The cryptocurrency market, a utopia intruded by macroeconomics

TechFlow Selected TechFlow Selected

The cryptocurrency market, a utopia intruded by macroeconomics

Cryptocurrency will once again become part of the macroeconomy, no longer independent of fluctuations in traditional markets.

Author: Musol

Foreword: I still remember when Bitcoin first became popular. It was an adrenaline-pumping era, with everyone in the circle talking about the "decentralization revolution," as if holding the key to the future. But what about now? Open any crypto community, and the screens are filled with "How many basis points will the Fed raise rates?" and "What if CPI data exceeds expectations?"

How did the crypto market we once envisioned fall from a technological utopia to a yes-man of macroeconomics?

An asset class that claims to overthrow the old world now seems like a spineless follower, living day by day by watching Powell's mouth, truly pathetic and laughable.

Pt.1. Where Does the Macroeconomic Color of the Crypto Market Come From?

We all know deeply that as an emerging force in the financial sector, the development of the crypto market is closely linked to changes in macroeconomic policies. In the context of global economic integration, even slight movements in macroeconomic policies can stir up huge waves in the crypto market. Bitcoin, as the leader of the crypto market, is often seen as a barometer of the market, and its fluctuations are closely related to adjustments in macroeconomic policies. The monetary policies of the Federal Reserve, the fiscal policies of various governments, and changes in the international political situation all affect market capital flows, sentiment, and market expectations to varying degrees.

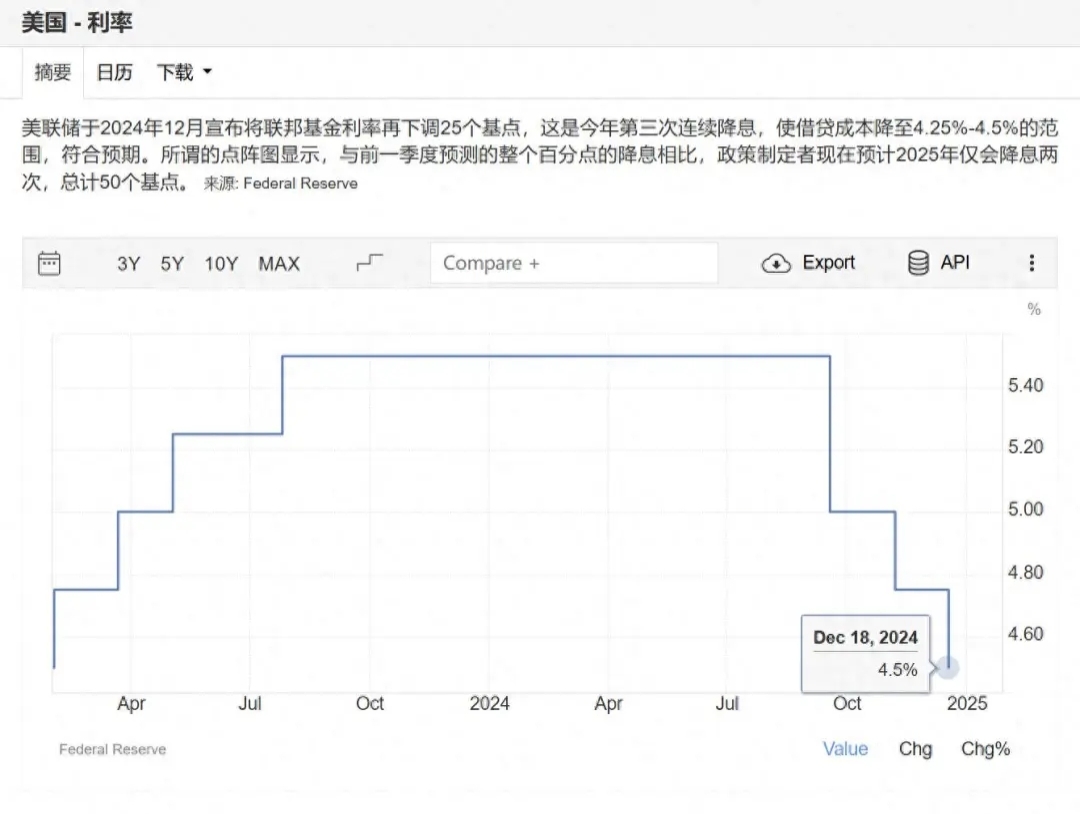

2023 - 2024: Fed Rate Cuts and Market Volatility

Using Bitcoin's halving cycle as a time reference, the Fed's rate-cutting cycle was originally expected to begin in Q4 2023. However, to maintain the superficial prosperity of the economy, the Biden administration adopted a series of unconventional measures. By allowing illegal immigrants to work, they increased the supply in the labor market, making employment data look more impressive; at the same time, expanding the size of government employees further distorted non-farm payroll data. These measures forced the Fed to resist cutting rates in Q4 2023, attempting to create the illusion of stable economic growth.

But to fund Biden's Keynesian policies, the U.S. Treasury needed to issue a large amount of bonds. This led to a steep decline in the yield of 10-year Treasury bonds. This change brought unexpected opportunities to the crypto market, creating a seasonal bull market spanning Q4 2023 and Q1 2024. During this period, capital activity in the crypto market increased significantly, and the prices of mainstream cryptocurrencies like Bitcoin rose accordingly. Investors flocked to the market, hoping to get a share of the bull market.

Entering Q2 2024, the market situation reversed. As the Treasury's bond issuance slowed, the supply of market capital decreased. At the same time, systemic risks in non-U.S. countries erupted, such as instability in the Eastern housing market and turmoil in the Japanese bond market, causing investors' demand for safe havens to rise sharply. In this situation, the U.S. dollar, U.S. Treasury bonds, and gold became hot commodities in the eyes of investors, with large amounts of capital flowing out of the crypto market in search of safer harbors. Coupled with the historical tradition of no significant activity in risk markets in Q2, the entire crypto market entered a downturn, with prices falling, trading volumes shrinking, and investor confidence severely shaken.

2024 - 2025: Election, Rate Cuts, and Market Contradictions

By Q3 2024, to salvage the election prospects of Biden/Harris, the Fed had to start the rate-cutting process. However, a bizarre phenomenon emerged in the market: the yield on 10-year Treasury bonds not only failed to decline with the rate cuts but instead rose strongly in the opposite direction, creating a situation where nominal interest rates were lowered while real interest rates approached historical highs. This anomaly made the crypto market's performance even more complex. The market activity in Q4 2024 was not driven by external hot money but was influenced by the "Trump trade" combined with autumn volatility. Starting from Trump's election as U.S. President, market sentiment was greatly stirred, with various Trump-related concept coins emerging one after another. When Trump issued a meme coin under his own name, it drained on-chain liquidity, tightening market capital and exacerbating price volatility.

By Q1 2025, the main contradiction in the market had fundamentally shifted. It was no longer the contradiction between data like non-farm payrolls and CPI and the Fed's expectation management but the contradiction between the White House, the Department of Government Efficiency, and the Fed. The impact of this contradiction was extremely severe, compounded by DeepSeek piercing the U.S. AI hegemony, sparking concerns about U.S. technological strength and economic prospects. This panic led to a massive sell-off of U.S. Treasury bonds, with bonds experiencing a rapid wave of selling. However, this decline in real interest rates caused by panic did not, as usual, promote a spring rally. Instead, it prompted a large outflow of capital. Investors, fearful of market uncertainty, withdrew their funds in search of safer investment channels.

Whether now or in the future, we are witnessing and foreseeing that the crypto market is no longer an isolated island of an asset class. They are once again deeply intertwined with macroeconomic forces and regulatory changes into a new chessboard. In the future, what will dominate the cryptocurrency market will be regulation and macroeconomics, not microeconomics or industry development within the sector.

Pt.2. Why Does the Crypto Market React to Tariffs?

Panic and Risk Aversion from Trade Wars

"Tariff-induced trade war fears typically fade quickly, but during that time, investors hedge with gold, Treasury bonds, and the U.S. dollar."

The threat of a global trade war has caused investors to flee risk assets. Traditional financial investors view Bitcoin as a high-risk asset and are turning to safer assets like gold, bonds, and the U.S. dollar. Classic risk-aversion trades are playing out, and cryptocurrencies are naturally categorized within this scope.

Inflation and Interest Rates Back in Focus

Tariffs increase the cost of imported goods, potentially leading to higher inflation. If inflation remains persistently high, the Fed may delay or cancel expected rate cuts, thereby reducing liquidity in financial markets. Since Bitcoin does not generate yield, higher interest rates make it less attractive compared to U.S. Treasury bonds or even cash deposits.

This dynamic contrasts sharply with the low-interest-rate, liquidity-driven environment of 2020-2021, when cryptocurrencies thrived. Therefore, macro trends have once again become the primary drivers influencing cryptocurrency performance.

The Role of Regulation and Traditional Finance

Although tariffs and inflation dominate the short-term outlook, regulatory changes are equally crucial. Global regulators are increasing scrutiny of the market, and the SEC and CFTC (Commodity Futures Trading Commission) have recently taken some industry-friendly actions, more or less hinting at the U.S. regulatory stance. Meanwhile, traditional financial institutions are accelerating their adoption of cryptocurrencies, gradually recognizing their potential as a diversified asset class.

"The market is not afraid of extreme tariff measures but is adapting to Trump's negotiation tactics."

This means that while volatility may be high in the short term, long-term investors may continue to accumulate Bitcoin and other cryptocurrencies during price declines.

Pt.3. About the Future

Cryptocurrencies will once again become part of macroeconomics, no longer independent of traditional market fluctuations. Economic policies, central bank decisions, and geopolitical events all directly impact the performance of digital assets.

As inflation, interest rates, and trade policies dominate financial market dynamics, digital assets are no longer detached from the broader economic environment. Institutional capital now views major cryptocurrencies as part of the traditional financial landscape, meaning regulatory changes and global economic trends will shape the trajectory of cryptocurrencies.

Over the next 3-6 months, expect continued volatility as the market digests tariff updates, Fed policy decisions, and upcoming regulatory measures. The question is not whether cryptocurrencies will decouple from macroeconomics but how they will adapt to this new reality. What truly matters now includes macro events and what Trump says regarding regulation. The market is reacting sharply to trade policies, interest rate expectations, and regulatory decisions—factors that may shape the industry's development trajectory in the coming months.

Pt.4. Some Reflections

The root cause of the fall of our ideal technological utopia is essentially the invasion of capital. In the early days, the crypto market was a niche utopia, with players consisting only of tech geeks and libertarians, with pitifully small amounts of capital, and the outside world had no interest in getting involved. Back then, Bitcoin was an isolated island, spinning on its own fueled by community fervor. But once its market cap broke through a trillion, Wall Street vultures smelled blood. Institutional capital flooded in like a tide, ETF applications sprouted like mushrooms after rain, and hedge funds entered with leverage, forcibly turning this small pond into a hunting ground for capital.

What was the result?

With a wave of the Fed's hand, the market's remaining dignity became useless. During the 2022 rate-hiking cycle, Bitcoin fell from $60,000 to $20,000, like a man whose backbone had been pulled out, causing the entire crypto space to bleed. When rate cut expectations rose in 2023, prices began to recover, and retail investors cheered, as if forgetting they were merely pawns on the chessboard. How can this still be called "free money"? It is clearly a slave chained by the global financial system, its every move dependent on the master's mood.

What's even more infuriating is that the crypto market's reaction to macro signals is particularly "despicable." When the U.S. stock market falls by 5%, it can fall by 15%, like a frightened rabbit running amok; when the Fed gives a dovish hint, altcoins can double in a day, like gamblers on adrenaline.

This "magnifying glass effect" exposes its nature: an immature market, at its core still a plaything of emotional trading. High sensitivity to liquidity is one reason—capital flows in and out quickly, leverage is played heavily, and any slight disturbance causes an explosion.

But the deeper issue is that it simply has no roots of its own. Without a technological narrative, without independent value, all that remains is the greed and fear of speculators.

Look at those KOLs, shouting calls on X every day, with retail investors following the trend faster than anyone else. What's the result?

After institutions harvest a wave of retail investors, the latter are still licking their wounds and shouting "faith."

This is not a magnifying glass; it's clearly a funhouse mirror for speculators, reflecting the ugliest side of human nature with crystal clarity.

Yet some naively argue: This shows crypto has been accepted by the mainstream, becoming a member of the asset class. How wonderful!

Isn't that laughable?

This kind of "acceptance" is merely the taming by capital; crypto has gone from rebel to accomplice of the system. Even if it survives the winter in the future, finding its own rhythm is nothing but wishful thinking. As long as the Fed's monetary policy remains the baton of the global economy, the crypto market can only continue to be a magnifying glass, magnifying panic, magnifying greed, but never magnifying its original ideals.

It is no longer the young man who made your heart flutter; it's a loser beaten to the ground by reality.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News