Taking Balancer as an example, discuss why veToken governance has failed

TechFlow Selected TechFlow Selected

Taking Balancer as an example, discuss why veToken governance has failed

Analyzing the reasons for the failure of Ve governance from Balancer's data.

Written by: Gabe Pohl-Zaretsky

Translated by: TechFlow

I see many protocols recommending veToken governance to solve their tokenomics issues.

In this article, I will explain objectively why veToken governance is a poor mechanism and unsuitable for implementation in protocols. It fails to solve any real problems and instead creates numerous new ones.

Why Are Protocols Turning to Ve?

Two reasons:

- Protocols need a decentralized way to distribute tokens.

- Protocols need a way to stop people from dumping their tokens.

The problem is that veToken governance does not effectively address either of these issues.

Take Balancer as an example regarding token distribution.

After observing CRV's price rise during the Curve wars, Balancer decided to implement its own version of veToken governance with veBal.

How well has the community performed in deciding which liquidity pools deserve emissions?

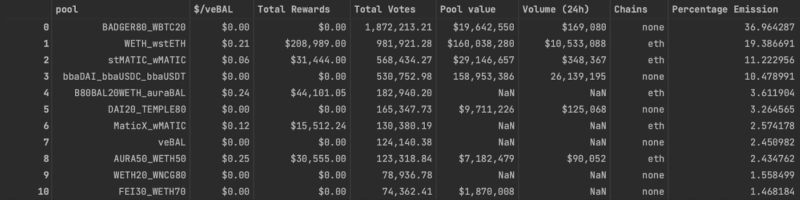

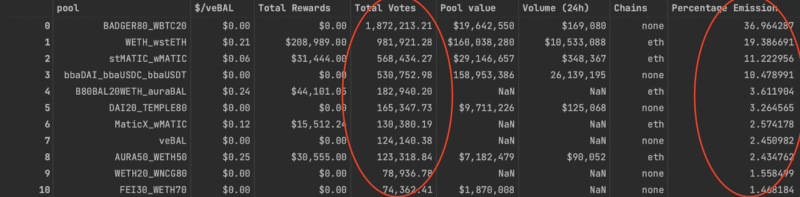

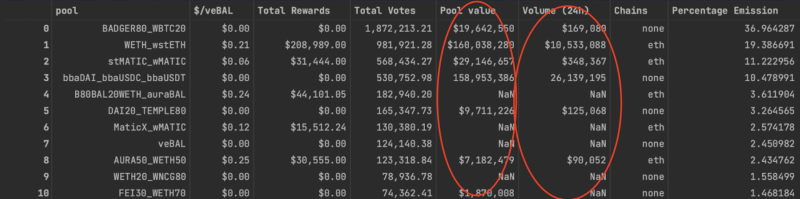

Below is data I pulled from Balancer showing TVL, volume, and the distribution of veBal voting power across the protocol.

Looking at the “Total Votes” / “Percentage Emissions” column, we can see the incentive distribution based on veBal voting weight.

A total of 78% of Balancer’s ~$926K daily reward budget is allocated to just 4 trading pools.

veBal voters believe these 4 pools require massive Balancer incentives compared to hundreds of other active pools on the platform.

But does this decision make sense?

Clearly not.

Collectively, these 4 pools contribute $367 million toward Balancer’s $3.2 billion in TVL (11.4%) and only $37 million in daily volume out of $102 million (36.2%).

The issue becomes even worse when focusing on BADGER/WBTC and stMATIC/MATIC.

These two pools received 48.2% of veBAL emissions but contributed only $48.7 million in TVL (1.5% of total) and $500,000 in volume (0.5% of total). The veBAL system clearly failed here.

The Balancer community recognized this and was forced to vote on a fix—effectively ending the practical operation of the veBAL system by granting veto power to Hidden Hand, a centralized intermediary.

So what went wrong?

The core issue is a misalignment of incentives between veToken voters and the protocol. The largest LPs are also the largest token holders. These LPs vote for their own pools rather than those most efficient or beneficial for the protocol.

Does veToken governance fail at effective token distribution? What about token price?

Could it still succeed by creating illiquidity at scale and driving up the token price?

It fails at that too.

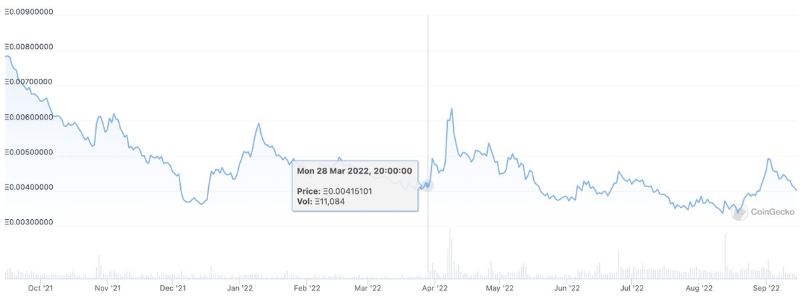

If we look at the price of BAL denominated in ETH (to remove market trends), we see a slight bump in the weeks following veBAL’s launch—but nothing beyond historical trends.

Even if we attribute this bump to veBAL, it wasn’t sustained and reflected trader sentiment more than any sound long-term strategy.

Why doesn't illiquidity drive up prices?

Because lock-up periods don’t work—traders who want to sell their tokens simply won’t lock them. Only tokens that were never intended to be sold get locked up.

veToken economics fails to solve both bootstrapping incentive emissions and preventing token dumps (reducing spend). It also misallocates tokens to inefficient liquidity pools. In my view, veToken governance has objectively failed.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News