Understanding Pendulum: How DeFi Protocols Bridge the Gap Between DeFi and Fiat Currency

TechFlow Selected TechFlow Selected

Understanding Pendulum: How DeFi Protocols Bridge the Gap Between DeFi and Fiat Currency

Thanks to Pendulum, TradFi's fiat services can be integrated with DeFi applications.

Written by: Kadeem Clarke

Compiled by: TechFlow

The decentralized finance (DeFi) ecosystem has been expanding at an astonishing pace, showing no signs of slowing down. According to DeFiLlama, the total value locked currently exceeds $48 billion, with innovative DeFi products emerging constantly—from yield farming and liquidity pools to decentralized investment protocols, prediction markets, and crypto lending.

Major DeFi protocols continue to thrive, offering double-digit returns on collateral. In just the past month, the DeFi ecosystem has added approximately $8.4 billion since hitting its cycle low on January 1st.

Welcome to the world of FiatFi—what would it look like to use fiat currencies within DeFi applications?

While many blockchains support FiatFi, some are better suited than others. Pendulum stands out as the ideal blockchain, providing solutions for scaling on-chain fiat use cases and integrating fiat into the DeFi ecosystem.

What Is Pendulum?

Pendulum is a blockchain network connecting the world of DeFi with traditional financial systems. It meets the growing demand for fiat currency in DeFi by offering trusted, compliant tokens pegged to major fiat currencies.

The Pendulum protocol was created by SatoshiPay, a fintech company with a long history in the blockchain space dating back to 2014.

Pendulum is expected to launch by the end of February 2023!

Built on Substrate

Parity Technologies developed Substrate, the blockchain framework used to build Polkadot.

Substrate offers numerous advantages, including native compatibility with Polkadot chains, cross-language support, forkless upgrades with built-in coordination, determinism (for fast consensus), and a pre-built yet customizable set of components known as "Pallets."

Cross-Chain Bridge to Stellar

The cross-chain bridge from Pendulum Chain to the Stellar network is a critical component.

The Stellar ecosystem serves as an excellent environment for integrating DeFi with current financial systems: over 15 different world currencies are already available as fiat-pegged tokens on Stellar, offering compliant on- and off-ramps compatible with traditional finance.

By connecting Stellar to DeFi via Pendulum, traditional banking systems can be linked with DeFi’s products and services.

Pendulum's Vision – The Internet of Fiat for Everyone

Pendulum aims to create a blockchain with fiat-optimized smart contracts, serving as the missing link between fiat and DeFi.

-

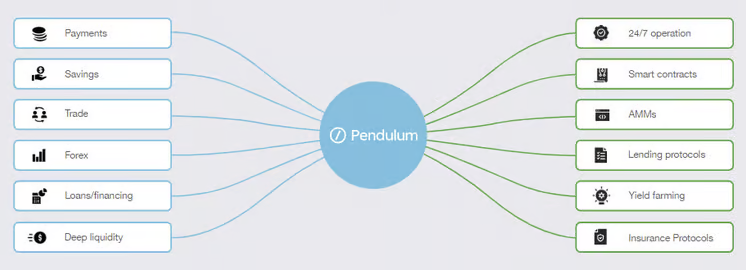

By developing on-chain utilities for multiple fiat currencies and fintech services, an open and inclusive financial future can be built. dApps can fully integrate traditional financial services such as foreign exchange, trade finance, or savings accounts.

-

To ultimately unlock DeFi use cases for a broad range of fiat currencies, Pendulum will serve as a key part of Web3 infrastructure. The ultimate goal is to create an open financial future that transcends borders and promotes economic inclusion.

Pendulum aims to become a one-stop hub for the internet of fiat. Innovations brought by Pendulum include:

-

Trust-minimized cross-chain bridges.

-

A network optimized for a basket of fiat-pegged stable tokens.

-

Next-generation smart contract technology.

-

An opt-in compliance layer with privacy features.

-

Seamless on- and off-ramp standards for integration with local banking networks.

Features of Pendulum

Cross-Chain Bridges

Connecting across various ecosystems requires multiple solutions depending on the target network: in some cases, specific network bridges are needed; in others, direct integration into multi-chain bridges—or even DotSama (Kusama and Polkadot ecosystems) via the Inter-Blockchain Communication Protocol (IBC) relay chain—is necessary.

Spacewalk will connect Pendulum and all Substrate-based networks with various fiat-stable tokens on the Stellar blockchain.

-

According to the Spacewalk roadmap, Pendulum will eventually link to other DeFi ecosystems, including Ethereum and Cosmos.

-

As a result, fiat currencies and fintech services will gain access to as many Web3 blockchain opportunities as possible. Pendulum benefits from WASM technology and high-performance WebAssembly smart contracts, thanks to Polkadot.

Use Cases and Opportunities

By combining the DeFi ecosystem with Stellar’s extensive range of fiat tokens, significant opportunities emerge for users of DeFi products, traditional fiat infrastructure, and users of Stellar, Ethereum, and Polkadot.

Connecting Forex Markets with DeFi

In 2023, the global foreign exchange market is valued at $1,934.5 trillion, or $1.93 quadrillion. Average daily trading volume has increased by 14% over the past three years, rising from $6.6 quadrillion in 2019 to $7.5 quadrillion today.

Thanks to Stellar’s 15+ fiat tokens, native integration with established banking infrastructure, Pendulum’s smart contract capabilities, and bridges to Ethereum and Polkadot, the DeFi ecosystem will gain massive forex liquidity.

Automated Market Makers (AMMs)

High demand for fiat-DeFi bridges often coincides with the need for scalable liquidity pools for fiat currencies.

With AMM smart contracts deployed on Pendulum, fast and efficient exchanges of fiat tokens—and cross-border remittances like DTransfer—will benefit from quick, transparent, and affordable currency conversion.

Fiat token holders can put their funds to work on Pendulum by contributing to lending pools or providing liquidity to AMMs.

Decentralized Forex – Amber AMM

Once DeFi supports local currencies such as the euro, Mexican peso, and Turkish lira, traditional finance can begin to realize the benefits of serving global customers.

The launch of Pendulum’s mainnet marks the beginning of intense dApp development within the ecosystem. Projects, developers, and builders have already started discussions with the Pendulum Ecosystem Grants program—similar to the Amplitude Grants Program. Amber AMM will be among the first dApps to run on Pendulum. PMM (Proactive Market Maker) may be a more accurate term for Amber.

Barriers to On-Chain Forex

Despite being a perfect and straightforward use case for DeFi, on-chain forex still plays no meaningful role in cryptocurrency.

There are several reasons for this:

-

Friction in on- and off-ramping.

-

Legal and compliance issues.

-

Limited supply of stablecoins.

-

High costs of forex trading via AMMs.

The crypto industry is working closely with regulators to address compliance, stablecoin availability, and on-/off-ramp challenges. For example, Pendulum is developing a fiat-optimized blockchain to solve all three issues. However, technological innovation is required to tackle the high costs of forex trading on AMMs.

Off-chain forex trading has extremely low transaction costs, with common currency pairs like USD/EUR typically cheaper than less common ones like USD/BRL.

The Solution

Amber is a completely new and highly efficient PMM (Proactive Market Maker) designed to enable forex liquidity on DeFi. Amber’s architecture provides automated market making while allowing low-risk, single-sided liquidity provision.

With swap liquidity, Amber aims to reduce the cost of a $100,000 trade to between 0.05% and 0.10%. Due to its ability to operate with significantly lower slippage and fees compared to other AMM designs, Amber can tap into new sources of liquidity—such as the forex market.

Pendulum (PEN) Tokenomics

Pendulum’s native token will be PEN. PEN enables governance, staking, and serves as the gas token powering transactions on Pendulum.

Economics Overview

-

Name: PEN

-

Relay Chain: Polkadot

-

Supply Structure: Inflationary

-

Total Supply: 200,000,000

-

Initial Circulating Supply: 15,200,000

-

Genesis Supply: 160,000,000

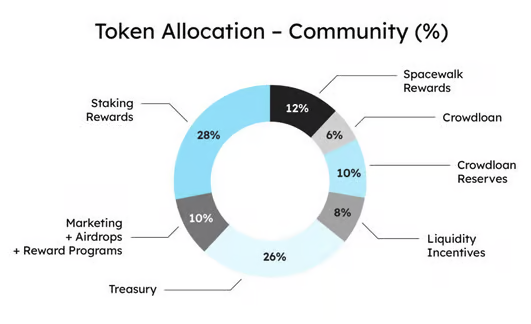

Distribution remains balanced between early supporters and the community, averaging a 50/50 split.

Community Distribution

The community allocation includes staking rewards for directly staking PEN (28%) and staking rewards for securing the Spacewalk Bridge (12%).

Uses of PEN

Gas

Just as DOT powers Polkadot and ETH powers Ethereum, the PEN token will power network transactions. Transaction fees must be paid in PEN when using the protocol. The blockchain’s sustainable business model is defined by transaction fees flowing into the treasury.

Staking

Holders will have the opportunity to stake PEN. To earn yields, token holders can delegate their tokens to collators. Staking incentivizes external collators to run high-performance nodes, helping to decentralize the infrastructure.

Governance

To guide the project’s direction, the PEN community can participate in on-chain governance. Holders can influence network development by proposing governance referenda and voting.

On-chain governance will use a quadratic voting mechanism to ensure relatively small holders have greater voting power and prevent a single holder from casting multiple votes on a single proposal.

Team

A project’s long-term success ultimately depends on the strength of its team.

-

Alex Wilke, CEO of SatoshiPay, brings 6 years of experience at SatoshiPay and 18 years of operational expertise.

-

CSO Dr. Aaron Linder, physicist, leads the project’s vision.

-

CTO Dr. Torsten Stüber, PhD in computer science, oversees the technical team.

-

Founder and Chairman Meinhard Benn, a blockchain programmer since 2011, guides the project with high-level oversight.

-

Daniel Masters, another early cryptocurrency adopter and current Chairman of CoinShares, serves on SatoshiPay’s board.

-

CMO Daniel Kisluk, former VP of Marketing at BeInCrypto, leads blockchain positioning that connects DeFi and TradFi ecosystems.

And they already have strong partnerships:

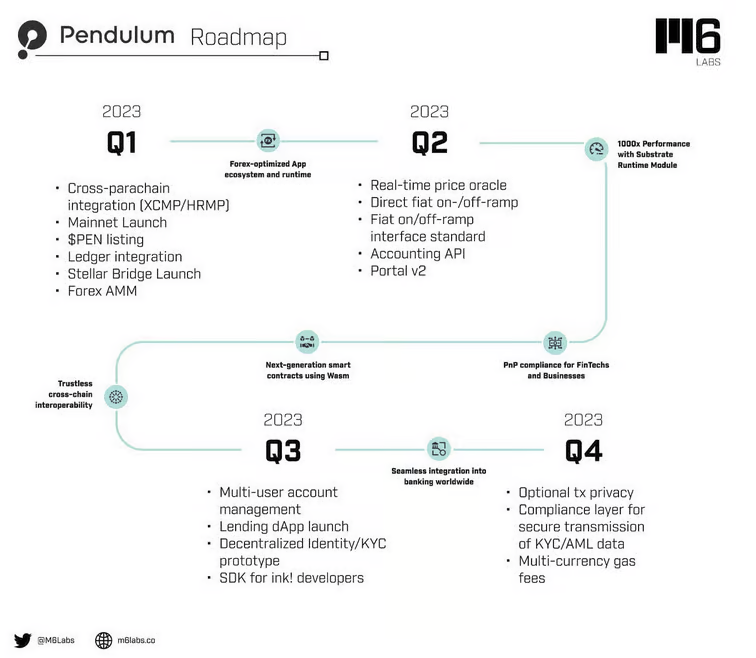

Roadmap

Pendulum’s 2023 roadmap will bring many advancements.

The next major milestone we’re anticipating is the launch of Pendulum on the Polkadot ecosystem in February 2023.

This release will include a token generation event. Once live on the Polkadot network, Pendulum will roll out several innovative solutions, including a trust-minimized cross-chain bridge (Spacewalk), support for a wider variety of fiat-pegged stablecoins, cutting-edge smart contracts, native-grade compliance and privacy layers, and integration with local banking channels for fiat on- and off-ramps.

The launch of Spacewalk is another exciting milestone following Amber’s launch on Pendulum’s roadmap.

Conclusion

Thanks to Pendulum, TradFi’s fiat services can now be integrated with DeFi applications.

The protocol has consistently grown, advanced, and innovated within the Polkadot and DeFi ecosystems.

Vision: The internet of fiat for everyone. With much development and innovation planned this year, Pendulum is definitely a project worth watching closely.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News