How to profit from the cryptocurrency volatility index?

TechFlow Selected TechFlow Selected

How to profit from the cryptocurrency volatility index?

Finally, some innovation has emerged from the tedious fork deluge.

Written by: korpi

Compiled by: TechFlow

From a price perspective, this period has been quite dull, with BTC fluctuating within a very narrow range... Is this the calm before the storm?

The Cryptocurrency Volatility Index (CVI) is nearly at its historical low.

If you anticipate increased volatility ahead, you can profit from CVI — and you don't need to predict whether prices will go up or down.

What is the Cryptocurrency Volatility Index?

CVI is the VIX index for cryptocurrencies — an index that tracks volatility. It was created by the COTI team (COTI Network) in collaboration with Professor Dan Galai, one of the original creators of the VIX. Its purpose is to establish a "market fear index" for crypto assets.

CVI ranges from 0 to 200: 0–85 ≈ low volatility, 85–105 ≈ medium volatility, 105–200 ≈ high volatility.

So, how can you profit from CVI?

There are two ways:

1. Bet on volatility,

2. Profit from others' bets.

If you believe volatility is coming, CVI will rise regardless of price direction.

You can acquire CVOL tokens pegged to the CVI index. Get them via their minting website or buy them on SushiSwap if cheaper there.

But watch out for funding costs.

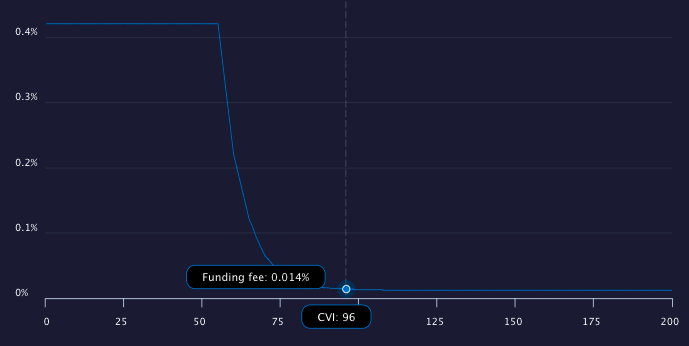

CVOL tokens have a built-in funding cost: the lower the CVI, the higher the fee. This is implemented as a daily Negative Rebase — the number of your CVOL tokens decreases over time.

Conclusion: only buy CVOL tokens if you expect a sharp increase in volatility soon.

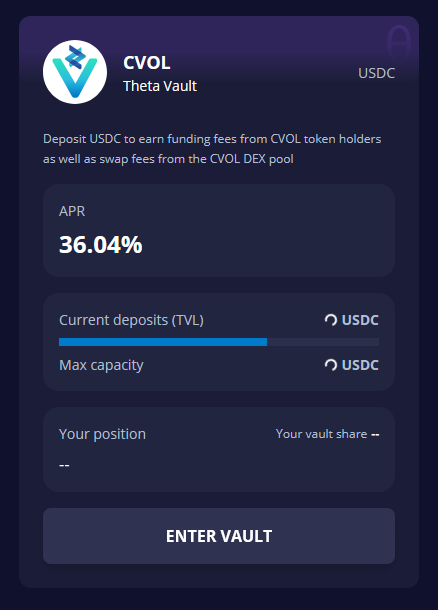

If you prefer to be the house, deposit USDC into the Theta Vault.

The Theta Vault works similarly to $GLP for $GMX — depositors gain when traders lose, and vice versa. The current annual yield is 36%, but you could lose money if CVI spikes sharply.

Unlike CVOL tokens, the Theta Vault is designed for long-term investment. Traders may profit at the expense of Theta depositors in the short term. But as $GLP has proven, in the long run, the house always wins.

Final thoughts:

CVI is an interesting new DeFi primitive. Finally, some innovation amidst the sea of boring forks. The team has demonstrated strong capabilities, and their roadmap remains full of innovation. Definitely worth watching.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News