Balancer hack aftermath continues, which of your assets could be affected by Stream's xUSD depeg?

TechFlow Selected TechFlow Selected

Balancer hack aftermath continues, which of your assets could be affected by Stream's xUSD depeg?

The market is not doing well, wishing you safety.

On November 3, Balancer suffered its worst attack in history, losing $116 million.

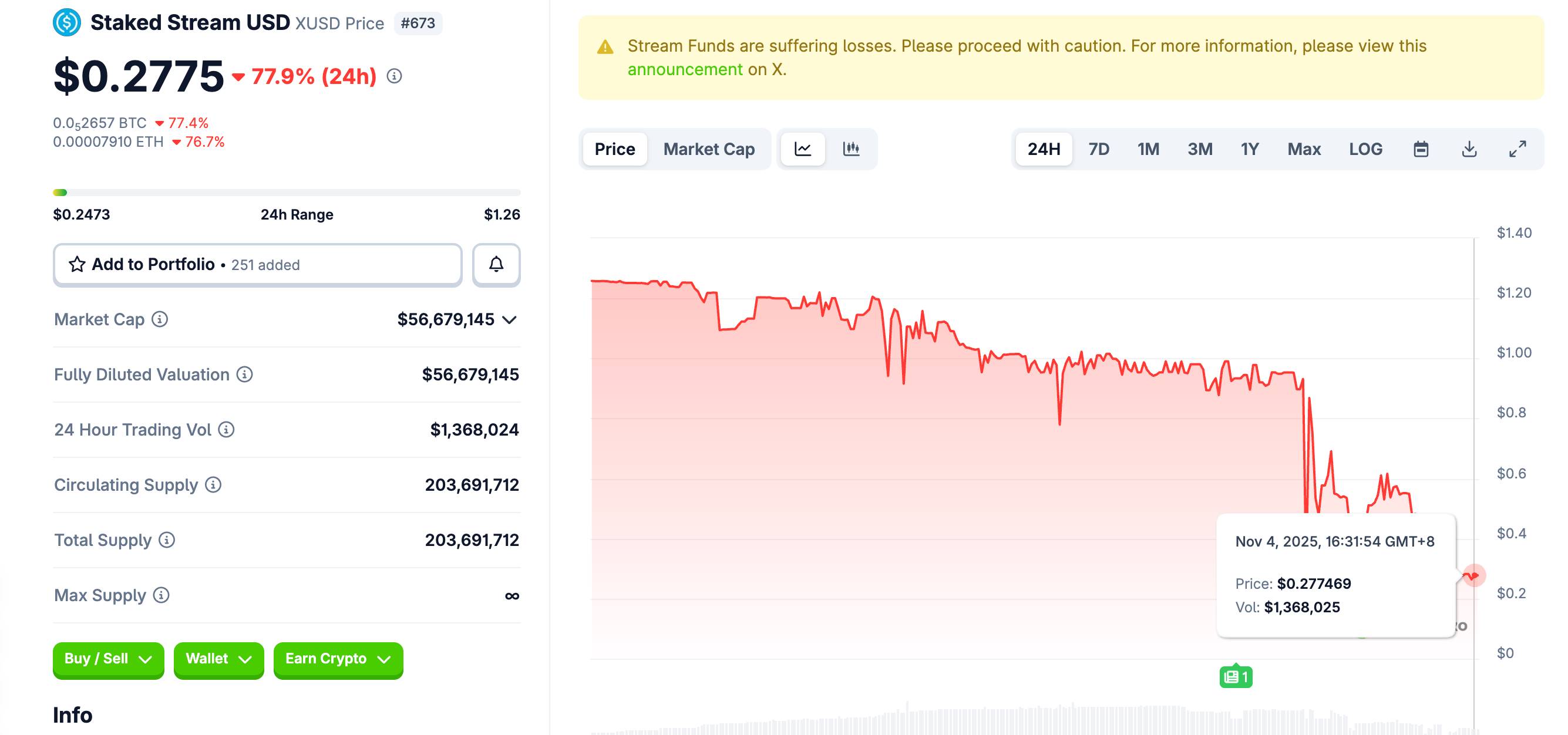

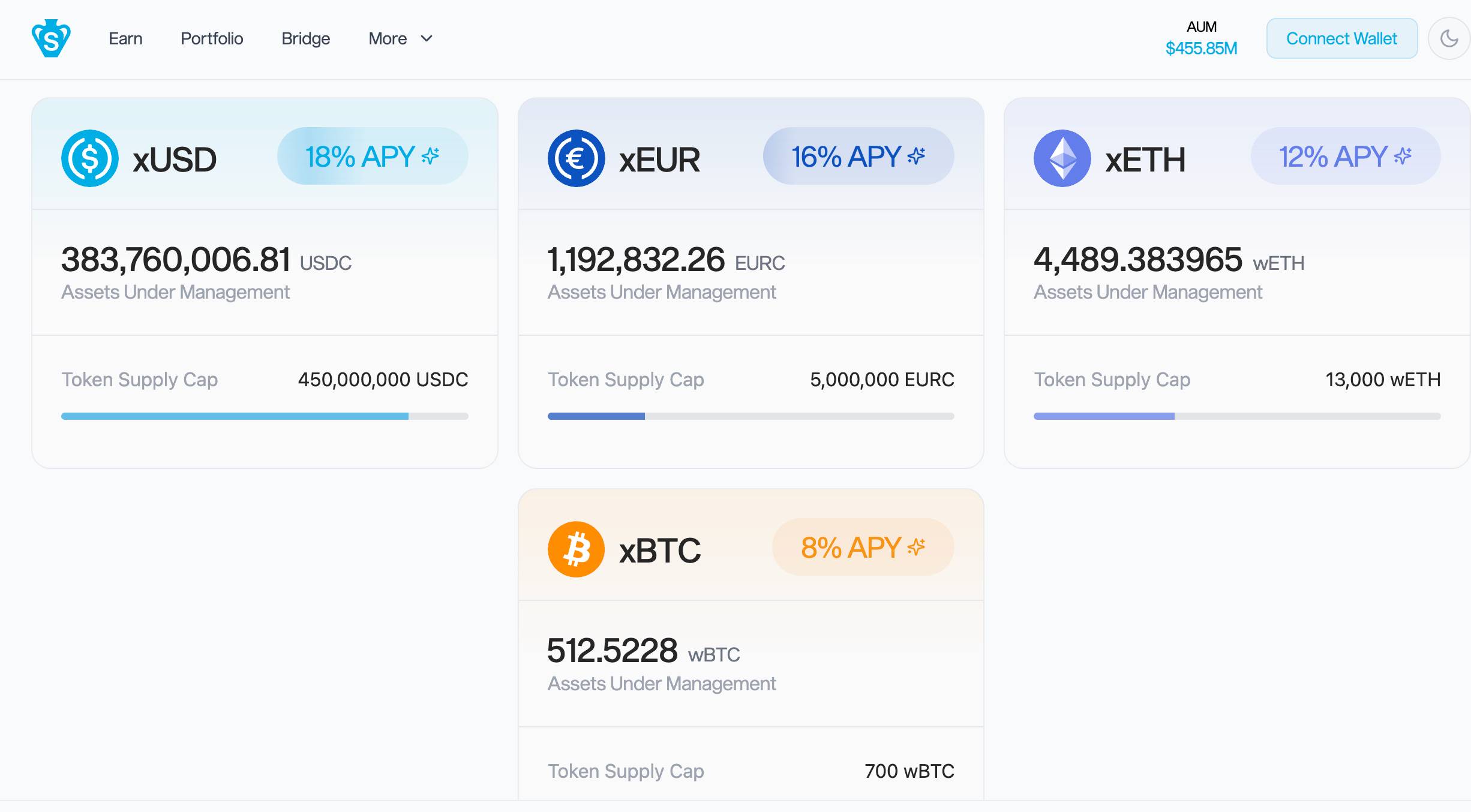

Just 10 hours later, another seemingly unrelated protocol, Stream Finance, began showing abnormal withdrawal patterns. Within 24 hours, its issued stablecoin xUSD started to depeg, plummeting from $1 to $0.27.

If you think this is just a story of two independent protocols getting unlucky, you're wrong.

According to on-chain data, approximately $285 million in DeFi loans use xUSD/xBTC/xETH as collateral. From Euler to Morpho, from Silo to Gearbox, nearly every major lending platform has exposure.

Worse still, 65% of Elixir's deUSD stablecoin reserves ($68 million) are exposed to risks from Stream.

This means that if you have deposits on any of the above platforms, hold related stablecoins, or have provided liquidity, your funds may already be caught in a crisis you don't yet know about.

Why did the Balancer hack create a butterfly effect that triggered problems at Stream? Are your assets actually at risk?

We aim to help you quickly understand these recent negative events and identify potential asset risks.

Balancer’s Butterfly Effect: xUSD Depegs Due to Panic

To understand xUSD's depeg and the potentially affected assets, we must first clarify how two seemingly unrelated protocols became fatally linked.

First, after the veteran DeFi protocol Balancer was hacked yesterday, the attacker made off with over $100 million. Since Balancer holds various assets, the news spread rapidly, sending shockwaves of panic across the entire DeFi market.

(Further reading: Five Years, Six Incidents, Losses Exceeding $100 Million: The Hack History of Veteran DeFi Protocol Balancer)

Although Stream Finance has no direct connection to Balancer, its depeg stems from the spread of panic and a bank run.

If you're unfamiliar with Stream, think of it simply as a high-yield-seeking DeFi protocol whose method for achieving high returns relies on "recursive looping":

In short, it repeatedly mortgages and borrows user deposits to amplify investment scale.

For example, if you deposit $1 million, Stream uses that $1 million as collateral on Platform A to borrow $800,000, then uses that $800,000 on Platform B to borrow $640,000, and so on. Eventually, your $1 million could be leveraged into a $3 million investment position.

According to Stream’s own data, they used this method to leverage $160 million in user deposits into $520 million in deployed assets. This over 3x leverage generates attractive high yields during stable markets, allowing Stream to attract many yield-seeking users.

But high yield comes with high risk. When news of the Balancer hack broke, DeFi users’ first reaction was: “Is my money still safe?”

A large number of users began withdrawing from various protocols. Stream’s users were no exception; the problem is, Stream’s funds may not be readily accessible.

Through recursive looping, capital is nested layer by layer across multiple lending protocols.

To meet withdrawal requests, Stream needs to unwind these positions step by step—first repaying loans on Platform C to retrieve collateral, then repaying Platform B, then Platform A. This process is not only time-consuming but may also face liquidity shortages during market panic.

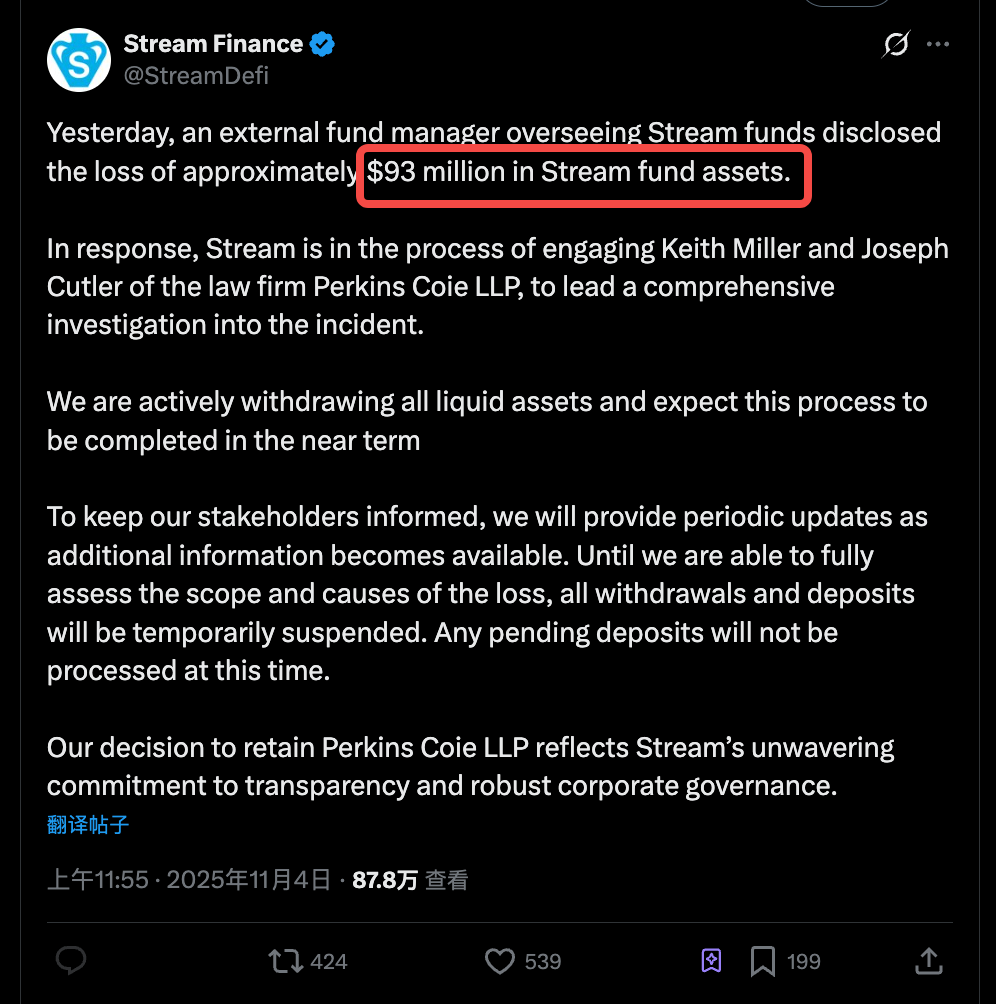

Even more critically, at the peak of user withdrawals, Stream Finance posted a shocking statement on Twitter: an “external fund manager” overseeing Stream’s funds reported that approximately $93 million in assets had gone missing.

Users were already panicking and withdrawing funds—now a nearly $100 million shortfall emerged.

Stream stated it has hired top law firm Perkins Coie for investigation. While the announcement sounds official, it says nothing about how the funds disappeared or when they might be recovered.

Markets won’t wait for investigation results. When users notice delayed withdrawals, a full-scale bank run begins.

xUSD, the "stablecoin" issued by Stream, should be pegged to $1. But once users realized Stream might not honor its promises, a massive sell-off ensued. From late November 3 to today, xUSD has dropped to around $0.27, severely de-anchored.

Therefore, xUSD’s depeg isn’t due to technical failure—it’s a collapse of confidence. With crypto markets declining, the Balancer hack was merely the spark; the real bomb may be Stream’s own high-leverage model, or even a systemic issue shared by similar DeFi protocols.

Asset Checklist You Need to Review

xUSD’s crash is not an isolated event.

According to on-chain analysis by Twitter user YAM, about $285 million in loans currently use Stream-issued xUSD, xBTC, and xETH as collateral. This means if these stablecoins and collateral assets go to zero, the entire DeFi ecosystem will feel the impact.

If the mechanics are unclear, consider this analogy:

Stream issues three types of "IOUs" using your deposited stablecoins like USDC:

-

xUSD: A certificate meaning "I owe you USD"

-

xBTC: A certificate meaning "I owe you Bitcoin"

-

xETH: A certificate meaning "I owe you Ethereum"

Under normal conditions, suppose you take xUSD (a dollar IOU) to the Euler platform and say: “This IOU is worth $1 million—I’ll pledge it and borrow $500,000.”

But when xUSD depegs:

If xUSD falls from $1 to $0.30, your pledged “$1 million” is actually only worth $300,000—but since you borrowed $500,000, Euler ends up losing $200,000.

Simply put, this becomes bad debt, ultimately requiring DeFi protocols like Euler to cover the loss. The problem is, most of these lending platforms likely aren’t prepared for bad debt of this magnitude.

Worse, many platforms use "hard-coded" price oracles—not real-time market prices, but fixed "book values"—to assess collateral value.

This helps avoid unnecessary liquidations from short-term volatility, but now it’s become a ticking time bomb.

Even though xUSD has fallen to $0.30, the system may still treat it as worth $1, preventing timely risk control.

According to YAM’s analysis, the $285 million in debt is distributed across multiple platforms, managed by different "Curators" (fund managers). Let’s examine which specific platforms are sitting on this powder keg:

-

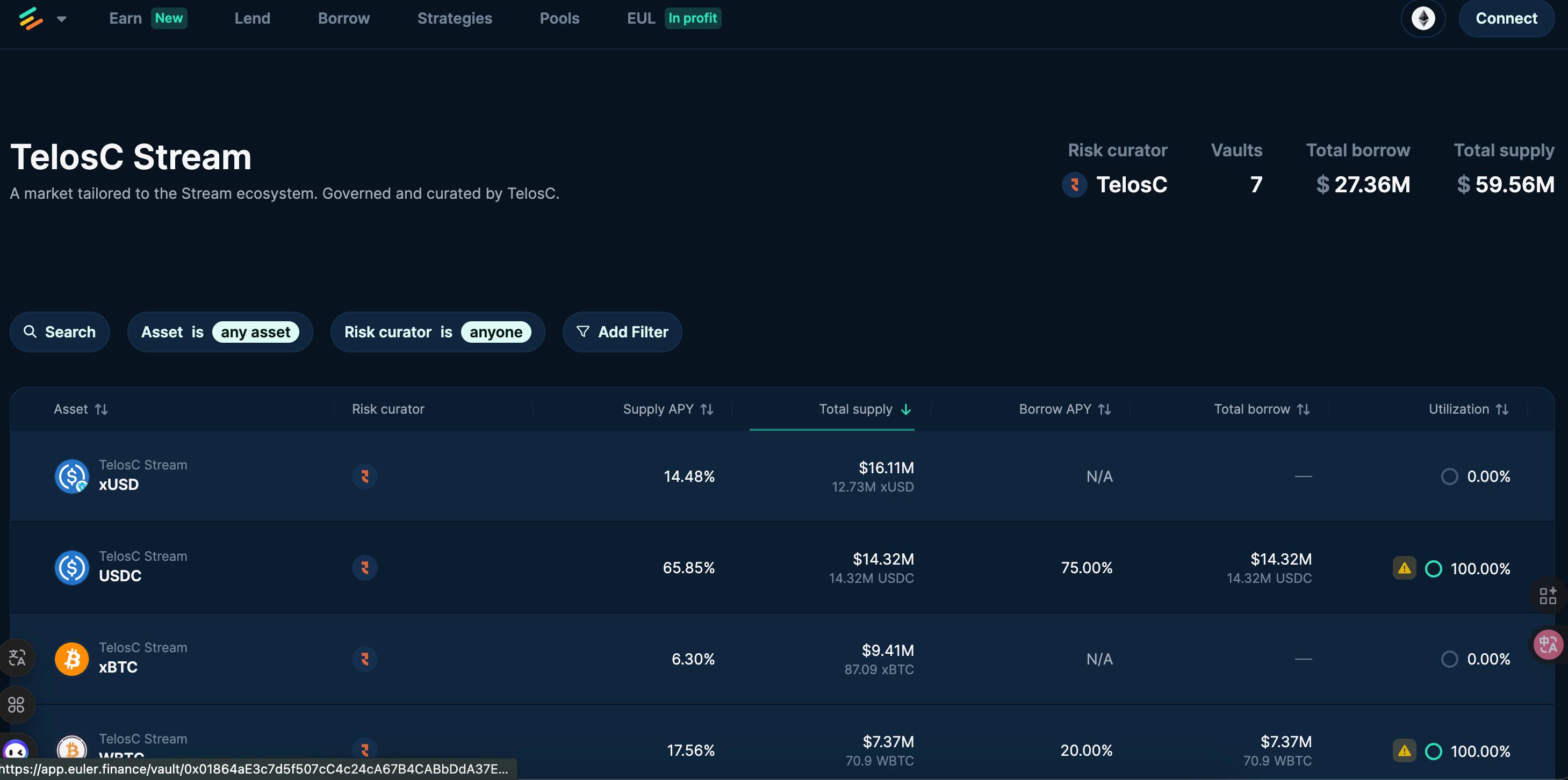

Biggest Victim: TelosC - $123.6 Million

TelosC is the largest fund manager, operating two main markets on Euler:

-

Ethereum Mainnet: Lent out $29.85 million in ETH, USDC, and BTC

-

Plasma Chain: Lent out $90 million in USDT plus nearly $4 million in other stablecoins

This $123.6 million accounts for nearly half of the total exposure. If xUSD goes to zero, TelosC and its investors will suffer massive losses.

If you have deposits in these Euler markets, you may already be unable to withdraw normally. Even if Stream eventually recovers part of the funds, the process of liquidation and bad debt resolution will take a long time.

-

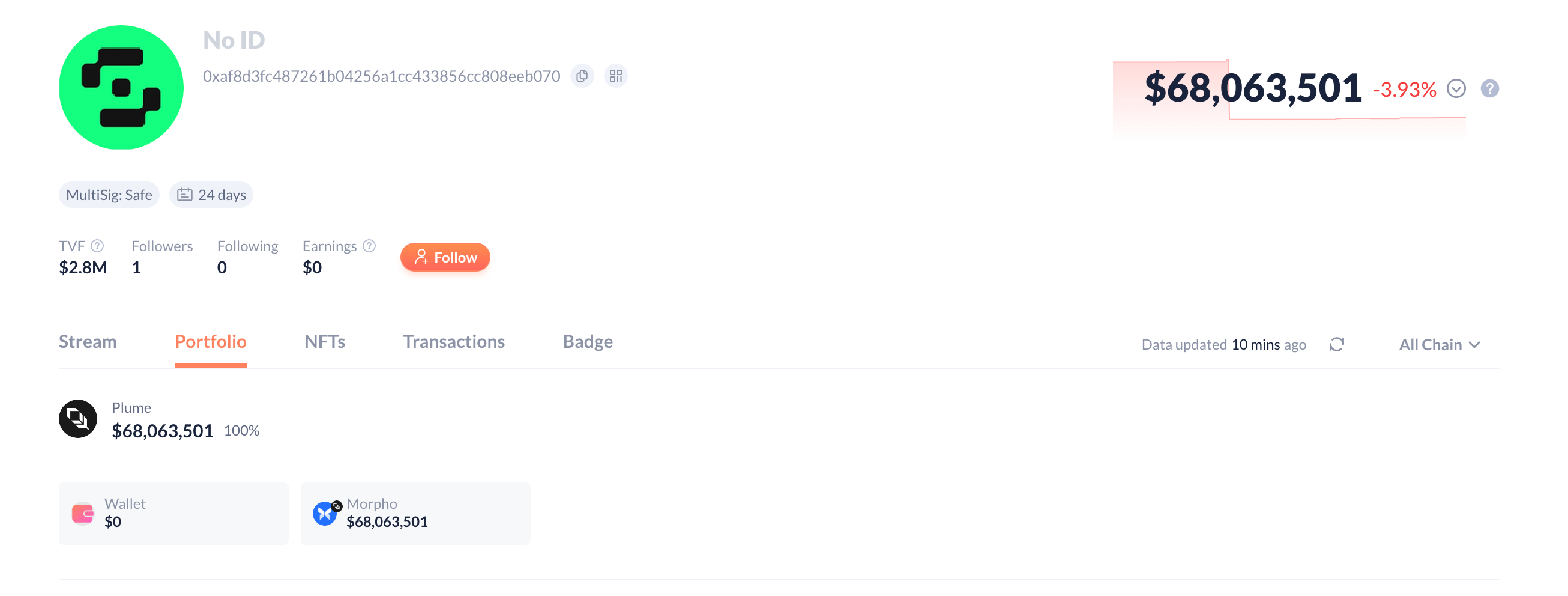

Indirect Blow-Up: Elixir's deUSD, $68 Million

Elixir lent $68 million in USDC to Stream, representing 65% of deUSD’s stablecoin reserves. Although Elixir claims to have “1:1 redemption rights”—the only creditor with such rights—the Stream team previously responded that payments cannot be made until lawyers determine who is entitled to what.

This means if you hold deUSD, two-thirds of your stablecoin’s value depends on whether Stream can repay. And right now, both “whether” and “when” are unknown.

-

Other Scattered Risk Points

On Stream, "Curators" are professional entities or individuals responsible for managing capital pools. They decide which collateral to accept, set risk parameters, and allocate funds.

In short, they act like fund managers, using others' money to lend and earn returns. Now, these "fund managers" are all trapped by Stream’s collapse:

-

MEV Capital - $25.42 Million: An investment firm focused on MEV (Maximal Extractable Value) strategies, active across multiple chains:

For example, in the Sonic chain’s Euler market, it deposited $9.87 million in xUSD and 500 xETH; on Avalanche, it has $17.6 million in xBTC exposure (272 BTC lent out).

-

Varlamore - $19.17 Million: A major liquidity provider on Silo Finance, with exposure distributed across:

Arbitrum: $14.2 million in USDC, nearly 95% of that market;

Avalanche and Sonic: Approximately $5 million. Varlamore manages institutional and whale funds—this event could trigger mass redemptions.

-

Re7 Labs - $14.26 Million: Re7 Labs opened a dedicated xUSD market on Euler’s Plasma chain, with the entire $14.26 million in USDT.

Other smaller players potentially affected include:

-

Mithras: $2.3 million, focused on stablecoin arbitrage

-

Enclabs: $2.56 million, operating across Sonic and Plasma chains

-

TiD: $380,000, small amount but possibly their entire capital

-

Invariant Group: $72,000

These Curators surely weren’t gambling with deposited funds—they must have assessed the risks. But when the upstream protocol Stream fails, all downstream risk controls become helpless.

Market Downturn: Is a Crypto-Style Subprime Crisis Unfolding?

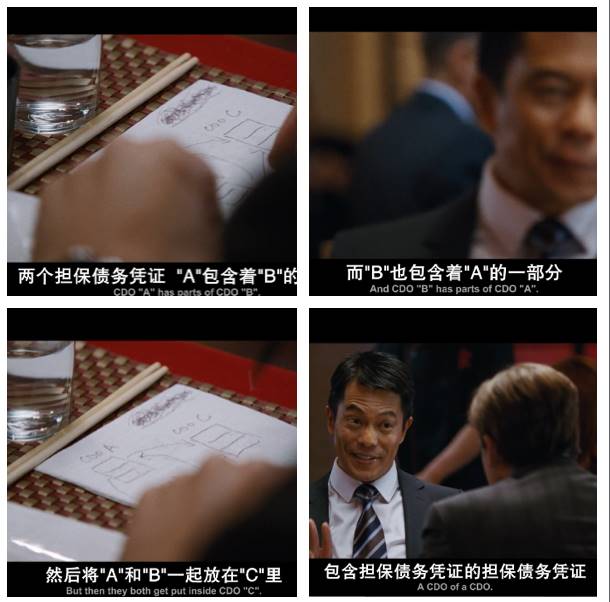

If you’ve seen the movie *The Big Short*, what’s happening now might feel eerily familiar.

In 2008, Wall Street bundled subprime mortgages into CDOs, then into CDO², and rating agencies slapped them with AAA labels. Today, Stream leverages user deposits via recursive looping by 3x, and xUSD is accepted by major lending platforms as “high-quality collateral.” History doesn’t repeat, but it rhymes.

Stream previously claimed $160 million in deposits, but this level of deposits ended up deploying $520 million in assets. How was that number reached?

DefiLlama long questioned this calculation method—recursive lending is essentially double-counting the same money, a form of inflated TVL.

The contagion path of the subprime crisis: mortgage defaults → CDO collapse → investment bank failures → global financial crisis.

The current path: Balancer hack → Stream bank run → xUSD depeg → $285 million in loans turn into bad debt → more protocols may collapse.

Using DeFi protocols for high-yield farming—when the market is good, few ask where the profits come from. But when negative events occur, it’s your principal that’s at risk.

You may never truly know the actual risk exposure of your funds in DeFi protocols. In a DeFi world without regulation, insurance, or a lender of last resort, the safety of your funds rests solely in your own hands.

The market isn’t kind. Stay safe.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News