A Casual Talk on Japanese Stablecoins, Saying Goodbye to the Turbulent 2022

TechFlow Selected TechFlow Selected

A Casual Talk on Japanese Stablecoins, Saying Goodbye to the Turbulent 2022

Looking across Japan, the country is gradually strengthening its Web3.0 infrastructure development.

Written by James QU, CTO of PlatON, in Tokyo on December 31, 2022

2022 has been a turbulent year for the cryptocurrency industry. As this year comes to an end, I would like to share some thoughts on Japan's stablecoins, wishing the crypto industry a stable and healthy development in the coming year. Happy New Year to everyone!

We are undergoing a massive transformation from Web2.0 to Web3.0. While the real world has established a robust legal framework for Web2.0, it is not yet prepared for the arrival of Web3.0. When conducting actual Web3.0-based business operations, entrepreneurs often feel overwhelmed by regulatory uncertainties—for example, due to lack of legal support, they cannot finalize their business models or close transactions. Today, the integration of Web2.0 and Web3.0 has become an essential path for organic growth, meaning enterprises must leverage Web2.0 platforms and tools to ensure compliance while introducing Web3.0-based business models to reduce costs (faster and cheaper settlement methods).

Typically, the Web2.0 platform referred to in this article denotes the existing regulatory system encompassing licensing regimes, customer identification procedures (KYC), anti-money laundering (AML) measures, investor protection, regulatory reporting, and legal documentation—all statutory requirements that businesses must follow under the current regulatory framework to complete any real-world transaction.

Looking at Japan, the country is gradually strengthening its Web3.0 infrastructure development

1. Enact regulations defining qualified crypto tokens as financial products, which can be traded through regulated (licensed) financial service providers who determine the fair value of each token.

2. Legalize trading of asset-backed security tokens (STO).

3. Issue regional utility tokens, stablecoins, and asset tokens.

4. Open up to the global stablecoin market in 2023.

5. Revise institutional tax policies for STO (ICO) targeting startups to promote innovation in crypto technology.

Overall, Japan’s cryptocurrency legal framework has matured and continues to evolve alongside advancements in crypto technology.

Today, I want to share my reflections after reading articles about Progmat, a stablecoin platform that exemplifies the convergence of Web2.0 and Web3.0.

Stablecoins (SC) come in various types depending on chain structure (consortium/private chains vs. public chains), issuance method (licensed vs. unlicensed, asset-backed vs. algorithmic), etc. Below are some examples:

• Issued by central banks on public blockchains;

• Issued by central banks on consortium blockchains;

• Issued by licensed institutions on public blockchains;

• Algorithm-based, unlicensed stablecoins issued on public blockchains;

• Asset-backed, licensed stablecoins issued on consortium blockchains.

Elements of Security Tokens (ST)

1. Clear definition of assets with confirmed backing;

2. Representation of existing assets or rights;

3. Robust asset governance (private key management);

4. Practical and verifiable trading and settlement mechanisms.

Let’s explore these aspects using the stablecoin platform Progmat as an example.

Progmat is an infrastructure leveraging distributed ledger technology (DLT) aimed at advancing market transformation and creating new markets, digitizing the financial transaction value chain, and fostering innovation in new markets. The DCC (Digital Asset Co-Creation Consortium), led by MUFG and comprising over 134 members as of September 2022, aims to innovate cross-industry digital asset ecosystems on the Progmat platform.

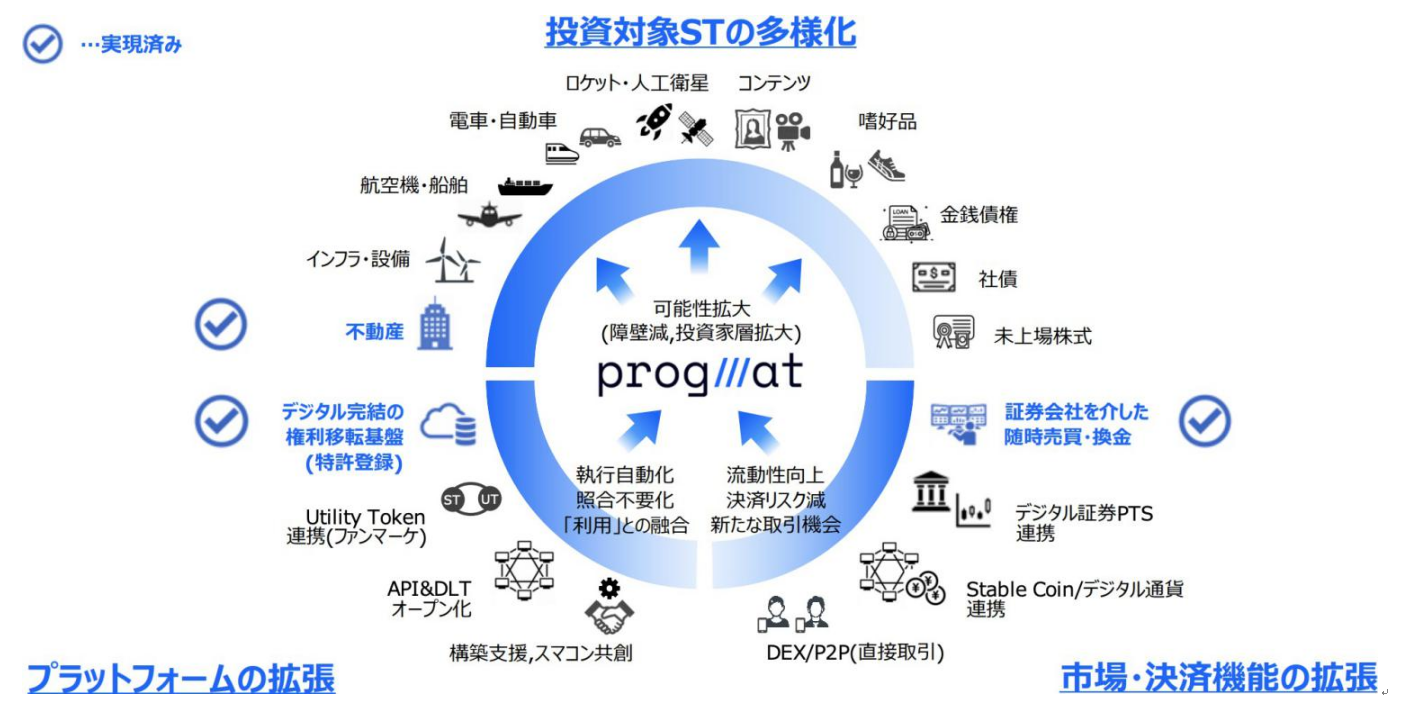

Progmat has achieved the following expansions and innovations:

- Platform expansion: Seamless inter-organizational collaboration enables execution automation, reconciliation-free operations, and integrated "investment x utilization" of security tokens (ST) and utility tokens (UT).

- Expansion of market and settlement functions: Enhancing liquidity and reducing settlement risk and intermediary costs through digital securities pass-through securities (PTS), stablecoins (SC)/digital currencies, and decentralized exchanges (DEX).

- Leveraging the above advantages to remove existing physical barriers and expand the investor base, enabling creation of unprecedented product markets and diversification of security token (ST) investments.

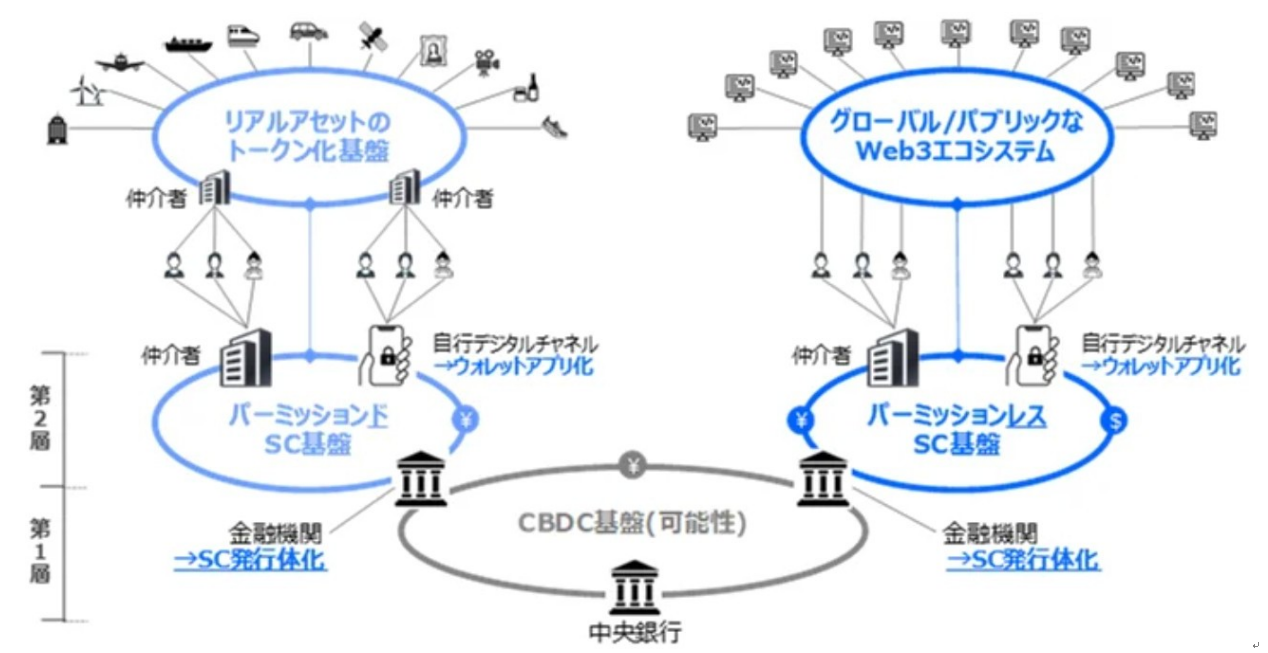

Participants and related financial instruments:

- Investors, trustees, agents, beneficiaries.

- Financial institutions. Such as PTS exchanges and other financial service providers; custodians;asset management companies.

- The Progmat platform supporting programmatic coins operates on a consortium blockchain.

- Central bank digital currency issued by central banks.

- Stablecoin issuers, utility token issuers as part of financial infrastructure.

- Security token issuers, etc.—institutions offering financial products.

Current Regulatory Framework

- Financial Instruments and Exchange Act

- Payment Services Act Enforcement Order

- Financial Instruments Sales Act

- Foreign Exchange and Foreign Trade Act

- Act on Prevention of Transfer of Criminal Proceeds

Note:List of Financial Services Agency Regulations in Japan

Two-Layer Architecture

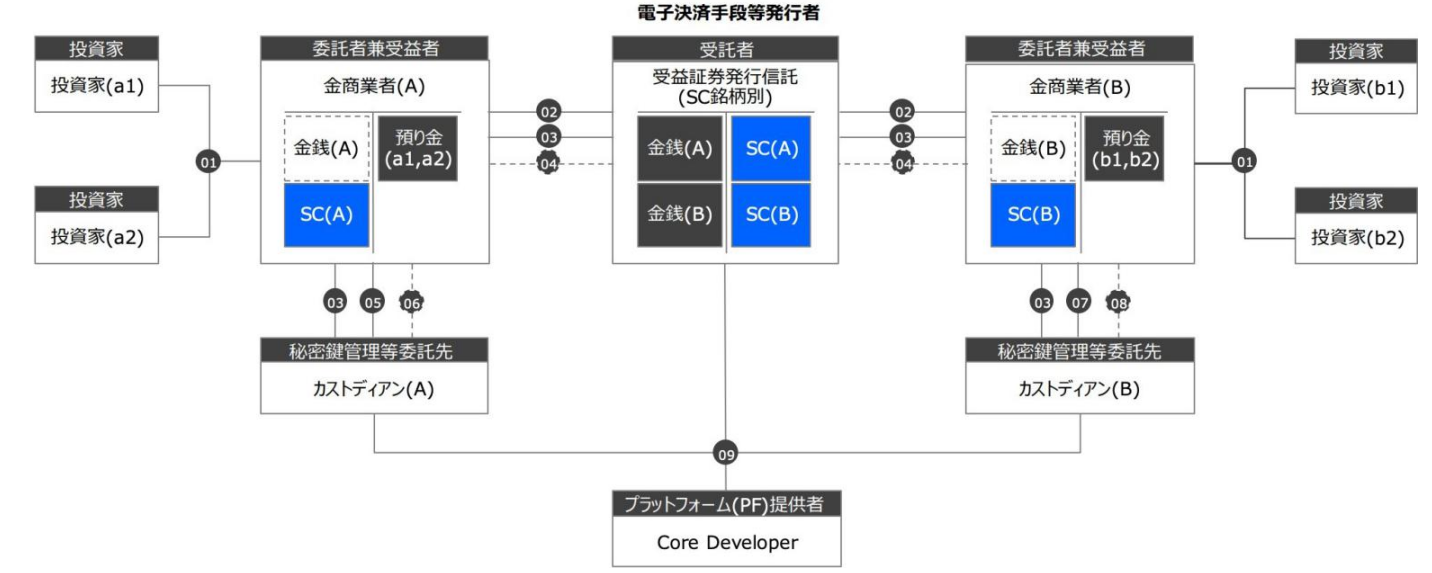

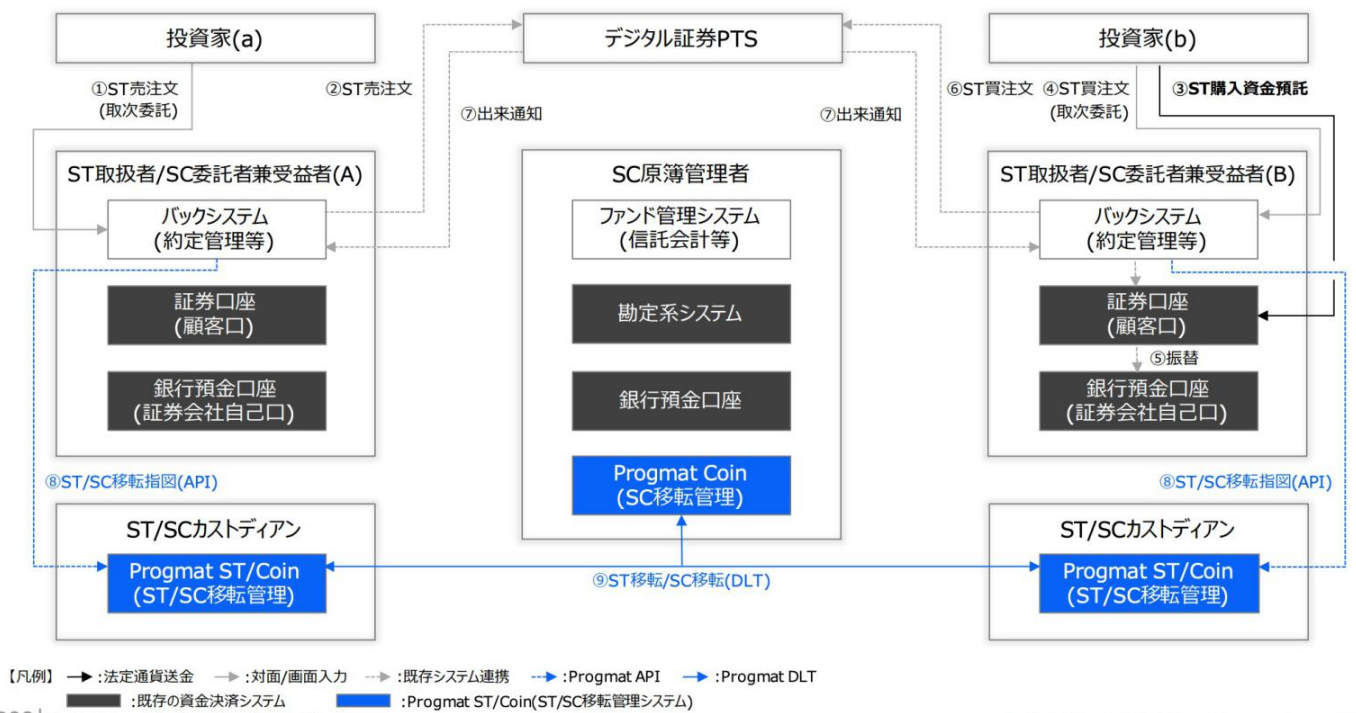

Business Processes

- Stablecoin issuer workflow diagram

- Common security token transaction workflow diagram

There are many more examples, but we will not list them all here.

Regarding common questions about cross-chain transactions, Progmat’s solutions are as follows:

- Cross-chain connection and authentication: After verifying trusted third parties (TTP), hash time-lock contracts (HTLC), and relays, the Progmat platform adopts the relay model as its primary method for cross-chain transactions;

- Cross-chain architect: Utilizes a TEE proxy based on the IBC protocol, executed on Corda;

- Conducted cross-chain transaction tests between Quorum and Corda.

Judging from Progmat’s development, only regulated institutions can become stablecoin issuers and service providers; investor protection and personal information protection remain top priorities; upon completion of stablecoin transactions, there must be asset reserves—i.e., a Web2.0-style proof of asset backing.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News