Interview with Hop Founder: Bear Market, Cross-Chain Bridges, and Hop's Future

TechFlow Selected TechFlow Selected

Interview with Hop Founder: Bear Market, Cross-Chain Bridges, and Hop's Future

How Hop Protocol Became One of the Most Trusted Cross-Chain Bridges?

Written by: Aylo, Alpha Please

Compiled by: TechFlow

Today, we have a special guest to share insights on the bear market. Chris Whinfrey is the founder of Hop Protocol, tackling one of the most complex challenges in our space: cross-chain bridges.

I had an excellent conversation with him about his journey, how Hop Protocol has become one of the most trusted cross-chain bridges, and what he envisions for the future.

How did you get into crypto?

In 2014, shortly after graduating, I was living with some people who founded a Bitcoin club at the University of Michigan—that's when I first learned about Bitcoin. That’s how I entered the space. At the time, the goal of blockchain development was simply to fork Bitcoin and use it to do different things.

Vitalik had already published the Ethereum whitepaper, which immediately fascinated me. I scoured the web for everything I could find, learned as much as possible, and started working with Solidity. Back then, there was basically only one main website that helped you code tokens in Solidity, but they upgraded their compiler so fast that I often couldn’t even work. Nick Johnson, the founder of ENS, played a big role in helping people learn Solidity. Thanks to him, I was able to pick things up quickly in those early days.

Then I moved to Boston, where I was doing iOS development. My background is in computer science, and I really wanted to go full-time into crypto and started looking for opportunities. But I couldn’t find anything in Boston, so I quit my job and started the Boston Ethereum Developer Meetup. I also co-founded an Ethereum development shop called Level K with a few friends. We began doing smart contract development and eventually conducted audits for various players in the space. That’s my entry story.

How much have Ethereum development resources and tools improved, and what impact has that had?

Until 2017, most people weren’t really building useful things—most serious code was just tokens, and only a handful of contracts existed to deliver actual utility. That was kind of the dominant narrative back then.

Prior to that, it was much harder to deploy anything reliably, and very few projects managed to do anything beyond launching tokens.

Now we have OpenZeppelin libraries, which have been crucial in adopting foundational modules and combining them in different ways. It’s now possible to build applications like Lego blocks on top of existing components.

Only after we had exchanges, lending markets, and these foundational layers did we truly unlock many new possibilities. Today, it’s easy to launch an app, connect a frontend, and actually build something useful.

If you could do that back then, you could easily raise tens of millions in an ICO and become one of the biggest projects.

What have you learned over the past few years?

The most important thing, watching everything unfold, is long-term thinking. If you have a long-term mindset in crypto, I believe it puts you ahead of about 90% of teams, especially in this cycle where Twitter plays such a large role in shaping narratives.

There are many opportunities in this space, but the big ones are often hidden from the crowd. There’s so much noise now. Every two weeks there’s a new hot narrative—if you’re just chasing those, you’ll always be behind. Because those are things someone wants you to know, and by the time you know, you're already late. Stay committed, don’t chase the hottest trends. Thinking beyond the current cycle is extremely helpful in cutting through the noise.

How did Hop Protocol come about, and why is Hop needed?

Hop emerged out of necessity. Our team previously built a contract-based account wallet called Authereum. The project targeted users unfamiliar with crypto, aiming to give them a Web2-like experience while staying true to all Web3 ideals. Authereum was fully non-custodial, yet allowed login with just a username and password. We abstracted away certain complexities—for example, covering users’ gas fees.

Then came DeFi Summer.

Gas fees skyrocketed, and we had to pass those costs back to users. At the peak of DeFi Summer, deploying a contract-based account cost over $200. This was just for a lightweight proxy—we’d deploy the proxy and assign an ENS domain, and that alone cost more than $200. After that, regular or new users were completely priced out of Ethereum.

We realized that if Authereum had a future, that future must be on Layer 2. We needed a way for users not only to enter and use Layer 2, but to never have to interact with Layer 1 at all. That led us to build Hop, and we soon realized it had massive potential—far beyond just Ethereum.

While we were working on this, Vitalik released his rollup-centric Ethereum roadmap, listing cross-rollup transfers as one of the unsolved problems in Ethereum’s scaling path. That excited us greatly. At that moment, we started seriously considering focusing entirely on Hop and gradually letting go of Authereum. This was an opportunity to build core infrastructure for Ethereum—exactly what we dreamed of.

To get feedback from the research community, we released a whitepaper and demo in early 2021 to gauge reactions. The response was positive. So that summer, we launched Hop—over a year ago. Since then, our total transaction volume has just surpassed $3 billion.

What were your goals when launching Hop?

We did have goals, but we achieved them so quickly that they didn’t serve as strong drivers for further progress.

I think the numbers we see today may pale in comparison to what we’ll see in the future.

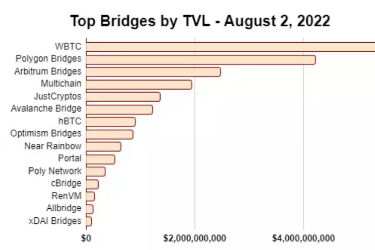

I believe cross-chain bridges are still a nascent field, especially in becoming a true core part of the cryptocurrency user experience.

I believe as Ethereum scales, if we truly see finance happening on Ethereum and across the broader multi-chain crypto landscape, we might see trillions of dollars in annual cross-chain volume.

This could eventually rival DEX trading volumes, which currently far exceed those of cross-chain bridges.

What approach does Hop take in building a scalable token bridge, and how is it different from other bridges?

With Hop, we’ve taken an approach focused on trustlessness and security. In our view, these two go hand in hand.

I recently gave a talk on bridge security, analyzing every major bridge hack over the past two years. Nearly $2 billion in losses resulted from bridge exploits, most due to compromised multisig wallets.

The fact that Hop has no multisig signers broadcasting messages and operates as a fully trustless bridge already sets it apart from many competitors. From a security standpoint, it’s unique because there’s no single multisig target that could be exploited to drain liquidity from the bridge.

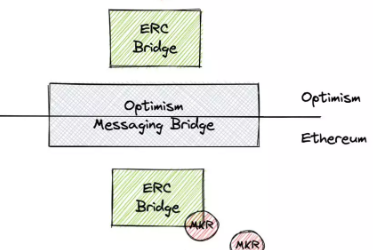

We also use a unique hub-and-spoke model. Using Ethereum as the hub, we rely on each supported network’s native messaging bridge to communicate with those networks. When transferring between two different Layer 2s, the route goes through Ethereum before reaching the destination.

The bridge used to communicate with the target network is based on that network’s native token bridge, meaning the network already fully depends on the security of its native bridge. If Hop can also isolate risks to those underlying native bridges, then Hop’s security becomes nearly equivalent to that of native cross-chain bridges.

If we can add support for more networks and more Layer 2s, and have contingency plans for catastrophic failures on any given network, such events would be isolated to that specific network, putting only its users at risk. We believe this is the only secure way for bridges to scale horizontally—which is exactly the approach we’ve taken from day one.

How has the bear market affected your team and progress?

I think it’s fine. Our team has been running for a while, and we actually enjoy bear markets—it’s a great time to build.

We’re also an extremely lean team, so we don’t need large amounts of cash to operate.

From that perspective, the bear market isn’t scary for us. But it does hit hard for teams with high burn rates, forcing them to raise more funds. Still, we’ve seen a lot of noise disappear. We’ve stayed focused on our work and will soon roll out some exciting updates.

What have been the outcomes of liquidity mining? What does it mean for you?

One key outcome is distribution. Hop has a large treasury, and unlike many teams in the space, we chose not to raise significant venture capital before launching our token. We truly want the DAO to hold the protocol’s value and be the entity fully in control.

If we had raised a large amount as a company, we might not feel obligated to empower the DAO, creating conflicts of interest. We’d have stronger incentives to push value toward equity, which we’ve seen many teams do. But we’re not fans of that model.

Instead of large fundraising rounds, we put more tokens into the DAO treasury, so the DAO benefits from any allocation—whether private sales held by the treasury or liquidity mining programs.

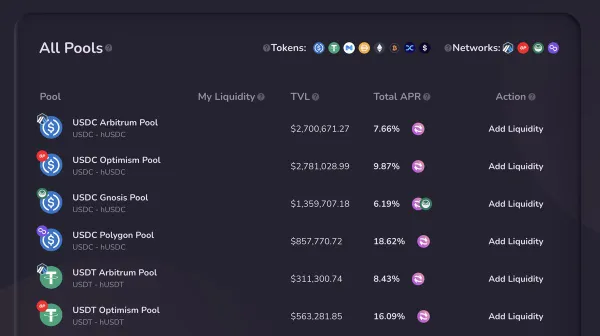

Hop has a large supply of tokens to distribute, and I believe this is critical for its long-term success. We aim for broad distribution across the Ethereum community. Liquidity mining provides a great channel for anyone to earn tokens by participating in the network.

Subsidies are great for capturing new markets, but aren’t necessarily sustainable long-term. For Hop specifically, I think they’ve been very meaningful for its current position. Given that many markets—especially DAI and USDT bridges—have benefited significantly from subsidies, they still make sense today. Going forward, once Hop achieves broad token distribution, we’ll gradually phase out subsidies and explore more sustainable models.

How do you attract a strong community?

It’s hard to say this was a direct result of early decisions, but we always hoped Hop would be community-owned.

In governance, we try to strike a good balance—driving initiatives when necessary, but otherwise stepping back and allowing community members to step in and take on various roles. Having a truly strong community is vital to our long-term success.

What will the next version of Hop look like?

I can only hint at this for now—we’ll soon release details on what we believe the roadmap should be. But it will be an open discussion with the community, so stay tuned.

How do you view your current competitors?

Our biggest concern is projects doing similar work to HOP but without caring about decentralization or trustlessness.

I do respect their business development and strategies, but I hope the space takes trustlessness and decentralization more seriously, rather than rushing toward commoditizing bridges at the expense of trust.

Can multiple cross-chain bridges win in the end?

As we’ve seen in many different markets, there’s often a dominant leader in each category.

The same likely applies to L1-to-L1 bridges, rollup bridges, and message layers.

Which L2s will succeed?

Ethereum, with its highly diverse rollup ecosystem. All rollups that have already built ecosystems will succeed, I believe.

There are many new entrants in the ZK space. It seems like a highly competitive field, which is great for users. With many teams taking different approaches, users will ultimately get the best solutions. In the future, we’ll see multiple ZK rollup ecosystems emerge.

Another style of rollup is exemplified by Arbitrum Nova. You could consider DyDx’s current StarkEx deployment as part of the same category. These use off-chain data availability, similar to StarkWare’s ImmutableX. Technically, these aren't full rollups since they don’t use Ethereum’s full data availability. While not fully decentralized or trustless, they offer extremely low costs.

For example, Reddit is now trading NFTs on Arbitrum Nova. Regular rollups aren’t cheap enough—costs need to be nearly zero. Reddit doesn’t want users to pay fees, nor does it want to bear high operational costs. So all these tokens live on Arbitrum Nova, can be bridged to Arbitrum One, then to Ethereum, enjoying full security there. This represents a real-world use case for L2s in recent years.

What are you optimistic about for the future?

I’m definitely bullish on many ZK technologies—perhaps I should say SNARK technologies, since it’s not all zero-knowledge, but includes both SNARKs and STARKs—not just for rollups, but for various use cases like privacy and proving storage across different chains.

Any advice for crypto investors?

Take a long-term view of this cycle. If you’ve been through several cycles in crypto, you’ll notice that the lasting things are built by those who truly believe in crypto—and those are usually projects that endure across multiple cycles.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News