How much money did top firms like Temasek and Paradigm lose in FTX?

TechFlow Selected TechFlow Selected

How much money did top firms like Temasek and Paradigm lose in FTX?

The FTX crisis has not only left customers in dire straits but also inflicted severe losses on investors.

Article by Forbes, edited and condensed by TechFlow

The FTX crisis has not only left customers "in the lurch," but also inflicted severe losses on investors. FTX once reached a peak valuation of $32 billion and raised a total of $1.8 billion in funding, attracting numerous elite global venture capital firms. Which of these were the biggest losers?

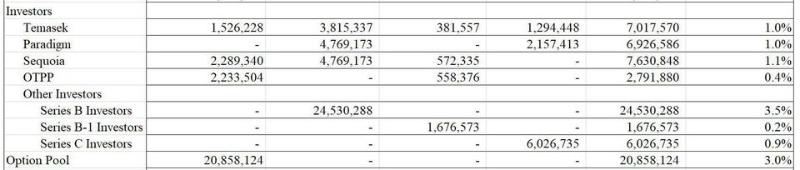

Forbes obtained a shareholder list for FTX, which SBF sent during coverage of the Forbes 400 in August. Below are the major investors:

Sequoia Capital

FTX Stake: 1.1%

Estimated Investment Amount (FTX only): $200 million

Peak Value in January 2022: $350 million

This Silicon Valley venture fund, known for investing in tech giants like Apple, Google, and Airbnb, invested over $200 million in FTX. On Wednesday, Sequoia shared a letter on Twitter stating it had written down its investment in FTX to zero.

However, according to a report published Thursday by The Information, Alameda Research and Bankman-Fried-backed venture fund FTX Ventures injected "$200 million" into funds operated by Sequoia and two other firms.

Earlier this year, Sequoia’s investment in FTX peaked at $350 million. In its letter to investors, Sequoia stated that its FTX equity represented less than 3% of the committed capital of one fund, and that the $150 million loss was offset by approximately $7.5 billion in realized and unrealized gains.

Temasek

FTX Stake: 1%

Investment Amount: $205 million

Peak Value in January 2022: $320 million

Temasek, the Singapore government-owned investment company, was FTX’s second-largest external investor, holding 7 million shares. A Temasek spokesperson told Reuters on Wednesday that its $320 million stake was nearly worthless, and they were “assessing developments” and working with FTX in their capacity as shareholders.

Paradigm

FTX Stake: 1%

Investment Amount: $215 million

Peak Value in January 2022: $315 million

Paradigm is an investment firm “focused on supporting the future of crypto/Web3 companies and protocols.” It participated in the exchange’s Series B and Series C funding rounds and held nearly 7 million FTX shares as of August. “Sam and FTX have a bright future,” said Paradigm co-founder Matt Huang in July 2021. “Paradigm is excited to be part of it.”

According to The Information, Alameda Research also invested at least $20 million in Paradigm.

Ontario Teachers’ Pension Plan

FTX Stake: 0.4%

Investment Amount: $80 million

Peak Value in January 2022: $125 million

The Ontario Teachers’ Pension Plan, which manages retirement funds for 333,000 teachers in the Canadian province, invested a total of 95 million Canadian dollars in FTX and FTX US combined between late 2021 and early 2022. “While there is uncertainty around FTX’s future,” the pension plan wrote in a statement, “any financial loss from this investment will have a limited impact on the plan, as the investment represents less than 0.05% of our total net assets.”

In addition, other major investors not listed here may have suffered significant losses.

The remaining participants in FTX’s $1 billion Series B round in June 2021 held 3.5% of the exchange. These investors include entities linked to billionaires Paul Tudor Jones, Daniel Loeb, and Israel Englander, as well as Tiger Global Management and SoftBank—both of which also participated in FTX’s Series C round in January and likely became substantial shareholders.

According to the cap table, investors from that round (excluding Temasek and Paradigm) held nearly 1% of FTX, representing paper losses exceeding $270 million.

Hardest Hit: FTX Employees.

According to the cap table, as of August, the company’s option pool held 20,858,124 shares, roughly 3% of FTX. In January, FTX employees collectively held stock worth up to $950 million—now potentially worthless.

Will they get their money back?

SBF clarified his priorities. In a series of tweets posted Thursday, he stated that first came users, then he would focus on investors, and finally, he said, he would take care of employees.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News