly formed bitcoin mining company whose profitability remains uncertain.

But investors don’t care.

They’re not buying current profits, but a concept: the Trump family’s proxy in the crypto world. Perhaps that is Dominari’s true business model—converting political capital into market valuation.

The Official Broker

Dominari’s ambitions extend far beyond its own investments. Its real value lies in acting as a “super connector” between the Trump family and the crypto world. The Wall Street Journal once described it as the Trump family’s “go-to dealmaker.”

Three cases best illustrate this.

The first involves the complex entanglement between World Liberty Financial (WLFI) and Justin Sun.

In September 2025, when WLFI tokens began trading, entities controlled by the Trump family held 22.5 billion tokens, increasing their paper wealth by roughly $5 billion at prevailing prices.

But the project nearly failed. According to Bloomberg reporting, initial sales for WLFI were dismal, achieving only 7% completion—falling short of the minimum threshold required to trigger payments to Trump. At the critical moment, Justin Sun stepped in with a $30 million investment, pushing the project past the threshold.

Later, Sun increased his investment to $75 million, becoming the project’s largest backer.

More significantly, Dominari Securities facilitated Tron’s reverse merger listing on Nasdaq. On June 16, 2025, SRM Entertainment announced a deal with Tron; on July 24, the renamed Tron Inc. rang the opening bell on Nasdaq, completing its public debut. In this transaction, Sun’s Tron acquired a toy manufacturer that supplied Disney and Universal Studios.

Dominari serves both the Trump family and Justin Sun, acting as a bridge linking their interests. When Sun needed access to U.S. capital markets, Dominari provided it; when the Trump family’s project needed a lifeline, Sun appeared.

The second case is Dominari directly orchestrating the recent marriage between Safety Shot, a publicly traded U.S. company, and BONK.

On August 11, 2025, Nasdaq-listed Safety Shot announced it would exchange $35 million in equity for $25 million in BONK tokens. The exclusive financial advisor for this deal was Dominari Securities.

Dominari designed the entire transaction structure: Safety Shot receives a 10% share of revenues from the BONK.fun platform, changes its ticker to BNKK, and grants the BONK team 50% of board seats.

Kyle Wool, President of Dominari Holdings, later publicly praised the advisory committee—especially Eric Trump—for helping facilitate the cooperation. This statement effectively acknowledges the Trump family’s pivotal role in these deals.

The third is the earlier-mentioned Trump family’s strategic moves in data centers and bitcoin mining.

In the formation of American Bitcoin, Eric Trump holds approximately 7.5%—the largest individual investor. Dominari Holdings owns about 3% of American Bitcoin. Both Trump sons also serve as advisors to Dominari, each holding around 6–7% of its shares.

Behind every major deal, there’s Dominari. Sometimes it’s the public-facing financial advisor, sometimes the behind-the-scenes coordinator, and always the operator, architect, and executor of the Trump family’s crypto empire.

A New Order in Trump Tower

Dominari’s official website states its headquarters is located on the 22nd floor of Trump Tower. Wool’s office overlooks Central Park. Their current monthly rent is $62,242.

Upstairs in the building, the Trump sons command political influence and family branding; downstairs, Dominari provides Wall Street expertise and execution power; and deals are hatched in elevator conversations.

Each successful transaction likely strengthens this symbiotic relationship.

While traditional investment banks seek projects through formal channels, Dominari has found a more direct path: live beneath power, so the elevator of wealth goes straight to your office.

On August 14, Kyle Wool stood at Nasdaq to ring the opening bell and said:

"It’s been a wild journey. As our president Trump would say, the best is yet to come."

He may be right. As Trump introduces more pro-crypto policies and more traditional companies seek entry into Web3, Dominari’s brokerage business will only grow more lucrative.

Paying multiple times the market rate in rent to move into Trump Tower now appears to be the smartest investment of Wool and Hayes’s careers.

The expensive annual rent bought more than just admission into the Trump family’s business circle—it secured physical proximity, social integration, and commercial alignment.

From a bankrupt-edge pharma firm to a nearly hundred-million-dollar market-cap investment firm; from an obscure tenant to the Trump family’s crypto broker—Dominari’s transformation, in many ways, mirrors American capitalism in the Trump era.

In this era, the line between politics and business has blurred like never before. This company functions like an invisible conductor, turning political capital into business opportunities, and converting power relationships into hard cash.

In America under Trump, the best business isn’t doing business itself, but becoming the connector of all businesses.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News