How much did FTX's bankruptcy lawyers make—without compensating domestic victims?

TechFlow Selected TechFlow Selected

How much did FTX's bankruptcy lawyers make—without compensating domestic victims?

Who is making the decisions, according to what standards are they acting, and who ultimately benefits?

Author: Sleepy, BlockBeats

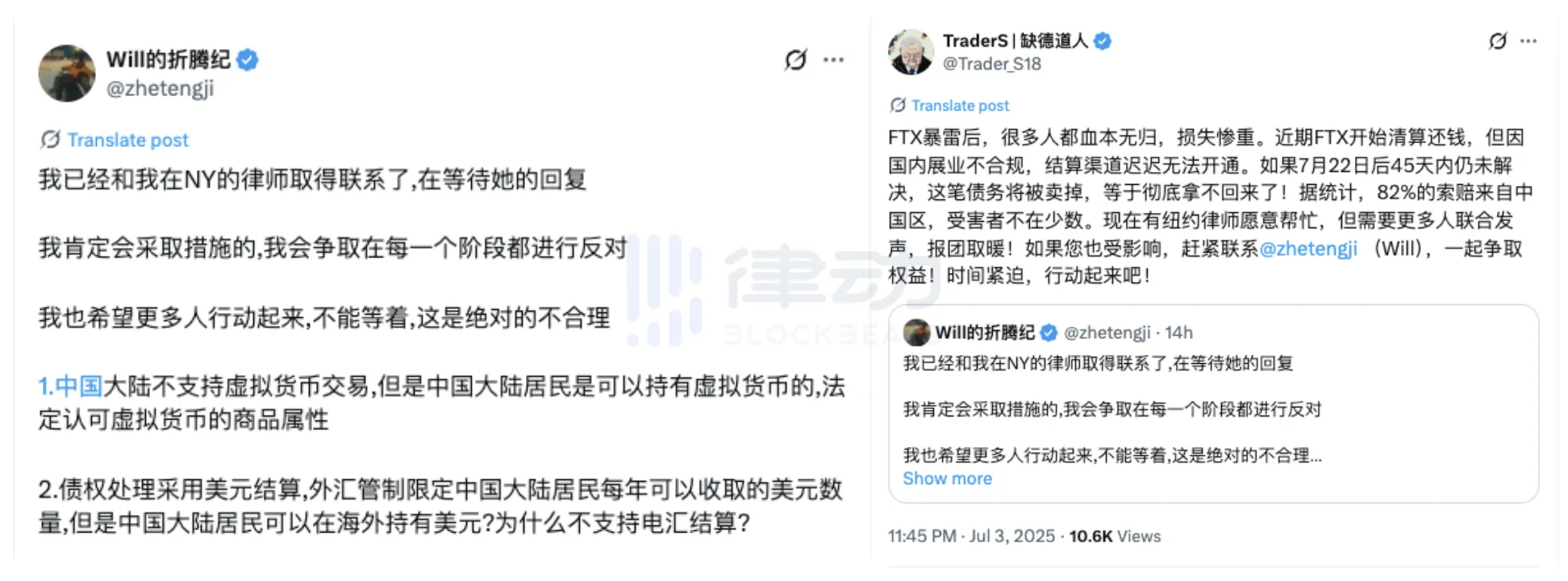

On July 4, 2025, Sunil, representative of FTX creditors, posted a screenshot of an FTX bankruptcy liquidation document on social media. The document revealed that FTX would seek legal advice to potentially confiscate claim funds from users located in restricted foreign jurisdictions.

Sunil also released one striking figure: 82% of the claims from users in "restricted countries" originated from Chinese users.

However, because cryptocurrency trading is prohibited within China, these users may be deemed "illegal," thus losing their eligibility to claim compensation. This means not only can they not recover their losses, but their assets could instead be "legally confiscated."

The community erupted in outrage, questioning whether the liquidation team's compliance rationale was merely an excuse to evade responsibility. Some labeled FTX’s decision as “American-style robbery,” lamenting that “Chinese people are treated worse than dogs,” with deep disappointment and helplessness evident in every word. Others argued that despite China's strict restrictions on crypto trading, user funds should not be directly seized, and that FTX’s move lacks clear legal grounding.

In the wake of such a statement—one that could reshape global understanding of creditor rights—the biggest concern isn't just whether FTX is “acting lawfully,” but rather: Who is making these decisions? By what standards? And who ultimately benefits?

Who Took Over?

The wreckage has been taken over by a Wall Street-led bankruptcy restructuring team: headed by veteran restructurer John J. Ray III as CEO, with the prestigious law firm Sullivan & Cromwell (hereinafter S&C) leading the liquidation effort.

John J. Ray—a seasoned professional in corporate corpse management. He previously oversaw the Enron bankruptcy, where his work brought nearly $700 million in revenue to S&C during that “trial of the century.”

This time, he brought along the same law firm team to take control of FTX.

High fees aren’t the issue—it’s how high they are. According to public filings, partner hourly rates at S&C reach up to $2,000, while John Ray himself charges $1,300 per hour. Bloomberg reports that by early 2025, S&C had cumulatively billed $249 million in legal fees under the FTX Chapter 11 bankruptcy process.

Assets that should belong to all creditors are being systematically carved away by this “professional team.” This is precisely why FTX creditors have long accused them: “They’re repeating the Enron playbook.”

Another oddity lies in the speed with which FTX declared bankruptcy. It wasn’t until a draft of SBF’s full congressional testimony was leaked that we learned how he was cornered just two days before filing.

A draft testimony prepared by Sam Bankman-Fried (SBF) shows that Ryne Miller, general counsel of FTX.US and also affiliated with S&C, closely coordinated with the liquidation team to force SBF and his management into initiating Chapter 11 proceedings.

In his testimony, SBF wrote: “People from Sullivan & Cromwell and Ryne Miller sent me countless threats—they even harassed my friends and family… People came to me in tears…”

But there was no turning back. His five emails went unanswered by John Ray.

He was merely the previous protagonist in this refined act of plunder.

The bankruptcy petition was filed amid overnight pressure, panic, and isolation. He had wanted to continue fundraising and save the company, but was pushed off stage by the very legal advisors he hired.

And then the real game—about who takes over the company and who divides its legacy—had just begun.

Who Is Dividing FTX’s Legacy?

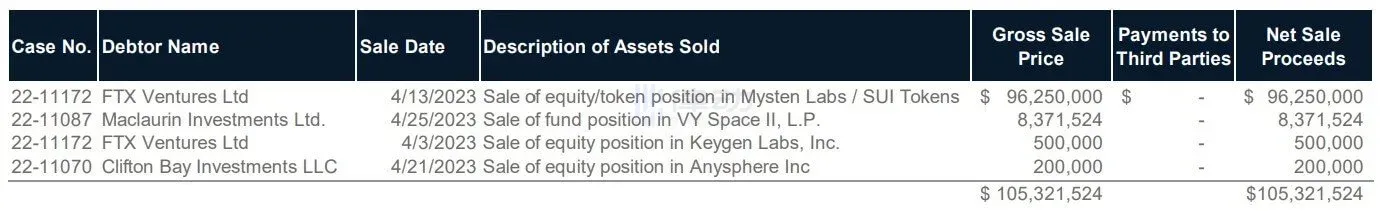

The liquidation team’s handling of FTX’s historical investment portfolio has sparked anger and confusion.

These investments were once key pieces in SBF’s “effective altruism” vision, and were widely seen as valuable reserves that might allow FTX to rebound. Yet John Ray’s team has almost entirely dumped them in a “fire-sale” manner, selling most at prices far below their true value.

Three particularly glaring deals reveal the absurdity of the entire liquidation:

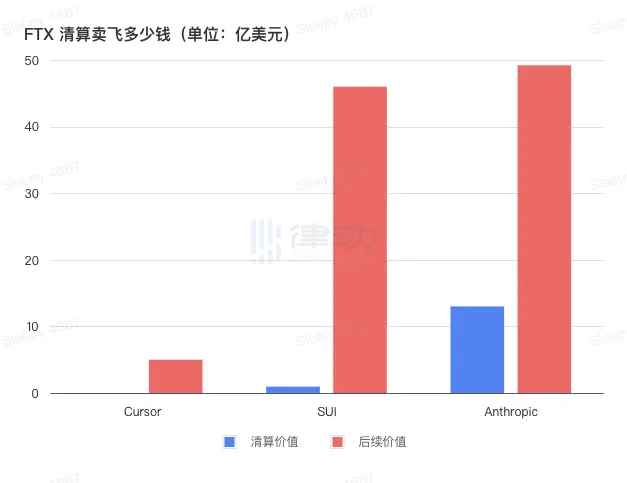

1) Cursor: $200,000 for a $500 Million sigh

Cursor, hailed in AI circles as the “Vibe coding神器,” received a $200,000 seed investment from FTX. During liquidation, it was sold at cost. On the surface, no loss—but considering authoritative outlets like TechCrunch and Bloomberg reported Cursor’s valuation reaching $9 billion, this sale price is outrageous.

Conservative estimates suggest FTX could have reclaimed equity returns in the $500 million range, yet the legal team handed it away. Industry insiders sarcastically remarked it was “faster than Trump makes money,” directly accusing the asset of being darkly dumped.

2) Mysten Labs / SUI: $96 Million for a $4.6 Billion dream

Mysten Labs and its developed SUI chain were considered the next Solana, boasting exceptional blockchain scalability.

In 2022, FTX paid approximately $100 million for equity in Mysten and subscription rights to 890 million SUI tokens. But the liquidation team sold the entire stake in 2023 for just $96 million, citing “quick capital recovery.”

At peak value, those SUI holdings exceeded $4.6 billion—meaning the $96 million sale represented only about 2% of their future worth.

The community joked that if SBF saw SUI’s market performance from prison, he might die of rage.

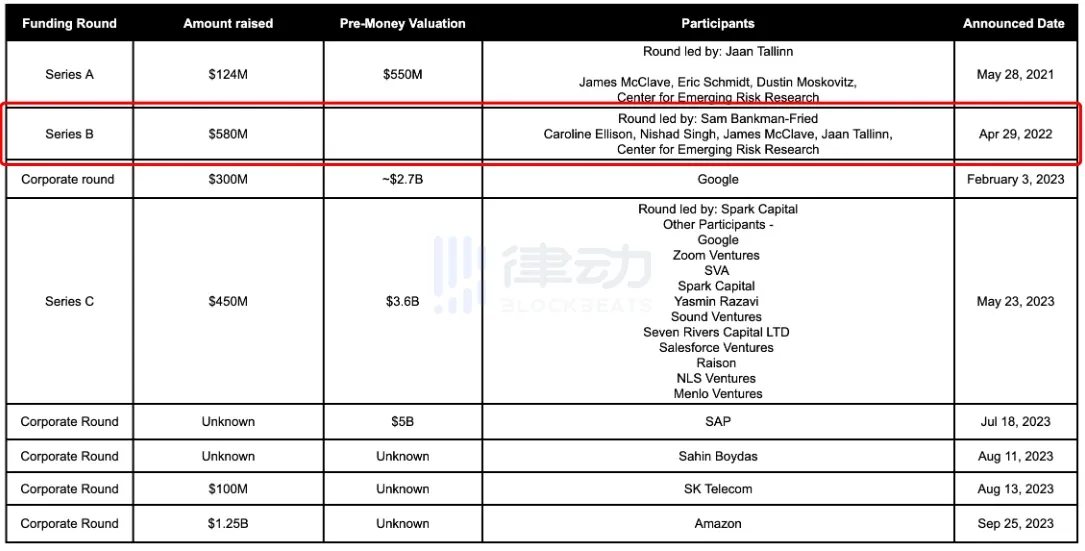

3) Anthropic: $1.3 Billion for a $61.5 Billion giant

Anthropic, founded by former OpenAI executives focused on AI safety, received a direct $500 million investment from SBF, giving him around 8% ownership.

The liquidation team sold all shares in two tranches during 2024, recovering a total of $1.3 billion. Initially seen as a decent exit, less than a year later, Anthropic’s valuation surged to $61.5 billion—implying FTX’s 8% stake would now be worth nearly $5 billion.

In other words, the bankruptcy team missed out on at least $3.7 billion in additional returns.

FTX’s investment foresight was sound—few would deny that. They accurately fired shots ahead of trends, betting big when these companies were overlooked, securing core stakes.

But after FTX collapsed, these bets were treated as scrap metal.

Beyond these three major cases, the FTX liquidation team used similar tactics to dump assets like LedgerX, Blockfolio, and large SOL token packages, sparking widespread controversy.

For example, during the 2024 auction of SOL tokens, institutions like Galaxy Trading and Pantera Capital bought low, then profited enormously as SOL prices skyrocketed—while original creditors could only watch opportunities vanish. Reports from Financial Times and Cointelegraph suggest FTX lost at least tens of billions in potential appreciation due to suboptimal disposal of high-quality assets.

Why did such concentrated, short-term “fire sales” occur? John Ray claims it was to “lock in cash quickly and avoid volatility risk.” Yet industry analysts argue this justification fails to explain why deep discounts consistently benefited familiar institutional allies—and why many assets more than doubled within six months.

Thus, conspiracy theories emerged: the liquidation team rapidly sold prime assets to well-connected funds, allowing themselves to collect exorbitant legal fees and close the case swiftly, thereby profiting handsomely. Under a “lawful and compliant” framework, creditor assets were quietly transferred at bargain prices to those closest to power.

The shares, tokens, and options sold cheaply continue to appreciate in value—while those meant to benefit from that growth can only look on through published PDFs, watching their futures seized by others.

Bankruptcy Liquidation or Legalized Looting?

No industry forgets faster than crypto. Markets are now chasing AI, stablecoins, and RWAs again; the 2022 crisis seems long gone. Yet the FTX liquidation process is far from over.

Over the past three years, FTX’s assets have been methodically sliced, bundled, and auctioned—stripped of all future potential, leaving behind only an empty shell.

The scale and complexity of FTX’s bankruptcy ranks among the most significant in global crypto history. But what deserves entry into textbooks may be the collective disillusionment of creditors toward the legal system.

On one hand, the liquidation lawyers led by John Ray and S&C have legally collected astronomical fees, facing virtually no possibility of judicial accountability. On the other, they’ve armored themselves with免责 clauses, shielding them from liability even if accused of malicious liquidation in the future.

For hundreds of thousands of retail investors wiped out by FTX’s collapse, this isn’t redemption—it’s a second betrayal. You might miss a market rally, but being stripped of fair recourse is the cruelest blow.

Currently, FTX’s bankrupt estate is expected to distribute between $14.5 billion and $16.3 billion globally. But if users from regions like China are ultimately blocked from claiming, another unresolved tragedy looms: some people are completely excluded from the legal system, their rightful funds devoured by procedural complexities and gray zones exploited by bankruptcy lawyers.

Worse still, hidden in FTX’s new proposal submitted to bankruptcy court are buried clauses granting immunity to consultants, making it nearly impossible for creditors to sue or appeal.

Perhaps for the industry, FTX’s collapse was just another cyclical trough. But for those trapped inside—especially hundreds of thousands of Chinese retail investors—it’s not just financial loss, but the end of hope.

This so-called “elite liquidation squad” of lawyers and advisors can decide the fate of tens of billions with just a few lines of text—yet no one remains to fight for ordinary investors, leaving them with zero chance of recovery.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News