When prices decline, which low-market-cap gem projects are worth positioning in?

TechFlow Selected TechFlow Selected

When prices decline, which low-market-cap gem projects are worth positioning in?

8 low-market-cap projects with strong value propositions and catalysts—worth considering when prices pull back.

Author: Minty

Compiled by: TechFlow

When everything in crypto is surging, it's hard to tell which low-market-cap tokens deserve attention. So I've compiled a list of low-market-cap projects with strong value propositions and catalysts worth considering when prices pull back.

Please note that listing these tokens does not mean I believe they are good buys right now. Personally, I have accumulated or am actively looking to accumulate these tokens during lower price pullbacks.

1/$FOLD

Many have overlooked FOLD due to the delay of Sushi Guard, but Sushi Guard could be implemented as early as March, potentially becoming a major revenue driver for xFOLD holders.

There are also interesting developments behind $FOLD, such as LLGP and potential partnerships. With a market cap between $30–50 million and most tokens already circulating, I believe $FOLD is one to watch in the MEV space. (Note: Recent price increase due to rumors)

2/$BTRFLY

Redacted Cartel, a real yield product forked from OHM and rebranded, has a team that continues to impress me. With Dinero, $BTRFLY can establish significant market share in the LSD sector, enabling further progress in this space.

Meanwhile, Redacted Cartel’s treasury holds a substantial amount of Convex, giving it strong leverage to attract liquidity.

3/$X2Y2

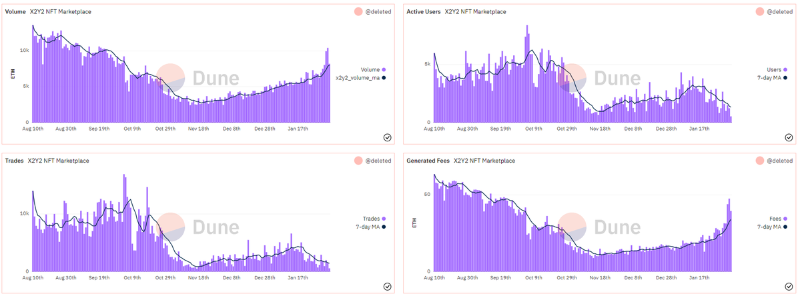

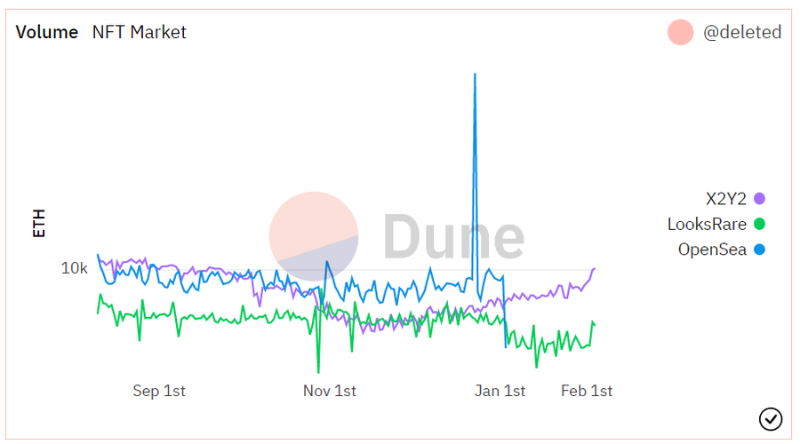

With the upcoming launch of $Blur, the NFT marketplace narrative may finally gain momentum. One of the most underrated projects in this narrative is X2Y2. Stakers receive all fees generated through the marketplace in WETH or via compounding x2y2.

Overall statistics for x2y2 are positive. Not only are trading volume and fees rising across the board, but x2y2 has already surpassed LooksRare in volume despite having only a fraction of its market cap. Additionally, they recently launched an NFT lending platform that has been growing steadily.

4/$SYN

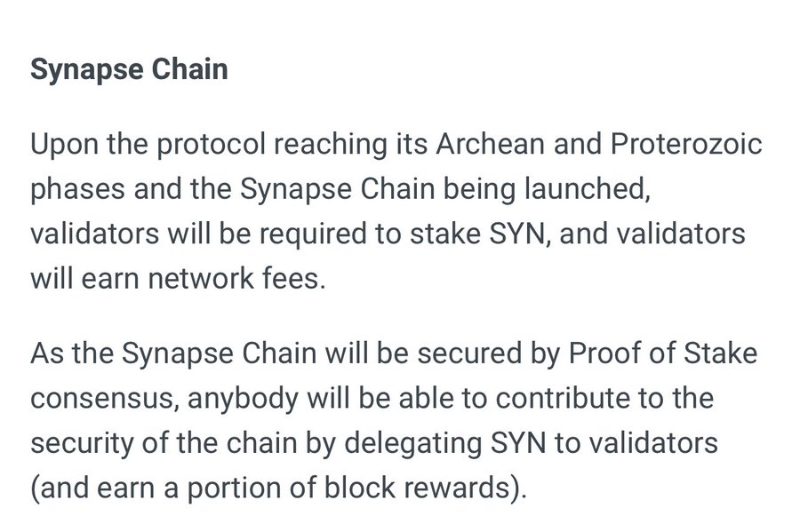

Synapse Protocol offers one of the best cross-chain bridging experiences, but what excites me more is the upcoming Synapse Chain—a cross-chain network enabling interoperability between blockchains. Calling it a low-market-cap project might be a stretch, but the potential returns could be enormous.

Although the token isn’t yet fully utilized, the launch of Synapse Chain may require validators to stake SYN—similar to other validator-based systems like $RPL.

5/$Y2K

Y2K Finance is a platform allowing traders to speculate on stablecoin de-peg events and derivatives. With the upcoming LSD market, Y2K Finance has a great opportunity to create a new speculative market.

The team has demonstrated strong adaptability to shifting market conditions, and this expansion from stablecoins to other derivatives could unlock massive risk/hedging speculation, generating additional protocol revenue.

While the Y2K token is relatively new and still highly concentrated due to its IFO distribution, the product’s strength is undeniable. I believe this could mark the beginning of a new speculative market.

6/$JPEG

JPEG'd is one of the most impressive NFTFi projects I’ve seen so far, with a product suite that generates real value.

Although JPEG hasn't received the same hype as other NFTFi projects, it has a solid team and long-term runway to grow into a dominant player.

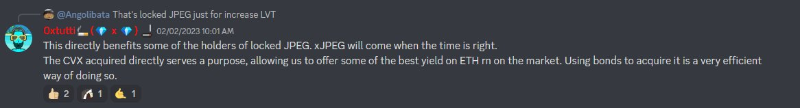

Additionally, there are hints of a future xJPEG, which could activate revenue sharing for $JPEG stakers.

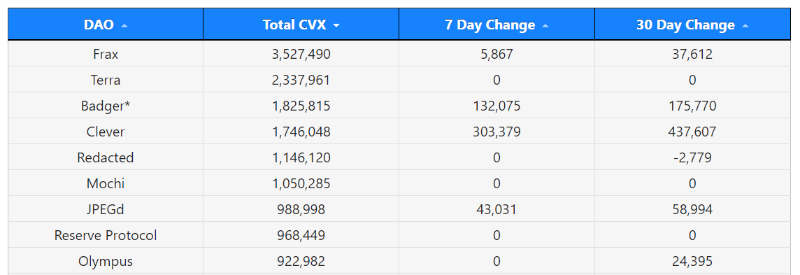

Strategically, the team has been selling some JPEG holdings to accumulate Convex and is now the 7th largest holder of CVX.

7/$PREMIA

For options protocols, Premia Finance is one of my favorites in this space. It offers American-style options, allowing exercise before expiration.

While trading volume still lags behind competitors, V3 and the Knox vault are compelling catalysts that could bring in new volume. The Premia token can be locked into vxPremia to earn approximately half of the accrued protocol fees, along with platform fee discounts.

Premia V3 will introduce permissionless pools and interoperable liquidity—critical features for cross-chain expansion and liquidity balancing.

8/$GRAIL

Camelot DEX has performed exceptionally well lately—and for good reason. With a strong team and robust xGrail holder tokenomics, Camelot has the potential to become the leading DEX on Arbitrum.

While I no longer consider Grail an early-stage buy, it still holds significant future potential. xGrail delivers reliable utility through its plug-in system, allowing users to choose between different reward options. If it continues to grow on Arbitrum, Camelot’s future looks bright.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News