How Nested Lowers the Entry Barrier in Crypto Through Copy Trading, Dollar-Cost Averaging, and Social Finance

TechFlow Selected TechFlow Selected

How Nested Lowers the Entry Barrier in Crypto Through Copy Trading, Dollar-Cost Averaging, and Social Finance

Nested: Serving as the gateway to bring hundreds of millions into DeFi.

Written by: Pickle and Aylo, Alpha Please

Translated by: TechFlow

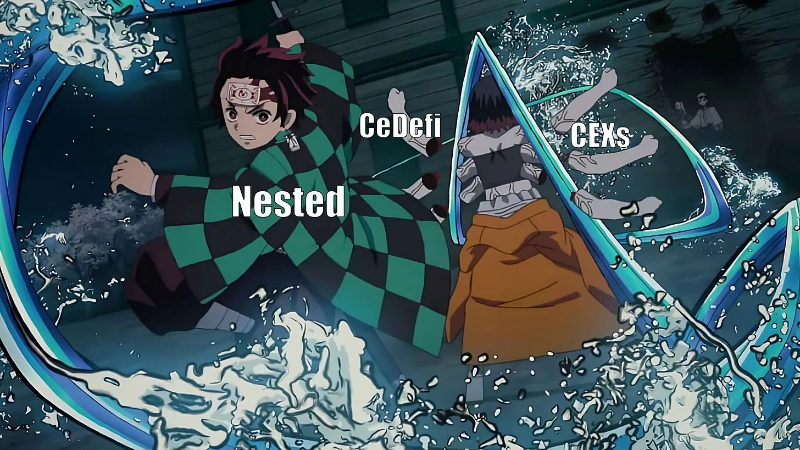

With the collapse of FTX, attracting new users to use DEXs for crypto trading has become more important than ever.

We have repeatedly seen centralized exchanges exploited or hacked, resulting in loss of customer funds (Mt Gox, Bitfinex), or worse—deliberate misuse and theft of user assets (FTX, Bitgrail).

“Not your keys, not your coins” is one of the most crucial lessons newcomers to cryptocurrency must learn.

Nested, a non-custodial platform, represents a major step forward in enabling people to access DeFi and join the world of crypto—a project born from the ashes of FTX’s demise.

DeFi is great, but most platforms only serve a small fraction of native crypto users. CeDeFi aims to solve that gap.

Nested is not just another ordinary platform.

Before using it ourselves, we were actually skeptical about the technology. Below, we’ll explain exactly how Nested works and how you can benefit from potential airdrops.

Before I go further, let me state this disclaimer: There is always smart contract risk in DeFi; nothing is risk-free, but here you trust code rather than people. Never invest more than you can afford to lose. Finally, this article is not financial advice.

What Is Nested?

Nested has an ambitious vision: to become the gateway that brings hundreds of millions into DeFi.

They’ve built a platform that lowers all barriers to entry when investing in digital assets, building portfolios, and leveraging DeFi strategies.

I know you might not believe me—you may think this sounds like typical CeDeFi nonsense.

But in reality, it's a fully on-chain product.

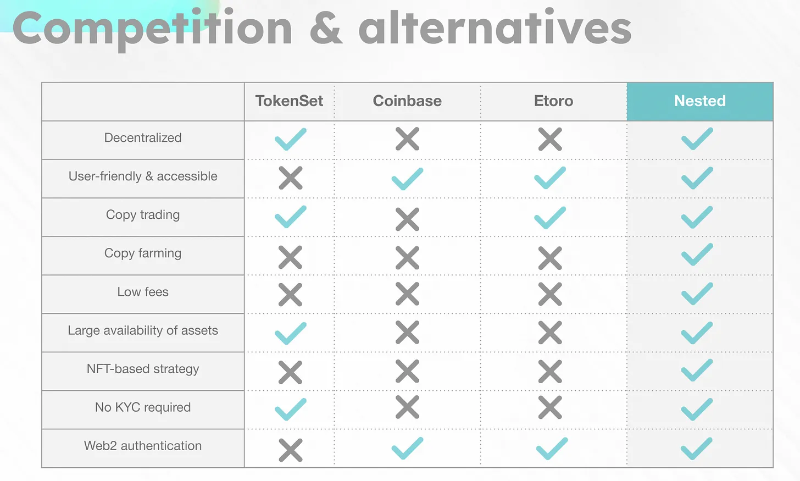

You can log in to nested.fi via email, social accounts, or Web3 wallets, and use your debit/credit card to purchase up to 12 different tokens across six EVM chains (Ethereum, BNB, Avalanche, Polygon, Arbitrum & Optimism) in a single transaction.

You can rebuild your portfolio anytime in under one minute.

Copy Trading

Another challenge faced by crypto beginners is not knowing what they should invest in or how to build and rebalance a portfolio according to risk tolerance.

Nested doesn’t just make entering crypto easy—they bring copy trading to the crypto space.

With just one click, you can replicate another investor’s portfolio. As long as you hold a Nested Portfolio NFT in your wallet, you gain exposure to those underlying assets.

This is excellent for beginners—and really anyone investing in the space.

You can find experienced investors/traders to make decisions on your behalf.

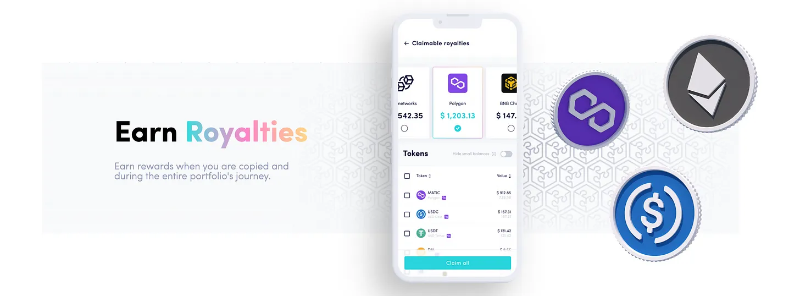

When investors/traders are copied by other users, they earn royalty income—which further incentivizes them.

This revenue is split 50/50 between the investor and the Nested protocol, which will be operated by a DAO next year.

For operations that do not reduce the Nested protocol’s TVL (deposits, swaps, creating portfolios, etc.), only a 0.3% fee is charged. Operations that reduce TVL (withdrawals, selling tokens, etc.) incur a 0.8% fee.

You can set push notifications to alert you whenever an investor/trader you’re following updates their portfolio, allowing you to instantly adopt the updated positions—Nested automatically executes the buys/sells.

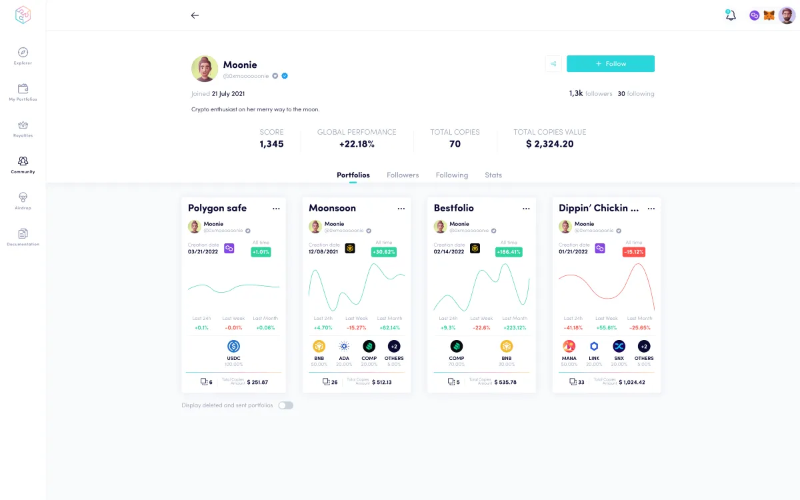

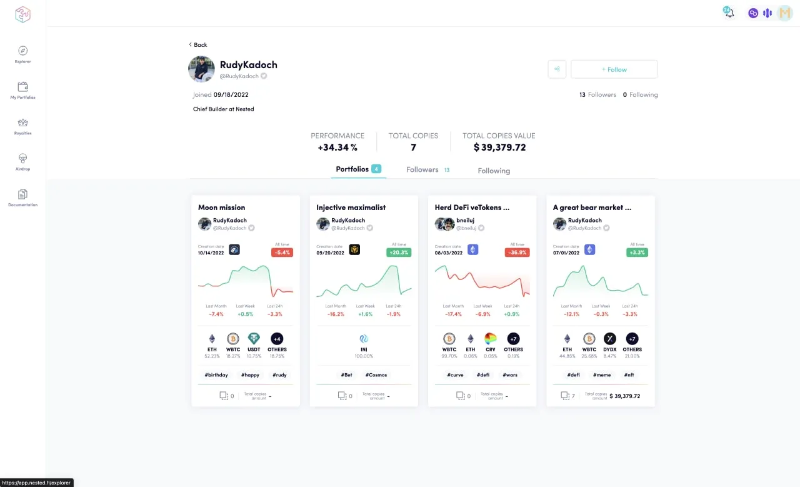

User Profiles

Nested isn't just DeFi—it's also SocialFi.

Profiles give everyone visibility into who’s earning profits, allowing you to follow top performers and track their activity.

Thus, Nested also becomes a great place to discover new investment ideas.

I’ve heard the platform will soon include social features, enabling users to share details about their portfolios and trades.

Roadmap

Nested has a well-defined and highly ambitious roadmap, which I believe will solidify its position as a one-stop DeFi service platform.

2022/23

Generate Passive Income

-

The base assets of each user’s portfolio will be deployed across various DeFi platforms to generate yield.

-

Simply holding a portfolio generates passive income.

Normally, you’d have to manually deploy your crypto assets across multiple platforms to earn DeFi yields. Nested automates this for you.

Dollar-Cost Averaging (DCA)

Users can regularly buy specific tokens regardless of price fluctuations. This will be powered by Gelato.

Trading Competitions (Phase 1)

Two types of trading competitions will be introduced:

-

Unrestricted: Anyone can set prize pools and rules. All users can participate with their portfolios.

-

Restricted: Nested sets the prize pool, rules, and whitelist. Users are selectively whitelisted at launch based on NFTs/tokens. For example, they could host a competition exclusively for BAYC holders.

Most of these features will be developed by Q4 2022, with some rolling out to the public in Q1 2023.

2023

Lending

-

Users will be able to borrow funds using their Nested portfolios as collateral.

-

Nested will integrate with trusted lending platforms such as Aave and Compound.

I believe this will be a killer feature. And again, everything happens seamlessly within the same platform.

$NST token will be launched.

Token Generation Event (TGE)

-

All tokens will be pre-mined, and every buyer will receive their allocated amount.

-

Locking, vesting, and distribution will be implemented at the protocol level.

Governance

- Once the token launches, holders will be able to participate in the DAO.

- They will vote on matters such as buyback ratios, platform fees, and VIP membership criteria.

- They will also be able to vote on proposals.

Trading Competitions (Phase 2):

Compared to Phase 1, two new types of trading competitions will be introduced:

-

Private competitions: Users can invite specific participants—ideal for friends.

-

Community competitions: Users can submit public competitions to governance. Once approved, all details—including prize pools and rules—are determined by the existing governance body.

2023 Q3 & Q4

NFT Copy Trading

- Users will be able to add NFTs (BAYC, CryptoPunks, or another Nested portfolio) into their existing Nested portfolios.

- We will enable tracking of markets through Nested portfolios containing NFTs.

This will be another industry-first innovation. Users will be able to copy other traders’ NFT portfolios.

Limit Orders

- Users can set limit orders on assets within their Nested portfolios.

- Once the asset reaches the target price, the trade will execute automatically.

Cross-Chain

Nested will explore cross-chain protocols (possibly using CCIP or LayerZero) when the time is right. The goal is for the technology to mature enough to abstract away network complexity and build a cross-chain platform, allowing users to hold assets across multiple chains within a single portfolio.

Technology

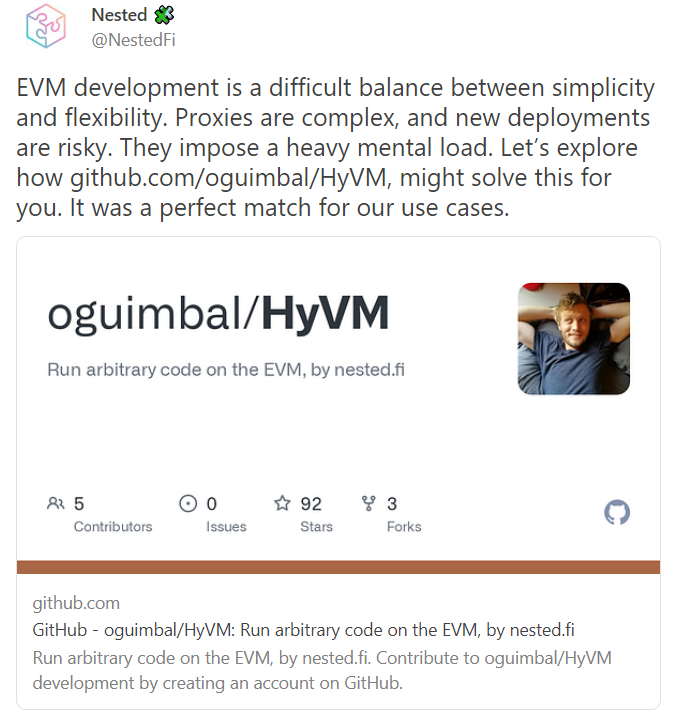

As far as I know, Nested’s developers are pushing the boundaries of DeFi, composability, and smart contracts.

Nested aims to abstract away complexity for DeFi users.

They’ve been relentlessly asking:

How can we offer maximum flexibility and functionality without requiring audits, deployments, and maintenance of individual smart contracts?

That’s why they created HyVM.

This topic may seem too technical for most, but Nested is pioneering a new approach to make DeFi safer and easier for users.

HyVM is a smart contract that acts as a virtual machine. It can dynamically execute EVM bytecode without needing to deploy it.

In DeFi, chaining operations is difficult because when swapping assets, you don’t know the exact output amounts. Slippage and price impact make it hard to get precise values.

HyVM allows Nested to perform chained operations even without knowing the exact token amounts required at each step.

Currently, all assets are pooled within a self-custodied smart contract. Soon, Nested will release a new version where each portfolio’s assets will have their own reserve—think of them as “vaults.” Asset isolation makes everything safer for everyone.

In a single transaction, you’ll be able to lend, swap, stake, and leverage the assets in your portfolio.

Nested Airdrop

Token generation is scheduled for 2023. A portion of the minted NST tokens will be airdropped to the community.

The more you use the platform, the larger your potential airdrop.

How to Increase Your Chances?

The following factors will be considered during snapshot:

-

Total value of all your portfolios;

-

Number of copy trades and their total value;

-

Diversity of networks used to build your portfolios: Ethereum, BNB Chain, Avalanche, etc.;

-

Overall activity level on Nested.

NST Token

NST is a utility token designed to facilitate and incentivize decentralized governance of the protocol.

It’s also intended to enhance user experience by unlocking unique features.

It draws inspiration from top-tier DeFi tokenomics models such as $CRV (Curve) and $SNX (Synthetix).

All decisions regarding ecosystem usage and reward reserves will be made by the DAO.

NST Use Cases

-

Governance — NST stakers can change parameters of the Nested platform and vote on or submit proposals to improve the protocol. Governance will go live at Rubik launch.

-

Staking Rewards — Two types of rewards: 1. $NST tokens from the ecosystem reserve. 2. A portion of protocol fees.

-

Bribes — Users will be able to feature their portfolio at the top of search results, but must first bribe governance.

-

VIP Tiers — $NST stakers will receive discounts on Nested platform fees.

-

Premium Content — Users can unlock private portfolios by paying a monthly subscription fee.

-

Tipping — Users will be able to tip others with $NST tokens.

If you believe the Nested protocol holds potential value, feel free to try earning it through the platform.

I don’t know what the token will be worth at launch or in the future. But there are some simple calculations around potential protocol revenue.

If Nested manages to achieve $20 million in daily trading volume, it would generate $60,000–$160,000 in daily revenue ($22M–$60M annually). Currently, the crypto market sees over $20 billion in daily trading volume.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News