How to build your portfolio within the rapidly growing Arbitrum ecosystem?

TechFlow Selected TechFlow Selected

How to build your portfolio within the rapidly growing Arbitrum ecosystem?

Arbitrum is one of the few L2s that has gained significant influence during this bear market.

Written by: Aylo, Alpha Please

Compiled by: TechFlow

Arbitrum is one of the few Layer 2 solutions that has gained significant traction during this bear market. Want to know how to capture upside from its rapidly expanding ecosystem? Here’s our Arbitrum-based portfolio for your reference.

For many chains, 2022 has been a difficult year—but Arbitrum has managed to swim against the current. More specifically, Arbitrum One, an Optimistic Rollup designed to scale Ethereum.

Overall, Arbitrum:

• Shows vertical growth in deployed contracts and unique wallet counts;

• Daily activity and transaction volume are nearing all-time highs, returning to August market levels;

• Currently ranks 5th in total value locked (TVL);

• Experiencing a Cambrian explosion of DeFi protocols.

Given these developments, we believe Arbitrum could become one of the best investment chains in the future. Although Arbitrum does not yet have a native token, we’ve already built a portfolio on NestedFi to capture potential upside from this growing ecosystem.

This portfolio will consist entirely of tokens on Arbitrum, making it inherently riskier. Some assets may drop to zero (or near-zero), but we believe a few hold 50x potential.

We will allocate 40% of USDC for dollar-cost averaging (DCA), fully deploying by April 2023, adding 1/4 monthly to the assets listed below.

ETH - 25%

The only constant anchor in the portfolio. Even if everything else underperforms or disappears, ETH will help recover losses and ensure you end up with more than you invested (in the next bull market, assuming it reaches or exceeds its previous ATH—a 4x move).

GMX - 20%

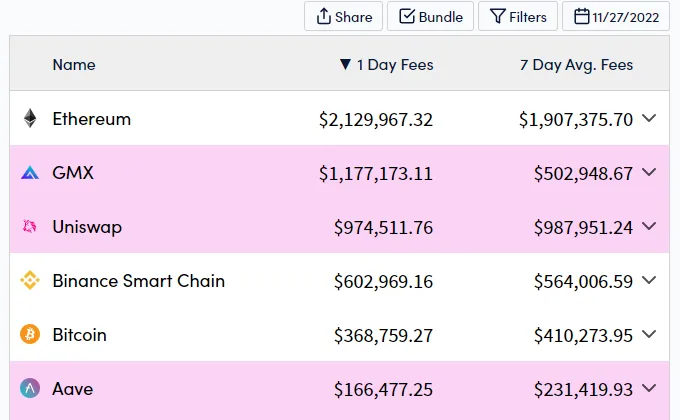

The leading DApp on Arbitrum and the most profitable on-chain perpetuals platform in crypto, having achieved $70 billion in trading volume and nearly $100 million in fees to date.

Currently ranks third in daily fees across all crypto protocols—behind only Ethereum and Uniswap (ahead of BSC and Bitcoin). It even briefly surpassed Uniswap on October 27th last month.

DPX - 12.5%

The primary options trading platform on Arbitrum. We believe on-chain options have yet to shine. As pricing aligns with CEXs and contracts become more liquid, we expect Dopex to emerge as a leading protocol.

MAGIC - 12.5%

Treasure DAO is the "Nintendo" of gaming protocols.

While MAGIC’s price remains far from its ATH, Treasure recently hit an all-time high in weekly active users within its ecosystem.

It hosts multiple NFT platforms, its own NFT marketplace, native swap mechanism, and numerous games in development. The games are improving significantly—far better than what we saw 12 months ago.

There’s massive potential here. Among all current gaming platforms and protocols, nothing matches Treasure in terms of fun, scope, or community strength.

MAGIC is one of the tokens that has changed significantly since we first deployed this portfolio.

SUSHI - 7.5%

Not strictly a token native to Arbitrum.

Sushiswap has gone through turbulent times in its two-and-a-half-year history. After the core team was ousted or left in early 2022, the project has been undergoing rebuilding efforts.

Investors like Avi Felman and GoldenTree have shown interest in the new team now led by Jared Grey.

Unlike UNI, SUSHI accumulates fees. While Uniswap currently dominates in trading volume, we believe a major shift could occur over the next two years, with Sushi gradually regaining momentum.

VSTA - 7.5%

One of Arbitrum’s main native lending protocols, featuring its own stablecoin (VST) and enabling interest-free borrowing with maximum capital efficiency.

Although initial hype has cooled, its small market cap makes this a bet we can’t pass up.

UMAMI - 7.5%

A protocol aiming to implement delta-neutral strategies to generate solid APR “real yield” using your stablecoins. Its initial launch faced some issues and ended prematurely.

The team is preparing for a relaunch, with all members doxxed to emphasize commitment. If they succeed in operating effectively across all market conditions, this protocol’s TVL could be enormous—and the token might perform exceptionally well alongside it.

CAP - 7.5%

An alternative contract platform to GMX. Current trading volume is low (less than $3 billion since launch), offering only BTC and ETH derivatives—but this may expand over time. We see this as a small hedge against GMX on Arbitrum.

With a sufficiently small market cap, it has room to carve out its own niche alongside GMX and potentially perform very well.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News