Merit Circle, the crypto gaming index, has recently demonstrated strong financial management by repurchasing its native token through its treasury.

TechFlow Selected TechFlow Selected

Merit Circle, the crypto gaming index, has recently demonstrated strong financial management by repurchasing its native token through its treasury.

Merit Circle offers one of the most interesting ways to engage with the entire gaming ecosystem.

Written by: Reflexivity Research

Compiled by: TechFlow

One of the clearest use cases for achieving product-market fit in crypto is expected to be gaming, and Merit Circle offers one of the most interesting ways to gain exposure to the entire gaming ecosystem.

Over the past decade, gaming has seen explosive growth. In 2021, the industry captured a total addressable market (TAM) of approximately $200 billion. We've observed experiments like Axie Infinity, which incentivized users through play-to-earn token models, but such models have proven unsustainable during market downturns.

Nevertheless, we remain optimistic that crypto gaming could evolve into a space where users participate not merely for token rewards, but because they genuinely enjoy the experience.

Yet, crypto gaming remains inherently a highly speculative market. As such, gaining indexed exposure to this sector appears more attractive, allowing investors to capture potential upside. Merit Circle stands out as one of the most compelling vehicles for achieving this kind of index-like exposure.

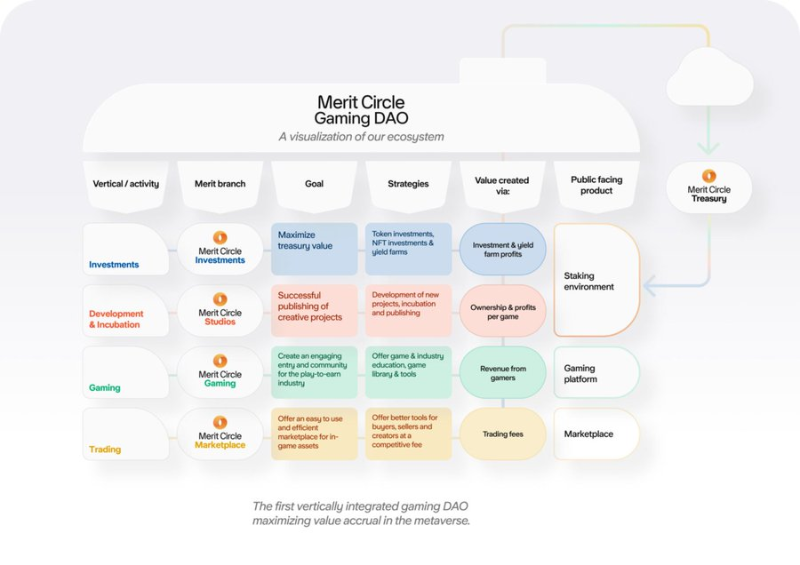

The Merit Circle DAO consists of four vertical divisions: Investments, Development/Hatching, Gaming, and Trading. It increases the value of the MC token by building an ecosystem that generates value for the DAO itself.

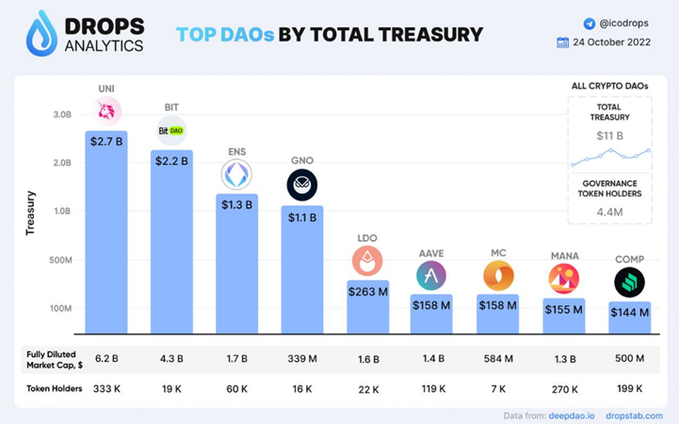

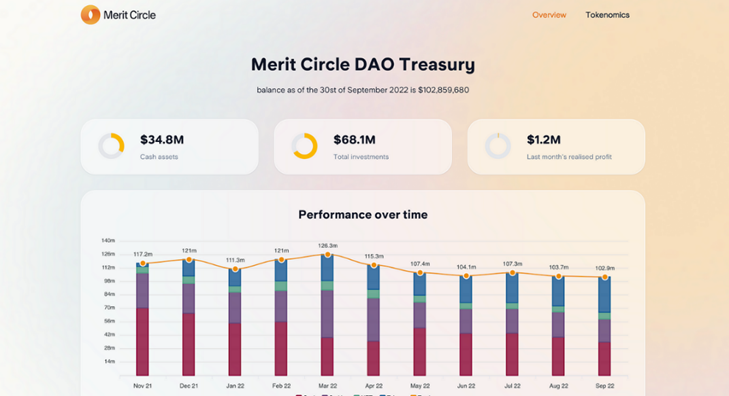

The DAO boasts one of the best financial management records in the digital asset space. Merit Circle ranks 7th in treasury size, behind DeFi blue-chips such as Uniswap, Aave, and Lido. Notably, Merrit Circle’s treasury does not include its native token.

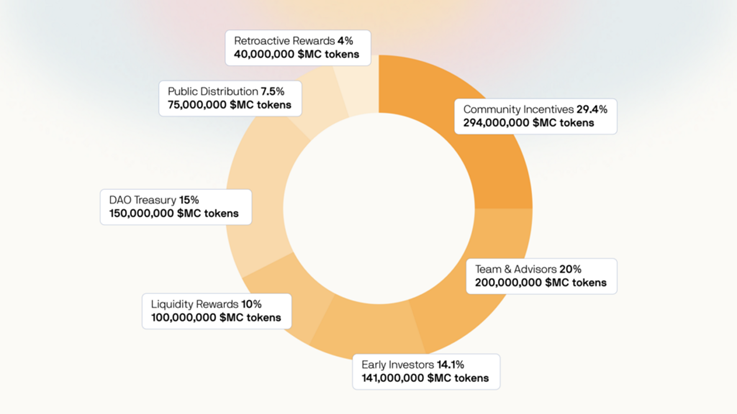

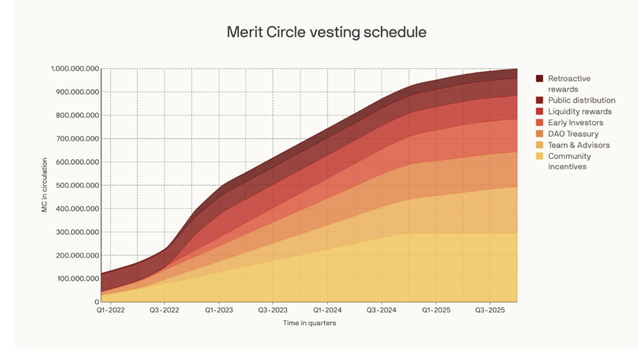

Now let's examine MC's tokenomics.

First, the token distribution and vesting schedule:

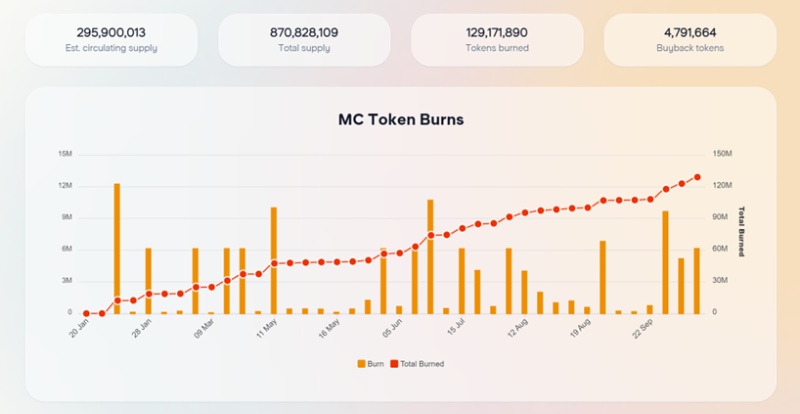

A $640 million FDV currently doesn't seem particularly attractive, but as the DAO continues burning tokens, the FDV will steadily decline.

To date, they have burned 129,171,890 MC tokens, totaling around $90 million.

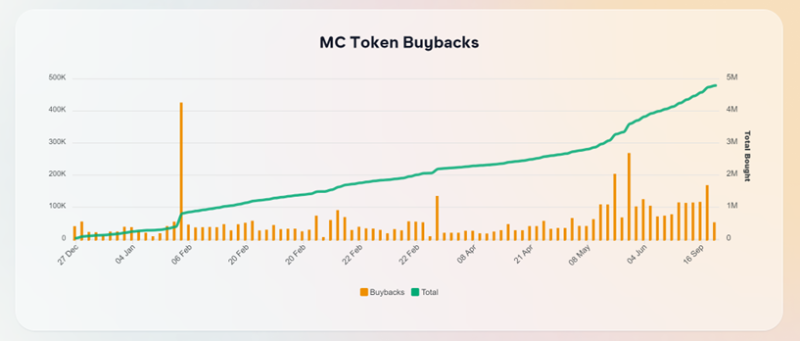

Meanwhile, they have repurchased 4,791,664 tokens on the open market using funds from their treasury.

MC token buybacks are funded by profits generated from seed investments made by the DAO treasury. In addition to secondary market purchases, they have also repurchased approximately 20 million MC tokens from seed investors. Combined, this removes 15.5% of the projected total token supply from circulation.

This week, they will burn 200 million tokens, resulting in about 20% of the total supply exiting circulation, reducing the fully diluted valuation to approximately $500 million.

Conclusion

Given the DAO’s strategy of converting seed investment profits into token buybacks and burns, coupled with potential speculative premium around GameFi narratives, we believe Merit Circle is well-positioned to attract significant capital inflows within the crypto gaming ecosystem.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News