Forget Cross-Chain Bridges—Is Vitalik's Advocated Atomic Swap Actually Practical?

TechFlow Selected TechFlow Selected

Forget Cross-Chain Bridges—Is Vitalik's Advocated Atomic Swap Actually Practical?

What exactly are atomic swaps? How do they work, and can they truly replace centralized exchanges?

Author: Ignas, DeFi Research

Translation: Baize Research Institute

How do you convert BTC to ETH? Or BTC to ATOM?

Like many others, I usually deposit ETH into a centralized exchange (CEX), trade it for BTC, and then transfer the BTC to an on-chain wallet.

This puts me in a somewhat ironic situation: while advocating for the use of DeFi, I myself am relying on CEXs for these so-called "cross-chain trades."

In fact, Ethereum co-founder Vitalik Buterin has repeatedly emphasized: "Keep assets on their native chains and use atomic swaps to transfer value across different blockchains."

Sounds simple, but reality is far from straightforward.

What exactly are atomic swaps? How do they work, and can they truly replace centralized exchanges?

Let’s explore this in detail.

Atomic Swaps: From Concept to Execution

The idea of atomic swaps was first proposed by Tier Nolan in a 2013 Bitcointalk forum post. However, it wasn’t until 2017 that the first successful atomic swap was completed. Litecoin founder Charlie Lee tweeted at the time: "Completed an LTC/BTC cross-chain atomic swap!" (By the way, it was quite a profitable trade—he made a 330% gain on that transaction.)

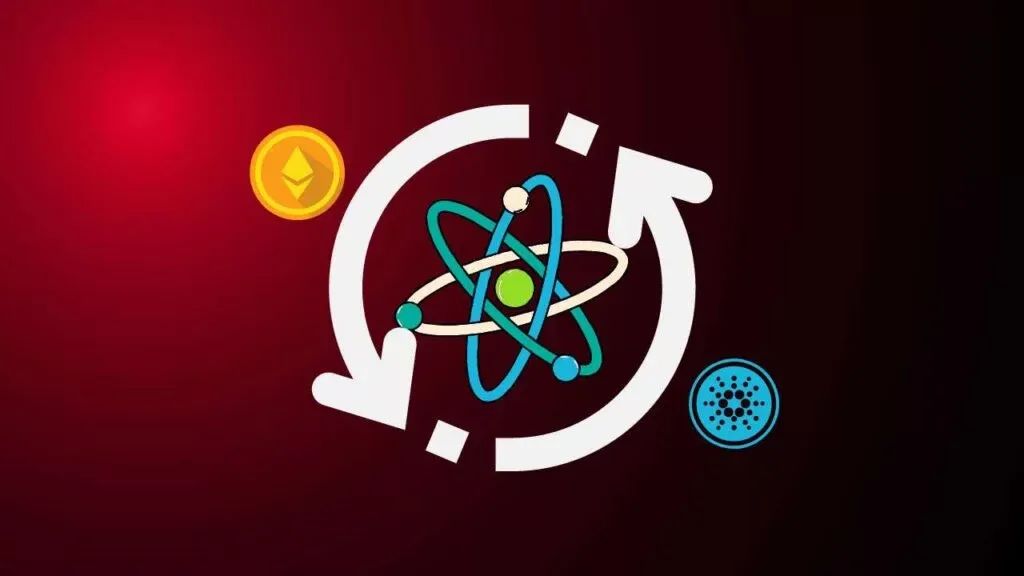

How do atomic swaps work? We can understand them simply as follows:

Atomic swaps occur directly between two cryptocurrency wallets without any intermediary facilitating the trade. They are "atomic"—just like atoms are indivisible—meaning either the entire transaction completes successfully and both parties receive each other's funds, or nothing happens and both traders retain their original assets.

The mechanism relies on Hashed Time-Locked Contracts (HTLCs), which can be thought of as virtual safe boxes with two special safeguards: "HashLock" and "TimeLock":

-

HashLock: Ensures funds remain locked in the contract until the initiating party reveals the secret key needed to unlock the HTLC to the counterparty.

-

TimeLock: If the transaction isn't completed within a specified timeframe, the cryptocurrencies involved are automatically returned to their respective owners.

Once both parties have submitted the required keys, the transaction is finalized.

If neither party submits the key within the deadline, the transaction is canceled, ensuring no one suffers losses.

Atomic Swaps vs Cross-Chain Bridges

Of course, atomic swap technology is much more complex than described here and continues to evolve. The benefits it offers include:

-

Trustless: No trusted third party is involved

-

Counterparty Risk Mitigation: If one party fails to meet the conditions, the other won’t lose their assets

-

Ownership Control: You maintain control over your assets until the trade is complete

-

Privacy: Transactions are private and known only to the two participants

Although early experiments were conducted by several tech pioneers, atomic swaps never really gained widespread adoption.

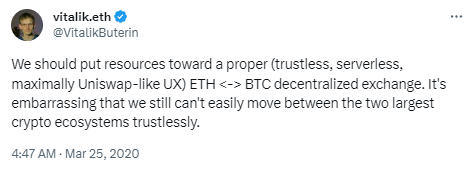

Here’s a tweet from Vitalik three years ago: “We should be focusing our resources on building proper (trustless, serverless, Uniswap-like UX) decentralized exchanges for ETH <-> BTC. It’s embarrassing that we still can’t easily transfer value trustlessly between the two largest crypto ecosystems.”

Three years later, things have changed—but not because of atomic swaps. Instead, it’s cross-chain bridges that have taken center stage.

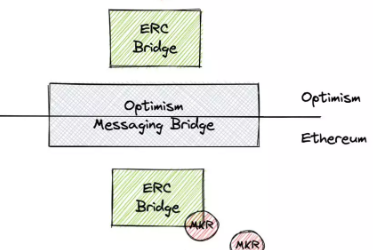

Over these past three years, cross-chain bridges—which aggregate user assets and issue pegged tokens (or wrapped tokens, such as wETH on Fantom)—have grown increasingly popular.

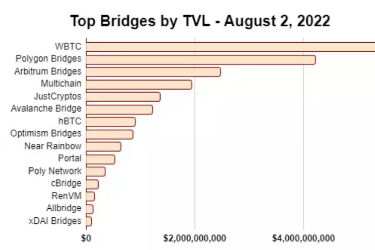

According to DefiLlama data, the total value locked across 14 major bridges reached $4.8 billion over the past seven days!

Vitalik has been highly critical of the design of cross-chain bridges. A year ago, he shared his pessimistic views about them on Reddit. Here are the key points:

-

While multi-chain ecosystems offer diversity benefits, cross-chain bridges introduce security risks due to smart contract vulnerabilities.

-

Even under a 51% attack, blockchains can preserve their rules, maintain user balances, and ensure transaction consistency.

-

However, during a 51% attack, if a bridge’s smart contract loses control, cross-chain assets could lose value.

-

Therefore, keeping native assets on their original chains is safer than moving them across chains.

-

Cross-chain activity exhibits a "negative network effect": the more it's used, the greater the risk—especially when bridges hold large amounts of assets.

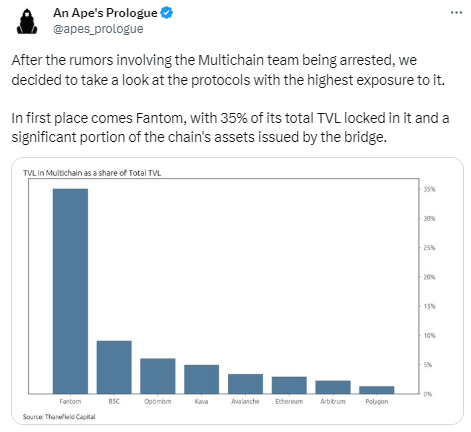

As I write this, the risk of this "negative network effect" has become alarmingly real, with rumors circulating that the Multichain development team holding multisig keys has been arrested.

To clarify, Multichain’s cross-chain bridge uses a pooled asset model to issue pegged tokens across supported chains.

For example, BTC on Fantom is actually wBTC that has been re-wrapped by Multichain.

On-chain analyst An Ape Prologue investigated Multichain and found that 40% of all assets on Fantom (excluding the native token FTM) were issued by Multichain. These pegged assets totaled $650 million, highlighting Fantom’s heavy reliance on cross-chain bridges.

Unfortunately, Multichain is neither the first nor the last bridge to face serious issues. The five largest bridge hacks have already resulted in $1.9 billion in losses.

As Vitalik said: “Keep assets on their native chains and use atomic swap protocols to transfer value across different blockchains.”

Despite the risks associated with bridges, atomic swap protocols remain rare today, mainly due to five key obstacles:

-

Different Languages: Blockchains use different programming languages, making direct atomic swaps difficult.

-

Limited Functionality: Bitcoin’s scripting language lacks the smart contract capabilities of Ethereum’s Solidity, complicating certain atomic swap conditions.

-

Different Consensus Mechanisms: Bitcoin uses Proof-of-Work, while Ethereum has transitioned to Proof-of-Stake. This difference complicates atomic swap mechanisms.

-

Complexity and Risk: Atomic swaps involve multiple steps and carry the risk of fund loss if executed incorrectly.

-

Liquidity Requirements: Effective atomic swaps require sufficient liquidity on both chains; otherwise, exchange rates may fluctuate significantly.

Attempts at “Atomic Swaps”

So, can we actually use "atomic swap" protocols today?

Currently, there are at least 15 related protocols using various swapping mechanisms.

However, what matters most to me is the ability to exchange native assets across chains—especially native BTC and ETH. In my view, that remains the holy grail.

Thorchain’s Thorswap

Thorswap is perhaps the best-known multi-chain asset trading protocol. It enables swaps of native ETH, BTC, and other tokens across nine blockchains.

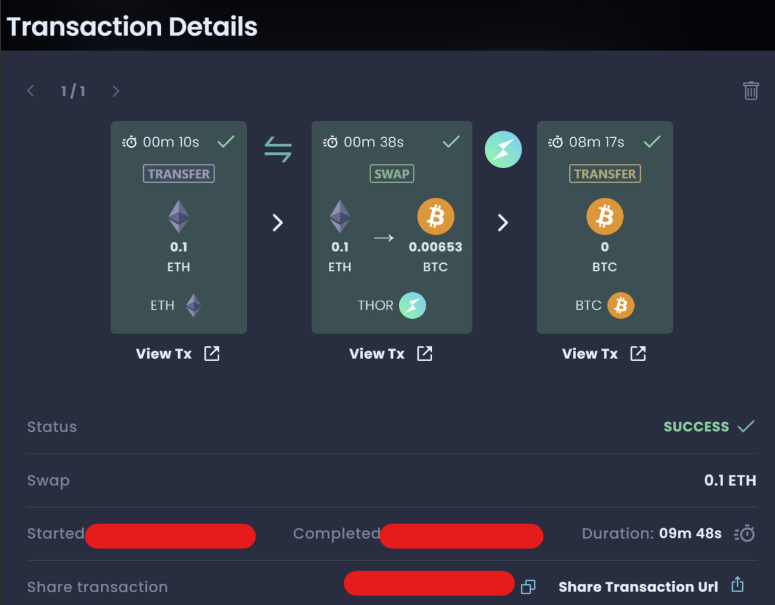

In the example below, I swapped ETH for BTC in 9 minutes, paying $37 in fees (mostly due to Bitcoin network costs).

At the core of the THOR system are liquidity pools, each containing 50% of THORChain’s native token RUNE and 50% of another asset like BTC or ETH.

When you want to swap ETH for BTC, the protocol first exchanges your ETH for RUNE in the ETH-RUNE pool, then uses that RUNE to acquire BTC from the BTC-RUNE pool.

Thus, THORChain still relies on liquidity pools, which can be targets for hackers—meaning it’s not a true atomic swap.

In fact, I reached out to the THORSwap team to ask why they abandoned atomic swaps. Here’s what their operations manager paperX said:

Due to limited liquidity, THORChain had to abandon atomic swaps. To provide a decentralized cross-chain trading protocol competitive with CEXs, we must offer competitive pricing.

Back in 2018/2019, THORChain explored atomic swaps as a technical option, but ultimately shifted toward building a decentralized cross-chain liquidity protocol using the Tendermint consensus engine, Cosmos-SDK state machine, and GG20 Threshold Signature Scheme (TSS). It does not peg or "wrap" assets—it manages funds directly in on-chain vaults.

Komodo (AtomicDEX)

Komodo is one of the pioneers in the atomic swap space.

Their decentralized exchange, AtomicDEX, uses atomic swap technology to provide a "secure and trustless multi-chain trading" environment. Komodo proudly asserts, "We cannot freeze funds or stop transactions."

Unfortunately, the platform is not very user-friendly on either mobile or desktop. Currently, it doesn’t support Metamask or Keplr and only allows connections via mnemonic phrases or hardware wallets.

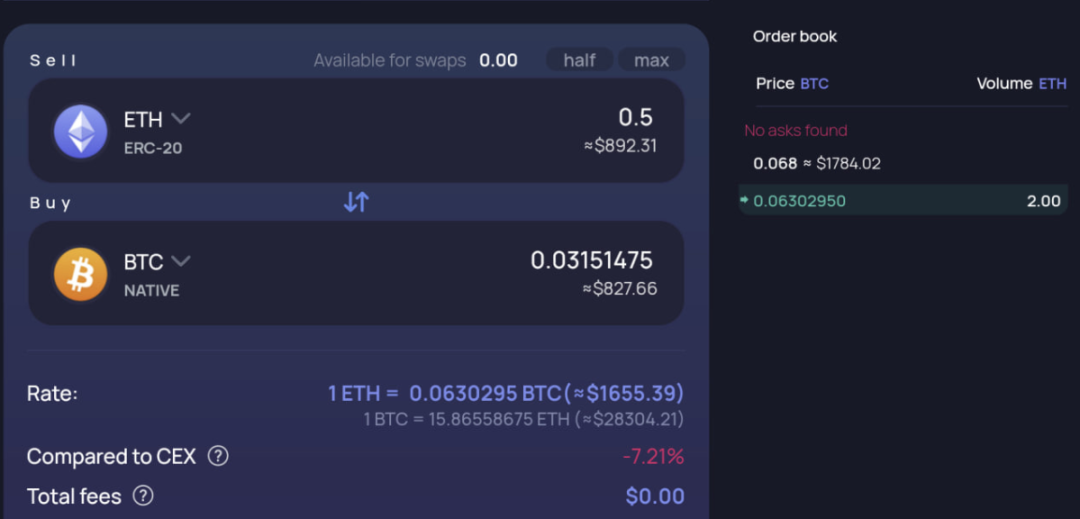

Additionally, the maximum BTC swap limit is capped at 2 ETH, and the exchange rate offered is 7% worse than those on centralized exchanges (CEXs).

This perhaps illustrates the trade-off users must consider when choosing between cross-chain bridges and genuine atomic swap protocols.

Conclusion

Achieving true atomic swaps between BTC and ETH remains challenging.

If using decentralized applications isn’t an issue and you need to perform cross-chain trades, you might also try SWFT AllChain Bridge or the Maya Protocol (a fork of THORChain).

Moreover, three next-generation cross-chain protocols are worth exploring:

-

InterSwap – A full-chain AMM with unified liquidity.

-

Orion Protocol – Allows users to trade across major CEXs/DEXs using a DeFi wallet. No KYC required.

-

Chainflip – Enables low-slippage cross-chain swaps aimed at replacing centralized exchanges.

(Note: The above represents the author’s personal views and should not be taken as investment advice. Do your own research.)

Regardless, I wonder which protocols Vitalik has in mind when recommending we avoid cross-chain bridges and instead adopt atomic swaps.

Still, it’s clear that true atomic swaps are far from achieving widespread adoption.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News