On-chain data could become a "battleground" for commercial banks?

TechFlow Selected TechFlow Selected

On-chain data could become a "battleground" for commercial banks?

How can on-chain data transform from raw material into productive force?

“How can on-chain data transform from a means of production into productive force?” As industries continue to explore data as a cutting-edge factor of production, this fundamental question stands prominently before us.

When it comes to on-chain data, due to its abstract nature and the niche status of the field, even many digital natives tend to overlook it—let alone the general public.

Extracting valuable information from blockchain networks through on-chain data empowers users with exceptional insights, enabling them to more effectively capture industry opportunities. Furthermore, forward-thinking tech giants are not only racing ahead in blockchain technology, but some have specifically entered the on-chain data space to unlock its vast potential. These companies focusing on on-chain data have achieved high valuations, with some already thriving despite macroeconomic uncertainties.

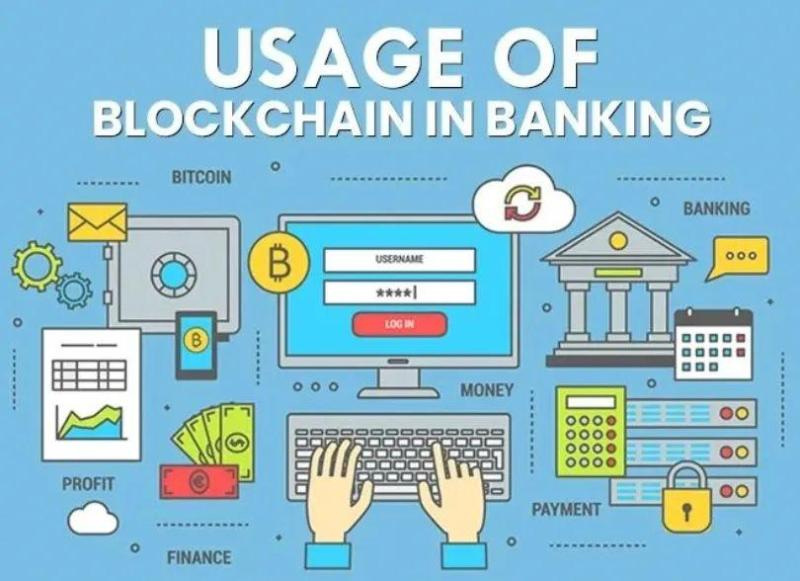

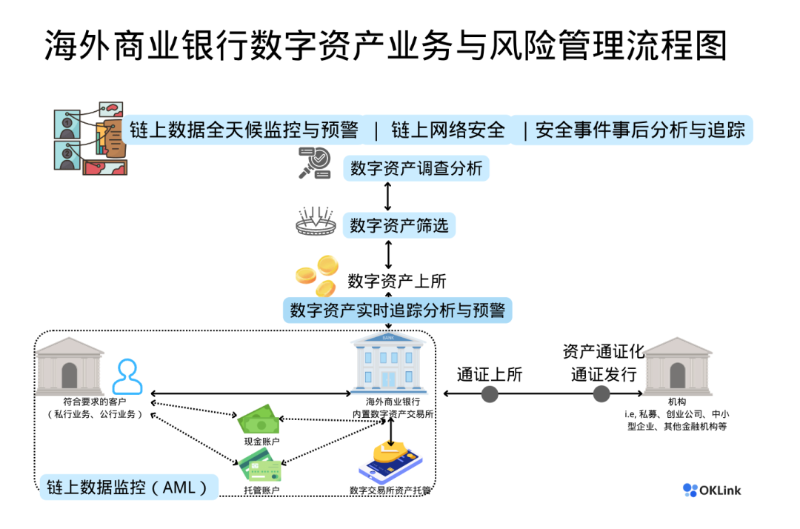

To address widespread public questions about on-chain data, OKLink Research Institute uses overseas commercial banks as a case study to help explain what on-chain data is and how it transforms from a production factor into productive force. Commercial banks were chosen primarily because their operations center around information and data analysis, giving them inherent advantages in data-driven innovation.

1. Their extensive data operations make integration with on-chain data relatively seamless, offering strong potential for advancing data elements toward becoming productive forces.

2. High societal acceptance allows them to provide replicable experiences and practical reference models for other industries.

Global banks’ exploration of on-chain data and its underlying distributed technologies dates back to 2014 with the founding of R3, the global blockchain consortium (with institutions such as JPMorgan Chase, Ping An Group, China Merchants Bank, and China Foreign Exchange Trade System joining over time).

Image source: Internet

Recently, several financial industry giants have also joined organizations like the Enterprise Ethereum Alliance. From internal process optimization to interbank collaboration, and now to exploring decentralized finance (DeFi) among institutions, overseas commercial banks have never stopped innovating.

Commercial Banks’ Exploration From Inside Out

According to KPMG’s “2022 Global Banking Survey,” 85% of surveyed bank executives said their institutions plan to offer digital wallets to customers, and some overseas commercial banks already provide digital asset custody services. On-chain data, as the foundational element of digital assets, underpins these services—the organization, analysis, governance, and application of on-chain data form the core logic behind banks’ digital asset-related operations.

Depending on differing regulatory environments across countries and regions, commercial banks vary in their focus on on-chain data initiatives. Below are examples illustrating how overseas commercial banks are exploring this domain from within outward:

01 Digital Asset Risk Management Goes Digital and Intelligent

On-chain data has become one of the primary tools used by overseas banks for risk control in digital asset-related businesses.

Digital asset risk management must undergo digital and intelligent transformation to keep pace with the exponential growth of on-chain data. As banking services diversify, overseas banks place increasing emphasis on analyzing on-chain data and refining risk management processes—particularly proactive, pre-emptive controls.

For example, DBS Bank in Singapore currently offers digital trading services involving four fiat currencies and six relatively mature digital assets, along with STO (security token offering) and digital asset custody services. In managing financial risks related to digital assets, expert analysts specializing in on-chain data security interpret blockchain records to determine which digital assets can be listed on the bank's internal trading platform and monitor ongoing risks associated with those assets, providing technical oversight.

Also in Singapore, during the 2022 Global Digital Business Conference hosted by the Shanghai Data Exchange, a presentation on Web3 technologies and data trading touched upon on-chain data and shared current application scenarios globally.

As a blockchain data company at the Shanghai Data Exchange, OKLink shared insights at the event on the digital and intelligent transformation of digital asset risk management—building a situational awareness system that acts as the intelligent brain of proactive security defense. This requires not only integrating big data and artificial intelligence technologies but also leveraging years of expertise from specialized teams. At the event, we also launched a global initiative: to establish a “Global Web3 Data Alliance.”

Image source: 2022 Global Digital Business Conference

We have already achieved real-time detection, tracking analysis, and responsive handling of suspicious address transactions across multiple chains and scenarios.

Image source: OKLink Research Institute

02 "DeFi" Entering National-Level Institutions

Beyond optimizing internal processes and launching new digital asset services, decentralized finance (DeFi) has emerged as a key direction for overseas nations and institutions exploring next-generation financial systems. DeFi leverages blockchain-based smart contracts to execute various financial services. While existing applications, due to their open-source and permissionless nature, may not suit mainstream financial institutions, DeFi is gradually entering the mainstream through the promising concept of “institutional-grade DeFi.”

According to the Monetary Authority of Singapore (MAS), on November 2, JPMorgan Chase, DBS Bank, and SBI Digital Asset Holdings completed foreign exchange and government bond trades on the Ethereum network using Aave, a decentralized protocol on Polygon. During the trial, digitized versions of Singaporean government bonds were exchanged for Japanese equivalents, and yen was converted into Singapore dollars. MAS described this as the first real-world use case of an institutional-grade DeFi protocol.

Image source: Internet

All actions in DeFi applications—including execution of smart contracts—occur on-chain, with every transaction recorded via on-chain data, while smart contracts define the transaction rules.

In essence, on-chain data serves as the carrier of value. Decentralized data does not equate to unregulated or permissionless access. By tracking, analyzing, and governing permissioned on-chain data, national institutions can accelerate adoption of novel financial applications.

With robust regulatory compliance frameworks ensuring financial stability, tokenized assets can enable instant cross-currency trading, clearing, and settlement directly between counterparties via DeFi applications. This eliminates costs associated with intermediaries in clearing and settlement, as well as the operational overhead of managing bilateral counterparty relationships required in today’s over-the-counter (OTC) markets.

Image source: Oliver Wyman Forum, DBS, Onyx by J.P. Morgan, SBI Digital Asset Holdings

03 "Asset Tokenization": A New Digital Experiment

The idea of converting rights to any asset into digital tokens on a blockchain and issuing them publicly is no longer unfamiliar. A September report by Boston Consulting Group projected that between 2022 and 2030, the total value of tokenized tangible and intangible assets could reach 10% of global GDP.

Due to the public visibility of on-chain data—accessible and verifiable by anyone with proper authorization—the financial status or value of a company or asset becomes transparent.

As tokens trade and circulate, the underlying asset’s value is reflected through fluctuations in token prices. Thus, the entire process enables more efficient pricing via on-chain data. For instance, Ball, a mid-sized fintech firm in Indonesia, raised over $100,000 within hours by issuing tokenized bonds, bypassing traditional banking and VC funding channels. Ball’s financial health is fully traceable via on-chain data, allowing investors to monitor critical credit risk factors affecting bond valuation through continuous on-chain data analysis.

Currently, regulators in Hong Kong, Singapore, and Japan have issued guidelines regarding tokenized securities. The Monetary Authority of Singapore (MAS) announced Project Guardian in May 2022. In the same month, DBS Bank issued S$15 million ($11.14 million) worth of bonds as “security tokens.” During Hong Kong Fintech Week 2022, HKMA Chief Executive Eddie Yue stated that the authority is preparing to issue tokenized green bonds, aiming to launch the world’s first tokenized sovereign green bonds within the year.

Image source: Hong Kong Fintech Week

Bringing On-Chain Data to Life and Unlocking Its Productivity

From the banking sector’s exploration of digital assets, it’s evident that while technological foundations are shared, different business needs exist—and industry standards for risk management and control continue evolving. How to unlock the productivity of on-chain data—a new factor of production—requires long-term, forward-looking exploration.

“Identify the underlying business logic and use a common language—on-chain data—to bridge the gap between shared technologies and specific needs. Only by bringing on-chain data to life can we unlock its true value.” Nick Xiao, global blockchain big data expert and Product Director at OKLink, offered this insight when discussing on-chain data solutions, due diligence reports for digital assets, and collaborative security situational awareness programs with overseas commercial banks.

Starting from full-node access and data collection via blockchain explorers—effectively building a “Google of the on-chain world”—to analyzing transaction behaviors using big data techniques combined with nearly a decade of expert experience to map user behavior patterns on-chain, and further decoding abnormal transactions to establish a global industry graylist/blacklist of addresses, OKLink has ultimately built a comprehensive product matrix covering the entire on-chain data value chain. Despite the apparent complexity and challenges, according to Nick Xiao, the ultimate goal remains simple: understand the core business logic, identify common elements, and bring those elements to life to meet customized demands—this is where true value lies.

Looking ahead, we observe that overseas commercial banks will not only continue experimenting in the three emerging areas mentioned above (digital intelligence, DeFi, and asset tokenization), but will also scale up practices in three established business lines—payments, collateralized lending, and prime brokerage—driving explosive growth in on-chain data. As more investors enter the digital economy, leveraging on-chain data to enhance banks’ capabilities in serving digital assets will become an essential foundation for the future of banking.

To Be Continued: From Niche to Mainstream

“The industry still needs significant evolution and greater alignment with regulation so governments can participate confidently—this will be a major driver of compliance. In the future, if the digital asset industry adopts sound incentive mechanisms and enables automated governance participation by governments, the general public might begin holding digital assets, leading to massive transaction volumes,” said Agostino Capponi, Associate Professor of Finance at Columbia University, noting that improved regulation could eventually drive large-scale adoption.

For sustainable and healthy development of digital assets in overseas commercial banks, the integration of technological oversight with financial regulation is essential to address new challenges posed by digital assets. Although most overseas banks already have mature AML, KYC, and BSA compliance programs, they must re-evaluate whether their technology infrastructure and on-chain data operations are agile enough and whether they have reliable partners offering expert on-chain data services. Additionally, standard-setting bodies are beginning to apply third-party certification and attestation methods to crypto asset business models. For example, audit procedures for overseas banks serving crypto clients—such as verifying asset ownership and control—must incorporate crypto-specific risks and rely on on-chain data to achieve these objectives.

The story between banking and on-chain data continues. On-chain data expands the dimensionality of data as a production factor, enabling more secure data architectures and databases, and fostering more efficient organizational workflows. New business models will emerge between organizational nodes due to the expansion of data elements and the formation of on-chain data markets—for example, institutional DeFi applications.

In the realm of digital asset compliance, overseas commercial banks can either adopt professional on-chain data service providers or draw on the experience of industry leaders like OKLink to build in-house capabilities, integrating big data and AI technologies to truly realize the widespread adoption and commercialization of on-chain data.

The fourth industrial revolution, marked by digitization, networking, and intelligence, has accelerated advancements in modern information technologies such as artificial intelligence and blockchain, driving transformative changes in data factor markets. In jurisdictions where digital asset compliance is maturing, on-chain data—as a new production factor in the data market—has the potential to integrate organically with the banking sector, transitioning from niche to mainstream in an open-ended evolution.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News