One Article to Understand the Forgotten Gems in the Optimism Ecosystem

TechFlow Selected TechFlow Selected

One Article to Understand the Forgotten Gems in the Optimism Ecosystem

Now that Arbitrum has been covered, it's time to provide an overview of what's happening in the Optimism ecosystem.

Written by: Degen Sensei

Compiled by: TechFlow

After focusing heavily on Arbitrum, it's now time to take a comprehensive look at what’s happening within the Optimism ecosystem. While I still have a soft spot for Arbitrum, as one wise person once said, "Don't fall in love with your positions"—broadening your perspective never hurts.

Velodrome has now become a giant on Optimism, while Synthetix and Perpetual are also rising rapidly. However, beyond these protocols lie many hidden gems that most crypto enthusiasts have overlooked—leaving them unaware of the exciting developments taking place on Optimism. Let’s dive deeper into some promising projects worth watching.

Thales

Thales is a decentralized betting market, allowing users to wager on whether a token’s price will reach a certain outcome—similar to an options contract.

However, unlike traditional options where sellers earn small premiums if the strike price is hit, betting markets are zero-sum: all collateral goes into a shared pool and is distributed entirely to winners of directional bets.

Thales brings this concept on-chain and uses oracles to create markets for any asset.

Teahouse Finance

Teahouse Finance is an asset management protocol offering various yield strategies through its vaults.

It operates similarly to protocols providing yield strategies atop GMX’s GLP, and recently launched a vault strategy using concentrated liquidity on Perpetual Protocol.

Access to vaults typically requires being whitelisted via a Teahouse Hightable NFT, although their latest Perpetual Protocol vault is now open to the public.

Key parameters to consider when entering vaults include a 0.1% platform fee upon deposit and a 0.2% fee upon withdrawal.

Teahouse charges a 1.7% APY management fee and takes a 10% performance fee on profits generated.

Overtime Markets

Overtime Markets is an on-chain sports betting platform that facilitates wagers across multiple sports leagues using a sports-focused AMM. This AMM leverages on-demand liquidity to act as a market maker for bets.

The protocol supports markets for football (soccer), American football, basketball, baseball, hockey, MMA, and motorsports. Within these categories, various leagues are covered, giving users plenty of options. Payouts are guaranteed instantly after event resolution.

If you're not confident in your betting skills, the platform offers vaults that execute specific strategies on your behalf. Overall, Overtime is doing its part to bring the massive sports betting industry on-chain.

Sonne Finance

Sonne Finance is a permissionless lending protocol on Optimism. The platform provides money markets for wETH, USDC, USDT, DAI, OP, sUSD, wBTC, and SNX.

Sonne employs Velodrome in its tokenomics—not by directly rewarding liquidity providers with SONNE tokens, but by bribing VELO holders to vote for the SONNE/USDC pool. Meanwhile, users who stake SONNE receive VELO rewards.

The protocol earns revenue by taking a cut of borrowers’ interest, determined by a “reserve factor.” For sound risk management, highly liquid assets like stablecoins and USDC have higher collateral factors than more volatile tokens such as SNX.

Lyra Finance

Lyra is a decentralized options exchange on Optimism. The protocol uses the Black-Scholes model for options pricing, while also adjusting for volatility since implied volatility naturally varies across different strike prices.

Lyra’s AMM allows users to deposit and withdraw funds at any time after an initial 3-day cool-down period. It aims to remain delta-neutral at all times, ensuring trading is driven by implied volatility market making.

The protocol has also released its Newport upgrade—an options AMM designed to be integrated into other perpetual exchanges. It features collateral management, where part of the collateral for hedging short positions is cash-based. Lyra has announced plans to integrate this functionality with GMX.

Kwenta

Kwenta is a decentralized derivatives platform enabling trading of synthetic real-world assets. If you enjoy trading synthetics like EUR, USD, and INR, this might appeal to you. It previously supported futures trading for precious metals like gold and silver, though those markets are currently paused.

The protocol relies on Chainlink oracles and Synthetix price feeds to ensure reliable and continuous price updates.

Depending on user preference, Kwenta offers both cross-margin and isolated markets (where your collateral can be used across all markets, or must be deposited and withdrawn separately per market).

How Will Optimism Handle Incentive Campaigns?

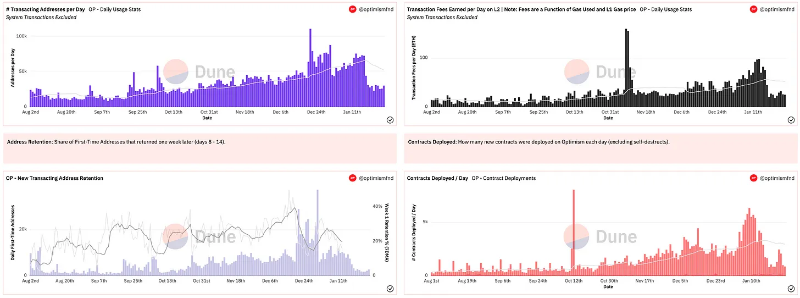

Optimism incentivizes growth by rewarding users and developers with OP tokens for completing tasks.

Following the recent conclusion of task campaigns, it's evident that on-chain transaction addresses and newly deployed contracts have sharply declined—a potential red flag for the ecosystem.

Given that its direct competitor Arbitrum has grown robustly without token incentives, it will be interesting to see how the team behind Optimism responds.

Optimism must act quickly—or else, as user activity declines, protocols within the ecosystem will suffer first.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News