Understanding Pendulum: Bringing Forex Markets to Blockchain and DeFi

TechFlow Selected TechFlow Selected

Understanding Pendulum: Bringing Forex Markets to Blockchain and DeFi

Last month, a DeFi project called Pendulum made history in the Polkadot ecosystem.

Author: Crypto Nova

Compiled by: TechFlow

Last month, a DeFi project called Pendulum made history within the Polkadot ecosystem. It completed its parachain crowdloan in just three minutes, hitting the hard cap of 300,000 DOT.

What makes this project so appealing that it broke this record even during a bear market?

The "foreign exchange market" is one of the largest industries on Earth. After all, fiat currencies (euros, dollars, yen...) are exchanged daily.

However, due to certain inefficiencies in today's markets, the foreign exchange industry remains highly challenging. If we could move this sector onto blockchain technology, forex would benefit in several key ways:

• Faster transaction speeds;

• Lower transaction fees;

• Greater security;

• Increased transparency;

And this is exactly what Pendulum is doing — bringing foreign exchange markets onto the blockchain.

Pendulum aims to deliver composable fiat services, bringing traditional "fintech" companies into the world of DeFi. Its vision is to become the missing link between DeFi and fiat by providing a smart contract network optimized for fiat currencies.

This enables traditional financial services such as fiat or savings accounts to seamlessly integrate with DeFi applications. Pendulum’s goal is to become the “internet of fiat,” unlocking new DeFi use cases for every major fiat currency.

More importantly, thanks to its integration with Stellar's technology called "Spacewalk," it has already laid the foundation for this vision. This allows Pendulum to leverage the vast number of fiat-pegged stablecoins on $XLM and help shape the future of fiat-based DeFi.

They also employ a new "active market maker" called Amber. Amber’s architecture provides automated market making and enables low-risk, single-sided liquidity provision.

It is designed to accelerate foreign exchange liquidity in DeFi.

Pendulum will launch their mainnet next month in February. Since it operates on its own blockchain, this also marks the market debut of their token, $PEN.

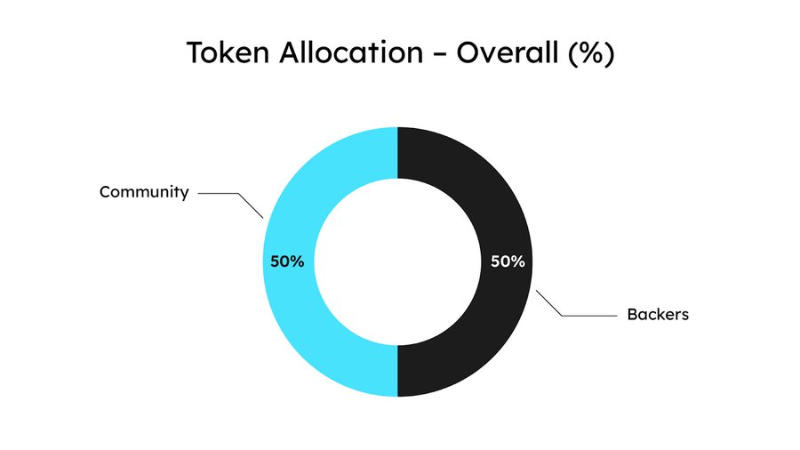

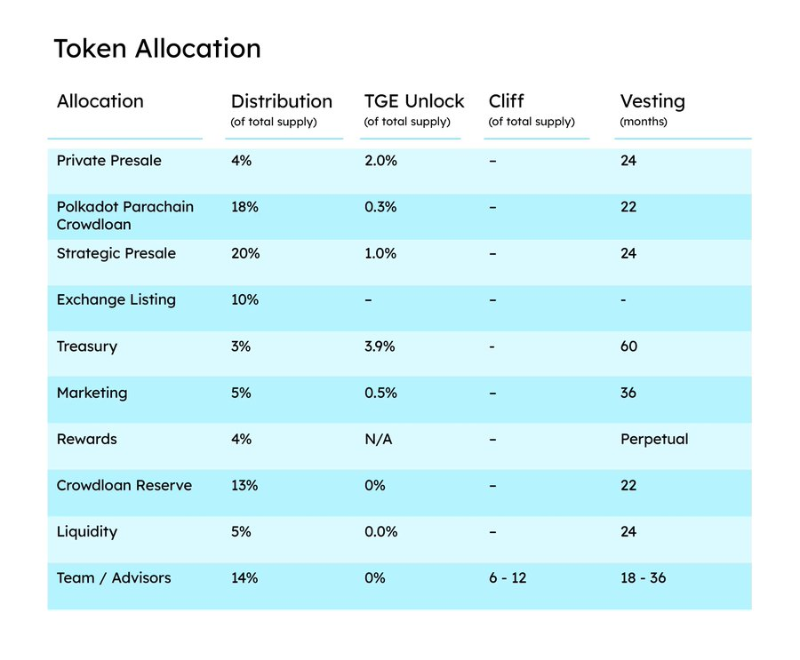

The total token supply is 200 million, with an initial circulating supply of 15.2 million.

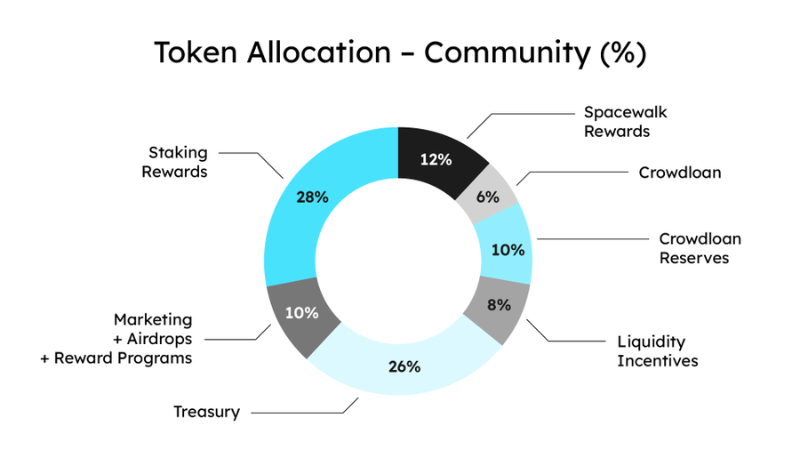

Fifty percent of the total supply is fully reserved for the community. As shown in the image below, this allocation can be further divided into different “buckets.”

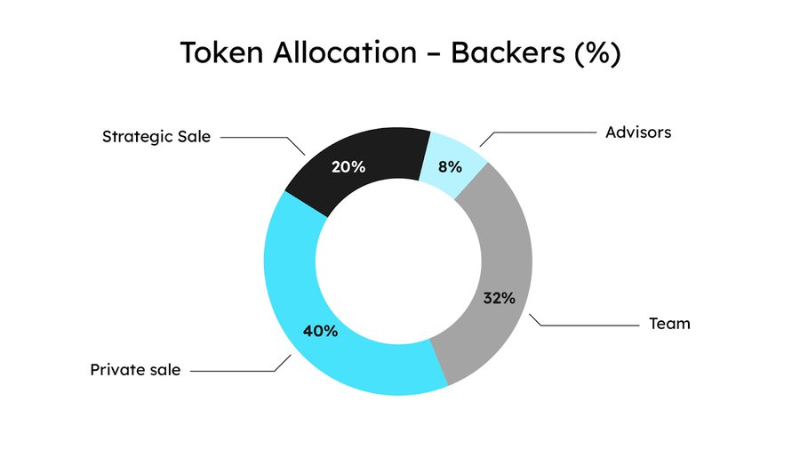

The other 50% is allocated to the team, partners, advisors, and other supporters.

Similarly, this portion can also be subdivided into various “buckets.”

Most tokens follow a linear vesting schedule over 2 to 3 years, ensuring all stakeholders remain incentivized to contribute to Pendulum’s long-term growth.

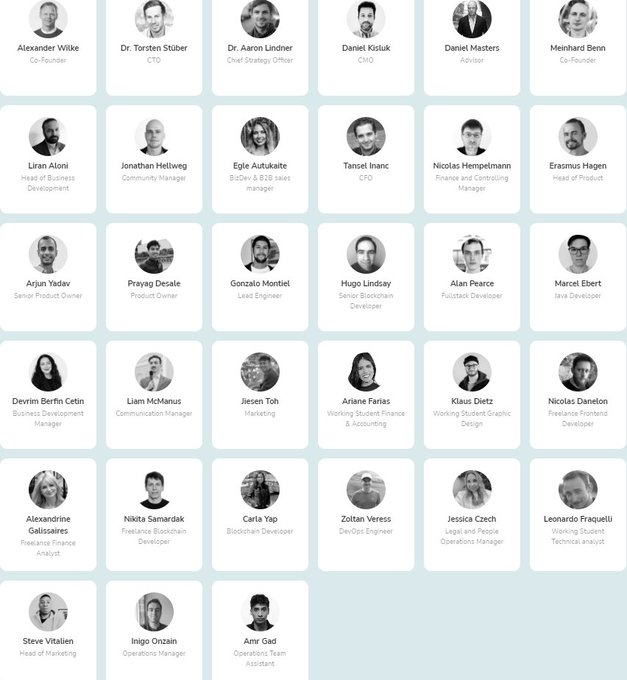

There is also an impressive list of project personnel, including partners and collaborators, highlighting the project’s momentum and strength.

Conclusion

Over the past few months, Pendulum has drawn significant attention. The foreign exchange industry urgently needs a blockchain platform that brings multiple DeFi use cases and benefits to the masses.

Currently, there are existing protocols where you can swap stablecoins. However, a truly global exchange with native, localized fiat on- and off-ramps is still missing.

With Pendulum, receiving foreign currency payments and cashing out into local currencies could soon become feasible for businesses worldwide. The technology appears full of promise, and Pendulum may emerge as a major player in today’s cryptocurrency market.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News