How a $30 Billion Company Went Bankrupt in 3 Days: The Untold Story Behind FTX’s Collapse

TechFlow Selected TechFlow Selected

How a $30 Billion Company Went Bankrupt in 3 Days: The Untold Story Behind FTX’s Collapse

When the sense of mission to "change the world" breaks free from ethical constraints, and when tech elites deem themselves above rules, idealism becomes nothing but a cover for criminal acts.

By Blockchain Knight

The rise of crypto stems from a convergence of technological revolution, financial demand, and social psychology. The phoenix-like resurgence after collapses reveals humanity's enduring desire for financial freedom and deep distrust toward authority.

No matter what the future holds, crypto has profoundly reshaped the narratives of finance, technology, and culture—just as Amazon and Google emerged from the wreckage of the dot-com bubble, crypto’s legacy may not lie in token prices, but in forcing the world to rethink the boundaries of money, trust, and power.

The rise and fall of Sam Bankman-Fried (SBF), a central figure in the crypto world, stands as one of the most dramatic episodes in business history. His story not only exposes the wildness and risks inherent in the crypto industry, but also offers profound warnings and insights for entrepreneurs and managers alike.

Sam is among the most contradictory tragic figures in crypto history—a man combining the mathematical mind of a genius quant trader with the grand narrative of an idealist, yet ultimately corrupted by unchecked power.

On the surface, he was a devout follower of "effective altruism"—pledging to donate 99% of his wealth to charity, living in a modest apartment, driving a used Toyota, crafting the image of an anti-capitalist saint. Yet behind the scenes, he built a systematic fraud machine: siphoning $16 billion in customer funds from the FTX exchange through related-party transactions to fuel high-risk bets made by his hedge fund Alameda Research, while falsifying accounts to conceal billions in liabilities.

This duality reveals a deeper parable about human nature: when a mission to "change the world" detaches from ethical constraints, and when tech elites believe themselves above rules, idealism becomes a cover for crime.

The New York court’s conviction on seven serious charges (with a maximum sentence of 115 years) marks the collapse of his "crypto savior" persona. But his legacy extends far beyond personal fate—he is the ultimate symbol of blockchain’s wild era, encapsulating the industry’s resistance to regulation, disregard for risk, collective obsession with the "get-rich-quick" philosophy, and the irreconcilable conflict between technological utopianism and human greed.

Yet SBF’s story is far from over. His criminal appeal, the $13 billion in user compensation lawsuits, and the U.S. Department of Justice’s investigation into crypto political donations are all ongoing. But he has already left humanity a digital-age version of *Faust*: when technical genius believes it can reinvent the rules, and when the creed “Move Fast and Break Things” crosses ethical lines, destruction becomes inevitable.

From the ruins of FTX, the crypto industry is being forced to transition from adolescence into adulthood. Surviving projects are learning to balance transparency with innovation, decentralization with real-world responsibility. For the broader technological civilization, SBF’s downfall serves as a reminder: algorithms can optimize the world, but only reverence can safeguard humanity.

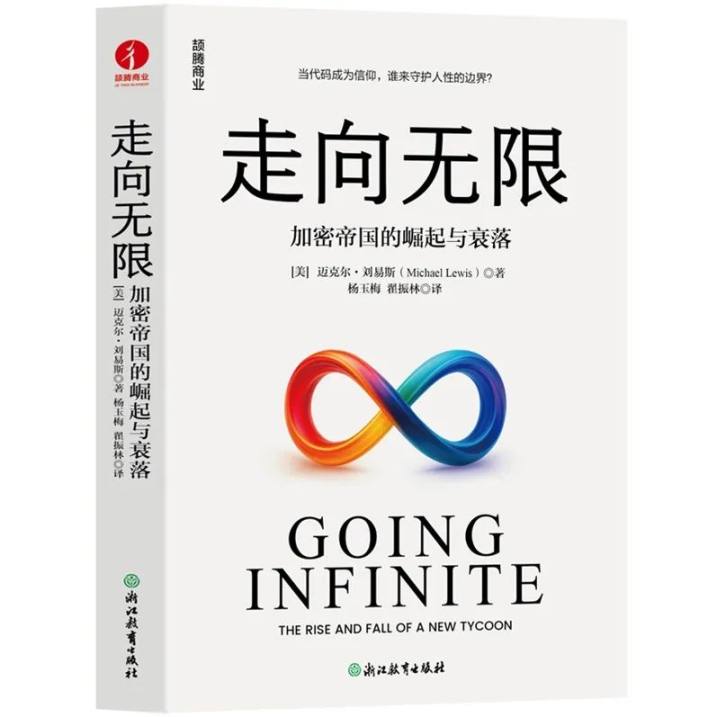

Bestselling author Michael Lewis—renowned for *Liar’s Poker* and *The Big Short*—once again immerses himself in the heart of the storm. Through deep investigation, close observation, and sharp insight, he uncovers the inside story of the FTX saga, meticulously reconstructing one of the most sensational and dramatic fintech events in recent global history. Michael Lewis’s work is not merely storytelling—it is truth-telling.

*Going Infinite: The Rise and Fall of a New Tycoon*

Author: Michael Lewis (USA)

FTX has now begun partial asset repayments to users, making the release of the Chinese edition of *Going Infinite* particularly timely. In 2025—a year when the world seeks breakthroughs amid shifting international trade rules and stablecoins gain momentum—Michael Lewis’s deep analysis of the rise and fall of the FTX crypto empire is more than just a dissection of a business myth. It is a lens reflecting technological frenzy and human frailty, compelling the world to re-examine the boundaries of money, trust, and power.

**Extreme character: Genius / Madman / Master Fraudster**

Sam Bankman-Fried was a MIT prodigy, spokesperson for effective altruism, billionaire—and is now a convict. He had no interest in money or sex, but craved the thrill of winning strategic games. He claimed to serve humanity by reshaping money through a vast crypto empire, which collapsed within 72 hours, landing him in prison.

Sam was exceptionally intelligent, deeply contradictory, and inscrutable—no one truly understood his motives. He created a legendary fortune and continues to influence the world long after his downfall.

**Exclusive insider perspective: A foundational deep dive into the crypto world**

Lewis wasn’t a journalist arriving after the storm—he was there before it hit. Granted unprecedented access, he spent months embedded within SBF’s inner circle prior to FTX’s collapse, conducting intimate interviews and close observations. This unparalleled “god’s-eye view” delivers information closer to ground zero than any other reporting could achieve.

Lewis excels at transforming complex financial concepts and technical issues into vivid, accessible, and deeply narrative prose. Even readers unfamiliar with crypto will grasp how the game works, its risks, and the human drama at its core.

**Global sensation meets profound reflection on our times**

The collapse of the FTX empire and SBF’s downfall constitute one of the most sensational and dramatic fintech events in recent global history. This book transcends financial gossip, touching on critical themes of our age: technological ethics, the paradox of idealism, regulatory failure, mechanisms of trust, and the twin forces of human greed and arrogance. It invites broad societal debate. At the intersection of wealth, ideals, rules, and temptation, both the brilliance and fragility of human nature are laid bare.

Crypto’s global popularity and enduring appeal result from a mix of technology, economics, social psychology, and speculative demand. Despite repeated blowups (such as FTX, LUNA, Mt. Gox), belief persists. After each crisis, new narratives reignite market enthusiasm, creating a recurring cycle of “winter followed by revival.”

Crypto’s rules represent humanity’s experiment in “trustless trust”—its impact depends on how it is used. The true measure of technological progress lies not in enriching a few, but in benefiting the many. Just as the telegraph was once used for stock manipulation and the early internet rife with scams, crypto may need a fundamental “reboot” to return to rational value.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News