On-Chain Data Insights: Which Protocols Are Growing the Fastest? What Are the Trends and Narratives?

TechFlow Selected TechFlow Selected

On-Chain Data Insights: Which Protocols Are Growing the Fastest? What Are the Trends and Narratives?

In this article, you'll see The DeFi Investor's findings: fastest-growing protocols, current trends and narratives, and the latest smart money movements.

Written by: The DeFi Investor

Translated by: TechFlow

The DeFi Investor, a crypto analyst, has spent extensive time hunting for Alpha through on-chain data. In this article, you'll see some of his findings:

-

Fastest-growing protocols

-

Current trends and narratives

-

Latest smart money movements

Let’s dive into these fastest-growing protocols.

Lybra Finance LSD

$LBR has performed exceptionally well recently. Lybra is the project behind eUSD, an interest-bearing stablecoin backed by LSDs (stETH). Its total value locked (TVL) surged from $16 million to $160 million within three weeks. Anyone can borrow $eUSD by collateralizing $stETH with zero fees.

Lybra takes a fee from the revenue generated by stETH, and the remainder is distributed to $LBR stakers.

The reason for Lybra's explosive growth lies in its flywheel effect: $ETH borrowers mint $eUSD and receive $LBR incentives → $LBR holders earn more income → higher $LBR price → more $eUSD minted.

GND Protocol

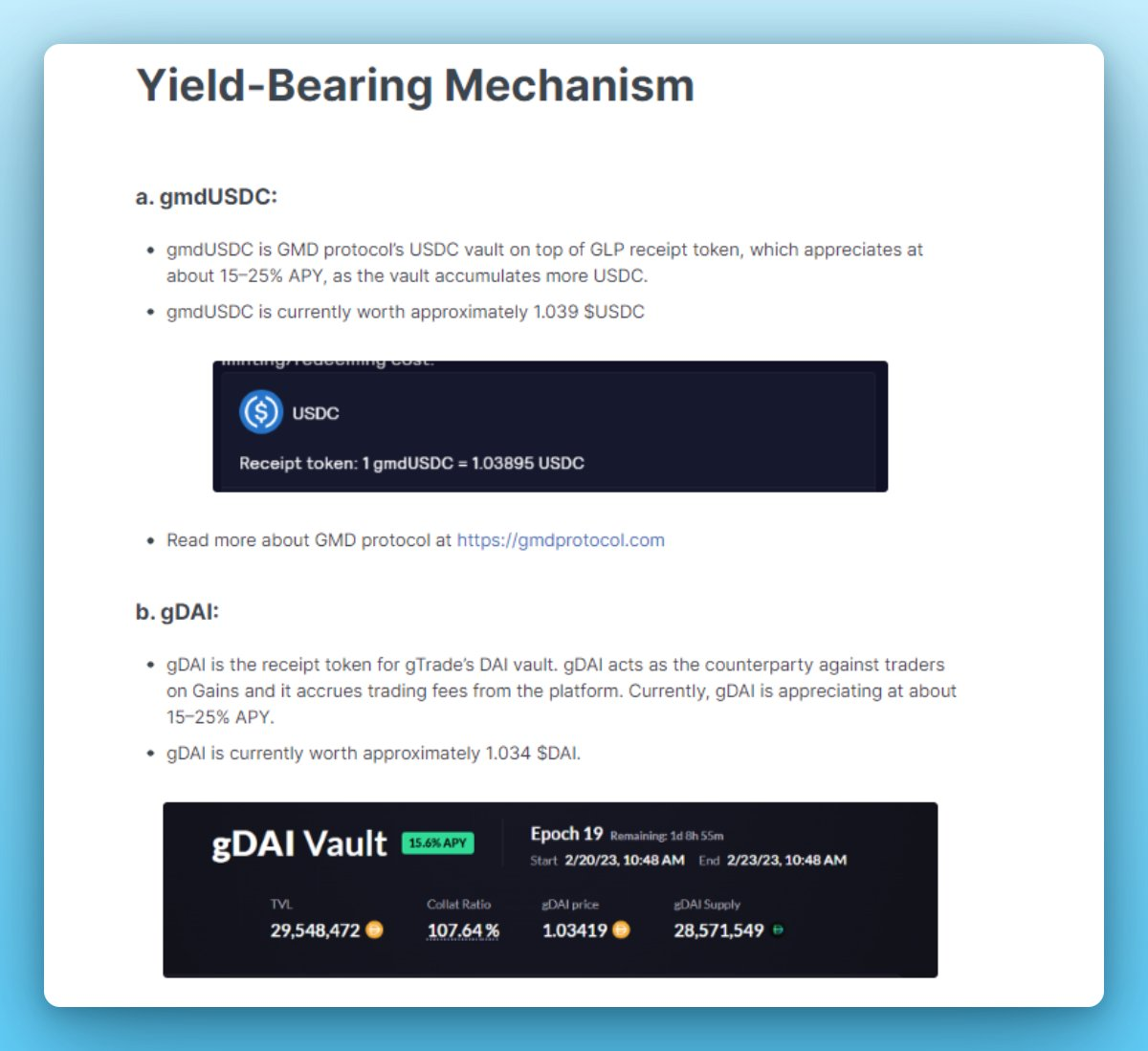

Launched at the end of April, GND Protocol reached $42 million TVL in under two months. It is the parent protocol of $gmUSD, a yield-generating stablecoin on Arbitrum. $gmUSD is backed by gmdUSDC and gDAI, and holders capture most of the yield generated by these tokens.

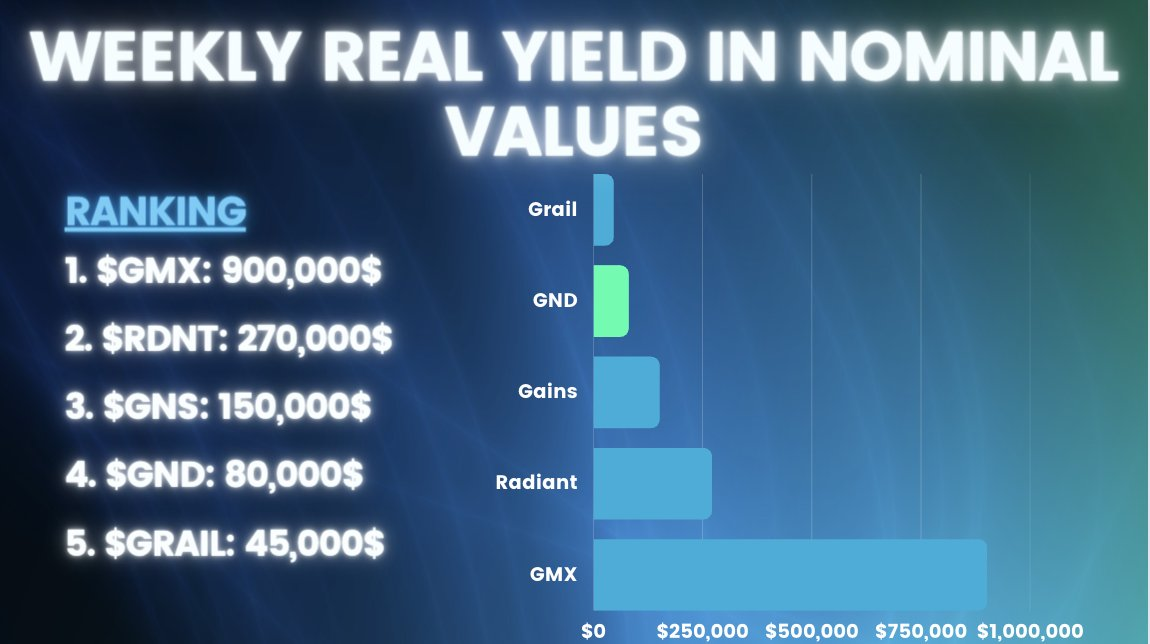

Its second product, GND Farm, manages concentrated liquidity on behalf of LPs and captures trading fees as revenue. Most of the GND revenue from $gmUSD and GND Farm is used to buy back and burn $GND from the market. GND has become the fourth-largest real yield project on Arbitrum.

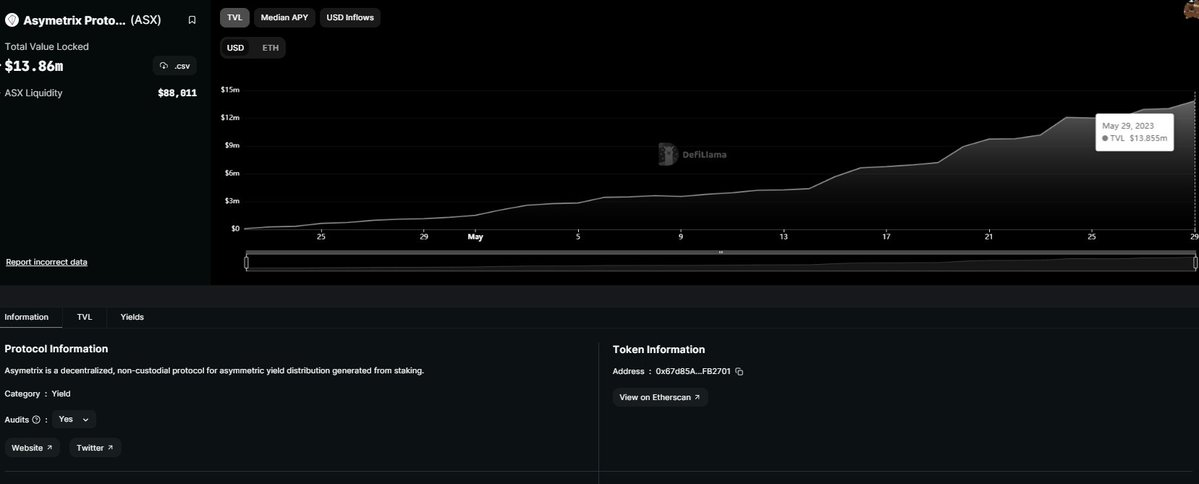

Asymetrix

Asymetrix is a protocol for asymmetric yield distribution via staking. Launched just one month ago, it rapidly reached $13 million TVL. Asymetrix works like a no-loss lottery, based on a simple concept:

Users deposit $stETH, and every week several users are randomly selected to receive all the yield generated by $stETH deposited in Asymetrix. So while you give up steady staking rewards, you gain a chance to win big. Moreover, regardless of outcome, all users receive $ASX staking rewards.

Now, let’s turn to the latest hot trends and narratives:

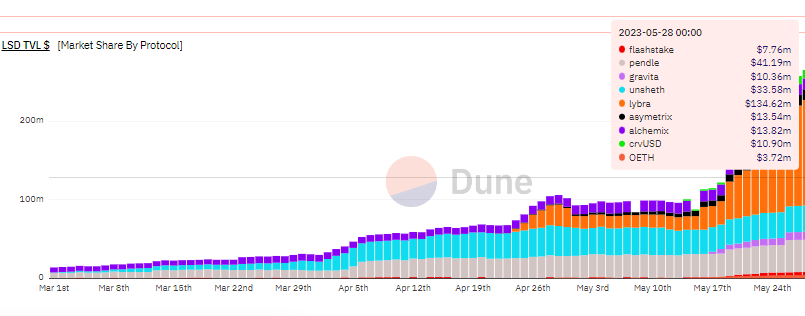

LSDfi

LSDfi remains the hottest DeFi sector. Among top players, Frax’s $frxETH and RocketPool’s $RPL saw the largest TVL increases. Swell is the fastest-growing new protocol, but it doesn’t appear particularly innovative.

In terms of rapid growth, Lybra Finance leads, followed by Pendle, as shown in the chart below.

Cross-Chain / Omnichain

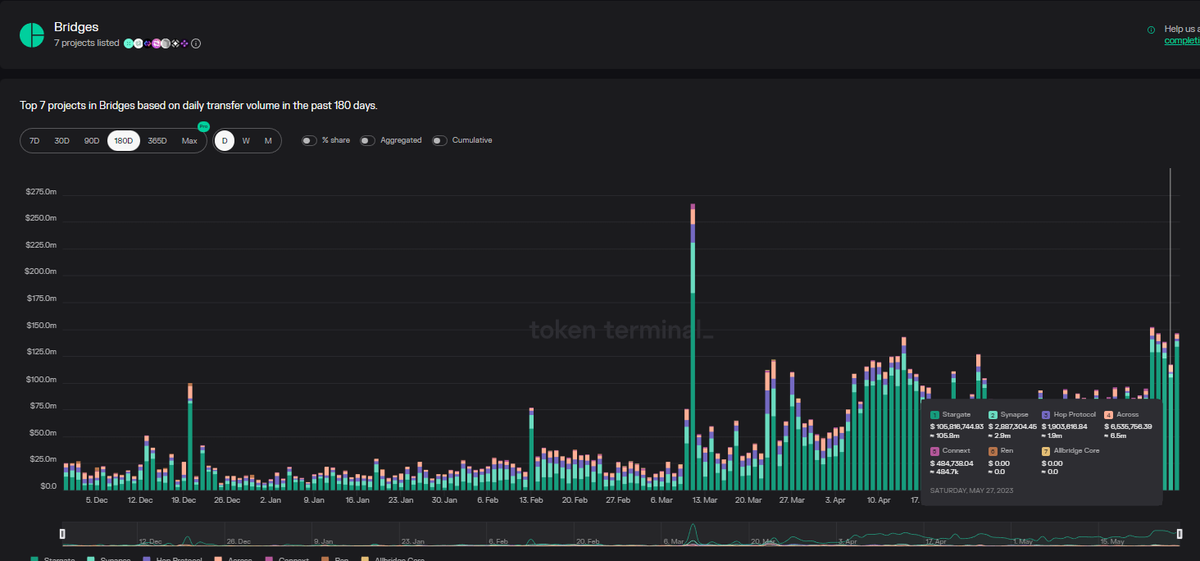

Daily bridging volume was under $20 million a few months ago; yesterday it reached nearly $150 million. The main beneficiary is Stargate, a composable liquidity transfer protocol powered by LayerZero—an omnichain interoperability protocol.

This surge in bridging activity may be due to rumors of an upcoming LayerZero airdrop. However, LayerZero’s technology is truly impressive and already powers many cross-chain applications.

Smart Money Movements

Among the top 100 smart money addresses tracked by ScopeProtocol, the most widely held token appears to be $RDNR. Over the past few months, $RDNR (Render Token) has significantly outperformed the market, rising fivefold since January. RenderToken is the leading provider of decentralized GPU rendering solutions.

With $NVDA stock surging 170% in 2023, $RDNR has also benefited from this momentum.

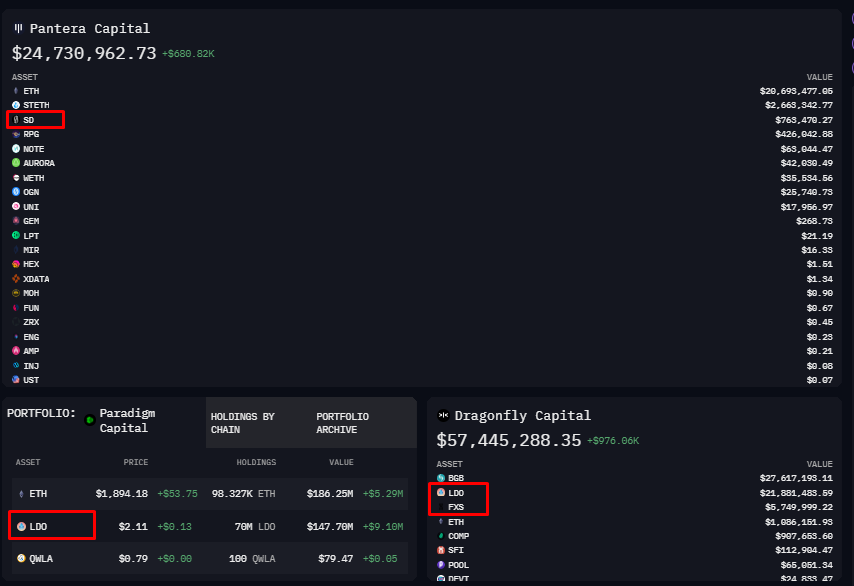

Looking further, VC public wallet addresses have remained quiet over recent weeks. Overall, however, most seem bullish on the LSD narrative. Some of the largest crypto VCs—including Pantera Capital, Dragonfly Capital, and Paradigm—hold at least one LSD token.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News