Balancer hack's butterfly effect: Why did $XUSD lose its peg?

TechFlow Selected TechFlow Selected

Balancer hack's butterfly effect: Why did $XUSD lose its peg?

Long-standing issues surrounding leverage, oracle construction, and PoR transparency have resurfaced.

Author: Omer Goldberg

Translation: TechFlow

Summary

Hours after a vulnerability attack on the multi-chain platform @Balancer triggered widespread uncertainty in the DeFi sector, @berachain executed an emergency hard fork and @SonicLabs froze the attacker's wallet.

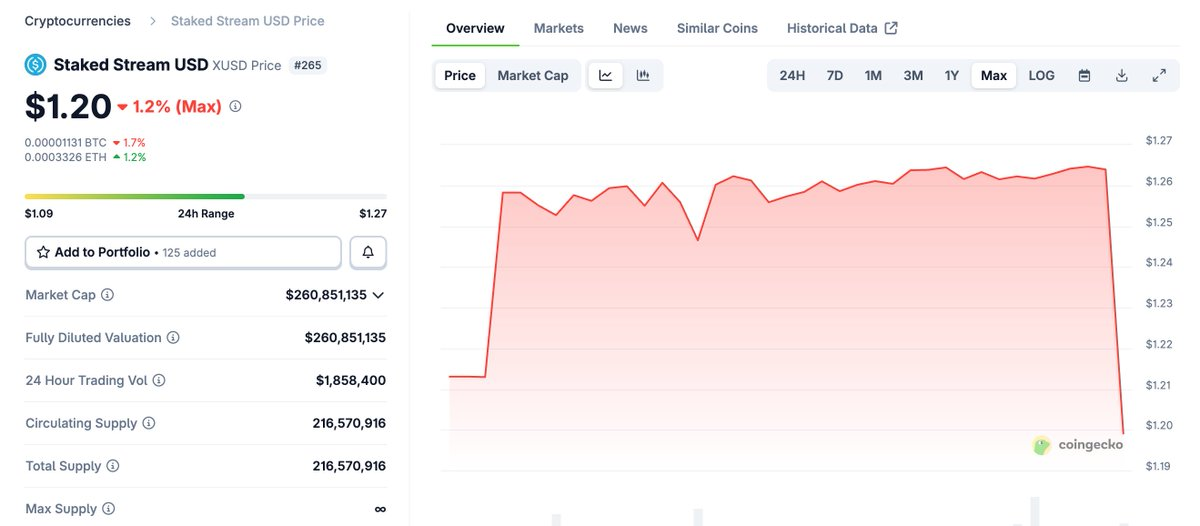

Subsequently, Stream Finance’s xUSD stablecoin deviated significantly from its target range, showing clear signs of de-pegging.

Long-standing Issues Resurface

Ongoing debates around leveraged operations, oracle design, and transparency of proof-of-reserves (PoR) have once again come into focus.

This is precisely the type of "reflexive stress event" we outlined last Friday in our article “DeFi’s Black Box / Vault.”

What Happened? / Background

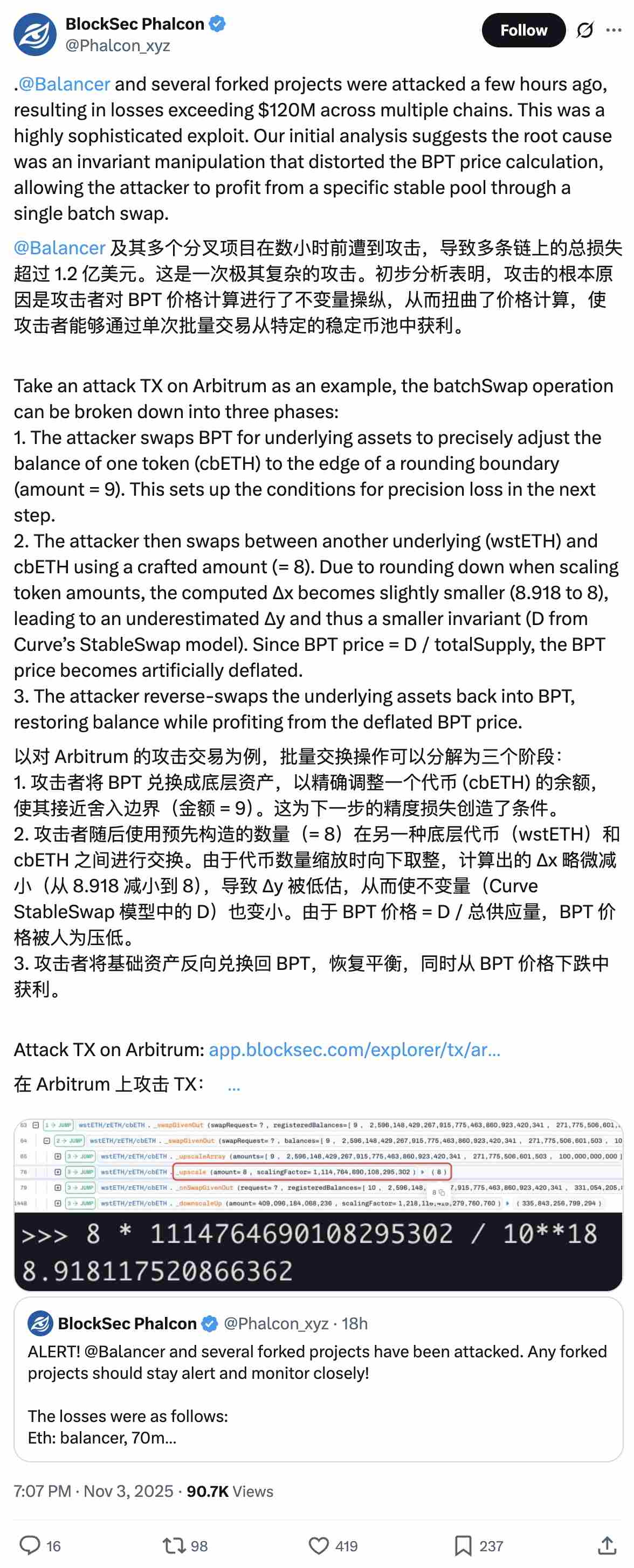

The Balancer v2 vulnerability erupted across multiple chains, and for an extended period it remained unclear which pools were affected and which networks or integrated protocols were directly exposed to risk.

Capital Panic in an Information Vacuum

In the absence of clear information, capital reacted as it always does: depositors rushed to withdraw liquidity from anywhere they perceived possible direct or indirect exposure—including Stream Finance.

Controversy Over Lack of Transparency

Stream Finance currently does not maintain a comprehensive transparency dashboard or proof-of-reserves (Proof of Reserve). However, it provides a link to a Debank Bundle showing its on-chain positions.

Yet, following the exploit, these basic disclosures failed to clearly address exposure risks: xUSD (Stream’s yield-accruing dollar product) dropped from its target price of $1.26 to $1.15, has since recovered to $1.20, and users reported withdrawal suspensions.

Risks and Controversies Surrounding Stream Finance

Stream is an on-chain capital allocation platform that uses user funds to execute high-return, high-risk investment strategies.

Its portfolio construction employs significant leverage, making the system more fragile under stress. Recently, the protocol has drawn public scrutiny due to controversies surrounding its recursive minting mechanism.

While the current situation does not directly indicate a liquidity crisis, it reveals the market’s extreme sensitivity. When negative news emerges and confidence is questioned, the shift from “probably fine” to “redeem immediately” can be extremely rapid.

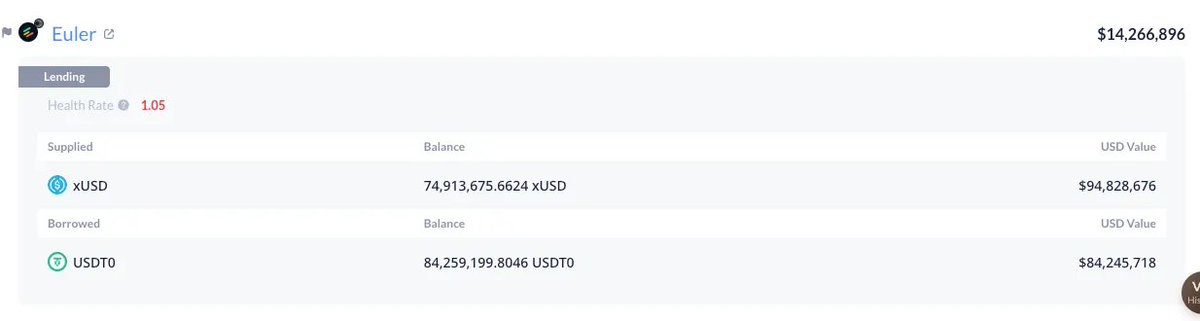

xUSD is used as collateral across curated markets on multiple chains, including Euler, Morpho, and Silo, spanning ecosystems such as Plasma, Arbitrum, and Plume.

The protocol itself has significant exposure in these markets, with the largest being an $84 million USDT loan backed by xUSD on Plasma.

Collateral Mechanism and Risk Buffering

When the market price of xUSD falls below its book value, related positions are not immediately liquidated because many markets do not tie collateral valuation to spot AMM (automated market maker) prices. Instead, they rely on hardcoded or “base value” price feeds that track reported asset backing rather than current secondary market prices.

Under normal conditions, this design helps mitigate tail-risk liquidations caused by short-term volatility—especially for stable products. This was one reason why DeFi protocols outperformed centralized platforms during the liquidation wave on October 10.

However, this design may quickly turn price discovery into trust discovery: choosing base or hardcoded oracles requires thorough due diligence, including verification of asset backing authenticity, stability, and risk profile.

In short, this mechanism only works when full proof-of-reserves (Proof of Reserve) is available and redemptions can be fulfilled within a reasonable timeframe. Otherwise, lenders or depositors may ultimately bear the cost of bad debt.

Stress Test on Arbitrum

On Arbitrum, for example, the current market price of the MEV Capital Curated xUSD Morpho Market has already fallen below LLTV (lowest loan-to-value ratio). If xUSD’s peg cannot recover, and utilization reaches 100% with borrowing rates spiking to 88%, the market could deteriorate further.

We are not opposed to base oracles—in fact, they play a crucial role in preventing unfair liquidations triggered by short-term volatility. Likewise, we do not oppose tokenized or even centralized yield-bearing assets. But we argue that when deploying money markets around such assets, basic transparency must be met, along with modern, systematic, and professional risk management.

Curated Markets can serve as engines for responsible growth, but they must not become races to chase high yields at the expense of security and rationality.

If you build domino-like complex structures, you shouldn’t be surprised when they collapse at the first gust of wind. As the industry becomes more professional and certain yield products become more structured—yet more opaque to end users—risk stakeholders must raise their standards.

While we hope affected users will ultimately be made whole, this incident should serve as a wake-up call for the entire industry.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News