5 Billion Buy Order Incoming: FTX Debt Distribution Benefits Set to Trigger Bull Market

TechFlow Selected TechFlow Selected

5 Billion Buy Order Incoming: FTX Debt Distribution Benefits Set to Trigger Bull Market

On May 30, 2025, the distribution of FTX's $5 billion will begin.

Author: Oliver, Mars Finance

In November 2022, the collapse of FTX sent shockwaves through the crypto industry—billions of dollars in customer funds vanished overnight, and founder Sam Bankman-Fried’s fraud scandal stunned the world. Yet, by May 30, 2025—three years later—FTX Trading Ltd. is entering the second phase of its bankruptcy restructuring, distributing over $5 billion to creditors via BitGo and Kraken. More encouragingly, this massive payout will almost certainly be made entirely in U.S. dollars and stablecoins, with no volatile crypto assets such as Bitcoin or Solana included. This means the market may see a wave of potential buying pressure rather than a sell-off. How will this capital release ignite the next upswing in the crypto market?

Dollars and Stablecoins: The "Fuel" for Buying Pressure

FTX's bankruptcy management team has acted like alchemists amid crisis. From high-return investments in Anthropic to the remarkable rebound of Solana tokens, they have consolidated a fragmented asset pool into a vast treasury worth approximately $16.5 billion. The second-phase distribution of $5 billion represents the latest fruit of this effort. But unlike traditional bankruptcy liquidations, the form of this payout opens up entirely new possibilities for the market.

According to authoritative media including CoinDesk and CryptoSlate, the $5 billion distribution will primarily consist of U.S. dollars and stablecoins (USDT and USDC). Dollars will be transferred via bank wires or directly deposited into Kraken and BitGo accounts, offering creditors stable value storage—ideal for investors seeking quick cash-outs or wishing to avoid market volatility. At the same time, the inclusion of stablecoins adds flexibility. An SEC filing from August 2024 explicitly classified "dollar-pegged stablecoins" as cash equivalents, allowing creditors to receive USDT or USDC directly into their crypto wallets for rapid trading within the crypto ecosystem. One user on X even predicted that the injection of these stablecoins could "trigger a massive rally."

More importantly, there is currently no evidence that volatile crypto assets such as Bitcoin, Solana, or Ethereum will be included in the distribution. FTX's holdings of Solana tokens (SOL), which were valued at just $10 per token during the 2022 lows, have now surged to between $150 and $200. However, most of these assets have already been converted into dollars or stablecoins. Direct distribution of crypto assets would not only spark valuation disputes—for example, whether prices should be calculated based on values at the time of bankruptcy—but might also face regulatory obstacles due to pressure from the SEC. In September 2024, the SEC warned FTX against paying creditors in crypto assets, reinforcing the priority of dollars and stablecoins. Furthermore, Steve Coverick, FTX's financial advisor, stated in court that purchasing large amounts of crypto assets to repay in-kind would be "extremely expensive," further eliminating this possibility.

The combination of dollars and stablecoins acts like injecting "fuel" into the crypto market. Unlike volatile crypto assets that could trigger sell-offs, this capital gives creditors flexible options: holding cash, converting to fiat currency, or immediately buying assets like Bitcoin and Solana. This flexibility transforms the $5 billion from a potential source of selling pressure into a catalyst for market buying activity.

Buying Potential: Sparking Market Momentum

The scale of $5 billion is significant within the crypto market. In May 2025, the global crypto market cap stood at approximately $2.5–3 trillion, meaning this payout represents around 2% of total market value. If half of it—roughly $2.5 billion—flows into major tokens, prices could see substantial gains. Solana deserves particular attention. Historically closely tied to FTX, SOL once made up a notable portion of FTX’s asset pool. Some creditors, familiar with Solana, may choose to reinvest in SOL, driving up its price. Traders on X have already begun betting on this outcome, stating, “Solana may be poised for a surge.”

The initial $1.2 billion distributed in early 2025 offers a glimpse of what’s possible. At that time, Alvin Kan, COO of Bitget Wallet, observed that some creditors reinvested their payouts into the crypto market, boosting valuations of both Bitcoin and Solana. With a much larger scale, the impact of the second-phase $5 billion distribution could be far more profound. Especially given the current market context—where the crypto sector is slowly recovering from the early 2025 downturn (when Bitcoin fell to $78,273)—the FTX capital injection could serve as a spark to restore market confidence. More importantly, the orderly resolution of the FTX bankruptcy case may provide a psychological boost. The 2022 collapse exposed the fragility of centralized exchanges and shook investor trust. Now, FTX’s successful fund recovery and distribution demonstrate the industry’s resilience in times of crisis. This positive sentiment could attract more external capital into crypto, further amplifying the buying effect.

Phased Distribution: Sustained Momentum

The $5 billion distribution from FTX will not happen all at once, but rather in phases to ensure a smooth market transition. Starting May 30, 2025, convenience-class creditors (those claiming less than $50,000) will receive payments first, covering an estimated $1.2 billion initially. Larger creditors (claims exceeding $50,000) may face delays until Q2 2025 or later, with the entire distribution process potentially lasting several months.

This phased release provides sustained buying momentum. A one-time injection of $5 billion could cause sharp short-term volatility, whereas staggered disbursement allows capital to flow gradually, minimizing market disruption. The involvement of Kraken and BitGo further enhances the reliability of the process. Kraken has even offered creditors trading fee credits, incentivizing them to keep funds within the crypto ecosystem and increasing the likelihood of reinvestment.

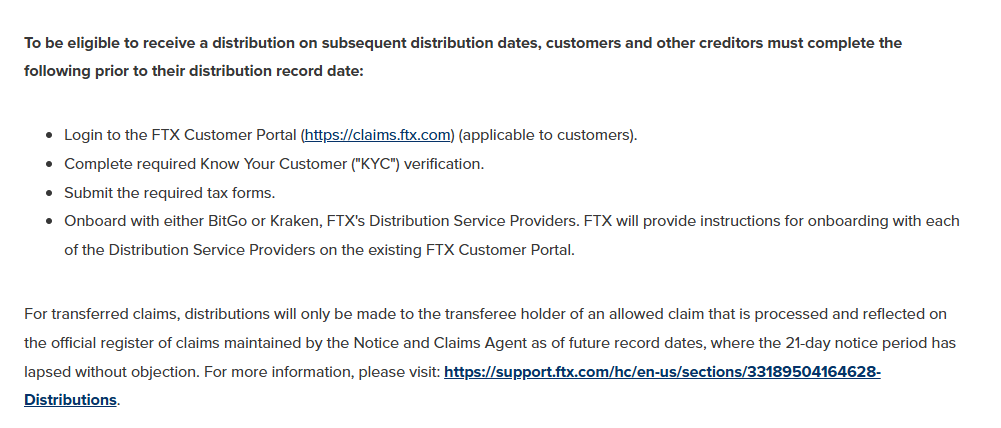

However, challenges remain. Creditors must complete KYC (Know Your Customer) verification and submit tax forms; certain regions (such as New York and Washington) may experience delays due to platform operational restrictions. As of April 2025, nearly 392,000 creditors faced the risk of having $2.55 billion in claims canceled due to incomplete KYC, highlighting the complexity of compliance. These hurdles may slow the pace at which funds enter the market, but they do not alter the fundamental nature of this capital as buying power.

Industry Implications: Turning Crisis into Opportunity

The $5 billion distribution from FTX is not just a win for creditors—it also delivers profound lessons for the crypto industry. The use of dollars and stablecoins underscores the importance of stable assets during crises. USDT and USDC, as digital counterparts to the U.S. dollar, not only simplify the distribution process but could also accelerate the mainstream adoption of stablecoins in areas such as payments and cross-border transactions. However, the SEC’s regulatory stance—viewing stablecoins as potential “crypto securities”—reminds us that compliance remains a key constraint on industry growth.

Moreover, FTX’s successful restructuring sets a precedent for other bankruptcies such as Celsius or Voyager. The experience in phased distribution, asset liquidation, and regulatory coordination may become standard practice for managing similar crises in the future. At the same time, the resolution of the FTX saga could accelerate the adoption of decentralized finance (DeFi) and self-custody wallets, prompting investors to reconsider their reliance on centralized platforms.

Summary

On May 30, 2025, FTX’s $5 billion distribution will begin. This capital, composed entirely of U.S. dollars and stablecoins, marks not only a milestone victory in the FTX bankruptcy case but could also act as a catalyst for the crypto market’s recovery. Transformed from potential sell-side pressure into a spark for buying activity, this capital release injects renewed hope into the market. As one user on X put it: “The final chapter of FTX hasn’t been written yet, but it has already changed how we view the crypto world.” On this journey rising from the ashes, the ripple of $5 billion may just ignite the next springtime for the crypto market.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News