Web3 Long-term Operation Strategy: Providing Continuous Services to Users Instead of Falling into Ponzi Incentives

TechFlow Selected TechFlow Selected

Web3 Long-term Operation Strategy: Providing Continuous Services to Users Instead of Falling into Ponzi Incentives

Conditions required to successfully launch a Web3 project that can enhance brand loyalty and awareness, rather than harm it.

Written by Bastian, VP of Products at Smart Token Labs

As more and more brands enter the Web3 space, bringing thousands of users along with them, it's worth stepping back to examine what conditions are necessary for successfully launching a Web3 project—one that enhances brand loyalty and recognition rather than harming it.

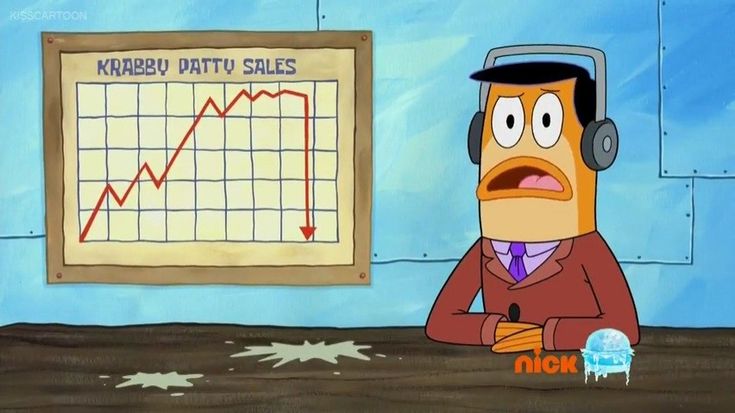

After the initial NFT hype of early 2021 faded, it became clear that simply uploading JPEGs onto a blockchain isn't enough to create value, sustain a healthy community, or drive holder engagement. A classic example is Jack Dorsey’s first tweet, sold as an NFT for $2.9 million. The buyer later listed the NFT on OpenSea for $50 million, pledging half the proceeds to charity. When the auction ended a week later, the NFT had only seven bids, with the highest at 0.09 ETH (worth about $109 at the time of writing). Jack Dorsey’s Twitter NFT failed to maintain its original sale price, let alone appreciate in value—because it offered no additional benefits to its owner. It was merely a "keepsake" commemorating a significant moment in internet history, providing no rights or utilities beyond being issued on the blockchain.

A new study from blockchain analytics firm Nansen shows that most NFT collections either lose money or generate net profits lower than their creation costs. One-third of NFT collections on the market have seen little to no trading activity. An illustrative case is World Wrestling Entertainment’s (WWE) experiment with NFTs: among the initial 500 NFTs released, only 7.4% were purchased by genuine fans. This is a company with a built-in audience and passionate followers, regularly selling out stadiums each week. Yet, due to the lack of meaningful utility beyond a $1,000 ticket price and a few physical goods handpicked by John Cena, both the Web3 and WWE communities showed little interest in the collection. This raises the question: were the intended audiences truly interested in WWE itself?

On the other hand, Nike has been actively experimenting with its Web3 strategy. In December 2021, they acquired the NFT studio RTFKT. Since then, they’ve had several successful NFT launches, generating $185 million in revenue. Their first major campaign was Cryptokicks—a series of 20,000 sneaker NFTs, one designed by artist Takashi Murakami and sold for $134,000. Additionally, the company has experimented with exclusive NFT airdrops and phygital (physical-digital hybrid) projects. Customers who purchased digital collectible sneakers gained the chance to receive corresponding physical pairs. RTFKT’s Discord server currently hosts 236,000 members, demonstrating their strong community-building capabilities and ability to deliver real economic value to their most loyal customers through Web3.

When brands seek similar cultural relevance in Web3, they must compete with esports brands, emerging digital fashion companies, TikTok influencers, and YouTube content creators—many of whom already resonate deeply with Gen Z. While others are just beginning to explore Web3, Nike has already firmly embedded itself within Web3 culture. Nike sees Web3 not merely as a new technology to dabble in, but as part of a broader phenomenon—a new cultural movement. And clearly, Nike has rapidly established itself as one of the most popular and influential brands in the Web3 space.

(courtesy of Midjourney — A visual representation of business commitment)

From Nike’s strategy, we can easily infer that building a strong community is the most critical prerequisite for creating a successful loyalty program or NFT project. The quality of the community ultimately determines the success of the project. Your collectors (community participants) should always be the top priority—whether you're an independent artist or a traditional brand dipping your toes into Web3. The more effort invested now in cultivating a brand presence, the greater the chances of launching a successful NFT project and building a long-term, loyal fanbase. Fair pricing is crucial, as demonstrated by the failure of the WWE NFT project. Some projects, like Smol Brain, have adopted a "free mint" model, aiming to generate value and manage risk through secondary market sales.

Developing a compelling roadmap, promoting it across the right social media channels, and consistently delivering on that roadmap are equally essential prerequisites for success. We should stop trying to replicate BAYC’s path to success. BAYC began with 10,000 unique ape artworks, but its community evolved continuously, offering new benefits to holders over time. Early on, BAYC airdropped serums that allowed holders to create Mutant Apes, significantly boosting engagement—many BAYC owners were able to sell their mutants or serums for far above the original mint price. Later, they announced the development of the Otherside metaverse and distributed ApeCoin as its future currency. Holders could use ApeCoin to purchase land in the metaverse called OtherDeeds and build public facilities on it, eventually monetizing those assets. Through all these innovative initiatives, it’s clear that BAYC is committed to creating long-term value for its holders.

Nansen’s Trends & Indices dashboard shows that by the end of 2022, Ethereum NFT trading volume reached 8.22 million ETH across 2.46 million unique wallets. The total market capitalization of the NFT market exceeded $11.3 billion. It’s projected that the market will grow at an annual rate of 33.8% over the next eight years, reaching a total market cap of $231 billion by 2030. These statistics reinforce the argument: brands must adapt to Web3 and commit to providing users with ongoing, engaging content and services. Otherwise, as this technology becomes mainstream, they risk falling behind and struggling to capture market share.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News