Understanding Balancer's Innovation in Response to the LSD Trend: Vault Architecture, Rate Providers, and Phantom BPT

TechFlow Selected TechFlow Selected

Understanding Balancer's Innovation in Response to the LSD Trend: Vault Architecture, Rate Providers, and Phantom BPT

The trend is already very clear: the rise of liquidity derivatives has become inevitable.

Written by: naly

Compiled by: TechFlow

The trend is now unmistakable—the rise of liquid staking derivatives (LSDs) has become inevitable. Legacy DeFi protocol Balancer is already technically prepared to offer the most efficient way to embrace this revolution.

Vault Architecture

Anyone leveraging Balancer's technology is tapping into an interconnected base layer of liquidity.

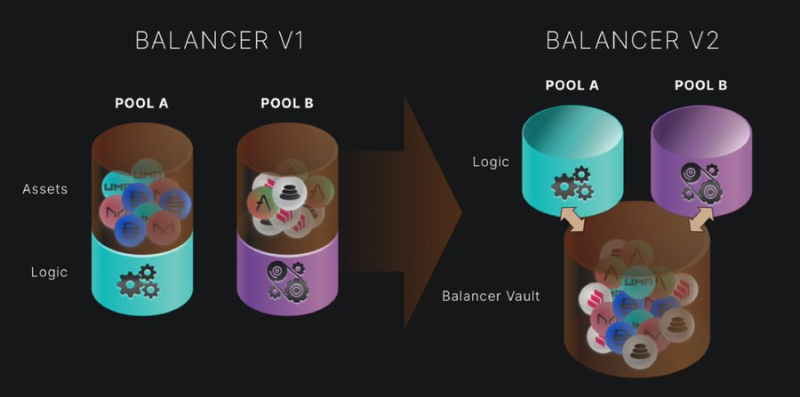

In other DeFi DEXs, pool contracts must actively manage assets (logic) while also handling all accounting operations for the pool.

Balancer’s Vault simplifies this in two ways:

-

Separating pool accounting from logic;

-

Placing all vaulted assets under a single contract.

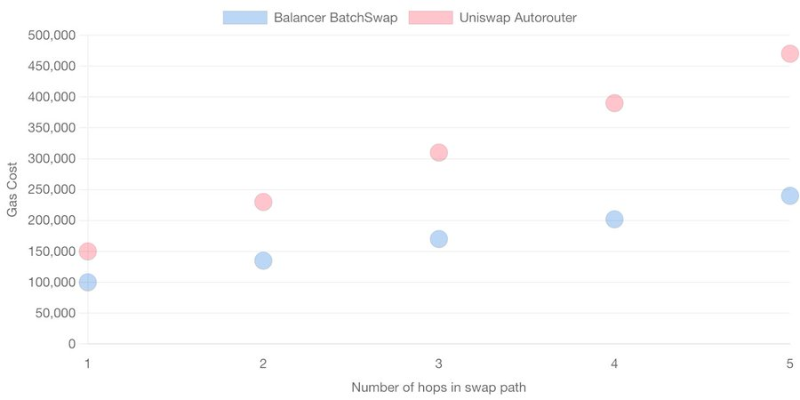

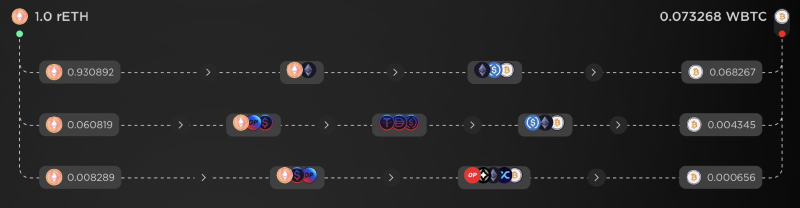

Because all assets are held under a single contract, pools only need to calculate swap, deposit, and withdrawal amounts without actively managing assets. This improves multi-hop trading across multiple pools—such as transferring tokens between different pools—a process that otherwise consumes significant gas. By eliminating the need for frequent gas-intensive logic, this enables BatchSwap (batched swaps). Thanks to its innovative Vault design, all LSDs deposited into Balancer can seamlessly leverage its liquidity hub for trading.

For example, executing trades on other protocols often requires moving tokens across multiple pools. Including logic, this is a highly gas-consuming process known as multi-hop trading. Below is an example between $BTC and $stETH:

$BTC > $ETH HOP $ETH > $wstETH.

But on Balancer, this isn't necessary. Since all assets reside within a single contract, only final token amounts are transferred into and out of the vault.

$BTC > $stETH

This eliminates the need for high gas costs. This innovation is called BatchSwap.

You can see how efficient this is in terms of gas cost below.

Through its innovative Vault design, all LSDs built on Balancer technology can seamlessly utilize an efficient liquidity center for trading.

Rate Providers

Now let's discuss the actual asset pools.

Instead of relying on a standard stable pool, LSDs use a specialized pool that continuously and efficiently updates the interest rate of staked assets. This is known as a Composable Stable Pool.

A standard stable pool treats LSDs as if they trade 1:1 with their underlying asset. While simple, it’s clearly inaccurate—so what’s the impact?

It’s bad for investors. As a liquidity provider (LP), your underlying LSD yield is effectively leaked to arbitrage traders. Traders profit from the inaccurate pricing within the pool.

Composable Stable Pools solve this problem.

These pools include a built-in feature called a Rate Provider, which queries and updates token rates to reflect the correct ratio whenever a trade occurs. This ensures that staking yields actually flow back to liquidity providers.

Phantom BPT

Now, imagine you have a three-token stablecoin pool ($DAI, $USDC, $USDT). A Composable Stable Pool allows this specific pool to be nested within an LSD pair for highly efficient pairing and connectivity—$rETH paired with ($DAI / $USDC / $USDT).

Sounds like Curve—what makes it unique? What truly sets Balancer apart is *how* this nesting is achieved.

While the Vault unlocks a foundational liquidity layer, it still requires calling underlying swap, join, and exit functions. When routing through these nested pools, each entry previously required substantial gas to mint BPT tokens.

Imagine swapping $rETH for $DAI.

$rETH > MINT > $USD (pool token) > $DAI

This minting mechanism incurs high gas costs.

Balancer introduces a novel primitive called Phantom BPTs, enabling a far more efficient process for Balancer pools. Instead of minting BPT tokens during swaps, Balancer mints an almost unlimited supply of BPTs at pool creation.

These pre-minted BPTs unlock efficiency unmatched by other DEXs. Traders no longer waste gas minting tokens upon each deposit but instead enjoy seamless, gas-efficient liquidity transactions.

Through nesting and vault design, all Liquid Staking protocols gain access to an efficient, interconnected liquidity center for their LSDs and other tokens.

At the same time, through Rate Providers, investors can leverage the most advanced and efficient technology available to earn yield on interest-bearing tokens!

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News