May Dapp Report: Daily Active Wallets Grow 8%, NFT Trading Volume Rises 40%

TechFlow Selected TechFlow Selected

May Dapp Report: Daily Active Wallets Grow 8%, NFT Trading Volume Rises 40%

DeFi total value locked (TVL) grows by 25%, as AI momentum continues to strengthen.

Author: DappRadar

Translation: Felix, PANews

May 2025 marked a turning point for the decentralized application (Dapp) industry. With rising user activity, a strong DeFi rebound, and AI solidifying its position in Web3, the ecosystem is showing signs of stability and maturity. From market recovery to infrastructure upgrades and shifting user preferences, May highlighted how Dapps are evolving toward long-term utility beyond mere hype cycles.

Key Takeaways:

-

Daily unique active wallets (dUAW) reached 25 million in May, an 8% increase, signaling healthy growth across the ecosystem.

-

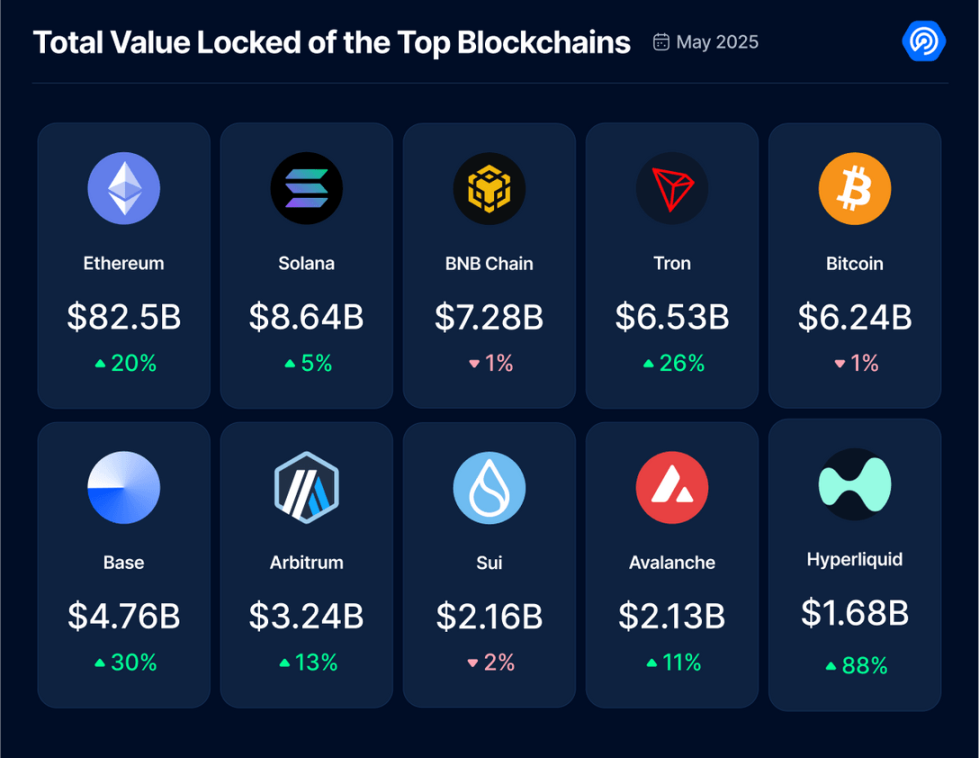

DeFi total value locked (TVL) surged 25% to $200 billion, driven by Ethereum’s 40% price rise and Hyperliquid’s $244 billion trading volume.

-

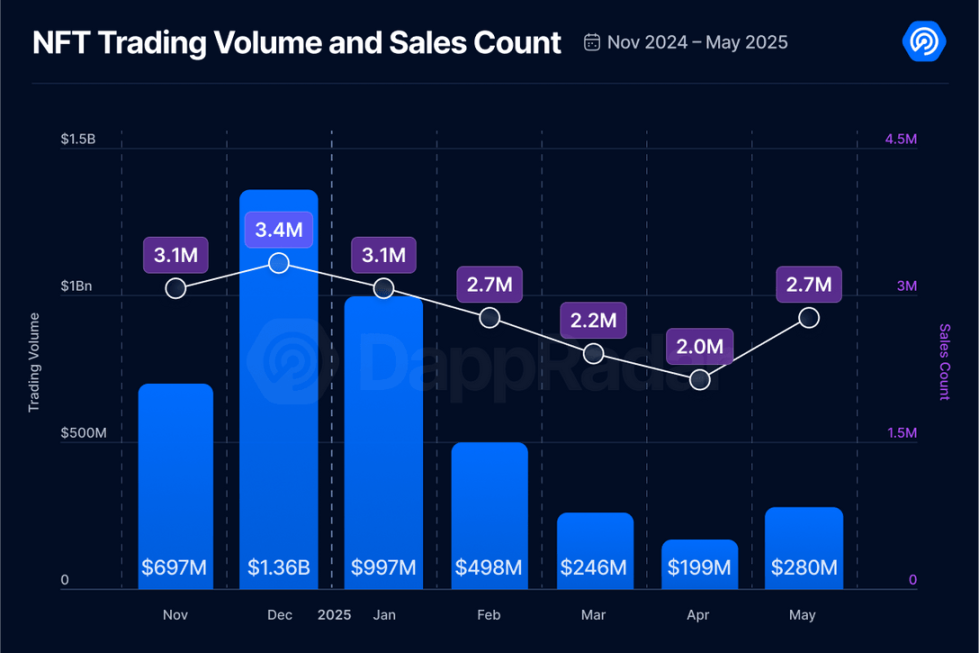

NFT trading volume grew 40% to $280 million, with transaction count up 35%, led by Ethereum, Abstract, and Telegram-related domains.

-

AI dapps achieved 4.8 million dUAW, a 23% increase, matching DeFi and gaming in user engagement.

-

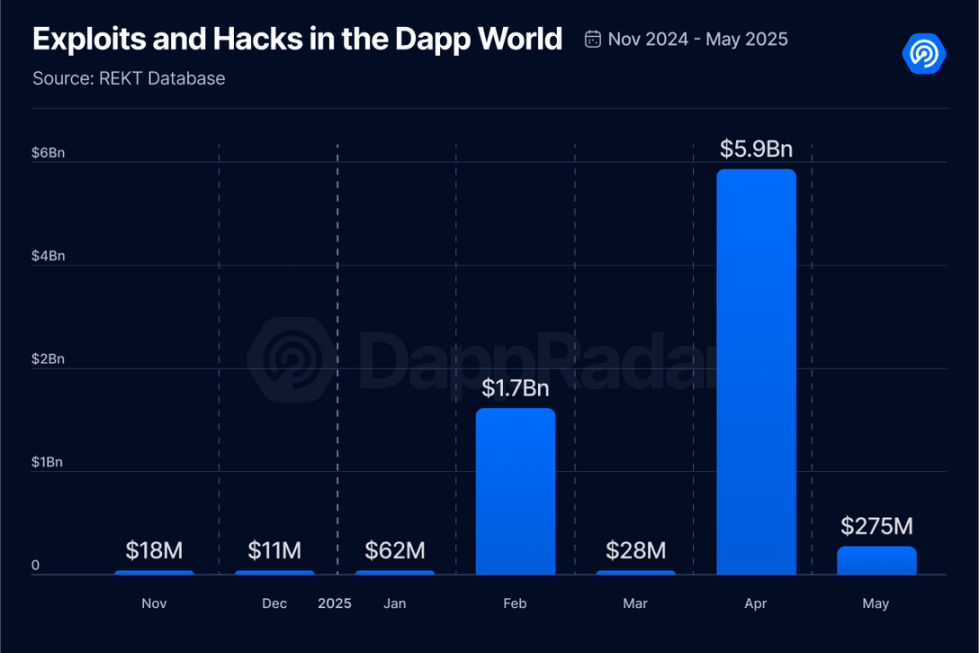

$275 million lost due to Web3 exploits—making it the third-costliest month in a year, surpassing combined losses from November through March.

1. 25 Million dUAW Signals Healthy Dapp Growth

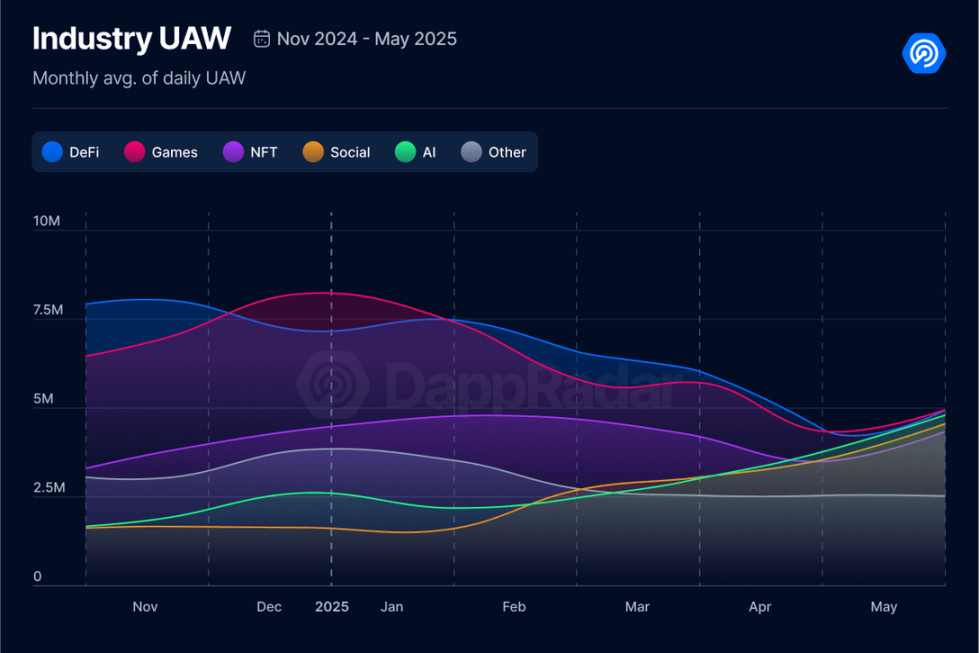

In May, dapps showed clear signs of optimistic recovery, with dUAW growing 8% to reach 25 million. This growth aligns with overall market sentiment and was fueled by renewed activity in DeFi and NFTs, as explored in the following sections.

Three sectors stood out this month with consistent and significant growth:

-

AI DApps increased by 23%, reaching 4.8 million dUAW

-

Social DApps grew 21% to 4.3 million dUAW

-

NFT DApps rose 9% to 3.9 million dUAW

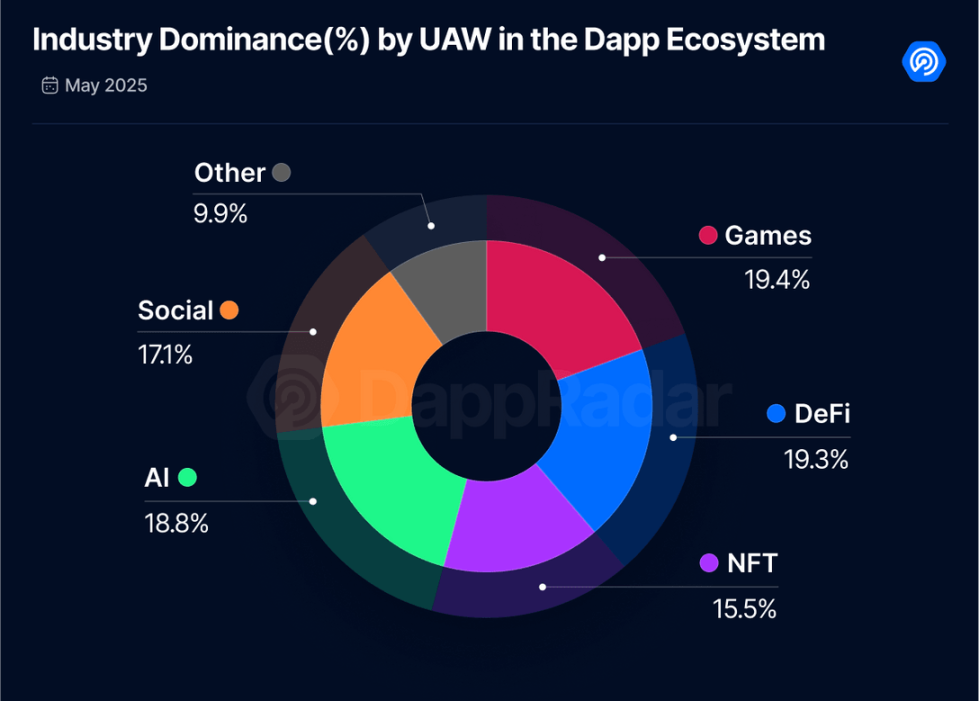

This growth not only reflects increasing appeal within each sector but also contributes to a more balanced ecosystem. We are now witnessing AI, DeFi, and gaming DApps gradually taking dominant positions, with their respective shares of user activity becoming relatively comparable.

Beyond rising engagement in AI, DeFi, and gaming, an emerging trend worth noting is "InfoFi"—the financialization of data and information within Web3. While AI continues to capture mainstream attention, InfoFi is quietly building a new layer of the decentralized stack. This trend enables users, protocols, and AI agents to buy, sell, stake, lend, or borrow data, insights, and models, typically leveraging blockchain for provenance, transparency, and monetization. Just as SocialFi redefined user participation, InfoFi is laying the groundwork for data to become an active financial asset.

The diversification of user engagement marks a significant milestone. A healthy and mature dapp ecosystem means multiple verticals can thrive simultaneously—not just during hype cycles, but through sustained utility, community adoption, and platform evolution.

While AI has been a dominant topic across industries, on-chain data now confirms the momentum. As AI dapps match DeFi and gaming in daily active wallets, AI is being integrated into blockchain experiences—from productivity tools and agents to social and marketing applications.

On-chain activity in May indicates a stronger, more diversified DApp ecosystem. With user attention spreading more evenly across domains and deeper integration of emerging technologies like AI, the Web3 landscape is evolving toward more robust and sustainable infrastructure.

2. Top DApps by UAW: From Meme Hype to Utility-Driven Growth

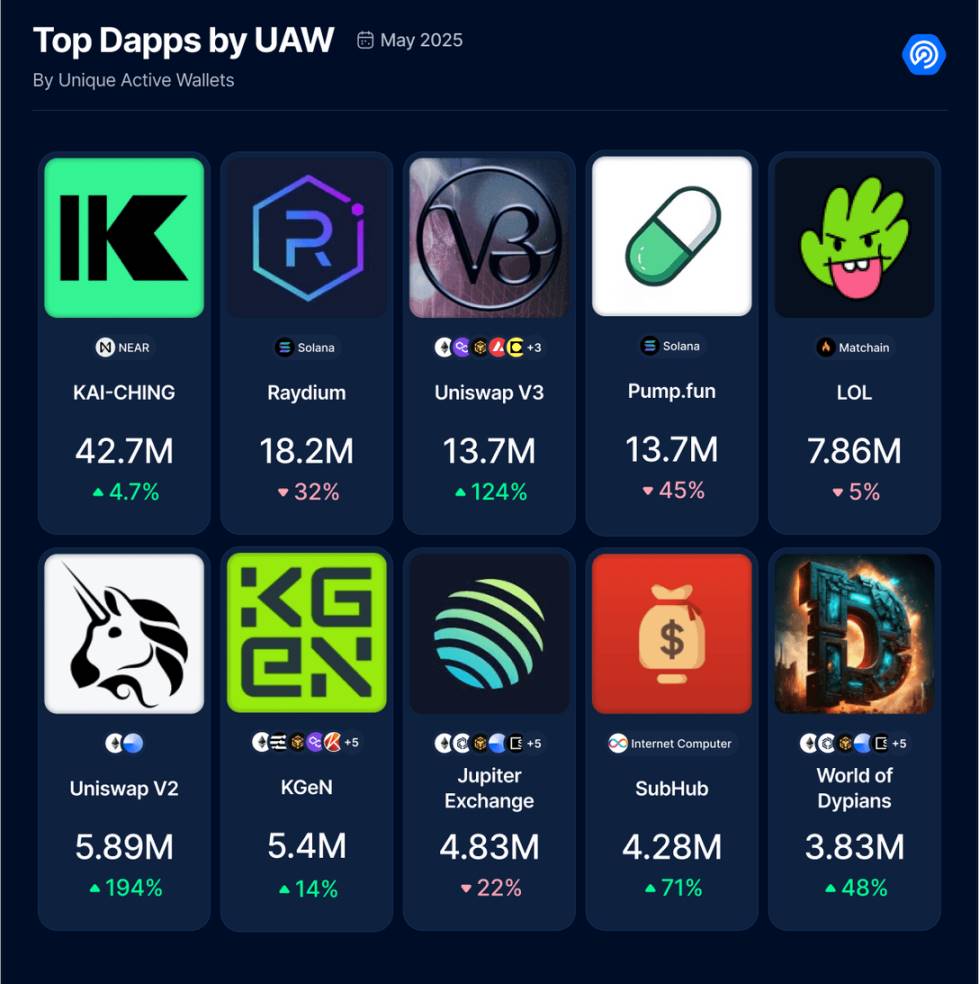

User engagement patterns in May revealed a shift from speculative trends toward more utility-focused DApps. Although meme coin platforms like Pump.fun attracted massive attention in April, that momentum appears to be cooling. By May, Pump.fun had declined from its peak activity levels, suggesting that meme coin trading may have reached saturation—for now.

In contrast, DeFi DApps saw significant increases in unique active wallets (UAW), particularly Uniswap V2, which continued to benefit from strong activity on Base. On May 4, Uniswap announced integration with Soneium—a major development. This move not only expands Uniswap's L2 presence but also opens a new chapter in merging DeFi with entertainment and consumer tech.

In gaming, World of Dypians maintained dominance, consistently ranking among the top monthly active user counts. Its immersive world-building and loyal player community are proving key to long-term retention—an ongoing challenge in this category.

Meanwhile, in AI and social, SubHub gained traction by combining personalized Web3 communication with AI-enhanced delivery infrastructure. Positioned at the intersection of messaging, wallets, and smart targeting, SubHub symbolizes how AI dapps are beginning to build dedicated user bases rather than simply riding hype cycles.

The performance of top DApps in May reflects a broader trend: while speculative hype can drive rapid user spikes, long-term retention increasingly depends on utility and platform innovation. Whether AI-powered communication, core gameplay mechanics, or L2-based DeFi scaling, today’s rising DApps offer users ease of use and functionality—not just speculation.

3. DeFi Resurgence: TVL Jumps 25%

DeFi continued its upward trajectory in May, with TVL growing 25% to approximately $200 billion. This recovery closely mirrored broader market gains, especially Bitcoin hitting all-time highs and Ethereum surging 40%, both significantly boosting DeFi asset valuations and liquidity depth.

All major DeFi ecosystems saw TVL growth, indicating renewed investor confidence and increased on-chain activity. One project stood out notably.

The standout performer this month was decentralized exchange Hyperliquid, which recorded $244 billion in trading volume—capturing about 10% of Binance’s market share. With this performance, Hyperliquid ranked:

-

Top five in trading volume across centralized and decentralized exchanges

-

Top ten in total value locked across all blockchain networks

-

This marks a significant shift in how on-chain derivatives protocols now directly compete with major centralized finance (CeFi) players, signaling that decentralized perpetuals and derivatives are maturing.

Beyond metrics, several important updates and policy moves shaped DeFi’s progress in May:

Ethereum’s Pectra Upgrade

This highly anticipated hard fork introduced two key improvements:

-

EIP-7702: Introduces account abstraction, giving regular wallets smart contract-like capabilities such as batch transactions and gas fee sponsorship.

-

EIP-7251: Raises the validator reward cap from 32 ETH to 2048 ETH, enabling institutional stakers to earn compounded staking rewards and improving capital efficiency.

XRP Ledger Launches EURØP Stablecoin

Ripple launched EURØP, a euro-pegged stablecoin fully compliant with the EU’s Markets in Crypto-Assets Regulation (MiCA). It becomes the first major stablecoin to meet MiCA standards, marking a new phase in DeFi regulatory compliance.

Progress on U.S. GENIUS Act

The U.S. Senate passed a cloture motion on a bipartisan GENIUS Act with 66 votes in favor and 32 opposed, aiming to establish federal oversight for stablecoin issuers. The advancement ends prolonged debate and signals growing regulatory momentum in Washington.

South Korea Considers Approving Crypto ETFs

South Korea’s ruling party pledged to approve spot crypto ETFs and relax bank restrictions on exchanges—a move that could significantly boost crypto accessibility in Asia’s highly active retail market.

With DeFi rebuilding its foundation through protocol upgrades, clearer regulation, and market growth, the future looks more mature and resilient. Despite risks, May 2025 demonstrated DeFi’s ongoing evolution in infrastructure and institutional relevance.

4. AI Momentum in Web3 Grows, Public Calls for Decentralized Intelligence

AI remains dominant globally, and its impact on Web3 is becoming increasingly pronounced. As industries race to integrate AI, AI-driven dapps are steadily gaining ground in decentralized ecosystems. This is no longer just hype—it reflects a societal shift toward open, user-owned technology.

This month, top-performing AI dapps remained stable overall, highlighting the staying power of early market leaders.

The most notable newcomer is SubHub, a Web3 notification and marketing platform developed by Dmail using AI-enhanced technology. Designed to optimize how projects engage audiences, it enables personalized messaging via wallet addresses and decentralized identifiers (DIDs). Positioned at the intersection of AI, communication, and social DApps, SubHub reflects growing demand for autonomous, targeted, and decentralized promotion as users grow tired of traditional centralized marketing models.

By combining intelligent messaging with wallet-based targeting, SubHub reinforces the idea of increasing convergence between social and AI DApps, delivering user-centric experiences across multiple layers of Web3 infrastructure.

Beyond DApps, significant progress occurred in the AI x Blockchain space this month:

-

ThinkAgents.ai released the open-source “Think Agent Standard,” a protocol for deploying autonomous agents on decentralized networks—a step toward interoperable on-chain AI.

-

Tether announced its entry into AI, planning to launch a decentralized AI platform integrating peer-to-peer communication with crypto-native features.

-

Assisterr (Solana) raised $2.8 million at a $75 million valuation to support no-code deployment of small language models (SLMs)—offering composable AI tools without heavy development costs.

-

Donut Labs secured $7 million in seed funding to build the first “agent” Web3 browser, combining AI capabilities with crypto wallets and DEXs.

-

Global exchange BingX committed $300 million over three years in its “AI Evolution” roadmap—integrating AI into its trading engine and ecosystem.

Yet perhaps most telling is the growing public support for decentralized AI. A Harris Poll commissioned by Digital Currency Group (May 29) found:

-

77% of Americans believe decentralized AI benefits society more than centralized models.

-

56% prefer AI development through decentralized systems.

-

These figures highlight a cultural shift aligned with Web3 values of transparency, user ownership, and anti-monopoly principles.

5. NFT Growth of 40%: Real Recovery or Short-Term Spike?

In May, the NFT market showed signs of revival, with trading volume climbing to $280 million—a 40% month-on-month increase. Likewise, NFT transaction count rose 35% to 2.7 million. While this brings cautious optimism, it falls short of a full-scale recovery. Sustainable trends require months of consecutive growth—but small wins still count.

Ethereum’s NFT volume grew 30%, reclaiming dominance with 53% of total NFT market volume. Immutable zkEVM followed with 13%, and Abstract with 10%. Notably, Abstract’s volume surged 1200%, driven by speculation around mining and expected airdrops—indicating that incentives still heavily influence the NFT market. This is evident in popular NFT collections seeing daily trades exceed one million, yet floor prices lingering around $300.

By category, art-based NFTs saw the strongest growth, with series like Good Vibes Club driving large transaction spikes. Close behind was a revival in domain NFTs, especially those linked to TON and Telegram, as Telegram-based dapps remain popular. Their appeal lies in easy access, gamified experiences, and low entry barriers—suggesting the fusion of messaging platforms with NFTs could become a lasting trend.

Several developments in May could reshape the NFT landscape:

Apple Removes 30% NFT Tax on iOS

Under legal pressure, Apple made a landmark move by eliminating the 30% fee on in-app NFT transactions on iOS—reducing friction for NFT markets integrated into iOS apps and opening doors for broader mobile adoption of NFT platforms.

OpenSea Launches OS 2.0

OpenSea unveiled OS2, a fully revamped multi-chain marketplace expanding beyond NFTs to include fungible tokens and meme coins, supporting 19 blockchains and unifying minting, swapping, and trading into one seamless experience.

FIFA Migrates NFT Platform to EVM

FIFA announced it will migrate its NFT platform from Algorand to a custom Ethereum-compatible chain—the so-called FIFA Blockchain—improving scalability and wallet compatibility for fan collectibles, enabling use with MetaMask and other EVM tools.

Tokenization of Physical Assets Gains Traction

Courtyard, a platform tokenizing physical assets, became one of the largest NFT collection platforms by volume, exceeding $55 million in trades—indicating rising demand for RWA-backed NFTs.

While enthusiasm for NFTs is gradually returning, much of the volume remains driven by airdrops, mining incentives, and speculation. If this momentum holds in the coming months, it may signal NFTs entering a new phase—one combining utility, accessibility, and real-world applications.

6. Web3 Losses Hit $275 Million This Month

Despite fewer individual incidents than in April, losses from hacks and exploits in May remain deeply concerning. According to the REKT database, just seven events caused over $275 million in losses—making it the third-costliest month in the past year, exceeding the combined losses from November, December, January, and March.

Although this figure represents a 95% drop from April’s record losses—largely due to the Mantra DAO incident—interpreting this as a sign of recovery would be misleading. The severity of individual attacks in May highlights persistent systemic vulnerabilities in the dapp ecosystem.

Notable breach events this month:

Cetus Protocol Exploit: $260 million

On May 22, Cetus Protocol, a decentralized exchange on the Sui network, suffered a major attack resulting in $260 million in losses. Token prices on the platform plummeted, with some dropping over 90%. The team immediately paused smart contract operations to contain damage and initiate investigations.

Cork Protocol Vulnerability: ~$12 million

On May 28, Cork Protocol was compromised due to a smart contract vulnerability, leading to the theft of approximately $12 million worth of 3,760 wstETH. The attack exposed critical flaws in contract logic and triggered immediate community alerts.

Mobius Token (MBU) Incident: ~$2.16 million

On May 11, a suspicious interaction with an unverified contract on Binance Smart Chain resulted in a $2.16 million loss. Though appearing like a typical exploit, evidence suggests it may have been a “rug pull,” further blurring the line between technical vulnerabilities and malicious intent.

Data from May clearly shows that despite improved tools and awareness, the Web3 space remains highly vulnerable. Repeated million-dollar attacks underscore an urgent need for stricter audit standards, real-time risk monitoring, and better education for developers and users alike.

7. Conclusion

May was a pivotal month for the dapp ecosystem, marking broad recovery and maturation of industry dynamics. Daily active wallets reached 25 million, with rising user engagement fueled by growth in key verticals including DeFi, NFTs, AI, and social.

The shift from hype-driven activity to utility-focused participation has become increasingly evident. While meme coins may be cooling, decentralized finance protocols like Hyperliquid and AI dapps like SubHub are gaining prominence—indicating users are gravitating toward platforms that deliver functionality, innovation, and real value.

A 25% rise in DeFi TVL reflects restored market confidence, supported by infrastructure upgrades and policy advances. Meanwhile, NFT trading volume spiked 40%, with Ethereum regaining dominance and RWA gaining spotlight. AI momentum continues to strengthen—not only in public sentiment (with 77% of Americans favoring decentralized AI) but also in usage, now rivaling DeFi and gaming in user engagement.

In short, the DApp industry is transitioning from a volatile experimental phase to a more stable developmental stage. With diversified user activity and tangible applications of technologies like AI, the ecosystem is entering a new era—one defined not just by trends, but by infrastructure, balance, and long-term resilience.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News