Analyzing Quest campaigns from 26 Dapps, we found that the majority have user retention rates below 1%.

TechFlow Selected TechFlow Selected

Analyzing Quest campaigns from 26 Dapps, we found that the majority have user retention rates below 1%.

Did doing social media-type Quests really increase Dapp's users?

Author: Jeff, Founder of Genki

Effective, data-driven marketing campaigns are the ultimate goal for every Dapp. As a provider of Quest tools, we’ve constantly been exploring how to help projects better acquire and retain users. Based on our operational data and market research, we classify Dapps into early-stage, mid-stage, and late-stage according to their maturity. Early and mid-stage Dapps primarily focus on finding new traffic sources—once they gain traction, they can build vibrant communities. In contrast, late-stage Dapps emphasize effectiveness and seek genuinely long-term retained users. Some even calculate the LTV (Lifetime Value) of different user segments within their products.

Currently, when Dapps use tools for marketing campaigns, the most common format is Quests—both social media-based and on-chain Quests. We found that over 80% of Dapps use social media tasks in conjunction with brand initiatives to drive user acquisition and activation. Driven by curiosity, we wanted to understand the long-term impact of running Quest campaigns.

Do social media Quests actually increase a Dapp's user base? Do on-chain Quests truly bring more users?

Surprising Results Worth Reflecting On

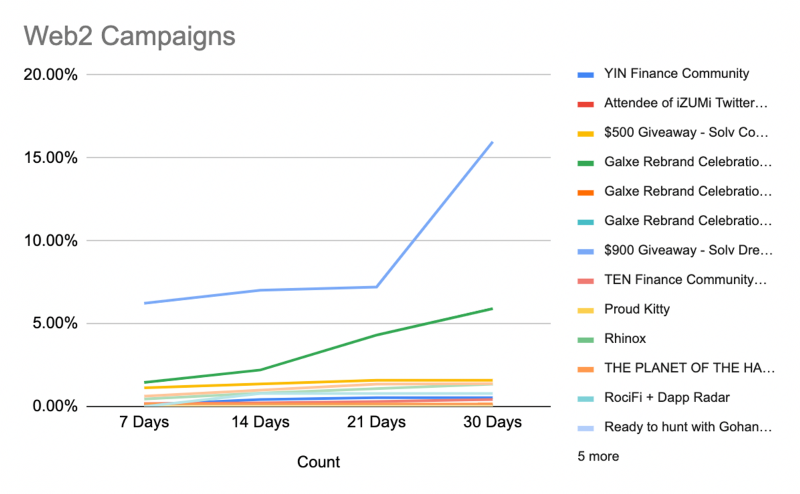

Category One: 17 Web 2.0-focused campaigns (one campaign required either Web 2.0 or Web 3.0 tasks—we classified it as Web 2.0).

-

The vast majority of these campaigns showed only 1% on-chain retention after 30 days.

-

Two exceptions: Solv and Duet (during Galxe’s rebranding campaign) achieved 16% and 6% retention respectively.

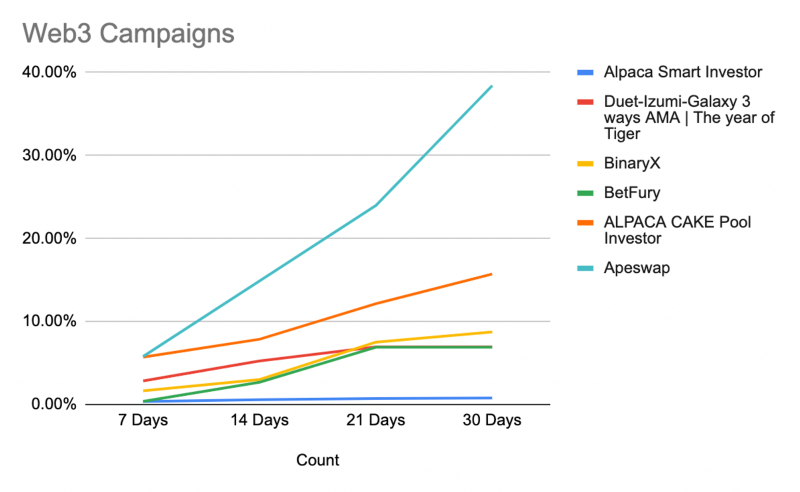

Category Two: Seven campaigns involving Web 3.0 tasks.

-

Four of them achieved over 6% retention.

-

Exception #1: GoodGhosting reached 93.5% retention (due to another campaign incentive around day 30 prompting users to re-engage with the protocol).

-

Exception #2: Alpaca Smart Investor (our verification method checks on-chain transaction behavior; we suspect low measured retention because users deposited funds into vaults and did not withdraw during the 30-day period).

Why Aren’t These Results Discussed More Often?

In Web 3.0, there aren't yet enough successful marketing case studies or templates. User acquisition and retention strategies have not matured into precise methodologies. For emerging Dapp teams, the easiest path is often to apply their understanding of traditional Web 2.0 marketing or simply copy what others are doing in the market.

VCs lack proper tools to measure a Dapp’s real success. If VCs prioritize social media follower counts, projects will naturally focus more on growing followers than cultivating loyal Dapp users.

There are insufficient high-quality tools enabling Dapps to rapidly run on-chain experiments.

-

Set up on-chain tasks within five minutes.

-

Analyze user profiles and accurately calculate average user value across segments.

-

Measure ROI for each campaign.

How Did We Define Parameters and Conduct This Experiment?

Those interested in the experimental design can continue reading; others may skip this section.

Premise

Many Dapps conduct social media tasks across various platforms—such as Genki, Project Galaxy, Quest3, Port3, Dequest—to attract new users.

Hypothesis

Are on-chain tasks more effective than purely social media-based tasks at bringing authentic, active users to Dapps?

Expected Outcome

Yes. On-chain tasks increase the cost for bounty hunters while helping Dapps more precisely convert such users.

Methodology

We selected qualifying campaigns from three platforms: Genki, Quest3, and Galxe.

-

We treated campaigns with only social media tasks as the test group; those with on-chain tasks served as the control group.

-

The Dapp must have publicly listed contracts on DappRadar.

-

The campaign must have ended at least one month ago (to allow sufficient time for measuring user retention).

-

Blockchains: Ethereum & BNB Chain.

-

Participant count: 1,000–5,000, or more than 5,000.

-

Reward distribution: Tokens or NFTs.

For different campaign types, we analyzed the following user behaviors:

1. Dapp

Whether participants remained active in the Dapp at 7, 14, 21, and 30 days post-campaign.

2. NFT

-

Number of NFT holders at 7, 14, 21, and 30 days.

-

Current number of NFT holders.

Note: How do we define a holder? Note that we don’t directly track NFT holding status, but instead identify users who have minted or received an NFT.

How Can This Experiment Become an Open-Source Tool to Help the Industry Evolve?

Our retention analysis tool can support your project.

-

Reduces development team effort in supporting marketing teams with retention calculations.

-

Adds richer user profile dimensions and helps optimize user acquisition workflows.

What kind of data can you access:

-

Check whether a specific address is a new user.

-

We determine this by checking if the address has interacted with any of the Dapp’s contracts.

-

-

Number of retained users at 7/14/21/30 days.

-

Projects can define "retained user" based on several criteria:

-

Received an NFT (via mint, purchase, or airdrop).

-

Executed specific functions on the smart contract.

-

Specific event logs recorded.

-

Holds a specific token.

-

-

If you’d like to use this retention analysis, please reach out. Required information is listed below.

After collecting 50+ samples, we’ll open-source this experiment as a tool, and hope to enhance its functionality through community feedback.

Finally, we believe: The journey of Web 3.0 has just begun. Transitioning from Web 2.0 to Web 3.0, there’s immense room to explore in marketing. Sharing insights and conducting joint experiments will be the best way to discover effective strategies. We look forward to engaging with more teams.

Recently, we’re experimenting with token distribution and using Perks in campaigns—feel free to connect. Email: support@genki.io TG: jeff_taiwan

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News