WEEX perspective: The exclusion of FTX compensation reflects not a national issue, but rather the platform landscape.

TechFlow Selected TechFlow Selected

WEEX perspective: The exclusion of FTX compensation reflects not a national issue, but rather the platform landscape.

This time, some stand outside the system, while others are within it. Which side are you on?

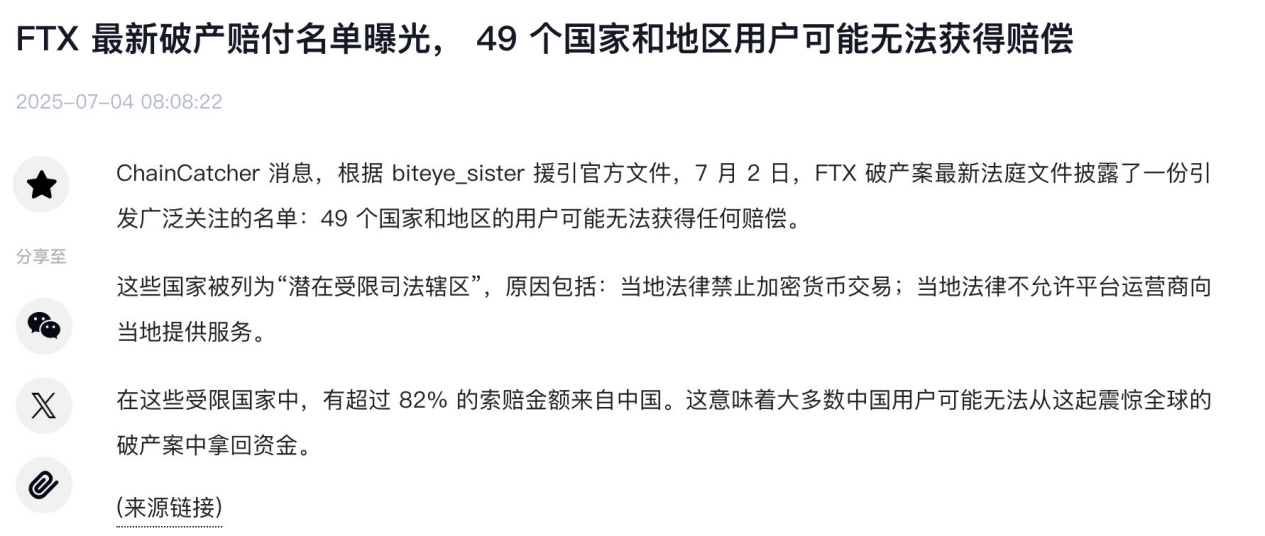

On July 4, 2025, Sunil, representative of FTX creditors, confirmed that in the upcoming FTX compensation plan, Chinese users may be excluded from the main payout due to regulatory jurisdiction issues. The announcement immediately sparked widespread discussion and emotional reactions within the Chinese crypto community.

According to BlockBeats, 82% of claimable assets from countries restricted by FTX originate from Chinese users. If these jurisdictions are officially classified as "restricted," these users could not only lose eligibility for compensation but also risk complete asset forfeiture. This news has caused a major uproar in the Chinese crypto space—some are angry, others resigned, while many are now rethinking a fundamental question: when a platform collapses, can I truly recover my own money?

We can feel anger or regret, but more importantly, we must calmly recognize that this exclusion reveals a deeper issue: Is a platform’s compensation mechanism based on “user location,” or on “the platform’s compliance boundaries”?

Exclusion is not new—but FTX exposes the largest problem yet

While there have been no large-scale public cases explicitly stating "nationality-based exclusions," in recent years, some DeFi protocols and centralized platforms have introduced compliance barriers into their compensation mechanisms (such as mandatory KYC or restrictions on anonymous wallets), fueling ongoing debates about who qualifies for restitution.

This time, FTX's approach marks one of the first instances where entire user groups are being excluded directly based on country or region. As a result, mainland Chinese creditors may stand to lose all chances of recovery—even if they were ordinary users who simply held funds on the platform without engaging in any illegal activities.

This method of division challenges our understanding of “platform responsibility.”

The real difference isn't nationality—it's the platform's system and vision

We should not interpret this incident merely as targeting users from a specific country. The real questions are:

- When crisis strikes, is a platform willing to stand by its users?

- Has it put systems in place ahead of time to manage risks?

- In governance, does it respect user asset rights, rather than hiding behind “legal gray zones” to avoid accountability?

In other words, the relationship between platform and user should be one of “service and trust,” not “contract and免责.” Some platforms use compliance as justification to define whom they will serve, aggressively recruiting users during expansion phases, only to abruptly cut off entire user segments when risks emerge.

WEEX isn’t just an observer—we saw this coming. Compensation mechanisms aren’t slogans—they require execution!

When the FTX collapse occurred in 2022, WEEX immediately launched a user asset protection strategy, establishing a “Trader Protection Fund” of 1,000 BTC and publishing its transparent address for public verification at any time. We did not impose nationality-based restrictions—any user who traded on our platform and met the conditions for triggering protection could apply for compensation.

Since then, we’ve continued advancing our compliance efforts, actively expanding in Europe, North America, Latin America, and Southeast Asia—securing institutional access while upholding the integrity of user assets.

We don’t claim to be the “safest” platform, but we firmly believe:

⟶ Risks are inevitable, but systems can still have humanity.

⟶ After disaster, what matters most isn’t blame—it’s delivery.

What remains for users is not just judgment—but choice

As FTX’s bankruptcy liquidation enters its final phase, the warning it sends is clear: a platform’s promise to you is only meaningful if it still holds when the platform fails.

When we talk today about compensation, responsibility, and user fate, we’re really asking ourselves a deeper question: When you entrust your assets to a platform, are you receiving mere “service,” or genuine “trust”? Are you riding a speculative wave, or participating in a resilient system?

This isn’t about which country you’re from, nor whether you trade crypto—it’s about what kind of service platform you choose.

The next time you open an exchange to place an order, ask yourself one more question: If something goes wrong one day, how far will this platform go to protect me? Will compensation be just a statement—or an outcome?

This time, some stand outside the system, while others stand within it. Where do you stand?

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News