How to view tribalism in cryptocurrency?

TechFlow Selected TechFlow Selected

How to view tribalism in cryptocurrency?

The identity of tribal members increases our chances of survival.

Author: STEVE GLAVESKI, GCR (Global Coin Research)

Translation: TechFlow

TradFi, CeFi, and DeFi Tribalism

Humans have always lived in tribes since we were hunters tens of thousands of years ago.

Tribal membership increased our chances of survival. Being in a tribe meant access to food, shelter, and warmth. It meant better protection against threats. It gave us community, identity, and belonging.

Being exiled from a tribe not only risked premature death but also loss of identity and emotional and spiritual devastation. Exile meant no longer being seen, needed, or loved—without these, life feels meaningless.

One of our strongest desires is to preserve our sense of identity—identity gives us a foundation from which to explore the world.

When we fully embrace a tribe’s values and beliefs, we stop thinking for ourselves. We selectively consume information that confirms and strengthens our tribe’s existing views, amplify all reasons why our tribe must be right, and downplay or ignore all reasons why our tribe might be wrong. We become trapped in our own bubble.

Tribal affiliation tied to our identity strips us of individual agency. But here's the problem: this identity is almost entirely borrowed—it doesn't make us unique; it simply adopts popular group narratives without critically assessing their merits.

The human mind seeks to conserve energy by taking the path of least resistance. So if everyone in our group says something, we easily accept it as truth.

Tribalism and Cryptocurrency

Earlier this year, we witnessed one of the largest events in the short history of cryptocurrency—the massive liquidation of Terra (Luna), an event so contagious that, combined with macroeconomic forces, wiped out 70% (or two trillion dollars) of crypto market capitalization.

Previously, anyone who publicly challenged Terra or its founder Do Kwon was quickly attacked by an army of “true believers.” Dissenting voices were either drowned out in public discourse or people simply dared not challenge Terra at all. Yet, as Winston Churchill reflected on truth, "It may be attacked by malice and ridiculed by ignorance, but in the end, there it is."

FTX and CeFi

Just months later, another nuclear-level event struck: the collapse of centralized exchange FTX and its founder Sam Bankman-Fried (SBF). Until then, SBF had been the poster child of the effective altruism movement, pledging his entire multi-billion-dollar net worth to social good.

Overnight, due to SBF’s illegal actions, 30% of the cryptocurrency market cap was destroyed, along with SBF’s $16 billion fortune.

DeFi as the Alternative?

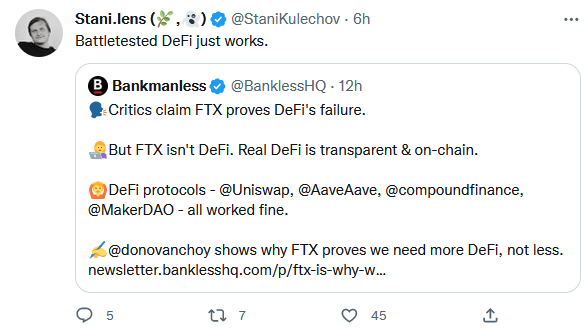

The fall of FTX reignited arguments in favor of DeFi, or decentralized finance.

"This wouldn’t have happened with DeFi." "This is why we need to move away from centralized exchanges toward DeFi." "The FTX problem was a CeFi problem, not a DeFi problem."

Yes, DeFi has its benefits. Relying on battle-tested code embedded in immutable smart contracts rather than self-interested and not always ethical intermediaries can offer better solutions.

Stani Kulechov is the founder of Aave, a DeFi protocol focused on lending. But has it truly been battle-tested by the market?

Aave, which has over $4 billion in value locked, has operated smoothly so far—but compared to 805 million global online banking users, it has only 5,500 daily active users.

Are 5,500 daily active users enough to claim something has been globally "battle-tested"?

Scams, Hacks, and Audits

Yes, the code is open-source and transparent—but how many people actually know how to audit it? How much can we really rely on independent smart contract auditors?

Despite Neodyme auditing Wormhole’s cross-chain bridge code, Wormhole was hacked, losing $320 million.

Nomad lost $190 million to a hack despite having its code audited by Quantstamp just two months earlier.

Let’s not forget the $650 million stolen from Axie Infinity’s Ronin network.

So far in 2022, over $3 billion has been stolen from DeFi protocols—and this occurred with only 5 million wallets connected (but not actively used) to DeFi protocols, less than 0.1% of global internet users.

User Experience

Anyone who has used a DeFi protocol knows the user experience is poor. Anyone spending time in Web3 online communities—whether on Telegram, Discord, or Twitter—knows the space is riddled with countless sophisticated scammers and hackers.

These are precisely the reasons why wealthy individuals from the traditional world keep most of their money in TradFi and see DeFi as merely an interesting experiment. For this reason, 95% of my net worth is invested in stocks, index funds, real estate, private equity, and regulated, centralized crypto exchanges.

Self-Custody

DeFi also relies on individuals managing their own private keys—essential for accessing their funds.

But if people lose their house keys, why would we expect them not to lose a 64-character private key or a 24-word recovery phrase?

Logical Fallacies

FTX was headquartered in the Bahamas, unregulated and not subject to independent audits.

Another centralized exchange, Coinbase, is based in the U.S., regulated, and undergoes independent audits by one of the Big Four accounting firms. It has not suffered the same fate as FTX (not to say it never will).

I’ve never worried about my bank account balance disappearing overnight—if it did vanish due to fraud or other issues, I’m 99.999% certain I’d get it back.

Concluding that because one centralized exchange failed, all centralized exchanges are bad, is a logical fallacy.

The reality is that DeFi has its own challenges, and using the same flawed logic based on everything discussed above, one could argue that DeFi is also flawed.

Barriers, Not Roadblocks

To be clear, DeFi’s shortcomings are barriers, not roadblocks. These are challenges inherent in early-stage innovation that must be addressed.

But can we just ignore or dismiss them?

The world won’t be ready for DeFi until we can reliably and easily use DeFi protocols—and DeFi isn’t ready yet to replace TradFi. But that doesn’t mean it never will be.

Final Thoughts

When you identify too strongly with a tribe’s values, you lose your ability to think independently. You outsource your beliefs. You become a victim of mob mentality and FOMO. You become like a puppet, swayed by the tides.

Sometimes it’s worth not going with the flow, even though doing so comes at a cost.

But people gain so much from tribal affiliation that they choose to stay silent—even when deep down they know they shouldn’t.

If Web3 is to succeed, we need to be honest about its shortcomings and work to fix them, rather than charging ahead with blinders on, downplaying the negatives.

If we’re not transparent and honest about the challenges, we’ll inevitably face more public backlash—and more backlash means public sentiment toward crypto, already deeply negative after this year’s events, will continue to deteriorate.

It also means crypto will attract harsh and damaging regulation, rather than thoughtful regulation designed to serve and protect crypto users.

Now is the time for the Web3 community to set aside its internal divisions and focus instead on the original promise—solving problems and delivering value to the world.

If cryptocurrency is to survive, it must create more value for humanity than it extracts.

Otherwise, it will follow in the footsteps of socialism and other systems that made grand promises to the world but ultimately failed to deliver.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News