From liquidity mining to real yield, what does the real yield narrative mean for the future of DeFi?

TechFlow Selected TechFlow Selected

From liquidity mining to real yield, what does the real yield narrative mean for the future of DeFi?

The trend of real yield? What does it mean for the future of DeFi?

Author: Russian DeFi

Translation: TechFlow

Recently, the DeFi world has been captured by the narrative of real yield. Projects are now focusing on paying users rewards from their actual earnings rather than inflating token supplies as past protocols did. This new sustainable model positions protocols for long-term success. In this article, we’ll explore the trend of "real yield" and what it means for the future of DeFi.

What Is Real Yield?

Real yield = actual project revenue distributed to incentivize token holders, instead of issuing diluted free tokens.

Before real yield emerged, users flocked to new DeFi protocols solely to mine generous token rewards and sell them before others—yield farming was highly profitable from 2020 to 2021.

Projects Under This Narrative

Let’s examine some protocols within this narrative and their achievements so far.

GMX

GMX is a decentralized exchange (DEX) for spot and derivatives trading. It gained popularity after its governance token reached $57 in September 2022, nearing its all-time high of $62 in January 2022—a notable achievement during a bear market.

GMX has built deep liquidity and seen surging trading volumes. Beyond its core product, much of its success stems from its unique revenue-sharing model.

The protocol has two tokens: GLP and GMX.

-

GLP represents an index value of all available platforms and traded assets,

-

GMX is the native governance token used for revenue sharing.

Seventy percent of exchange fees go to liquidity providers or GLP token holders (typically paid in ETH on Arbitrum and AVAX on Avalanche), while 30% goes to GMX stakers.

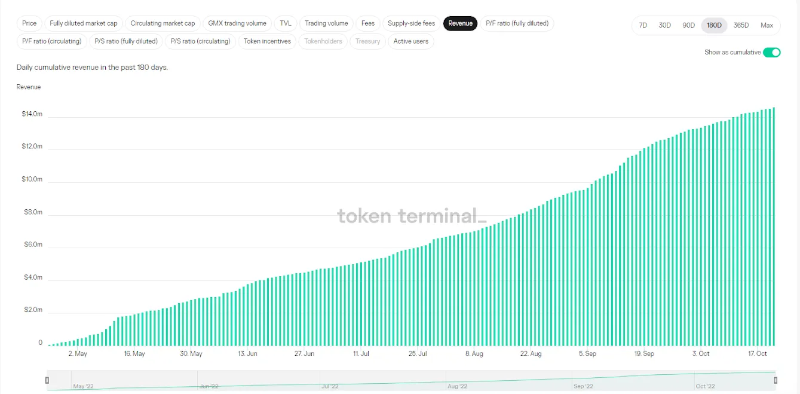

As shown below, GMX’s cumulative revenue has exhibited a sharp upward trend over the past 180 days.

Synthetix (SNX)

SNX is a decentralized protocol where you can trade synthetic assets (tokenized derivatives) and standard derivatives, one of the oldest projects in DeFi.

It achieved early success on Ethereum after shifting its tokenomics toward a real yield model. As of September 2022, the SNX protocol generated $82 million in annualized revenue, but growth has since significantly slowed, likely due to macroeconomic conditions.

As of October 2022, annualized revenue stood at $12 million (source: Token Terminal); all earnings go to SNX stakers.

SNX is not a pure real yield protocol: staking rewards are partially funded by inflationary token emissions, with the remainder coming from fees generated by the exchange, paid in sUSD stablecoin. Nonetheless, it remains one of the top revenue-generating protocols in DeFi.

Dopex (DPX)

DPX is a decentralized options exchange on Arbitrum that allows users to buy and sell options contracts and earn passive yields.

Its main product is the Single Staked Options Vault (SSOV), which provides deep liquidity for option buyers and automated passive income for sellers. DPX also enables users to speculate on interest rate directions in DeFi via interest rate options and Atlantic straddles, allowing bets on volatility in certain asset prices.

In addition to generating real yield from directional risk-taking, DPX produces actual income through these mechanisms.

Fees are distributed among stakeholders:

-

70% to liquidity providers,

-

5% to delegates,

-

5% used to buy back and burn the protocol’s discounted token rDPX,

-

15% to DPX stakers.

Similar to SNX, DPX also allocates part of its staking rewards through inflationary token emissions.

Redacted Cartel (BTRFLY)

BTRFLY is a meta-governance protocol that acquires tokens from other DeFi protocols for governance and provides liquidity-related services.

The protocol generates revenue through three main channels:

-

Treasury (composed of various yield-generating governance tokens),

-

Pirex (creates liquidity for auto-compounding and future voting tokens),

-

and Hidden Hand (a governance incentive/bribe marketplace).

To qualify for revenue sharing, users must “yield-lock” their BTRFLY tokens for 16 weeks to receive rlBTRFLY.

After locking, users receive 50% of Hidden Hand revenue, 40% of Pirex revenue, and between 15–42.5% of treasury revenue. These rewards are paid out in ETH every two weeks.

The Future?

Given that this model emphasizes actual revenue as the source of financial incentives, the outlook for real yield appears bright.

This marks a turning point in DeFi—from unsustainable inflationary token models to protocols generating real income and distributing it to holders.

Of course, this model has drawbacks:

(1) Projects must be profitable, which may lead some to initially attract users via inflationary strategies before transitioning to real yield—this approach is unlikely to work for new projects.

(2) Protocols that distribute large or nearly all of their revenue will have little left for research and development, limiting funds for growth and improvement, potentially harming long-term potential.

If projects can find the right balance in revenue distribution between holders and developers, a major boom in the real yield narrative could follow.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News