FTX's liquidation team has set its sights on the $380 million held by Chinese creditors

TechFlow Selected TechFlow Selected

FTX's liquidation team has set its sights on the $380 million held by Chinese creditors

This unresolved debt collection may have torn away the last veil of compliance.

Article by: Tuoluo Finance

The industry environment is improving, and markets are eagerly anticipating interest rate cuts—but FTX creditors can hardly feel at ease.

After three long years of disputes and delays, FTX’s compensation process has finally begun, entering its second phase. The market hasn’t experienced major volatility from potential sell-offs, and everything seems to be on track—yet one statement from a creditor representative has completely shattered the hopes of Chinese claimants.

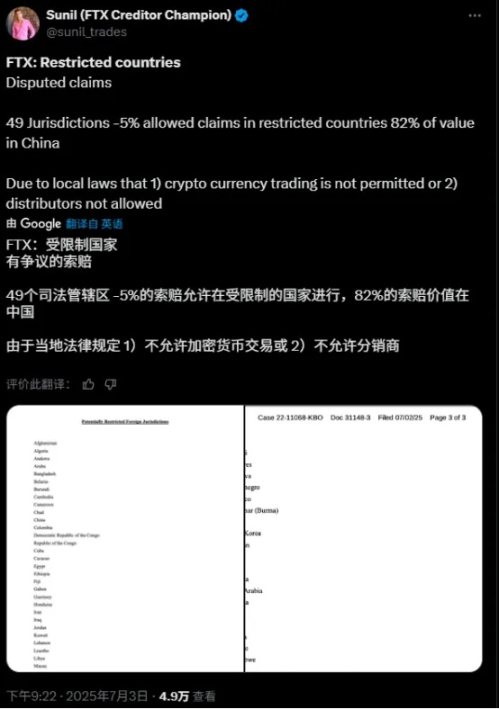

On July 4, Sunil, an FTX creditor representative, posted on X stating that creditors in 49 jurisdictions—including China—might lose their right to claim, with claims from these regions accounting for 5% of total funds. On July 7, he further clarified that the total amount claimed by restricted jurisdictions stood at $470 million, among which Chinese investors held $380 million in claims—the largest group of FTX creditors—and accounted for 82% of restricted claims.

This revelation sent shockwaves through the market. After years of waiting, investing immense time and effort, Chinese creditors now face what appears to be a legally sanctioned confiscation—an outcome no one can easily accept.

Since FTX declared bankruptcy in November 2022, creditors have been subjected to repeated false alarms about relaunches, acquisitions, and restructurings. During this time, FTT surged as a meme coin amid the chaos. Finally, on January 3 this year, FTX's reorganization plan officially took effect. The first round of repayments began within 60 days of that date, prioritizing users claiming $50,000 or less. BitGo and Kraken were enlisted to assist with the distribution.

On February 9, Kraken announced it had completed the initial fund disbursement from the FTX estate, compensating over 46,000 creditors. More than three months later, the second payout commenced. Sunil stated that repayments would be issued on May 30, with users claiming more than $50,000 receiving 72.5% of their owed amount; the remainder (up to 100%) plus interest would follow in subsequent distributions, totaling over $5 billion expected to be returned to creditors.

Creditors thought they could simply wait for payouts—but news on July 4 disrupted all expectations. Sunil tweeted that FTX would file a motion seeking legal advice on whether distributions could proceed to restricted foreign jurisdictions. If deemed permissible, payments would continue; otherwise, claims from individuals identified as residing in restricted jurisdictions would become contested, potentially resulting in loss of claim rights. The trust listed 49 such jurisdictions, including Russia, Ukraine, Pakistan, Saudi Arabia—and notably, China. Documents indicated that the deadline for creditors to object to this motion was July 15, with a 45-day window for filing objections to the distribution plan.

This announcement hit like a sledgehammer, especially for Chinese creditors. They represent a significant portion of overall bondholders, making up 82% of the total claims from restricted jurisdictions—$380 million in outstanding claims. Facing the prospect of losing such substantial compensation, creditors naturally refuse to accept it. Most critically: how can assets rightfully belonging to them be seized by the U.S.? Under whose law does this fall?

In theory, FTX’s selective payout approach raises serious concerns. First, FTX is a U.S.-based company bound by local laws. Under Section 1123(a)(4) of the U.S. Bankruptcy Code, there is a clear requirement for “equal treatment of creditors within the same class.” In early stages of the payout, FTX’s bankruptcy team made no mention of nationality, clearly stating that anyone who submitted a claim and voted in favor of the restructuring plan would receive compensation. Second, consistent with standard procedures, all claims are denominated and paid in USD—meaning cryptocurrency need not be involved at all. Chinese residents could receive funds via wire transfer or traditional banking methods. Even if payments were made in stablecoins, current Chinese regulations generally recognize virtual currencies as property and do not prohibit individual ownership. At the very least, given Hong Kong’s existing policies, a blanket exclusion makes little sense. In previous insolvency cases like Celsius, U.S. courts successfully delivered dollar payouts to Chinese creditors via international wire transfers.

From the perspective of Chinese stakeholders, it's hard not to suspect this is a premeditated act of "legalized robbery." In fact, signs emerged as early as February when the creditor representative hinted that claims from jurisdictions like Russia and China would not be included. At the time, however, creditors didn’t fully grasp the implications.

Looking deeper into the actions of FTX’s liquidation team reveals even clearer patterns. The team boasts unusually rich experience and prominent backgrounds. John J. Ray III serves as CEO—he previously oversaw Enron’s bankruptcy proceedings and earned over $700 million in fees. For this case, he brought along his trusted firm, Sullivan & Cromwell, forming a powerful alliance to extract value from FTX’s remains.

Ordinary creditors may prioritize asset prices when selling, but professional liquidators care only about speed of monetization. As disclosed in shareholder reports back in August 2023, FTX’s top 10 crypto holdings made up 72% of its total digital asset portfolio, valued then at approximately $3.2 billion. Its largest holdings included 55 million SOL, around 21,000 BTC, and 113,000 ETH. Beyond crypto, thanks to extensive prior investments, FTX also held a vast equity portfolio featuring high-potential companies like Cursor, Mysten Labs, and Anthropic.

This impressive lineup fueled creditor hopes—and lined the liquidators’ pockets. Nearly all these assets were sold off at steep discounts: Cursor, acquired for $200,000, was resold at cost despite being valued at $9 billion; SUI token purchase rights worth up to $890 million were dumped for just $96 million, though peak valuation reached $4.6 billion; 8% stake in Anthropic was sold for $1.3 billion—seemingly reasonable until Anthropic’s valuation soared to $61.5 billion a year later. Not to mention the SOL tokens auctioned cheaply in 2024, now trading at $151, delivering massive profits to those who bought in during the fire sale.

The liquidation team operated without restraint because they had already secured exorbitant consulting fees. Court records show that by January 2 alone, FTX had paid nearly $948 million to over a dozen firms handling the bankruptcy, with court-approved expenses exceeding $952 million. Sullivan & Cromwell LLP, FTX’s lead law firm, received over $248.6 million; financial advisor Alvarez & Marsal collected about $306 million; advisors representing customer and other creditor interests earned roughly $110.3 million. Just these public figures make this one of the most expensive bankruptcies in U.S. history—not counting hidden profits derived from insider deals during asset sales.

This context lends credibility to SBF’s earlier testimony—once widely dismissed—that he faced severe pressure from the liquidation team to rush into bankruptcy. Even more alarming, FTX’s new proposal submitted to the bankruptcy court contains hidden clauses granting immunity to advisors, meaning the liquidation team bears no legal liability regardless of future actions. Liquidation has effectively become a vehicle for personal enrichment, while ordinary creditors are reduced to insignificant bystanders.

Currently, the outlook for Chinese creditors is bleak. First, cross-border recovery is inherently complex, and the July 15 deadline to oppose the motion is extremely tight. Once the motion passes and enters the stage where liquidators appoint lawyers, the position of creditors becomes significantly weaker. Second, voting determines the outcome, and although Chinese creditors dominate among restricted jurisdictions, they account for less than 5% of total claims. Over 95% of claims come from others who, eager to expedite payouts, may readily vote in favor regardless of the impact on Chinese claimants.

Still, Chinese creditors aren’t surrendering quietly. Group organizing, protests, and self-help initiatives have sprung up. On July 9, according to Cryptoslate, over 500 Chinese creditors filed challenges in U.S. courts regarding the freeze on FTX payments. A Chinese creditor using the pseudonym Will told Lüdong News that they’ve hired U.S. attorneys and are coordinating responses with more than 500 fellow claimants. He urged others to seek legal counsel or individually submit objection letters to the court.

Beyond direct legal confrontation, various debt transfer schemes have emerged—packaging claims and selling them to entities eligible under the payout framework to recover funds quickly. The motion itself subtly encourages this path. As Will noted, the motion includes a clause stating: “If a third-party institution purchases your claim, your original country of residence will no longer be considered when determining eligibility for payment.”

Why would someone buy claims in bulk? The answer lies in profit. FTX claims accrue interest at 9% annually—nearly three years’ worth so far—and interest continues to accumulate. Beyond guaranteed interest returns, FTX is still recovering additional assets, leaving room for future supplemental distributions. Overall, FTX claims qualify as premium financial instruments, highly attractive not only to individual buyers but also institutional investors. Sophisticated financial institutions could even package these claims as underlying assets and create derivative products for arbitrage.

Selling claims is a rational exit strategy—but being forced into it distorts the entire situation. Whether Chinese creditors’ efforts will pay off, whether they can reclaim what’s rightfully theirs, remains uncertain. As previously noted, even if technically compliant with laws, the liquidation team is exploiting the issue of “jurisdiction” to justify withholding Chinese investors’ assets—raising profound questions about the true meaning of compliance. Is compliance meant to protect investor assets—or merely provide an unavoidable justification for seizure?

This unresolved debt saga may well rip away the final veil hiding the truth behind compliance.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News