Cross-chain bridge on-chain data analysis: approximately $2 billion in weekly bridged volume, deBridge generates the highest revenue

TechFlow Selected TechFlow Selected

Cross-chain bridge on-chain data analysis: approximately $2 billion in weekly bridged volume, deBridge generates the highest revenue

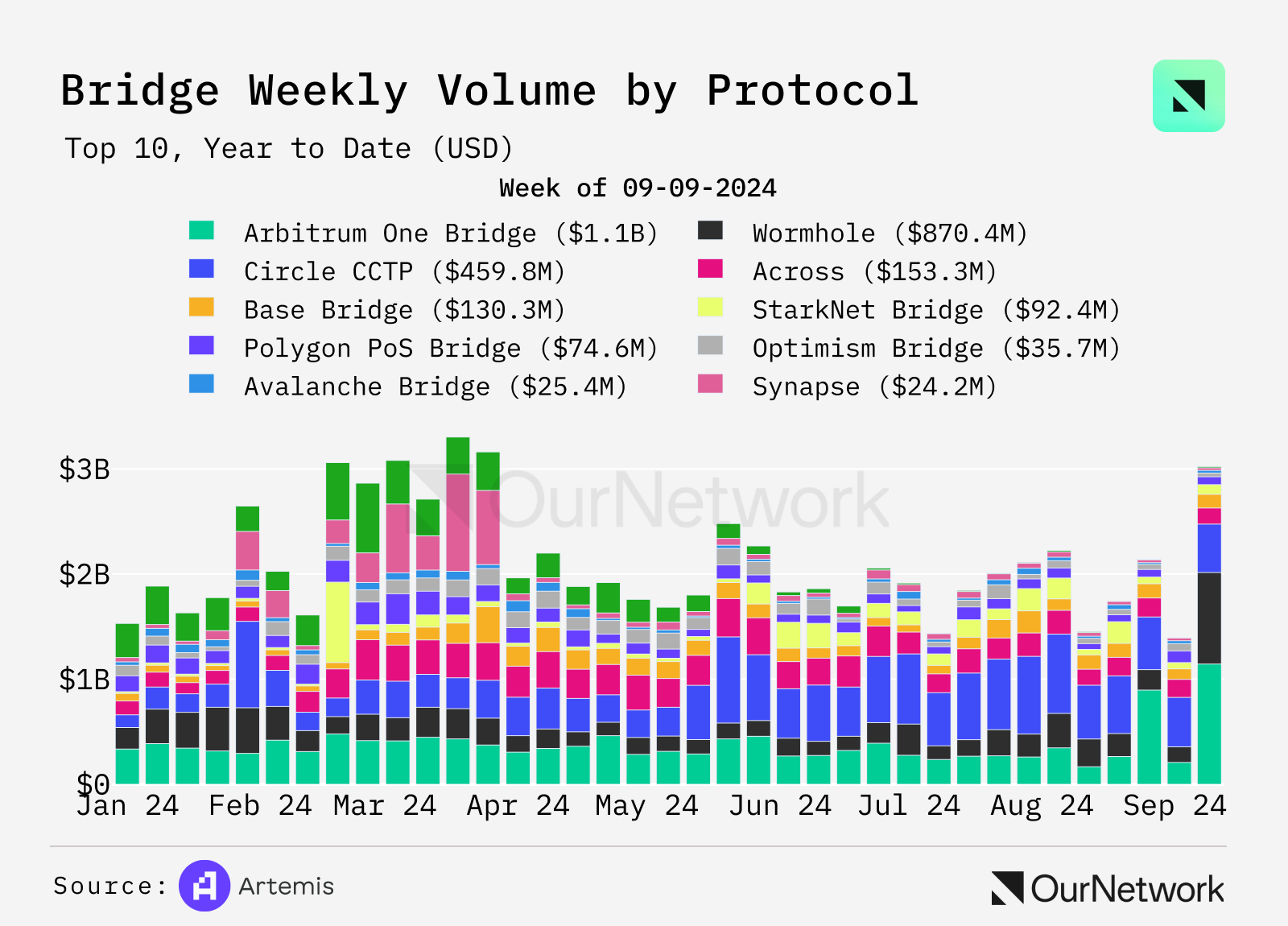

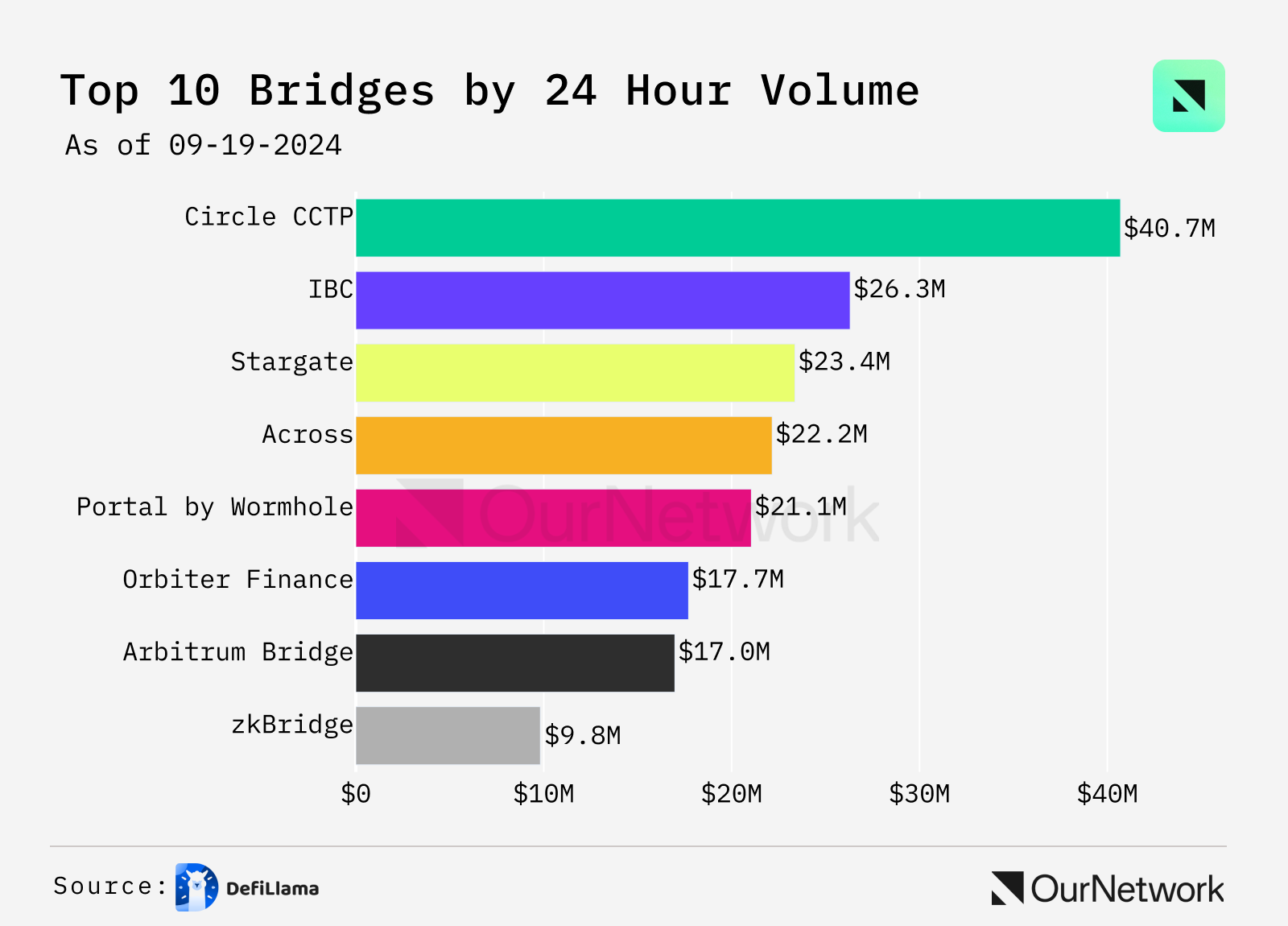

Except for Circle's CCTP, which is dedicated to USDC transfers, no single bridge accounts for more than 20% of total volume, with most bridges ranging between 10% and 20%.

Author: OurNetwork

Translation: TechFlow

Bridges

Synapse | deBridge | Across | zkBridge

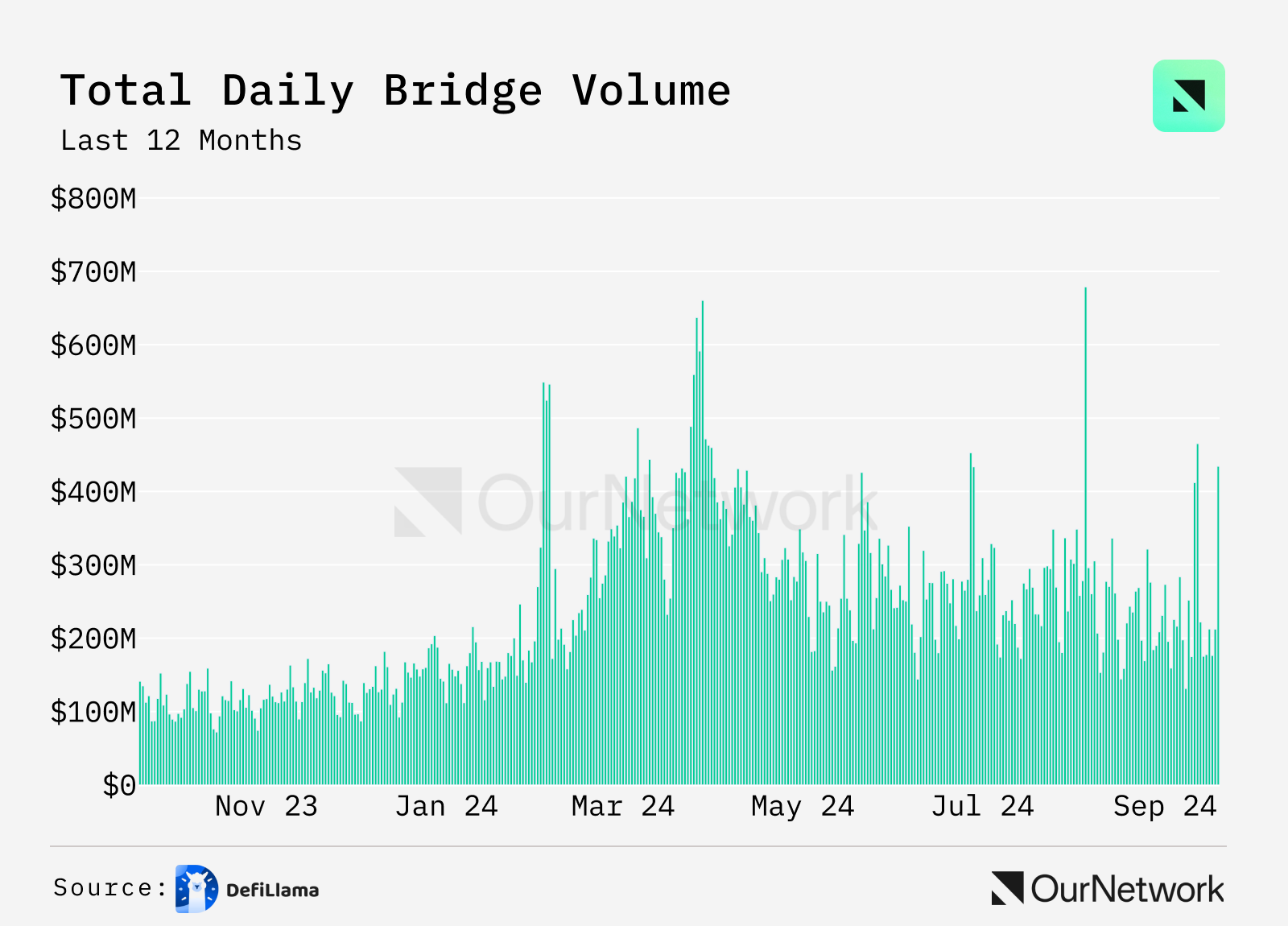

Weekly bridging volume reaches ~$2 billion, up over 60% year-on-year

-

According to Artemis data, weekly bridging activity now exceeds $2 billion. Traffic distribution across bridges is relatively balanced—aside from Circle’s CCTP, which is dedicated to USDC transfers, no single bridge captures more than 20% of total volume, with most ranging between 10% and 20%.

-

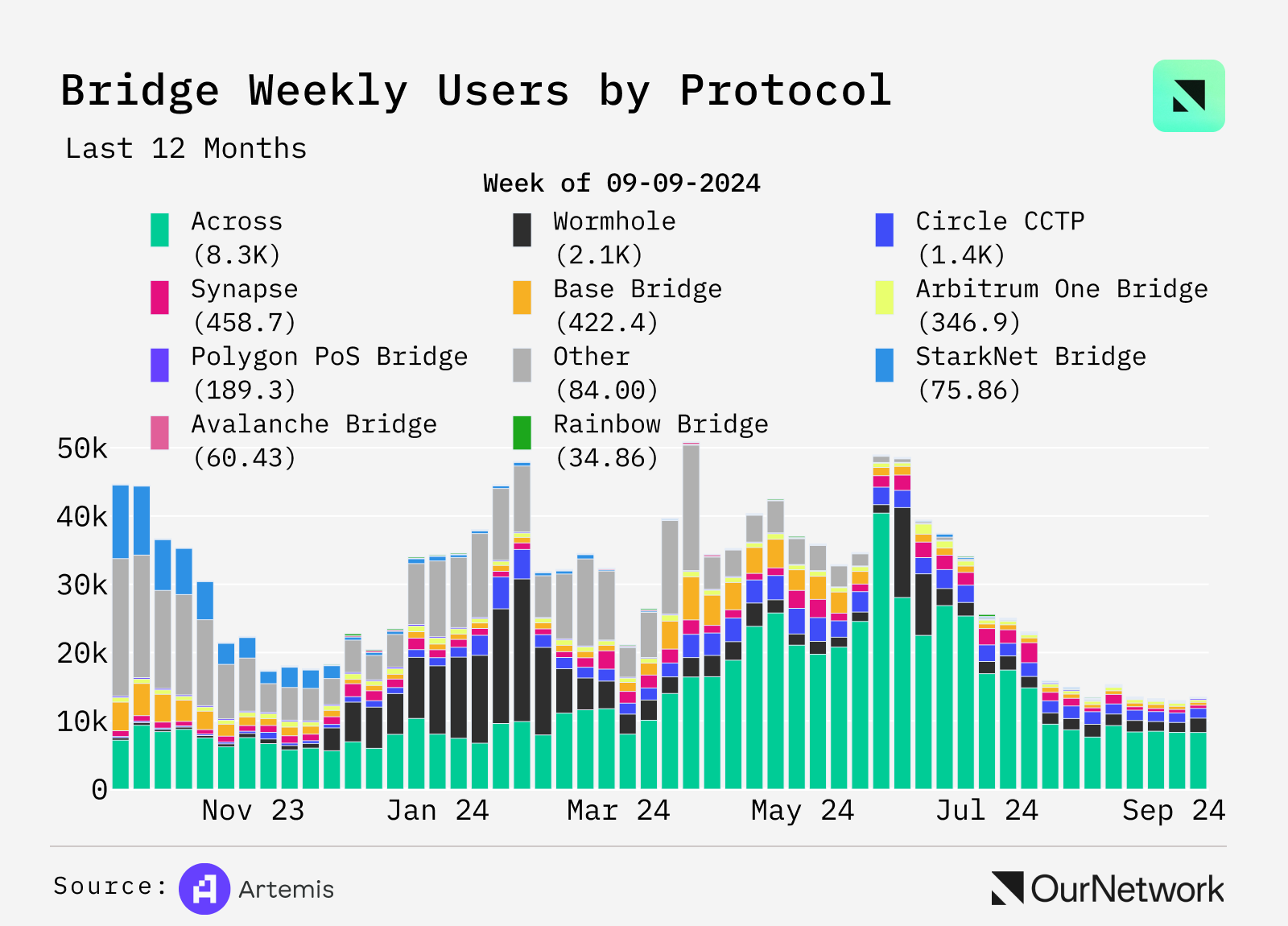

The number of daily active bridging addresses has declined by over 70%, as users who previously bridged to farm ZK-rollup airdrops—on StarkNet and zkSync—have largely stopped after token launches. Across Network remains the leading unofficial bridge, with around 7,000 addresses bridging daily.

-

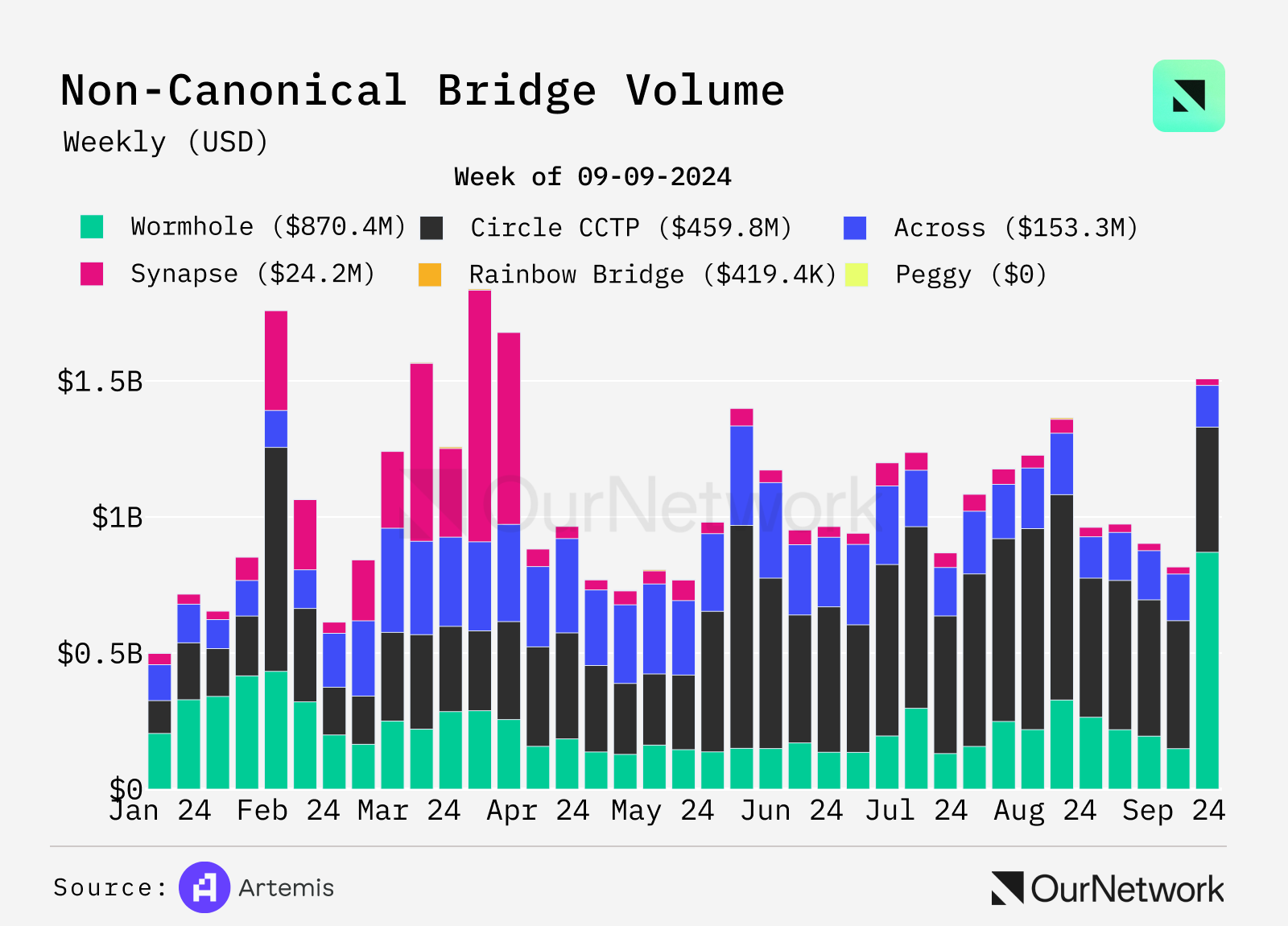

Unofficial bridges—that is, general-purpose cross-chain bridges rather than internal solutions built specifically for connecting two blockchains—have seen explosive growth this year. Circle's CCTP processes around $400 million in weekly transaction volume, nearly 10x its volume from last year.

Synapse

Synapse nears $55B in total volume with 2.5M users

-

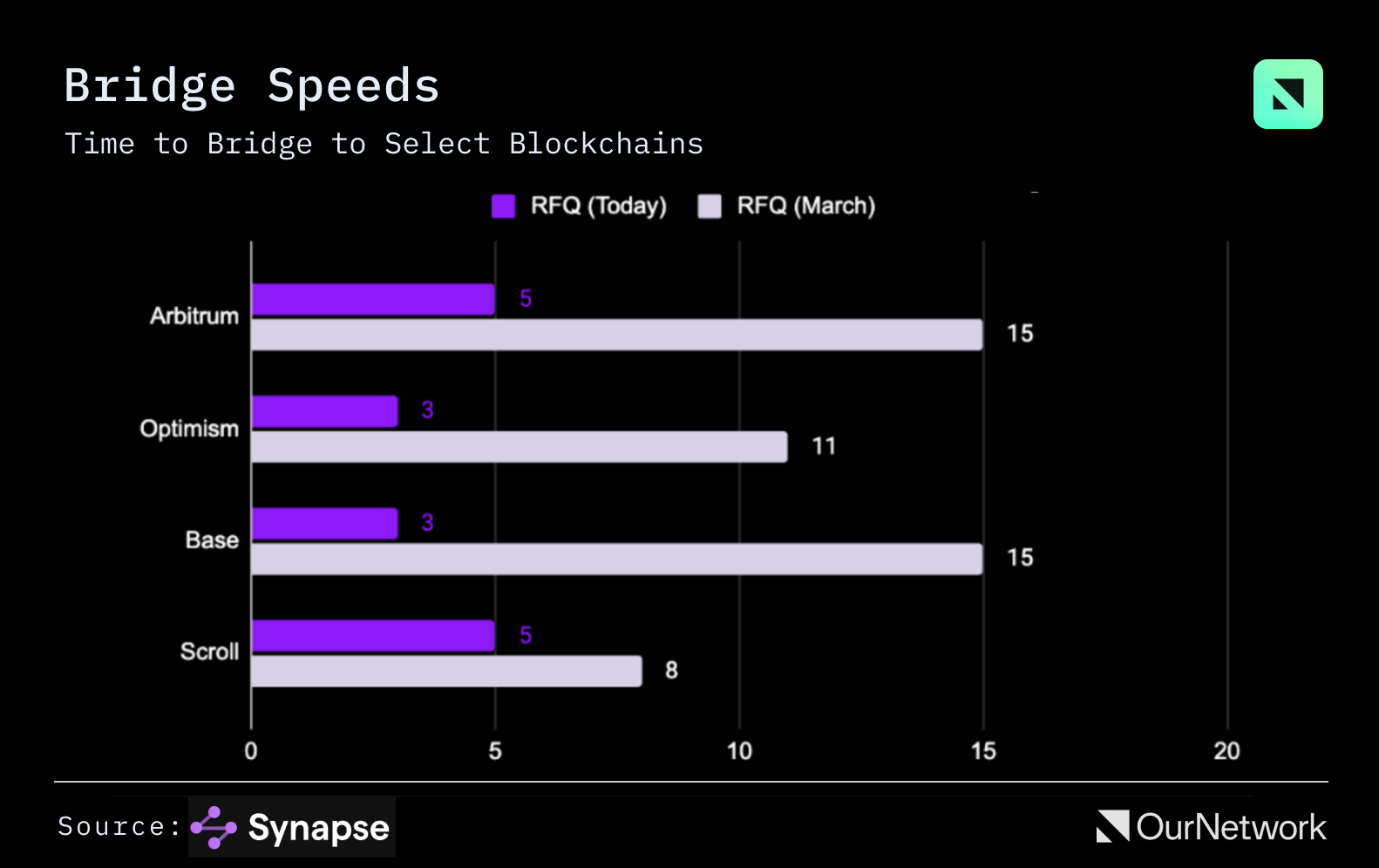

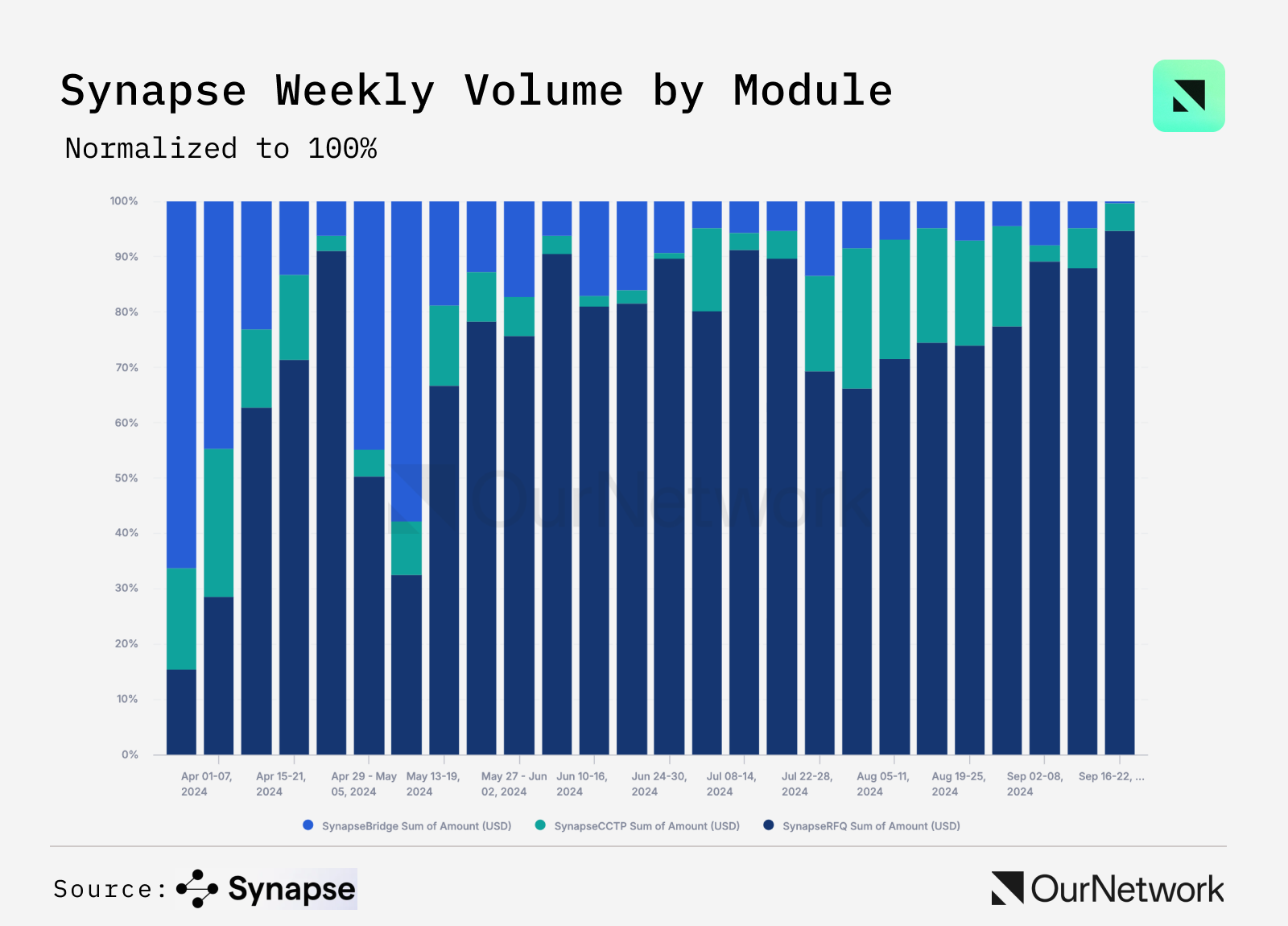

Synapse Protocol is a decentralized cross-chain network enabling developers and users to read and write data across different blockchains. To date, over 2 million users have completed $50 billion in transactions via the bridge, generating over $30 million in fees. Over the past six months, Synapse launched SynapseRFQ, an intent-based bridging solution offering zero slippage and fast confirmations. Since launch, bridging times have decreased by 60–80%, with sub-second confirmation times on certain routes, making it one of the fastest bridges available.

-

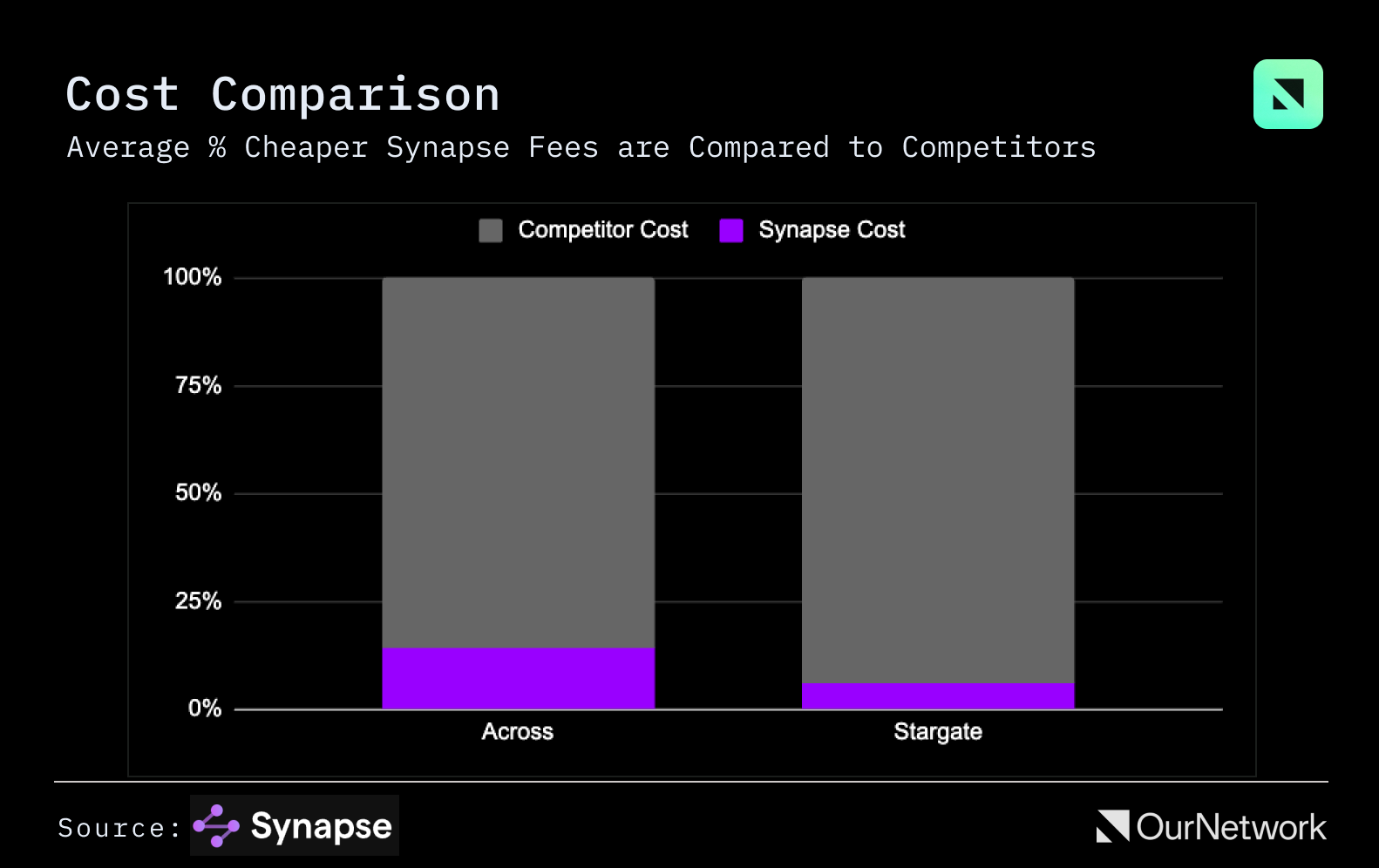

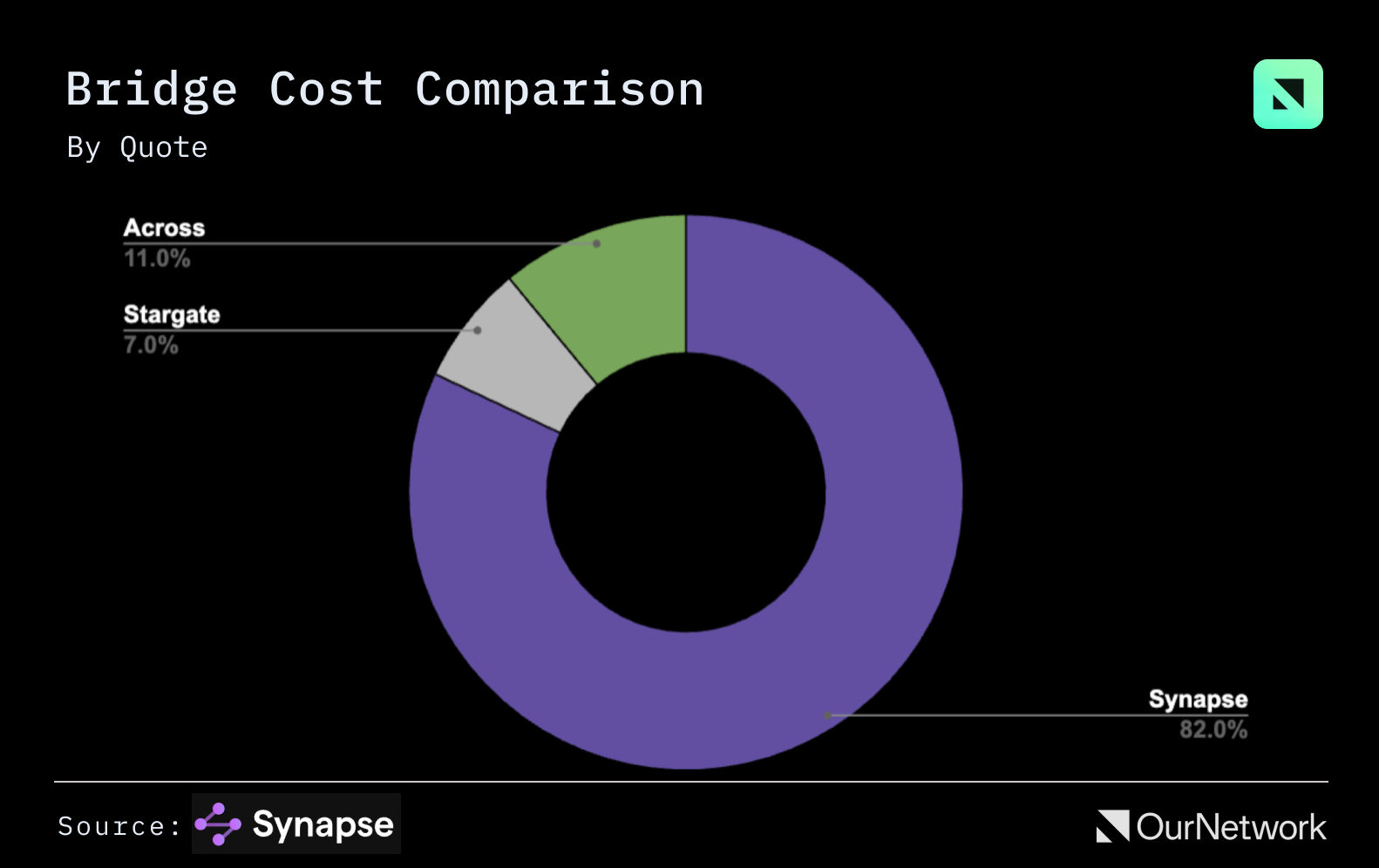

In an analysis comparing Synapse, Across, and Stargate across various routes between Ethereum and major L2s, the Synapse team found that Synapse offered the best quote in 82% of routes. When Synapse provided the optimal quote, transaction costs were reduced by 85–95%, translating to user savings of 85–90% on fees.

-

Since its launch at the end of March 2024, SynapseRFQ has quickly become the preferred method for users bridging through the Synapse protocol. With growing liquidity, more relayers joining, and improved pricing competitiveness, nearly 95% of Synapse order volume is now routed through SynapseRFQ.

-

Transaction highlight: This transaction of $700,000 was completed in under two seconds. Such rapid bridging, combined with instant and reliable settlement, enables applications to build features that abstract blockchain complexity away from users. Ample liquidity and fast confirmations are the final puzzle pieces for truly seamless cross-chain applications.

deBridge

Jonnie Emsley | Website | Dashboard

deBridge becomes largest bridge economy, earning $12.5M in fees without TVL

-

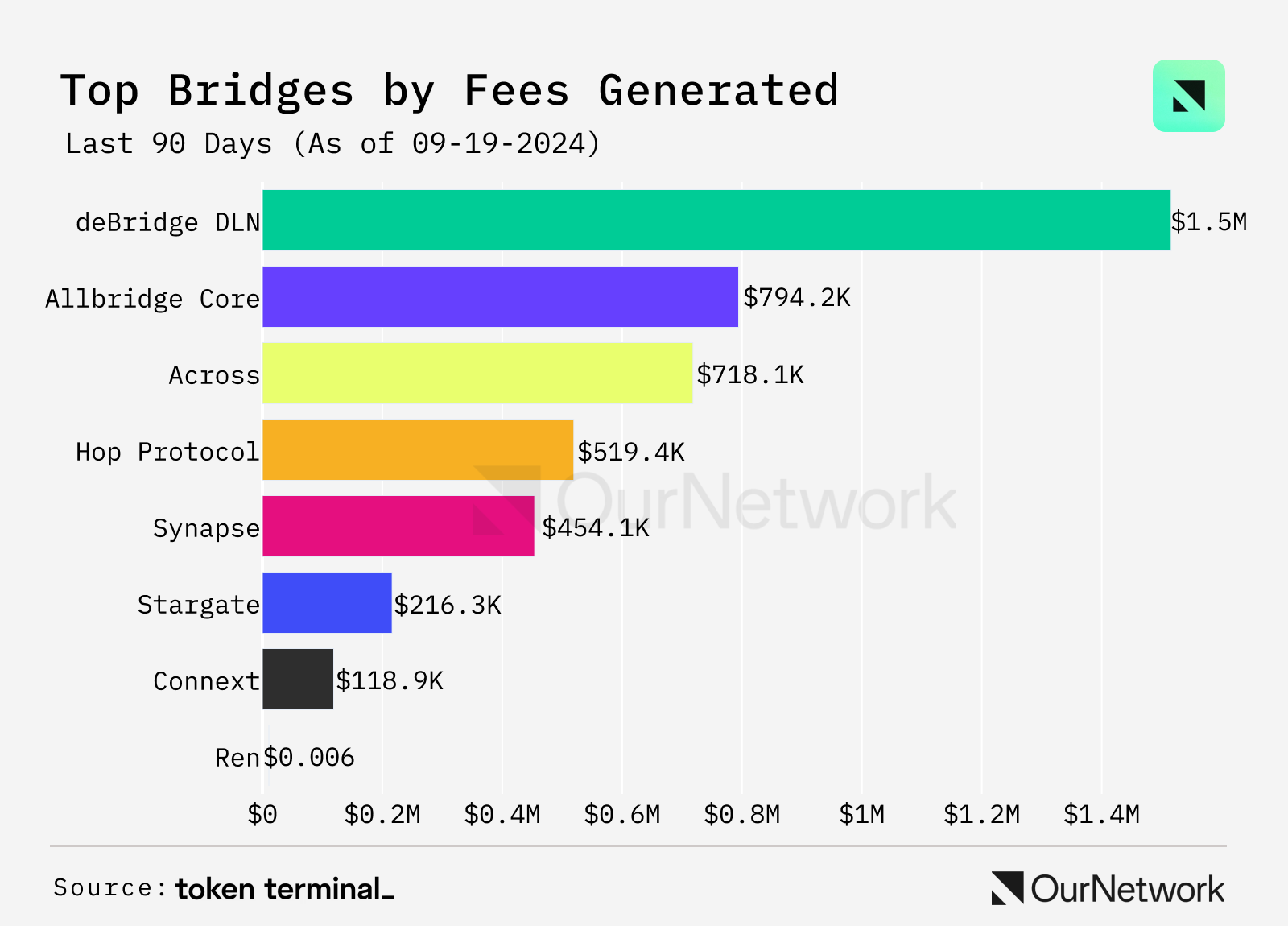

Historically, bridges have relied on TVL incentives to bootstrap their economies, but these incentives often exceeded fee revenue, raising sustainability concerns. However, since launching its 0-TVL design in early 2023, deBridge has emerged as the largest bridge economy. It generates $100K–$180K in daily fees, surpassing the total fees collected by Stargate, Hop, Connext, Synapse, and other providers combined.

-

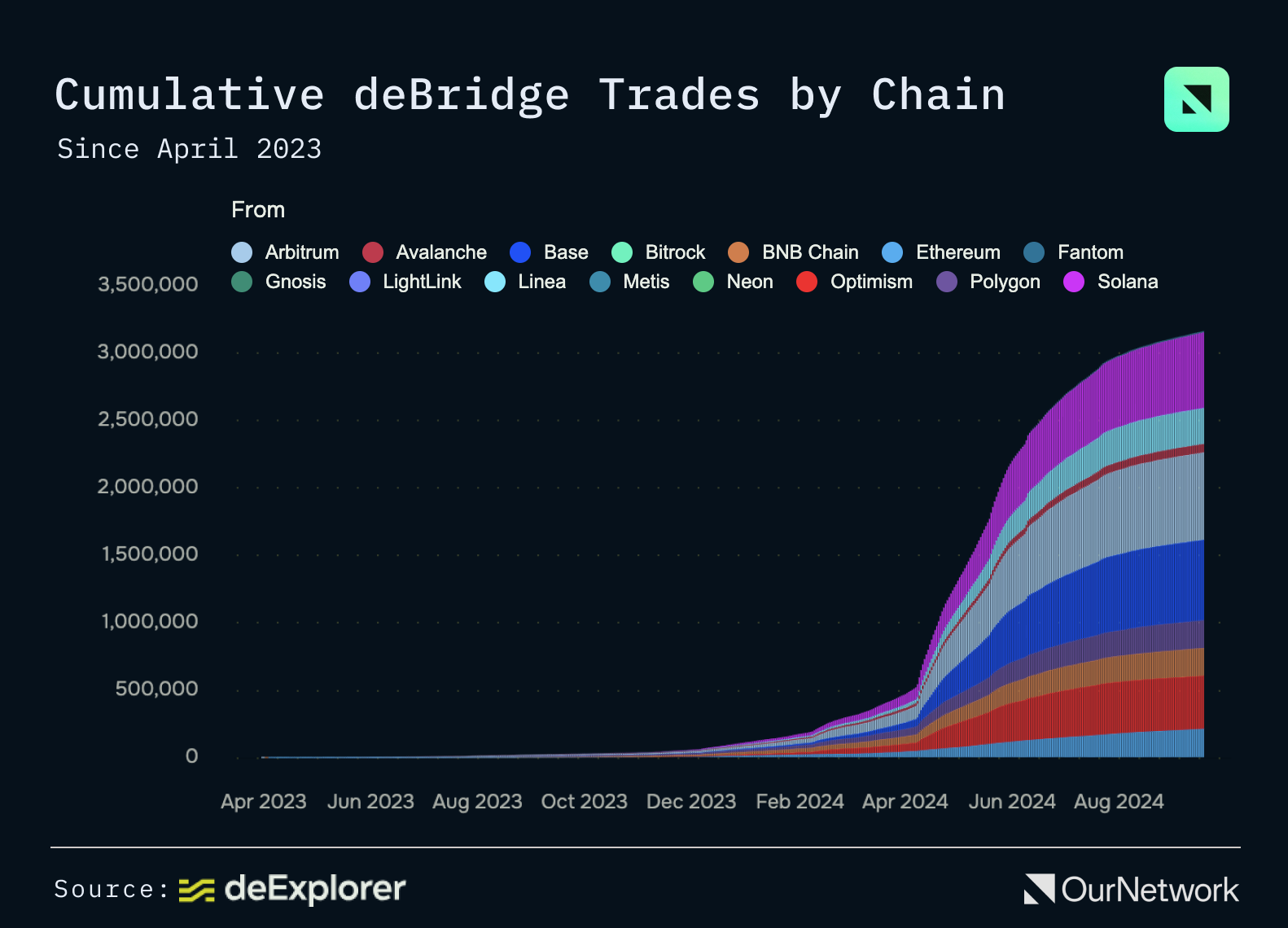

deBridge has become the go-to bridging platform for Solana, with over 117,000 active users transferring over $2 billion on and off Solana via the platform. Over 30,000 of these users come from Jupiter, a trading aggregator built on Solana that has integrated with deBridge.

-

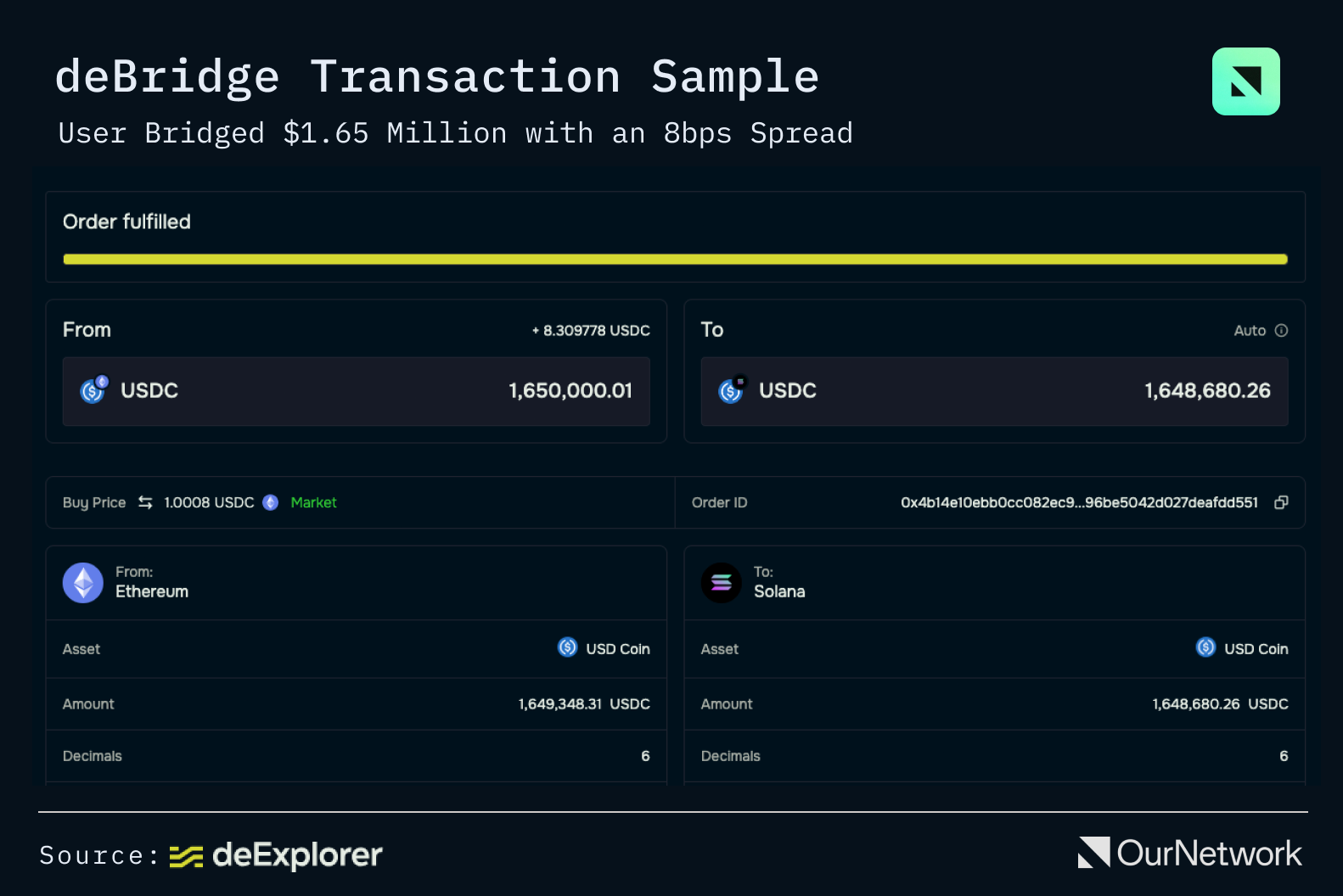

Thanks to deBridge’s peer-to-peer bridging engine, users can transfer over $1 million between blockchains while enjoying guaranteed exchange rates and tight spreads. For example, a user successfully bridged $1.65 million at a spread of just 8 basis points.

-

Transaction highlight: In this transaction, a user leveraged deBridge’s peer-to-peer functionality—the world’s first cross-chain OTC platform—to execute a $920,000 cross-chain OTC swap of bsdETH from Base to WBTC on Ethereum. This marks the first known large-scale OTC trade executed at cross-chain scale.

Across

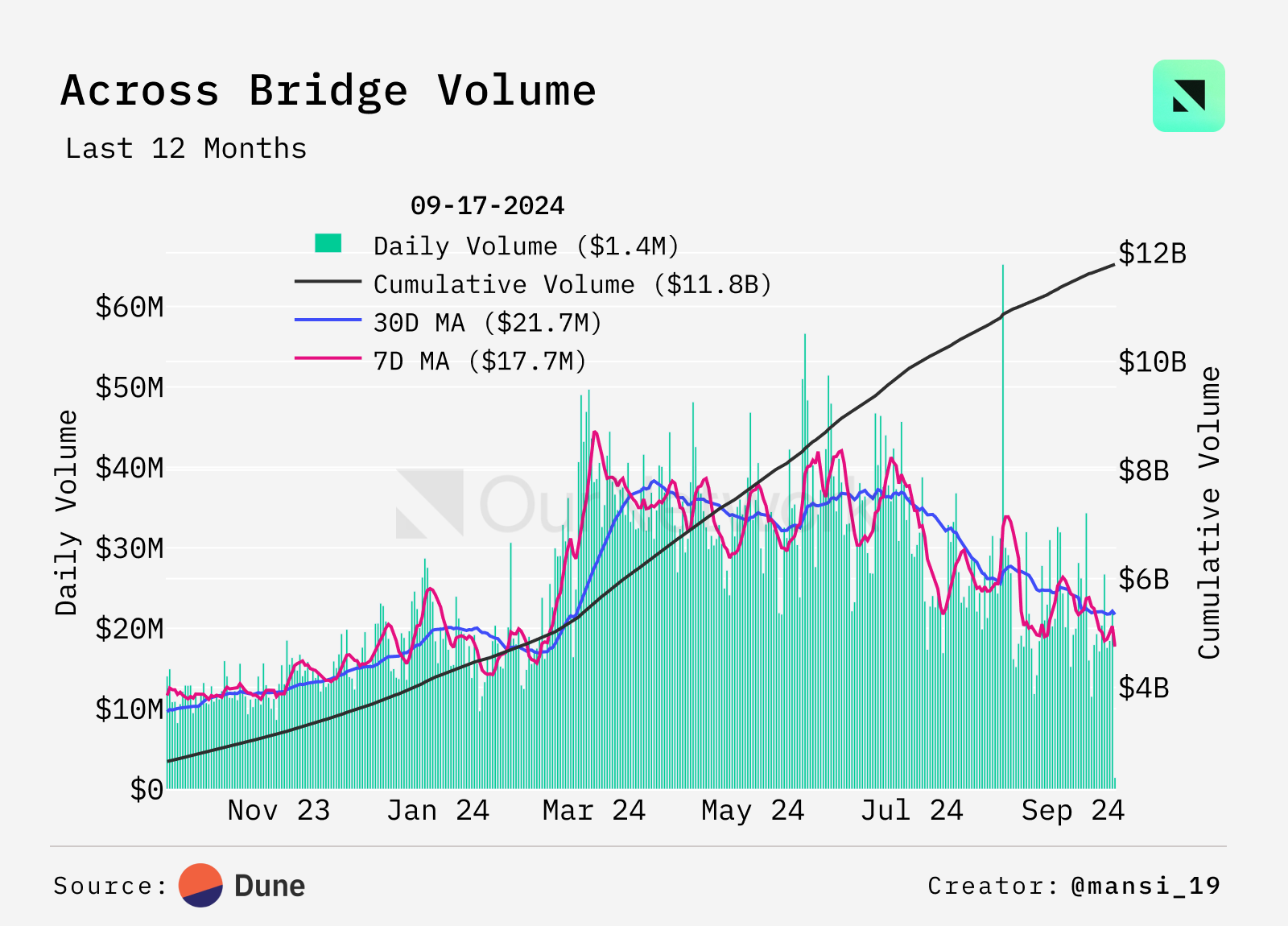

Across Protocol hit a daily volume peak of $65M in August 2024, with cumulative volume nearing $12B!

-

As one of the leading intent-based cross-chain bridges, Across saw significant growth in 2024, nearly tripling in volume since December 2023. March to June marked key months, each exceeding $1 billion in monthly volume, with May 2024 seeing peak activity. However, volumes have steadily declined post-Q2. While Across led the bridge sector before mid-year, it now ranks 4th on DefiLlama. This shift may be attributed to the rising popularity of Stargate V2, which introduced batched transactions via "Stargate Buses," aggregating multiple transfers and significantly reducing costs.

-

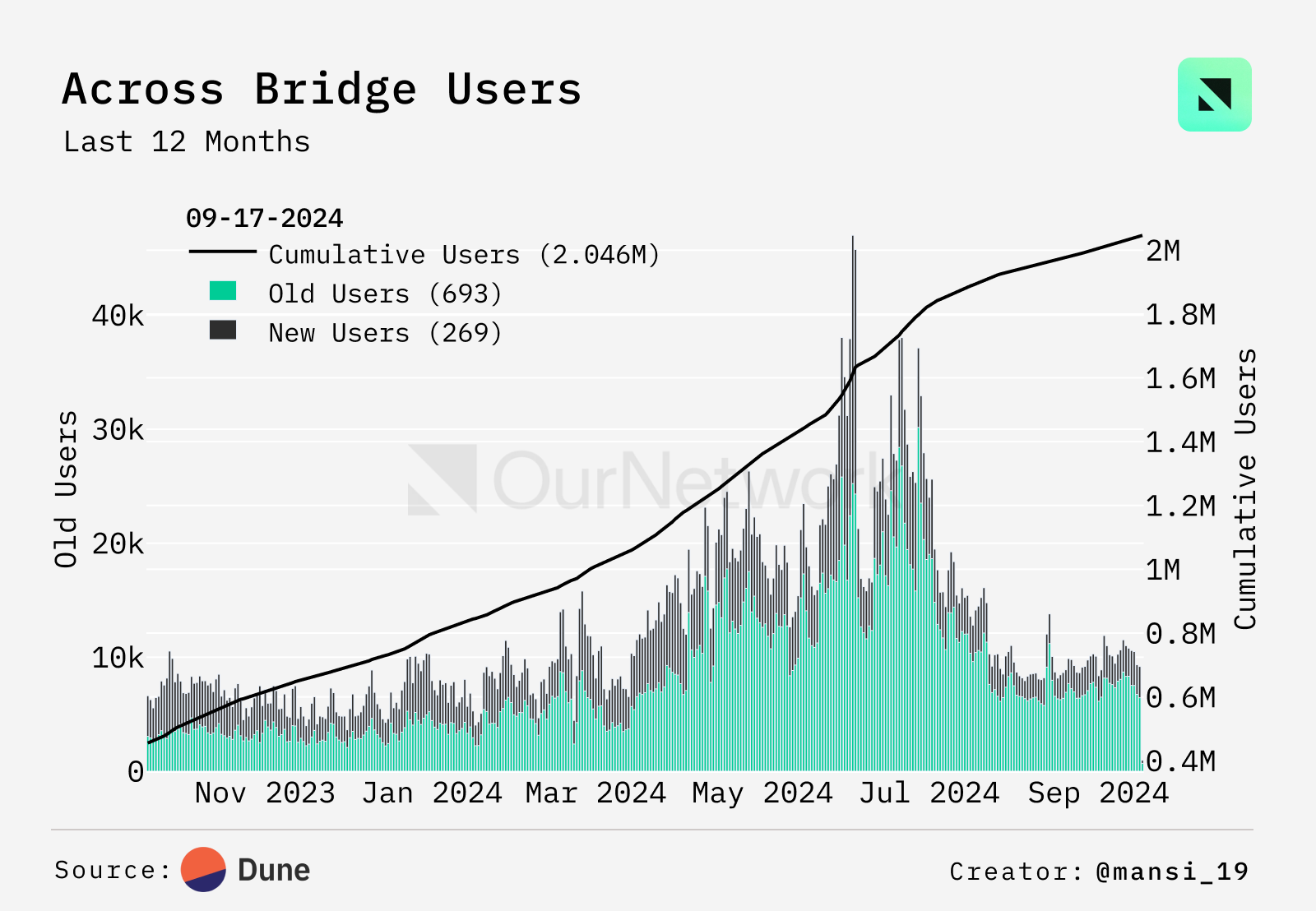

Over 2 million users have completed 8.1 million transfers via Across, averaging four transactions per wallet. Until Q2 2024, new and returning user counts were nearly equal. Since then, returning ("old") users have increasingly outnumbered new ones, with a current daily ratio of approximately 2.5 old users to every new user.

-

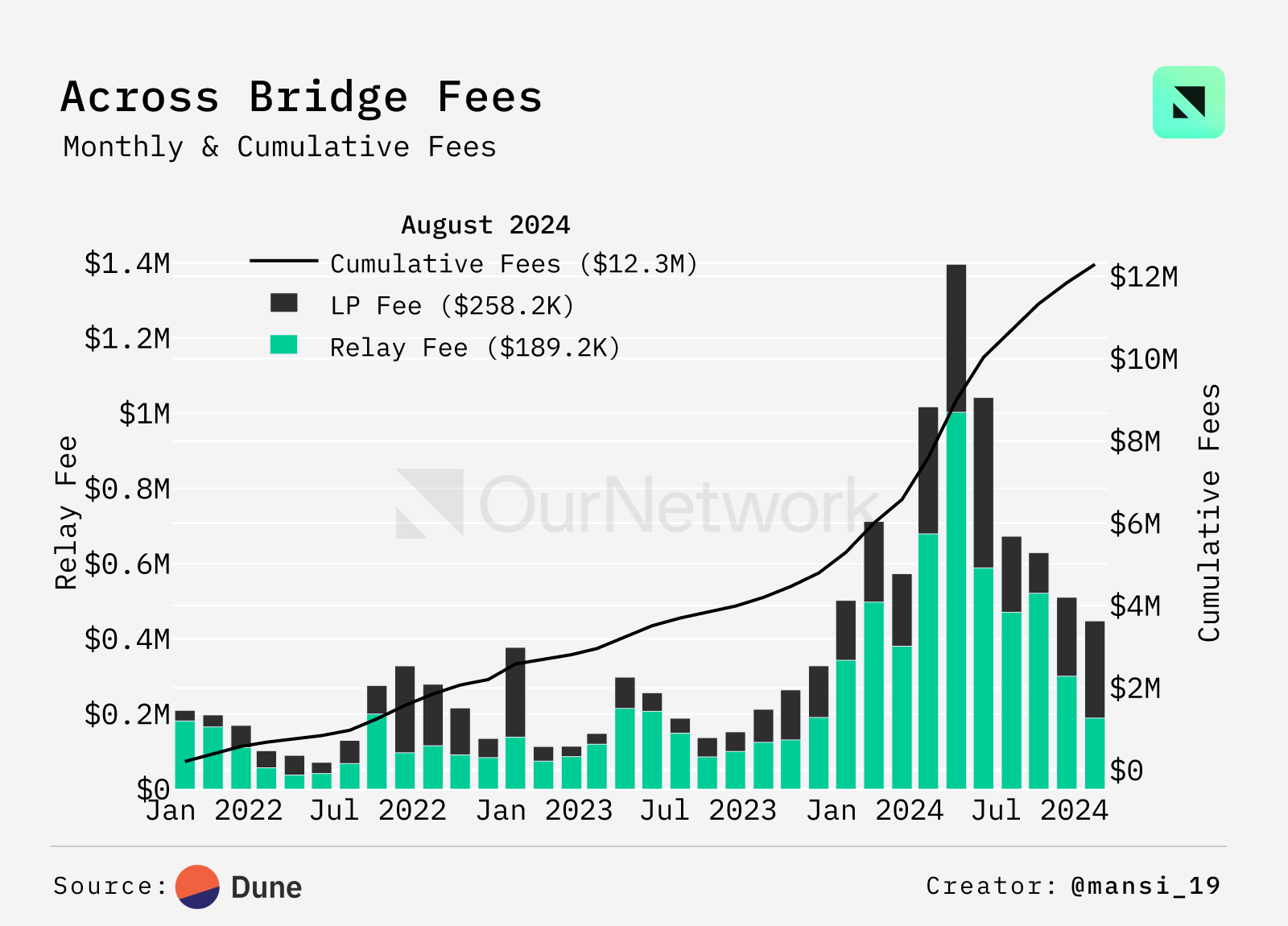

Across charges two main fees: “liquidity provider fees” and “relayer fees.” Relayer fees incentivize relayers to deliver user transactions, functioning similarly to gas fees in the Ethereum ecosystem. Liquidity provider fees are distributed to users supplying liquidity. During this period, the protocol generated over $11.5 million in revenue for its liquidity providers and relayers.

zkBridge by Polyhedra

Eric Vreeland | Website | Dashboard

zkBridge monthly volume exceeds $320M

-

With new blockchains launching and attracting liquidity through incentive programs, bridge transaction volumes have surged year-on-year. On September 19, 2024, 24-hour bridge volume reached $434 million, a significant increase from $142 million during the same period last year. The two highest-volume days occurred on March 11, 2023—when Bitcoin hit an all-time high of $71,000—and August 5, 2024—when Bitcoin began a 30% sell-off. During such periods of extreme volatility, savvy Web3 users rapidly use bridges to seek yield opportunities.

-

zkBridge consistently ranks among the top ten bridges by transaction volume, despite having fewer transaction counts than others. Over the past 24 hours, IBC had an average transfer amount of $722, while zkBridge averaged $1,591. Due to its stronger security model and fewer trust assumptions, zkBridge is often the preferred choice for high-value transfers.

-

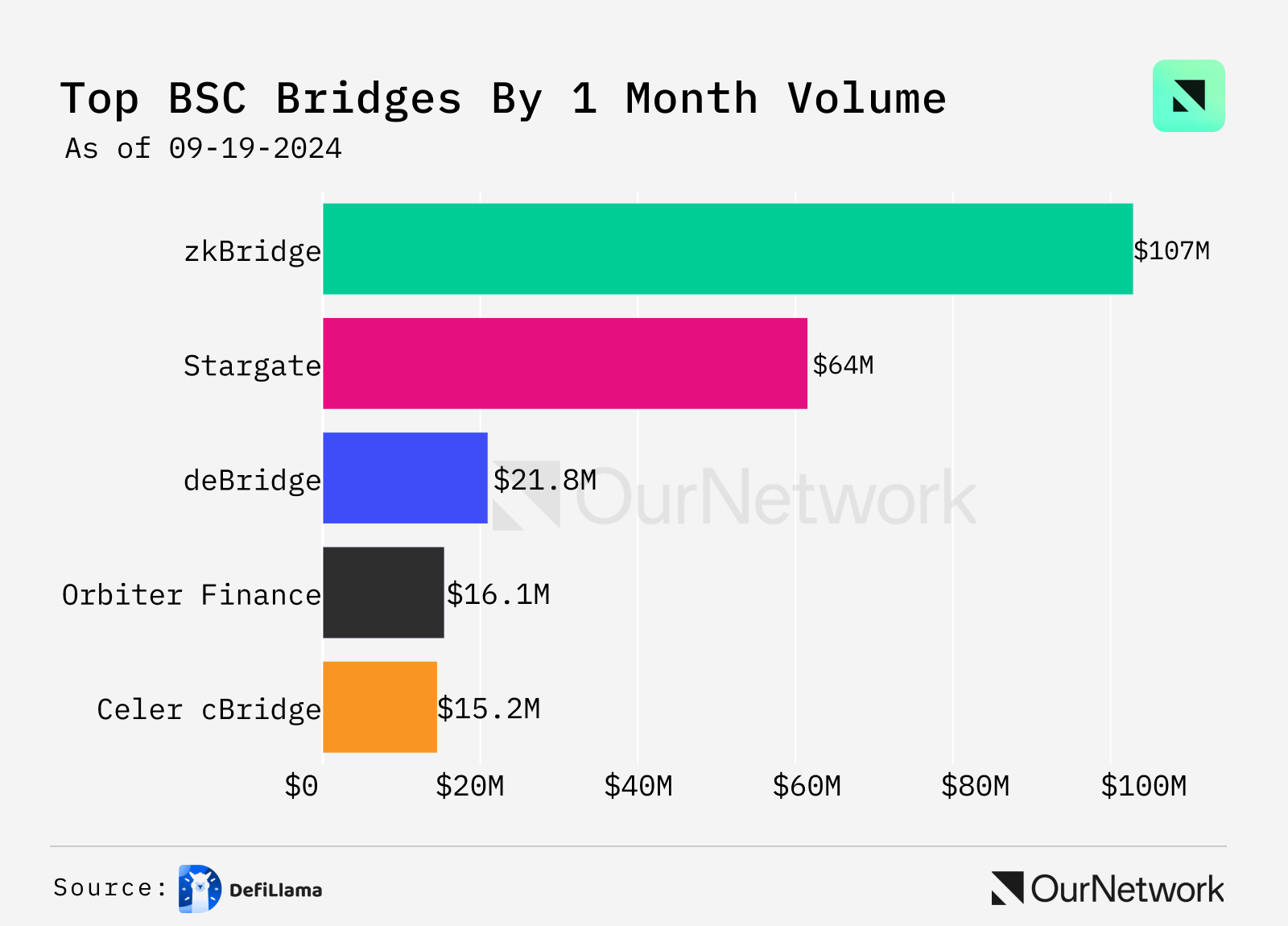

Due to frequent collaboration with Binance and strong community overlap with the BNB ecosystem, zkBridge is the highest-volume bridge on BNB Chain, processing over $100 million in monthly volume. zkBridge is also the official bridge for Binance’s opBNB, the exchange’s Layer 2 solution.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News