How Can Web3 Open New Avenues for Enhancing User Loyalty?

TechFlow Selected TechFlow Selected

How Can Web3 Open New Avenues for Enhancing User Loyalty?

One of the most promising application areas for Web3 is customer loyalty programs.

Many enterprises have overlooked the potential advantages of Web3. Coupled with recent cryptocurrency market crashes that wiped out billions in customer wealth, public perception of Web3 may remain tied to such negative events—especially high-profile collapses like the now-bankrupt FTX exchange, which ushered in a so-called "crypto winter" and scared off many retail companies and institutional players from embracing Web3’s promises.

Web3, the third evolution of the internet, holds one of its most promising applications in customer loyalty programs. Web3 offers multiple ways to revitalize loyalty initiatives. Concepts like tokenization—digital tokens representing assets or ownership—support use cases related to wholesale payments, identity management, and, crucially for retailers, new revenue streams through loyalty. Today’s consumers are open to loyalty relationships, and Web3 provides a rich environment adaptable to consumer needs, boosting engagement and expanding partnership networks more effectively.

Meanwhile, rapidly evolving regulatory and technological conditions are pushing brands to view loyalty programs as reliable drivers for collecting customer data. Regulators are increasingly scrutinizing consumer privacy, while major tech platforms are restricting third-party cookies and tightening controls around data sharing. As more brands focus on a cookie-less future, they are eager to build their own loyalty programs to gather first-party data and better engage customers—an effort where Web3’s inherent diversity can play a key role.

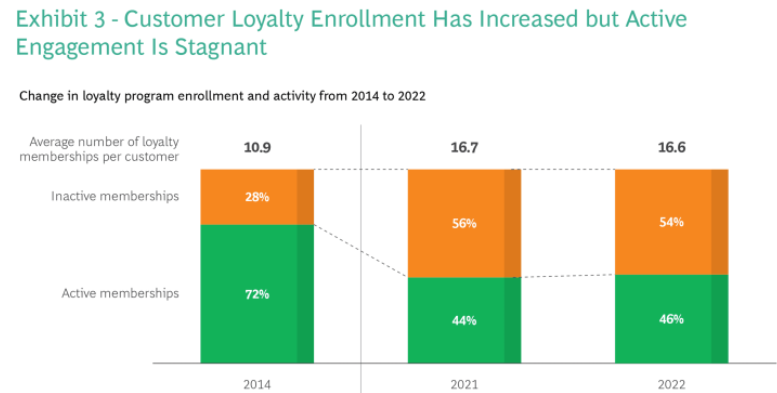

However, the solution isn’t simply launching yet another loyalty program into an already saturated market. According to Bond’s Brand Loyalty Report, U.S. consumers held memberships in over 16 loyalty programs on average in 2022. Yet, active participation remains frustratingly low, with fewer than 50% of enrolled members actively engaging in recent years. Enterprises must understand various Web3 solutions that boost engagement; consumers will make choices, but only for products they truly value and enjoy.

Benefits—the services and features customers can access alongside digital assets—are critical to the success of Web3 loyalty programs. Companies can tokenize customer relationships via non-fungible tokens (NFTs) to increase engagement and activate brand-specific communities. Tokenizing transactions to strengthen cross-partner loyalty collaborations also makes sense. Enterprises should avoid mimicking short-lived mainstream cases or, worse, shying away entirely from the Web3 wave out of caution. This article explores challenges in existing loyalty models, examines Web3 technology applications in loyalty, and provides a framework to help businesses restart or enhance their loyalty offerings to drive customer activity.

Getting Started with Web3

Discussions about Web3 are often clouded by misunderstanding or hype, making it essential to clarify how this new technology differs from previous versions of the internet. Web3 integrates emerging technologies, with blockchain at its core, giving users greater control over their activities and interactions online.

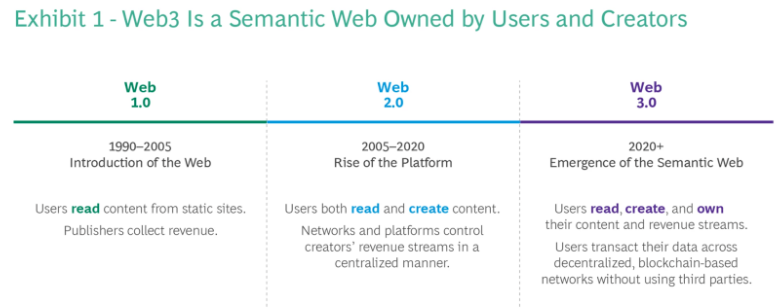

Web1.0, lasting roughly from 1990 to 2005, supported an information economy where publishers controlled content and earned revenue while users consumed it.

Web 2.0 (2005–2020) ushered in the platform economy, enabling users to both read and create content. However, these platforms still centrally controlled creators’ revenue sources. (See Figure 1).

Web3 ushers in a token-based, decentralized application era powered by blockchain. Through tokens, users directly own their identities and monetize the content they produce. Tokens allow active participants and creators to gain economic benefits from network activities without intermediaries. These tokens are fungible assets, such as cryptocurrencies or stablecoins, or non-fungible tokens (NFTs). (For more on Web3 technology, see “Web3 Fundamentals.”)

Web3 Fundamentals

When discussing Web3, numerous buzzwords and industry terms come into play:

Blockchain: As the building block of Web3, blockchain operates as a distributed database or ledger across a network of nodes, maintaining secure and decentralized transaction records.

Smart Contracts: These are programs that execute transactions based on predefined conditions, operating automatically without human intervention.

Fungible Tokens: Composed of data on a blockchain, these represent non-unique, divisible assets (such as currency).

Non-Fungible Tokens (NFTs): Blockchain data representing unique, non-replicable asset ownership (e.g., art collectibles).

Cryptocurrency: Digital currency known as fungible tokens on blockchains, secured by cryptography to prevent counterfeiting or double-spending. Cryptocurrencies include volatile tokens like Bitcoin and Ethereum, as well as fiat-pegged stablecoins like USDC.

Token Gating: A method where companies use digital tokens (often NFTs) to restrict access to content, products, or services.

Decentralized Autonomous Organizations (DAOs): Communities of users governed collectively without centralized management, making decisions from the bottom up; DAOs are popular in some online projects.

Decentralized Finance (DeFi): Financial products managed programmatically via smart contracts, without intermediaries.

Challenges Facing Today's Loyalty Programs

Regardless of how many members a company’s loyalty program attracts, there are persistent challenges in fostering meaningful interactions between brands and new customers—interactions that loyalty programs are meant to facilitate but often fail to deliver. (See Figure 2)

Fragmented Loyalty Relationships. Although most customers are willing to join loyalty programs, managing multiple accounts often overwhelms them with promotional messages and fragmented information from different programs (see Figure 3). An increasing number of ads and offers pop up randomly on their screens, rarely personalized. This constant flood of promotions dilutes the visibility of individual programs.

To compete, brands must build compelling loyalty products that stand out in crowded markets, offering simple and addictive user experiences, along with meaningful partnerships.

Engaging the Long Tail: Low-Activity Users. Many programs face large populations of inactive users, especially in travel, hospitality, and luxury sectors. Engaging these less-active customers can effectively convert their latent participation into additional revenue.

Brands should explore diverse incentives and rewards, with cash being the simplest option. According to Bakkt’s 2022 Loyalty Program & Rewards Outlook Study, 66% of U.S. consumers prefer cashback over earning points. While long-term point or merchandise rewards may appeal to certain customer segments, they don’t attract everyone. Instead, converting fungible points into cash, digital assets with potential utility, or forms usable across other programs can effectively engage inactive long-tail users.

Closed Ecosystems. Large digital platforms dominate customer attention, leaving smaller brands and merchants squeezed out. For example, tech giants have built self-sustaining, closed ecosystems offering broad product and service ranges.

To reach more customers, brands must enter these ecosystems—or so-called “walled gardens”—where third-party companies or platforms control access to users and advertising.

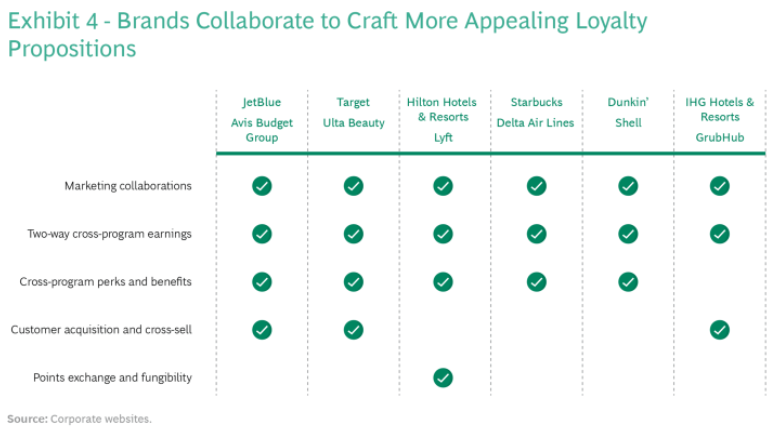

One way brands can scale competitively is through multi-party partnerships that attract consumers. Collaborations enable brands to access broader audiences, deeper insights, and wider reward incentives. The resulting numbers are impressive: for instance, Starbucks’ partnership with Delta Airlines allowed Delta to tap into Starbucks’ 27 million loyal customers, many of whom might not otherwise fly Delta. Starbucks, in turn, gained additional touchpoints during customers’ travel experiences. (See partnership examples in Figure 4.)

Complex Partnerships at Scale. While many partnership opportunities exist, establishing and managing them remains difficult. Brands often create “connected loyalty” arrangements to offer more comprehensive content across distinct customer bases. However, these are mostly point-to-point integrations, hard to scale beyond one-on-one setups into broader, interoperable ecosystems. Moreover, managing cross-program agreements involves significant overhead, including legal and regulatory compliance, currency tracking and reconciliation, and marketing coordination.

Web3 offers methods to expand cooperation and automate these complex details, potentially unlocking enhanced functionality as companies improve their loyalty offerings.

Diversity in Community Engagement via Web3 Loyalty Programs

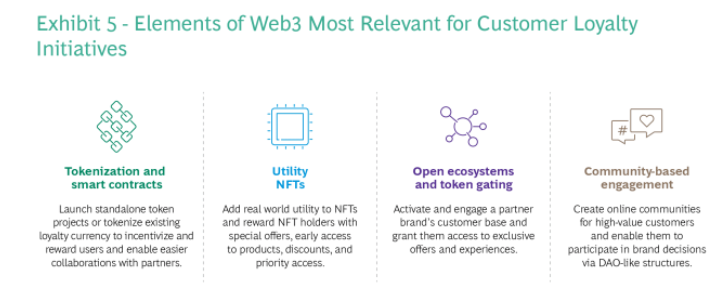

Leading Web3 use-case brands act systematically and strategically, thoroughly examining how Web3 integrates into their customer engagement and loyalty strategies. Others experiment with various Web3 paths, such as NFT airdrops, opening metaverse branches, or rewarding with cryptocurrency. (See Figure 5)

Tokenization and Smart Contracts

The world of Web3 content creation illustrates how tokenization can enhance loyalty programs. Creators can use tokens to launch projects and build communities of loyal, active fans who gain access to premium content and interact with each other and the creator.

For loyalty programs, brands’ fungible and non-fungible tokens on blockchains can replace or complement traditional points within tiered loyalty management systems. These tokens can gamify interactions, track brand engagement, and incentivize participation with real-world benefits and rewards. Tokens also open new pathways for easier integration with diverse partners and merchants under interoperable rules. Smart contracts can automate administrative responsibilities and reduce manual settlement overhead across partners.

A case focused on tokenization and partnerships: In October 2021, Starbucks announced its intention to explore tokenizing its Stars rewards on blockchain to simplify partner onboarding. A year later, Starbucks announced a loyalty partnership with Delta Airlines.

Benefit-Based NFTs

Collectible, digitally native NFTs have created wealth effects. However, due to early speculative trading by mainstream consumers, blue-chip NFTs have recently struggled. For example, Bored Ape Yacht Club (BAYC) floor prices peaked at around $420,000 in May 2022 but fell nearly 80% by year-end.

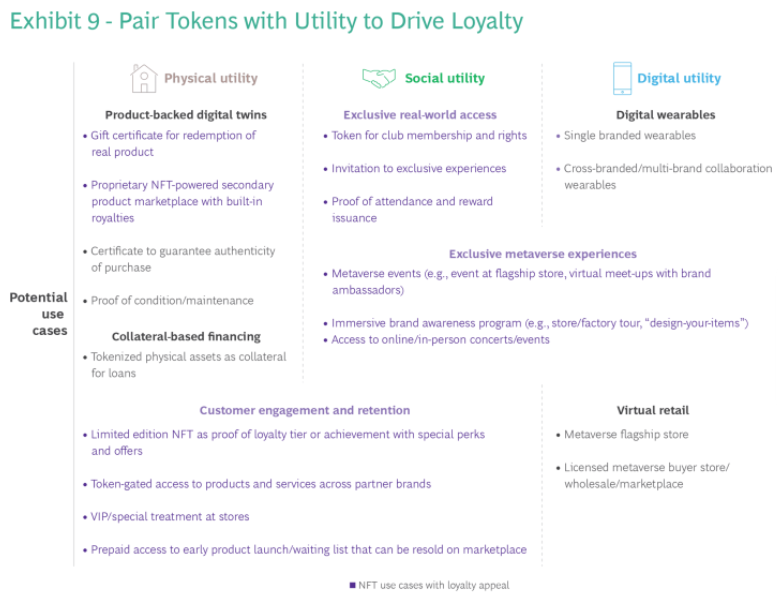

Customers are increasingly evaluating NFTs based on their associated benefits, linking digital and physical worlds. The success of any Web3 loyalty product often hinges on pairing utility with issued tokens. These assets can grant holders special offers, early product access, discounts, and priority entry to stores or events. NFT metadata can track progress within loyalty programs and achievements across brands and partners, such as completed tasks or earned milestones.

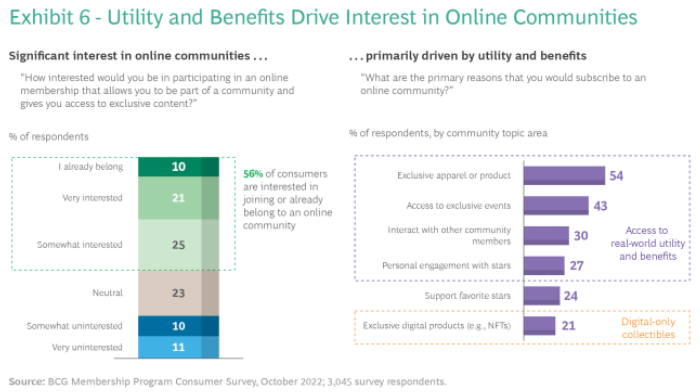

In a BCG consumer study conducted in October 2022 on membership programs, most consumers expressed interest in joining online communities or memberships, with up to 54% citing real-world benefits as a primary reason for joining. Only 21% said NFTs or other digital items motivated their participation, indicating that tying pure digital NFTs to tangible real-world perks creates value beyond the digital asset itself. (See Figure 6)

There are several real-world examples. Gap launched NFTs on Tezos, granting holders limited-edition collectible hoodies. Similarly, Starbucks Odyssey allows members to earn and purchase NFTs that unlock immersive coffee experiences and rewards. Clinique released NFTs that users could earn by completing social media tasks, unlocking annual skincare product bundles.

Open Ecosystems and Token Gating

As more open, multi-interface ecosystems emerge as alternatives to “walled gardens,” token gating has grown in popularity, enabling smoother collaboration between brands and loyalty programs. One brand can invite another’s token holders to participate, offering exclusive deals and experiences. Public or consortium blockchain platforms can support frictionless, plug-and-play cross-brand collaborations, bypassing complex, one-off IT integrations.

Token gating enabled Tiffany & Co. to target affluent, NFT-savvy customers at minimal cost. In 2022, Tiffany launched the NFTiff project, granting holders exclusive rights—such as necklaces and pendants inspired by their owned CryptoPunks NFTs.

Community-Driven Engagement

Passionate communities have formed around creator-led token projects, such as NFT art collections and emerging DeFi protocols. Many of these aim to gather community input and drive collective decision-making through active social media presence, exclusive virtual and in-person member events, and decentralized autonomous organizations (DAOs)—user collectives without central management.

Brands can adopt similar online communities among their superfans or high-value customers. Leaders can use DAO-like structures to easily conduct votes reflecting deep customer insights—for example, deciding which product to launch next or selecting new partners. Governance processes can be decentralized via DAOs, granting certain token holders more voting power based on loyalty, participation history, or involvement in key missions.

Framework for Web3 Loyalty Products

Many institutions have begun experimenting with Web3, mostly adopting opportunistic, ad-hoc approaches. But their commitment should be stronger. Companies must take structured, strategic approaches to ensure their loyalty services are truly Web3-native.

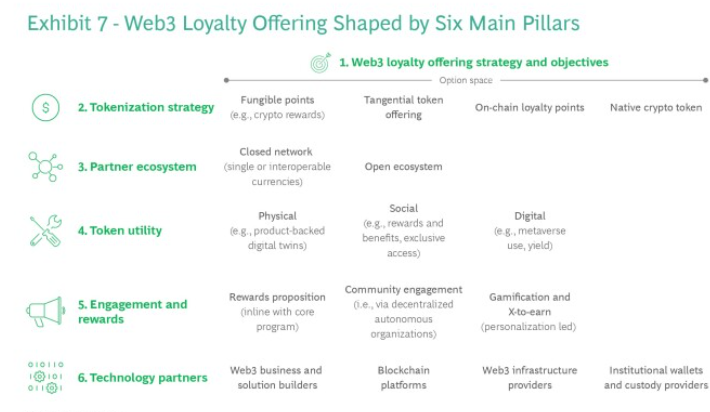

We’ve developed a six-pillar framework to help businesses shape their Web3 loyalty propositions. (See Figure 7)

Web3 Loyalty Strategy and Goals

Before experimentation or proposal, the first step is for enterprises to understand gaps and opportunities within their current loyalty programs and assess how Web3 can help. Leaders should define overall strategy, competitive advantages, and priority target groups.

Afterward, the Web3 use case must address core objectives or shortcomings of existing loyalty programs. Common goals include expanding rewards to broader, less-active customer segments; simplifying and scaling partnerships; attracting new customer bases; and increasing engagement and stickiness with the brand.

Tokenization Strategy

Next, institutions must decide how to apply tokenization strategies—to deploy, supplement, or replace current offerings—and align them with strategic goals. These options fall into a range of prototypes differing in technical and regulatory complexity. Detailed financial modeling must accompany the chosen prototype to ensure it meets desired financial outcomes for the overall loyalty product. Four prototypes are outlined below (see Figure 8):

Fungible Points

Some programs may choose to make their existing point-based systems fungible. Crypto-enthusiast customers could convert points into cryptocurrencies for liquidity or investment. Financial institutions like SoFi and Venmo have already launched credit cards that reward with cryptocurrency or allow point-to-crypto conversion.

Plug-in Token Offerings

Brands can explore alternative token products composed of NFT collections that offer real-world benefits beyond the digital token itself. These can integrate with existing loyalty systems and gamify the experience to attract and motivate customers—especially younger, digitally fluent audiences. Starbucks Odyssey members can earn NFTs sold as digital collectible stamps, unlocking new experiences. They selected Polygon as their issuance blockchain—a Layer 2 scaling solution built atop Ethereum.

Loyalty Points on Chain

Companies without loyalty programs—or those wanting to overhaul existing ones—can issue fungible loyalty tokens or points directly on blockchain. This is particularly helpful for partner-heavy programs needing optimized cross-program token tracking, settlement, and reconciliation.

Emirates Airlines used Loyyal to tokenize cross-platform transactions.

Most companies experimenting in this space adopt the first two options. A few venture into on-chain point tokenization to achieve cross-program settlement efficiency. Some Web3-native firms operating under crypto-friendly regulations have launched crypto-native tokens as part of broader ecosystem strategies requiring loyalty utility and incentives. An example is the Basic Attention Token (BAT), funded by advertisers and earned by users and creators participating in the ad ecosystem.

Partnerships & Ecosystems

A third critical consideration is integrating partners’ ecosystems with the brand’s loyalty collaboration strategy. Can the company’s goals be better achieved through closed, one-to-one or one-to-many partnership networks where fungible tokens are minted and used as rewards or payment?

For example, a financial institution could help expand a closed loyalty network, issuing merchant-funded loyalty tokens at POS across a pre-approved network of merchants and partners.

An example of a more open ecosystem strategy is a brand issuing a plug-in, collectible NFT product and choosing a public blockchain to mint these NFTs. Choosing this path allows customers to transfer or sell NFTs on marketplaces, while partners can leverage token gating to engage specific NFT holders.

Token Benefits

As previously outlined, the success of any Web3 loyalty product depends on aligning benefits with issued tokens. Benefits can span physical, social, or purely digital realms. Physical benefits involve access to real products and services linked to digital assets—for example, NFTs that grant access plus redeemable goods. Tokens can also carry social benefits, such as participation in community events, VIP perks, or exclusive brand voting rights. Digital benefits include metaverse events, virtual meetups with brand ambassadors, or in-game privileges and access to digital worlds.

Loyalty benefits can span all three domains, and companies can use NFTs as tools for engagement and retention. These benefits can also be gamified. For example, if a customer collects three rare NFTs, they could burn them to mint a limited-edition NFT granting priority shipping for a year. Figure 9 illustrates examples of NFT-based benefit applications.

Engagement and Rewards

Beyond traditional rewards based on discounts and perks, companies can leverage Web3 to access novel engagement tools.

One option is using DAO-like organizational structures, allowing elite loyalty members or select customer segments to participate in brand decisions. Campaigns like “What hoodie color should we launch next?” or “Which band would you like to see at our virtual concert?” give customers a voice in shaping products or the loyalty program itself. Companies can selectively target specific token holders or wallet addresses—such as customers holding exclusive NFTs or wallets with a certain token balance or loyalty tier.

Another strategy brands can explore is the “x-to-earn” model, gamifying experiences across one or more partners, establishing milestones and moats, and rewarding achievement. For example, customers earn a token upon their tenth purchase. A key advantage is that gamification can scale across multiple partners, creating relevant, personalized differentiation.

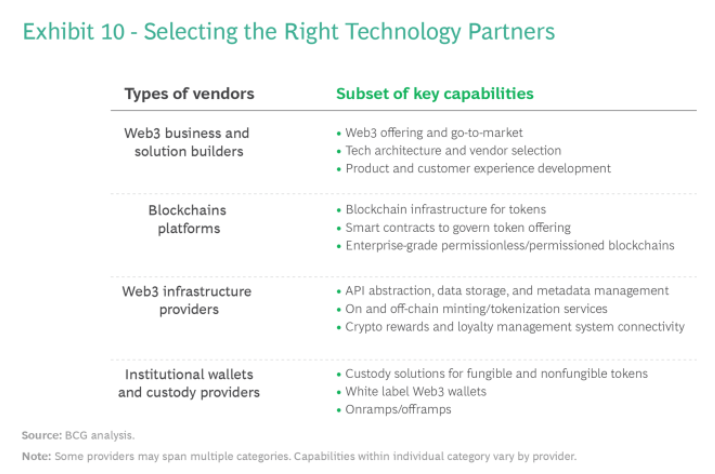

Technology Partners

Navigating the Web3 tech landscape is no simple task. Standards vary by blockchain platform, and Web3 infrastructure providers are emerging to simplify cross-platform complexities via APIs and SDKs. (See Figure 10.) Startups must consider four aspects:

Which Web3 business and solution builders will the company partner with to drive overall Web3 market strategy, business case, product vision, customer experience development, and vendor selection? BCG, together with its technology-building and design arm BCG X, is equipped to support enterprises in this area.

On which blockchain platform will the company deploy its tokens? Will it use public or private blockchains?

When selecting a platform, companies must consider:

- Environmental impact;

- Platform reliability and uptime;

- Transaction size/cost;

- Developer community activity;

- Institutional readiness;

- And whether the platform is supported by Web3 infrastructure providers to accelerate development.

Which Web3 infrastructure provider(s) will the company use (if any)?

These providers offer Web3 tools via SDKs/APIs for smart contract management, cross-chain connectivity, KYC verification, transaction monitoring, and royalty workflows.

Can partnering with such firms aid go-to-market efforts? Which wallet platform and custodial infrastructure will the company choose to manage its loyalty tokens?

Will it opt for self-custody—where users manage their own keys—or collaborate with a provider to custody digital assets? Some Web3 infrastructure players may also offer custody solutions.

Outlook

With the emergence of on-chain fungible tokens, NFTs, smart contracts, and DAOs, Web3 can enhance or completely reshape existing customer loyalty programs. Institutions and brands cannot afford to ignore this potential upside.

Companies should take a more strategic approach to clearly define how they will evolve their loyalty offerings. Starting small is acceptable, but firms must design toward a clear Web3 vision and predetermined target markets. Initial pilots must be sustainable and aligned with intended visions and ROI goals. Customer engagement and loyalty must remain the core of every Web3 strategy; otherwise, customers may feel let down by what appears to be a one-off effort.

There is no one-size-fits-all solution. Companies can draw inspiration from existing experiments but should avoid blindly copying products and mechanics. A company’s Web3 strategy should be shaped by the scale, performance, customer base, and goals of its current loyalty program.

Web3 remains complex for both institutions and end users. Companies must avoid jargon, replacing terms like “NFT” with simpler concepts like “collectibles” or “badges,” and focus on embedding underlying technical complexity into seamless, Web2-native customer experiences.

Firms must invest time understanding the tech landscape. Rebuilding existing infrastructure makes no sense. Don’t tackle this challenge alone. Invest in selecting the right technology partners, but ensure you build and own the core customer experience around it. Collaborate to establish viable business frameworks, ensuring the program delivers targeted ROI and sustains ongoing customer engagement and loyalty.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News